- Zero Flux

- Posts

- 1 in 4 Americans have a subprime credit score, Vegas rents fall 4.1%

1 in 4 Americans have a subprime credit score, Vegas rents fall 4.1%

Mapped: Median Rent price by U.S. States, A terrarium House and more

Share Zero Flux with a friend using your unique link and unlock 3 months of premium free:

https://www.zeroflux.io/subscribe?ref=PLACEHOLDER

And if you get 25 signups overtime with this link, premium is yours for life 🎉

A quick word from our sponsor

The best marketing ideas come from marketers who live it.

That’s what this newsletter delivers.

The Marketing Millennials is a look inside what’s working right now for other marketers. No theory. No fluff. Just real insights and ideas you can actually use—from marketers who’ve been there, done that, and are sharing the playbook.

Every newsletter is written by Daniel Murray, a marketer obsessed with what goes into great marketing. Expect fresh takes, hot topics, and the kind of stuff you’ll want to steal for your next campaign.

Because marketing shouldn’t feel like guesswork. And you shouldn’t have to dig for the good stuff.

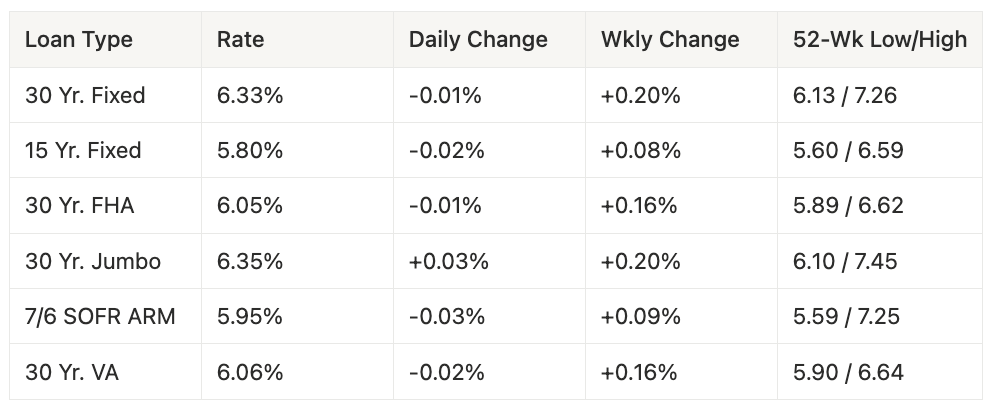

Latest Rates

⚡Snapshot: Rates inched slightly lower today across most loan types, except Jumbos, which ticked up +0.03%. Declines were minor (-0.01% to -0.02%), and weekly trends are still higher, suggesting a pause rather than a meaningful reversal.

New here? Join the newsletter (it's free).

Macro Trends

1 in 4 Americans now has a subprime credit score link

According to Apollo Chief Economist Torsten Sløk, roughly 25% of U.S. adults have a FICO score below 660, putting them in the subprime range.

Subprime rates are highest across the South and parts of the Midwest, topping 50% in some counties.

Low credit access could slow housing demand and refinancing activity, especially in lower-income and rural regions.

My take: Investors should watch how rising subprime levels hit mortgage origination and rental demand. For brokers, this signals more cash or FHA-backed deals ahead.

Real Estate Trends

New apartments still rent 6% higher despite supply surge link

New lease ups averaged $1,982 in September vs $1,871 for stabilized units, a 6% premium, per RealPage. All 37 metros analyzed beat the national average, with New Jersey, South Dakota, Jacksonville and Los Angeles showing double digit premiums.

Memphis and Detroit were the outliers, lease up rents were roughly 80% higher than older stock, helped by riverfront, mixed use and downtown revitalization locations that offer modern amenities.

Tenants are still paying for quality, rent to income ratios sit at 22% and on time payments have stayed above 95% since 2022, but RealPage flags that high development costs and affordability pressure can force concessions in some pockets.

Good buildings in the right locations can still charge more, even with lots of supply. People will pay for newer, well-designed units. The trick is to look at pricing by submarket, not the whole city.

FHFA eyes fee relief for second homes and cash-out refis link

The FHFA is considering targeted cuts to loan-level price adjustments (LLPAs) on second homes and cash-out refinances, according to MBS Highway’s Barry Habib, now on Fannie Mae’s board. No full-scale LLPA overhaul is planned.

Lenders have flagged these two categories as pain points since current pricing adds heavy fees that can’t be absorbed into today’s high mortgage rates, forcing borrowers to pay out of pocket.

The move follows 2023’s failed LLPA revamp under the Biden administration, which added fees tied to debt-to-income ratios above 40% before being rolled back after industry backlash.

My take: If FHFA trims fees here, expect a modest lift in second-home and cash-out refinance volumes heading into 2026. For investors, it could unlock sidelined equity and reheat demand in high-income vacation markets.

Industrial cap rates tick up 20 bps, but pricing holds firm link

Industrial cap rates rose to 6.3% in Q3 2025, up 20 bps year over year, yet asset values have stayed resilient as buyers underwrite higher capital costs without discounting prices.

Quarterly warehouse sales have ranged between $15B and $25B this year, above pre-pandemic averages of $10B to $20B, signaling investor confidence in logistics and distribution assets.

CMBS delinquencies in the sector sit at just 0.6%, compared to 11.1% in office and around 6–7% in retail and multifamily, underscoring industrial’s position as the safest CRE asset class.

My take: Investors still see industrial as the cleanest cash-flow story in CRE. Expect cap rate stability and selective buying in 2026 as institutional capital doubles down on logistics assets over volatile office or retail plays.

One Acquisition

Prologis snaps up $315M Bay Area portfolio, tops 2025 industrial charts link

Prologis acquired an 11-asset industrial portfolio from CalSTRS for $314.5M, marking the Bay Area’s largest industrial deal this year. The assets total 940K sq. ft. within Brisbane’s Crocker Industrial Park and are 95% leased.

The properties averaged $330 per sq. ft., well above the Bay Area’s $235 avg. and the national $142 avg., underscoring investor appetite for small-bay warehouses near core logistics hubs.

Bay Area industrial rents hit $13.99 per sq. ft. in September, up 60% from the $8.72 U.S. average, while vacancies remain lower than national levels at 8.1%, reflecting continued supply constraints.

Location Specific

Vegas rents fall 4.1%, among the steepest drops in the West link

Apartment rents in Las Vegas fell 4.1% year-over-year in September, compared to a 0.3% national decline, per RealPage Market Analytics. Only Denver and Phoenix saw deeper cuts.

The pullback follows a wave of new supply hitting Western metros, with operators slashing rents to protect occupancy amid weaker demand.

While milder than the 10% rent crash Vegas saw in 2010, the current decline mirrors early COVID-era softness, signaling that the city’s “recession-proof” reputation is fading.

AI & Real Estate - Today’s Trends

Tool of the day: Leni

Analyze real estate data across systems to detect inefficiencies, forecast performance, and deliver real-time portfolio insights.

AI-Edited Photos Are Misleading Homebuyers link

Emma Rogers reports that AI-edited photos are transforming average homes into picture-perfect illusions, fueling buyer frustration and trust issues. With weak disclosure enforcement and “fake walk-throughs” spreading fast, experts warn that AI’s $34B efficiency upside could collapse if transparency doesn’t catch up.

The Real Brokerage Bets on AI to Fix Home Search, Despite Thin Margins link

GuruFocus.com reports that The Real Brokerage (REAX) launched HeyLeo, a voice-based AI concierge built on its reZEN platform, entering the home search market with personalized recommendations. With zero debt and falling gross margins, HeyLeo is both a tech play and a profitability test.

Vacant Malls and Warehouses Are Becoming AI Data Centers link

Gensler’s Felicia Santiago writes that AI servers use up to 10× more power than traditional IT, making old warehouses and retail sites ideal for retrofit. Reusing these spaces cuts carbon, avoids rezoning delays, and brings data centers closer to users — a faster, greener play for developers chasing AI demand.

New ChatGPT Playbook for Agents Hits No. 3 on Amazon link

Kevin Hawkins’ The REAL AI Guide for Real Estate Agents cracked Amazon’s top three in real estate sales books just three weeks after release. With 32% of agents still not using AI, Hawkins’ no-hype guide offers hands-on ChatGPT prompts and a seven-day challenge aimed at providing a practical AI manual for real estate professionals.

One Chart

Mapped: Median Rent prices by U.S. States

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

New opportunities around stadiums

(This content is restricted to Pro Members only. Upgrade)

A Coast-to-Coast Look at 125 Apartment Investment Markets link

(This content is restricted to Pro Members only. Upgrade)

10 Cities Where Apartment Rents Are Dropping Fast

(This content is restricted to Pro Members only. Upgrade)

A new generation is driving the home equity comeback

(This content is restricted to Pro Members only. Upgrade)

Wait, is office space actually filling up again?

(This content is restricted to Pro Members only. Upgrade)

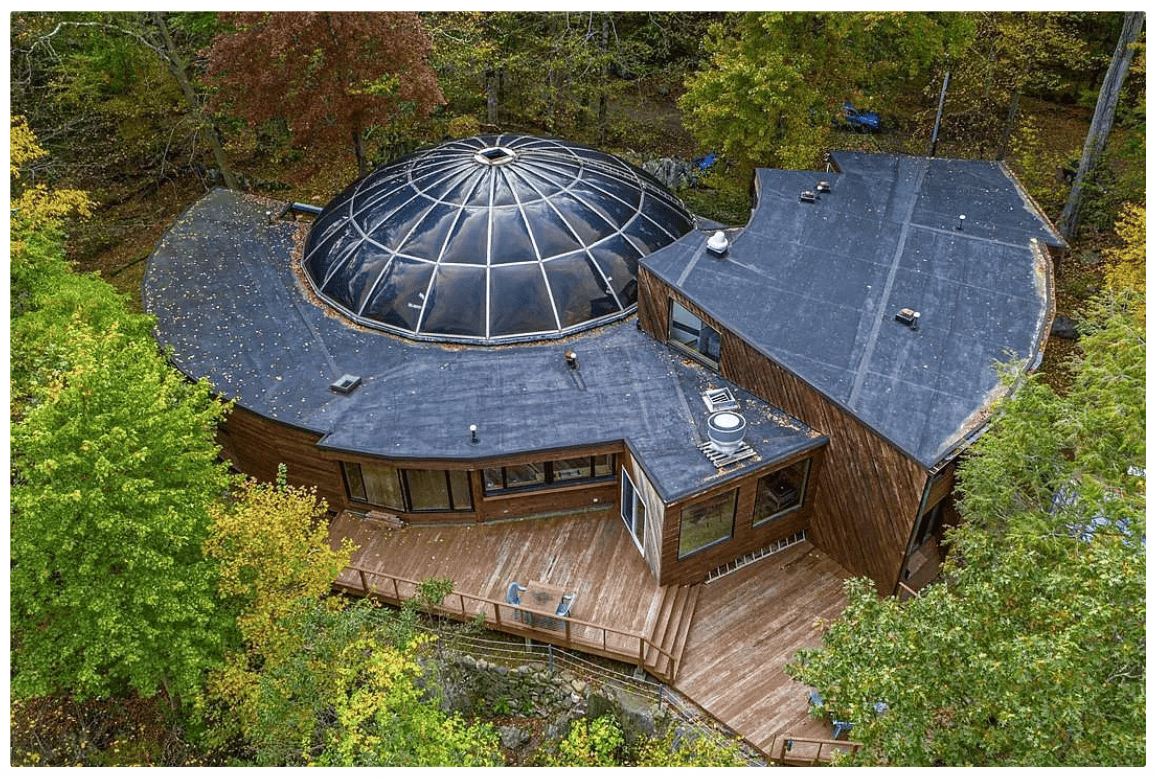

Unreal Real Estate

A terrarium House

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply