- Zero Flux

- Posts

- 25 U.S. Cities Are Surging in Jobs

25 U.S. Cities Are Surging in Jobs

Ranked: The World’s Worst Performing Economies in 2025 and 12 other real estate insights

Share Zero Flux with a friend using your unique link and unlock 3 months of premium free:

https://www.zeroflux.io/subscribe?ref=PLACEHOLDER

And if you get 25 signups overtime with this link, premium is yours for life 🎉

Latest Rates

Current | 1 day | 1 week | 1 month | 1 year | Low | High | ||

|---|---|---|---|---|---|---|---|---|

30 Yr. Fixed | 6.81% | -0.01% | -0.01% | -0.06% | +0.00% | 6.11% | 7.26% | |

15 Yr. Fixed | 6.04% | -0.03% | +0.01% | -0.09% | -0.26% | 5.54% | 6.59% | |

30 Yr. FHA | 6.39% | -0.01% | +0.04% | -0.02% | +0.11% | 5.65% | 6.62% | |

30 Yr. Jumbo | 6.92% | +0.00% | +0.02% | -0.03% | -0.11% | 6.37% | 7.45% | |

7/6 SOFR ARM | 6.27% | -0.04% | -0.05% | -0.15% | -0.32% | 5.95% | 7.25% | |

30 Yr. VA | 6.40% | -0.02% | +0.03% | -0.02% | +0.10% | 5.66% | 6.64% |

New here? Join the newsletter (it's free).

Macro Trends

These 25 U.S. Cities Are Surging in Jobs and Talent link

Nearly half (46%) of U.S. workers now live far from where they grew up, and cities like Grand Rapids, Boise, and Harrisburg are becoming magnets for professionals due to job growth and affordability. These metros combine career opportunities with livable costs, attracting younger and relocating workers.

In places like Fayetteville, AR, and Reno, NV, massive corporate investments are transforming local economies—Fayetteville boasts a per capita income of $89,095 while Reno’s home prices now average over $1 million. Tech giants and universities are playing a key role in this growth.

Several cities—like Nashville, Sacramento, and Colorado Springs—are seeing billions in infrastructure and healthcare expansion, fueling housing market competition. Nashville’s average income hits $79,450 while Sacramento’s average listing price now exceeds $850,000.

Real Estate Trends

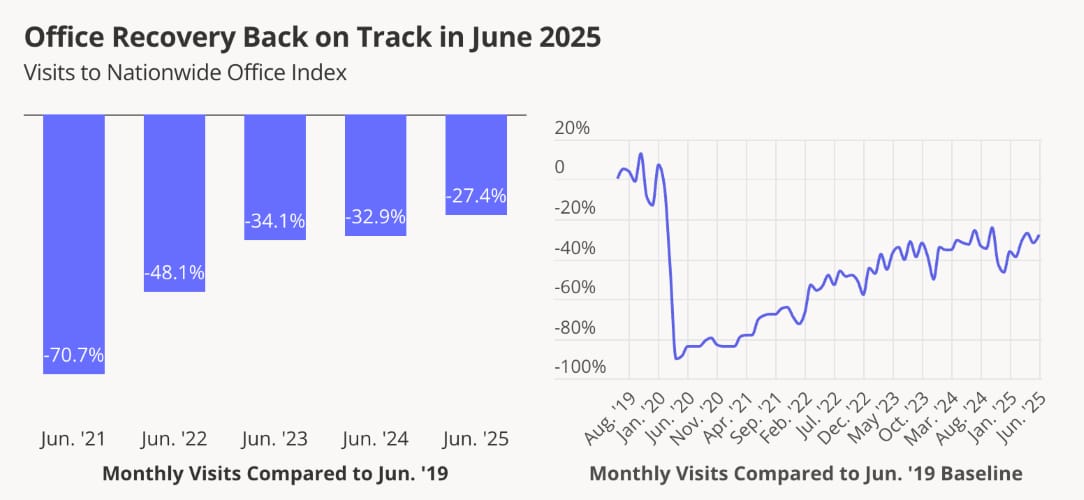

Office traffic rebounds link

Office foot traffic rose 8.3% year-over-year in June, rebounding from a 1.1% dip in May. June ranked as the fourth-busiest month for in-office activity since the pandemic began.

Miami and NYC are nearing full recovery, with June 2025 office visits down just 4.2% and 5.3% from June 2019, respectively. Meanwhile, San Francisco remains down 44.6%, the worst among major markets.

Nine out of ten major cities saw return-to-office gains year-over-year, led by Houston (+17.2%) and San Francisco (+11.3%). Los Angeles was the only one to decline, falling 2.9% from last year.

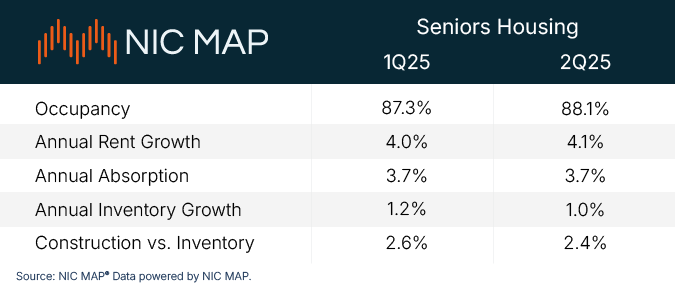

Senior Housing Demand Surges, but Builders Can’t Keep Up link

Senior housing occupancy jumped to 88.1% in Q2 2025, the highest in years, driven by 6,000+ new move-ins—yet only 809 new units were added, the lowest supply figure in two decades.

Rents for independent and assisted living rose 4.25% and 3.97% year-over-year, hitting $4,402 and $6,976/month respectively, pricing out nearly half of seniors with limited income.

Independent living continues to outpace assisted living in demand, with 89.7% occupancy and three straight quarters of faster growth, showing boomers prefer lifestyle-focused communities.

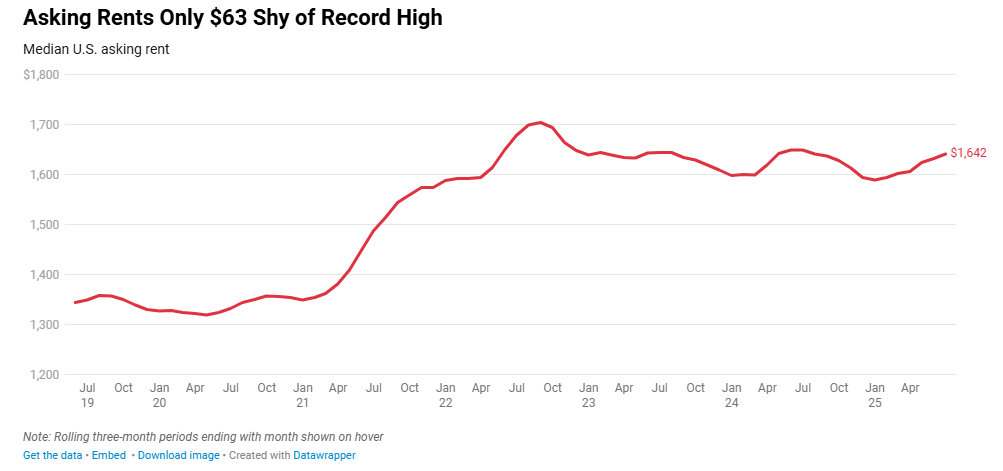

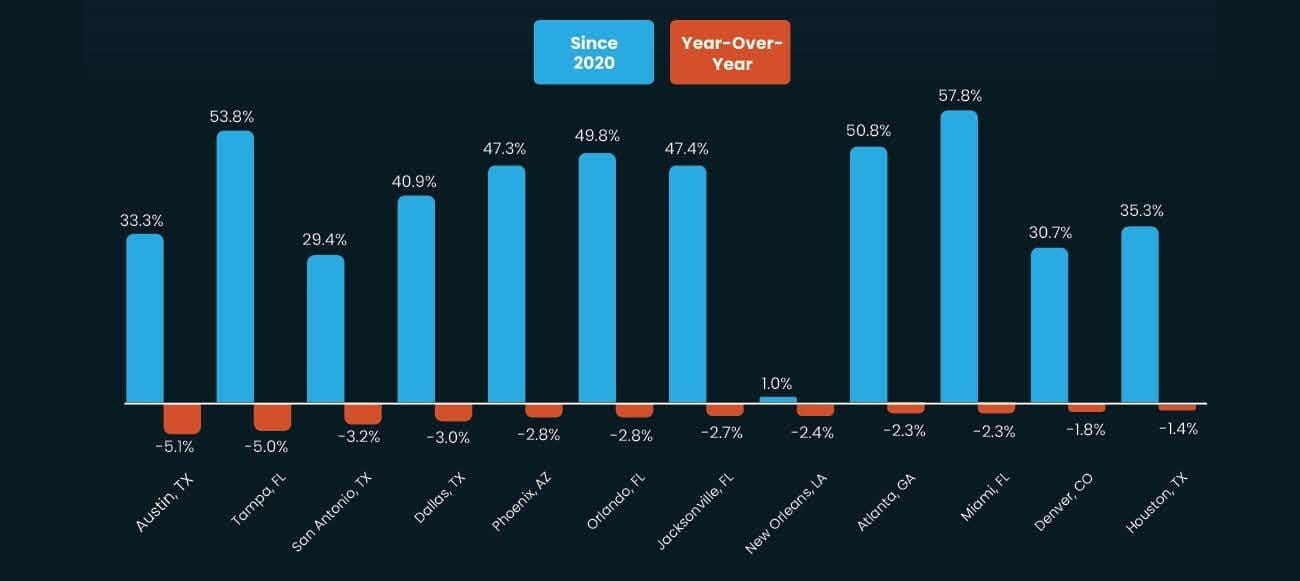

Renters Take Control as Landlords Slash Prices in Key Cities link

Median asking rents dropped for the fourth month in a row, hitting $1,642 in June—just 0.5% lower than last year, but only $63 below the 2022 all-time high. This points to a stagnant market where renters still have some leverage.

Major rent drops were seen in cities with oversupply: Minneapolis fell 5.8%, Austin 5.7%, and Las Vegas 4%. Austin rents are at their lowest in over four years despite demand, largely due to a pandemic-era construction surge.

Less than 50% of new apartments completed at the end of 2024 were leased within three months. With permitting now back to pre-pandemic levels and construction expected to slow, this renter-friendly window may close soon.

Homebuilders slash prices at fastest pace in 3 years — buyer traffic hits 2-year low link

38% of builders cut prices in July, the highest rate since tracking began in 2022. The average price cut was 5%, unchanged for 9 straight months.

Buyer traffic dropped to 20 on the index, its lowest level since late 2022, signaling demand continues to shrink despite incentives like mortgage buydowns.

Single-family permits are down 6% year-to-date, and builder sentiment has stayed negative for 15 months straight, with especially weak outlooks in the South and West.

Worried About Falling Home Prices? Here’s Why You Shouldn’t Be link

Home values tend to rise over time—even when there are short-term drops. Historical trends show long-term gains usually outweigh temporary declines.

If you plan to stay in a home for at least 5 years, you’re likely to avoid the impact of any market dip. The 5-year rule gives buyers a safety cushion.

The message: short-term market fluctuations aren’t as risky for long-term owners. Talking to a local agent can help clarify what's happening in your market.

Location Specific

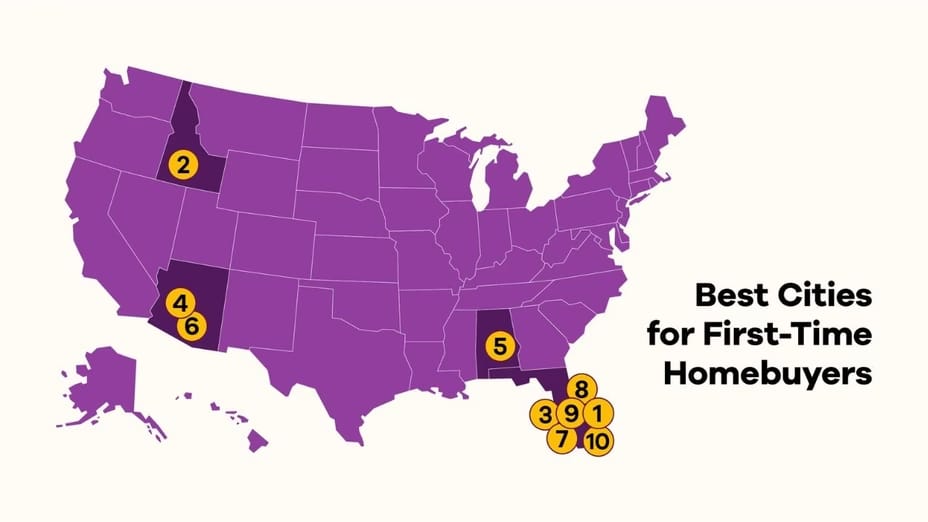

Florida's Smaller Cities Are Quietly Becoming First-Time Buyer Goldmines link

Six of WalletHub’s top 10 cities for first-time homebuyers are in Florida, with Palm Bay, Tampa, and Lakeland leading due to affordability and livability. Sunrise had the lowest median list price at just $212,000 and saw a 49.1% surge in listings year-over-year.

Florida’s housing inventory hit a record 168,717 listings in February 2025—the highest since 2016—creating a more buyer-friendly environment. Lakeland’s listings jumped 36.3%, giving buyers more time and options to shop.

Migration during the pandemic drove up prices in major metros, pushing first-time buyers into second-tier cities like Palm Bay and Melbourne. Rising rates, taxes, and insurance made big cities unaffordable, but smaller Florida markets are now benefiting from that shift.

AI in Real Estate

One AI Tool

AI platform that transforms public municipal data into actional insights for real estate developers.

—

Top AI Headlines

AI in Property Management Is Getting Smarter link

Investment in generative AI surged to $29.1 billion across nearly 700 deals in 2023, signaling heavy momentum toward AI-driven real estate operations. Major firms like CBRE, JLL, and Prologis are already deploying it for predictive maintenance and tenant sentiment analysis.

Prologis is using generative AI to interpret unstructured data—like investor calls—to understand tenant sentiment, while C&W Services leverages AI to optimize technician training based on work order data. These tools help cut costs and reduce human error in day-to-day operations.

A big roadblock is messy, outdated, or fragmented data. Without clean inputs, AI can produce flawed outputs—making proprietary, well-structured data a critical competitive advantage.

Real Brokerage’s AI Bet: Is This the Next Palantir-Level Growth Story? link

REAX posted 76% year-over-year revenue growth in Q1 2025, reaching $354M from 33,617 transactions and $13.5B in gross transaction value—while scaling agent count 61% with just 10 full-time transaction staff.

Its AI tool, Leo CoPilot, now handles over 10,000 daily client interactions per agent and has boosted agent productivity by 5% YoY—a major edge in a text-driven industry where speed and scale matter.

REAX’s Real Wallet fintech arm grew 40% YoY to a $700K run rate with $8M in agent deposits, adding sticky, non-commission income to buffer against housing downturns and regulatory pressure on fee splits.

A word from our sponsor

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs who backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits in their operating history.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

Cross-Market Demand Report

(This content is restricted to Pro Members only. Upgrade)

Retail Vacancies Tick Up—But These Markets Still Dominate

(This content is restricted to Pro Members only. Upgrade)

CRE Benchmarking Is Shifting—Are You Keeping Up?

(This content is restricted to Pro Members only. Upgrade)

September Rate Cut Back on the Table—What It Could Mean for Housing

(This content is restricted to Pro Members only. Upgrade)

CRE Market Looks Calm—But Hidden Risks Are Growing Fast

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

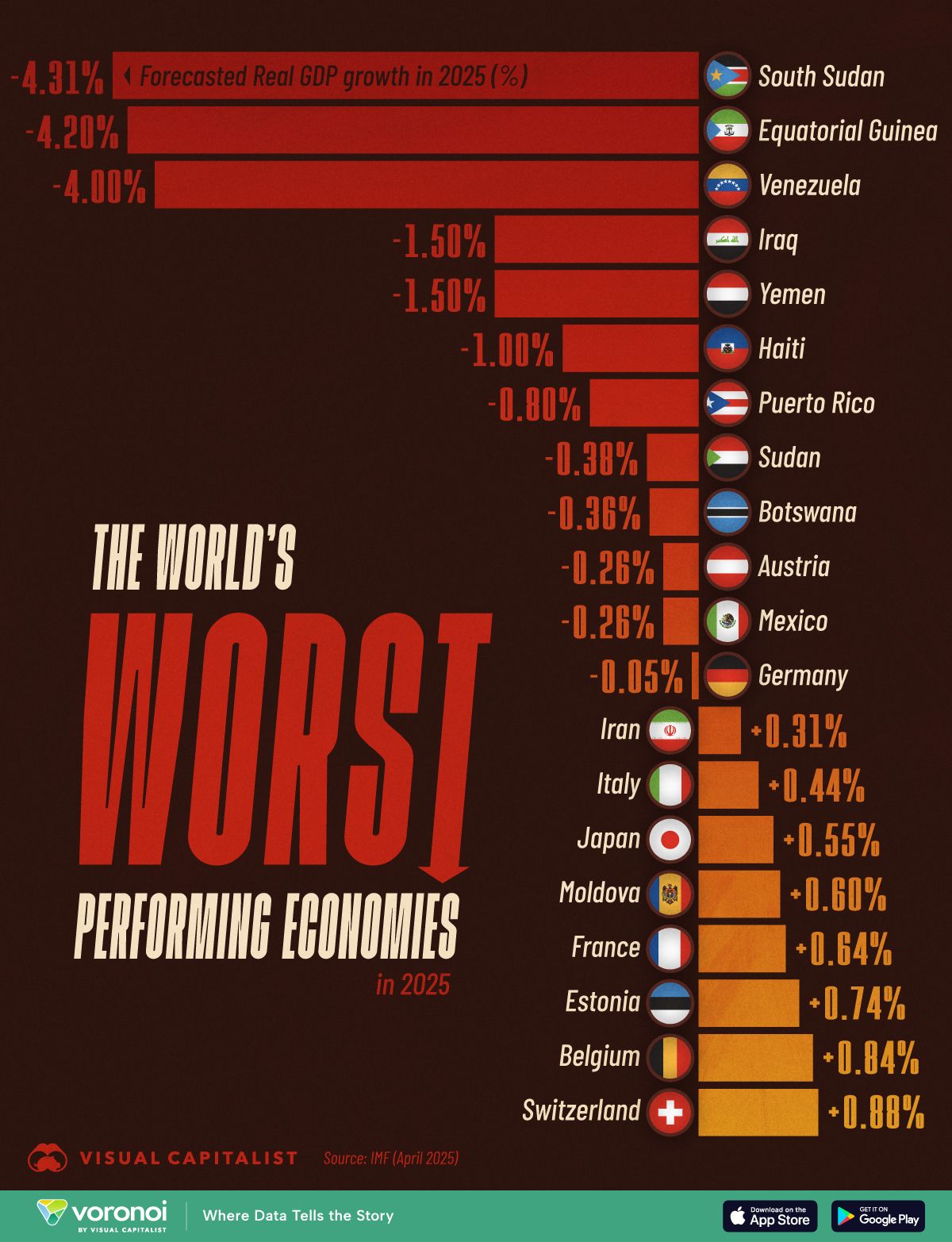

Ranked: The World’s Worst Performing Economies in 2025

Unreal Real Estate

Straight out of a Scandinavian murder mystery!

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply