- Zero Flux

- Posts

- 92% of CRE teams now piloting AI, A tiny boathouse!

92% of CRE teams now piloting AI, A tiny boathouse!

LA multifamily sales, Bay Area Home Sales and more

Want the full Zero Flux experience?

For a limited time, you can upgrade to Premium at just $6.32/month and get deeper data drops, investor insights, and access to every tool we’ve built for serious operators.

If you work in fintech or finance, you already have too many tabs open and not enough time.

Fintech Takes is the free newsletter senior leaders actually read. Each week, we break down the trends, deals, and regulatory moves shaping the industry — and explain why they matter — in plain English.

No filler, no PR spin, and no “insights” you already saw on LinkedIn eight times this week. Just clear analysis and the occasional bad joke to make it go down easier.

Get context you can actually use. Subscribe free and see what’s coming before everyone else.

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.33% | -0.01% | +0.20% | 6.13% / 7.26% |

15 Yr. Fixed | 5.80% | -0.02% | +0.08% | 5.60% / 6.59% |

30 Yr. FHA | 6.05% | -0.01% | +0.16% | 5.89% / 6.62% |

30 Yr. Jumbo | 6.35% | +0.03% | +0.20% | 6.10% / 7.45% |

7/6 SOFR ARM | 5.95% | -0.03% | +0.09% | 5.59% / 7.25% |

30 Yr. VA | 6.06% | -0.02% | +0.16% | 5.90% / 6.64% |

⚡ Snapshot: The 30 Yr. Jumbo rose the most (+0.03%), while most other loan types slipped slightly. Overall, rates stayed mostly flat with a mild downward bias.

New here? Join the newsletter (it's free).

Macro Trends

Borrowers still finding it hard even after rate cuts link

The Fed’s second consecutive 25-basis-point cut brings the federal funds rate down to a 3.75%–4.00% range, the lowest since early 2024 , but most credit card holders will save only about $61 total on a $7,000 balance, according to LendingTree.

A new homebuyer taking out a $350,000 mortgage could see monthly payments fall roughly $150, while adjustable-rate and HELOC borrowers feel the impact faster as banks reset prime rates.

Savings yields above 4% are likely to fade soon; analysts say now is the time to lock in CDs or high-yield accounts before deposit rates slide further.

Real Estate Trends

U.S. apartment demand drops 63,000, deepest gap in 30 years link

Only 42,430 market-rate units were absorbed from July to September, about half the decade average, signaling a major slowdown tied to weaker job growth and falling consumer confidence.

Developers still delivered 105,525 new units in Q3 2025, leaving demand 63,100 units below supply , the second-worst Q3 imbalance since RealPage began tracking in 1993.

Despite this quarter’s softness, year-ending absorption remains strong at 637,079 units, suggesting that as new construction cools, the market could quickly tighten again.

92% of CRE teams now piloting AI but only 5% hit their goals link

In just three years, the share of corporate real estate (CRE) companies experimenting with AI surged from 5% to 92%, yet only 5% say they’ve achieved most of their program goals, underscoring a massive execution gap.

Energy management, portfolio optimization, and real estate data workflows are the top three AI focus areas, with many CRE teams prioritizing long-term infrastructure over quick wins.

AI is widening the gap between tech leaders and laggards , firms with mature data systems and C-suite sponsorship are pulling far ahead, while 60% of companies still struggle with outdated or duplicate tech systems.

Location Specific

LA multifamily sales down; Q3 deliveries hit 5,292 as absorption lags link

Investment volume fell 32% year-to-date through Q3 to $4.2B. Colliers ties the drop to a supply wave while cap rates held flat at 5.7%.

New deliveries jumped to 5,292 units in Q3 (vs. 3,218 a year ago) while net absorption slid to 2,420 (vs. 3,902). Absorption has trailed new supply in 5 of the past 7 quarters, nudging occupancy ~30 bps lower since Q1 2024.

Rents barely moved,up 0.7% YoY to $2,294,despite “robust” construction still in the pipeline (26,226 units, down from 32,632). Occupancy varies: Westside & Hollywood/Mid-Wilshire ~94.1% vs. South LA at 96.8%.

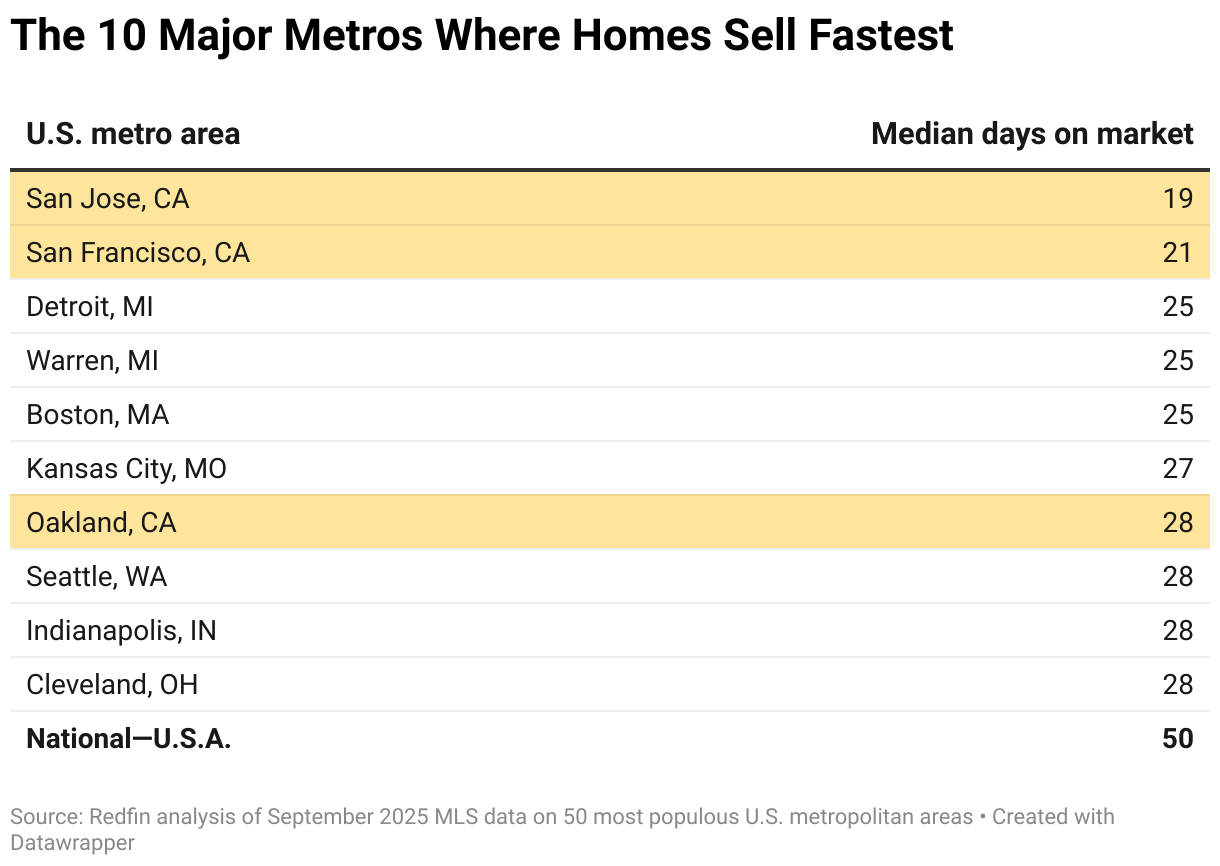

Bay Area home sales surge 17% - fueled by AI paychecks and shrinking supply link

Pending home sales in San Francisco jumped 17% year over year, the largest increase of any major U.S. metro. Homes sold in just 20 days on average, less than half the national pace of 50 days.

Nearly half of all San Jose homes (48.5%) went under contract within two weeks, up from 16.8% a year earlier, signaling a fast-moving, highly competitive market.

Falling condo prices (-1.3% in Oakland, -0.7% in San Francisco) and rising AI-driven incomes are drawing tech workers back, while active listings dropped 7.7% in SF and 6% in San Jose, tightening supply.

AI & Real Estate - Today’s Trends

Tool of the day: MaxHome

An AI-native platform designed for residential real estate brokerages, automating tasks such as transaction management, compliance, and agent workflows to enhance operational efficiency.

Collov AI & Side Team Up to Give Agents Instant Virtual Staging Power link

The partnership gives Side’s ~3,700 agents access to Collov AI’s ultra-fast, photorealistic virtual staging platform,letting listings go live with impactful visuals without the time or cost of traditional furniture setups.

Generative AI Unleashes a New Era of Innovation in Commercial Real Estate link

From due diligence to design, GenAI is cutting underwriting time from weeks to minutes and delivering 15%+ efficiency gains in energy use and operations, marking the biggest technological shift in CRE since the digital revolution.

AI Tools Boost Property-Management Ops Overnight link

This article outlines how on-site teams are deploying AI for chatbots, marketing automation, dynamic photo displays and predictive maintenance , freeing staff from repetitive tasks and increasing conversion, engagement and efficiency.

Linkhome Holdings Inc. Teams Up with Beike Realsee to Bring AI-Powered 3D Home Tours to Life link

By combining Linkhome’s tech stack with Beike Realsee’s immersive 3D visualization platform, the partnership aims to enable agents and developers to generate interactive, AI-enhanced property tours in minutes , signalling a shift in how listings are marketed and consumed.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

A new trend across retail real estate.

(This content is restricted to Pro Members only. Upgrade)

A subtle turn in industrial real estate could reshape 2026’s top markets

(This content is restricted to Pro Members only. Upgrade)

6 States Push to Axe Property Taxes

(This content is restricted to Pro Members only. Upgrade)

The Real Estate Playbook for Scaling Healthcare Brands

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Unreal Real Estate

A tiny boathouse!

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply