- Zero Flux

- Posts

- AI bots are taking over leasing

AI bots are taking over leasing

Visualizing the World’s Top 50 Private Equity Firms in 2025 and 12 other real estate insights

Share Zero Flux with a friend using your unique link and unlock 3 months of premium free:

https://www.zeroflux.io/subscribe?ref=PLACEHOLDER

And if you get 25 signups overtime with this link, premium is yours for life 🎉

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.83% | +0.01% | +0.04% | 6.11 / 7.26 |

15 Yr. Fixed | 6.03% | +0.00% | +0.04% | 5.54 / 6.59 |

30 Yr. FHA | 6.37% | +0.02% | +0.08% | 5.65 / 6.62 |

30 Yr. Jumbo | 6.90% | +0.00% | +0.01% | 6.37 / 7.45 |

7/6 SOFR ARM | 6.27% | -0.05% | -0.08% | 5.95 / 7.25 |

30 Yr. VA | 6.39% | +0.02% | +0.09% | 5.66 / 6.64 |

New here? Join the newsletter (it's free).

Macro Trends

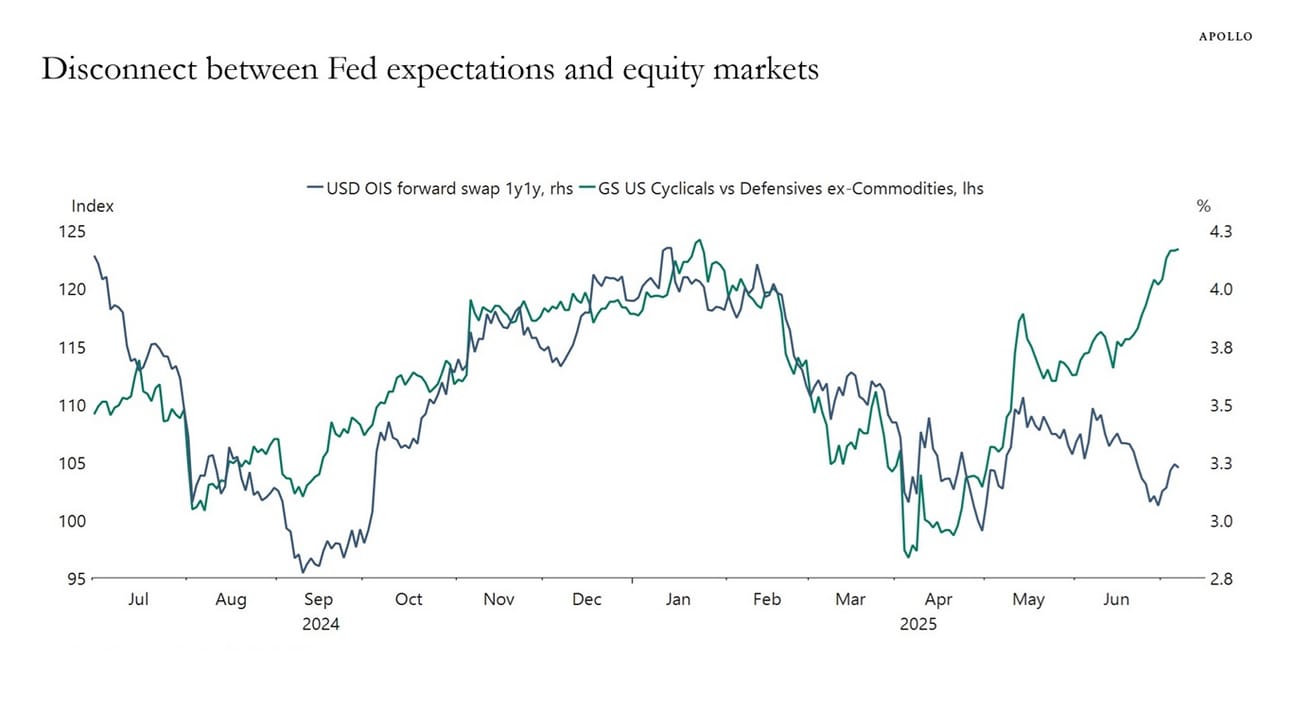

Markets Sending Mixed Signals—Bonds Say Recession, Stocks Say Boom link

The bond market expects a Fed rate cut, signaling slowing growth, while the stock market is rallying cyclical sectors, betting on growth acceleration. These two can't both be right.

If the bond market is wrong and growth speeds up, rates might rise again—bad news for real estate financing. If equities are wrong, a market correction could hit risk assets hard.

This split suggests heightened uncertainty in macro outlooks, making it harder for investors to gauge timing on major asset moves or debt refinancing.

Real Estate Trends

Inside the High-Stakes Boom in Life Sciences Real Estate link

Life sciences buildings are significantly more expensive to build due to complex infrastructure needs—like specialized HVAC, backup power, and structural load capacity—which can’t tolerate service interruptions without risking multi-month research losses.

Boston, the Bay Area, and San Diego lead the market, but second-tier hubs like Philadelphia, New Jersey, and Raleigh-Durham are gaining ground thanks to proximity to research institutions and rising demand.

Developers are pulling back from speculative builds and only launching projects with committed anchor tenants, especially in emerging markets where a controlled oversupply can become an advantage when demand spikes.

Multifamily prices plunge—worst drop since 2008 link

Multifamily property prices fell 12.1% year-over-year, the steepest drop since the 2008 crash. The price index also declined 1.5% from March to April, signaling accelerating pressure.

Total multifamily sales volume in May hit $8.2 billion, down 18% from last year—ending an 11-month streak of double-digit growth. Garden-style properties were hit hardest with a 30% drop in sales.

Rents have now declined for 23 straight months, even during a period that usually sees seasonal increases. New inventory from high completion rates is likely keeping rent growth flat or negative.

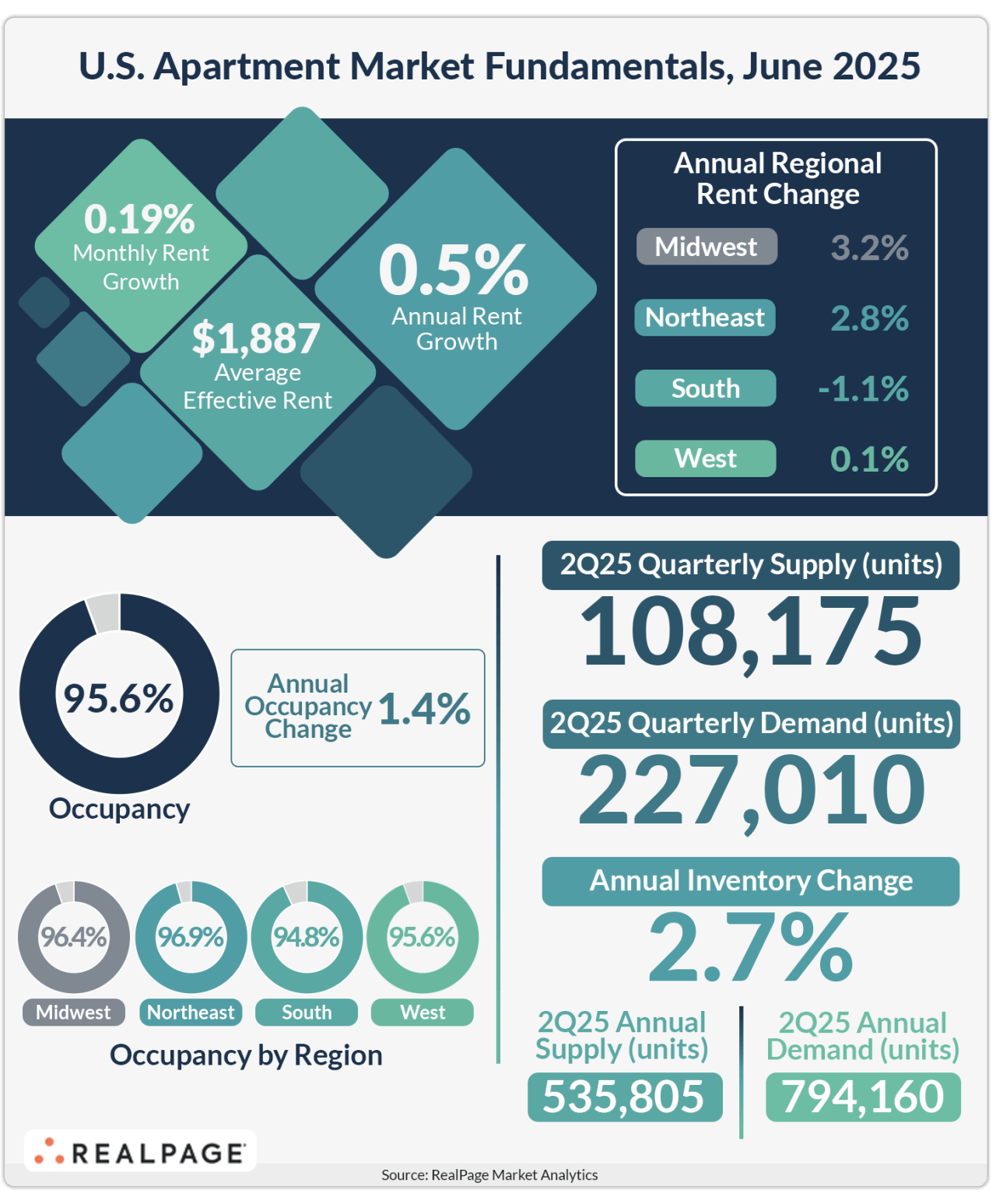

Apartment demand hits record highs—but rents barely move link

U.S. apartment demand surged with over 227,000 units absorbed in Q2 2025, outpacing even the post-pandemic boom, while completions slowed slightly to 535,000 units annually. This mismatch supports occupancy but hasn't boosted rent growth.

Nationwide occupancy rose to 95.6%, up 140 basis points year-over-year, even as rents in the South fell 1.1%. Operators are choosing to keep units full with concessions instead of raising rents.

Tech-driven cities like San Francisco and Boston saw improving fundamentals, while tourism-heavy markets like Las Vegas and Nashville showed signs of softening—potential early warnings of economic stress.

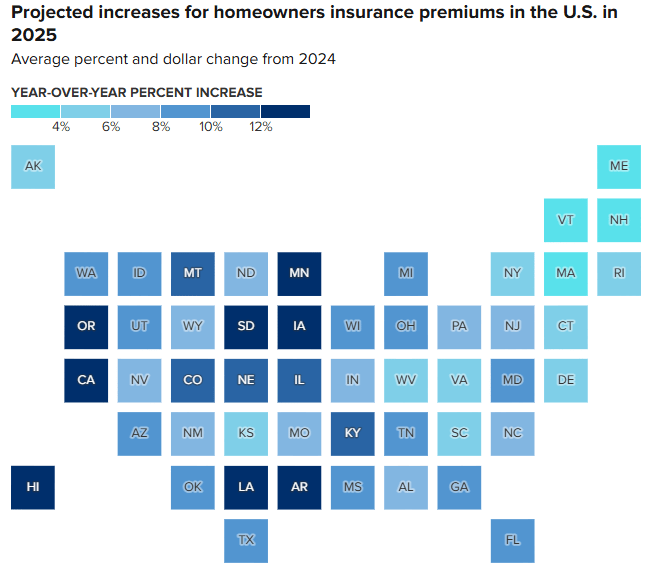

Insurance premiums skyrocket nationwide—Louisiana and California brace for biggest hikes link

Louisiana leads the nation with a projected 28% jump in homeowner's insurance premiums for 2025, while California follows at 21%, even in areas untouched by January’s wildfires. Nationwide, premiums are set to rise 8% on average across all 50 states.

Florida still has the highest average premium at $15,460, despite some reforms slowing increases. In contrast, Vermont holds the lowest at $1,248, though it's also seeing a spike due to recent flooding.

National insurers are rebalancing risk portfolios by dropping policies and raising rates unevenly across states—even profitable regions may see hikes if others underperform. Some California homeowners are turning to unregulated “non-admitted” insurers just to stay covered.

Location Specific

Vegas home listings explode as retirees flee and investors cash out link

Las Vegas saw a 77.6% year-over-year jump in new listings, the biggest spike of any U.S. market, with retirees moving out and investors offloading properties.

Despite rising inventory, the area remains a seller’s market with only 3.6 months of supply, though some sellers are now offering concessions or price cuts to stay competitive.

Inventory across the U.S. grew too—up 38.3% in the West and 29.4% in the South—while national active listings stayed above 1 million for the second month in a row.

One Real Estate AI tool

Build faster and boost margins with an AI workforce that delivers ROI from day one. No lengthy onboarding, no workflow disruption.

AI in Real Estate

AI bots are taking over leasing—and they’re shockingly good at it link

Cortland’s AI assistant “Cortney” handled 80,000 leasing inquiries and booked 60,000 tours in one year—with 98% accuracy. It now handles calls and maintenance support, showing just how far automation is going.

Spending on agentic AI in real estate could hit $155 billion within 5 years, with major players like Greystar, JLL, Yardi, and RealPage already deploying their own systems.

These tools don’t just answer questions—they act like full-time agents, learning from data and working 24/7 to reduce vacancies and boost team productivity.

Quantum Cities Are Coming—Can AI and Real Estate Deliver 10% GDP Growth? link

Cities that achieve “quantum” status aim for 10% annual GDP growth for 10 straight years—Singapore, Dubai, and Shenzhen already hit this target during past decades by streamlining permitting and investing in digital infrastructure.

Civic tech and AI are key drivers: think cities as platforms where citizens access jobs, transport, and amenities through a single app, like Dubai’s all-in-one city control system.

New urban models are emerging—like startup-built cities (California Forever, Liberty City)—while existing metros like Boston face trade-offs between historic value and outdated infrastructure.

A word from our sponsor

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

Multifamily markets are hurting—but these 3 cities could boom next:

(This content is restricted to Pro Members only. Upgrade)

States roll out bold new funding tools for affordable housing—here's what's working

(This content is restricted to Pro Members only. Upgrade)

Sales volume trends across different asset classes

(This content is restricted to Pro Members only. Upgrade)

Fixer-Upper Goldmine? These States Have the Most Homes Begging for Renovation

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

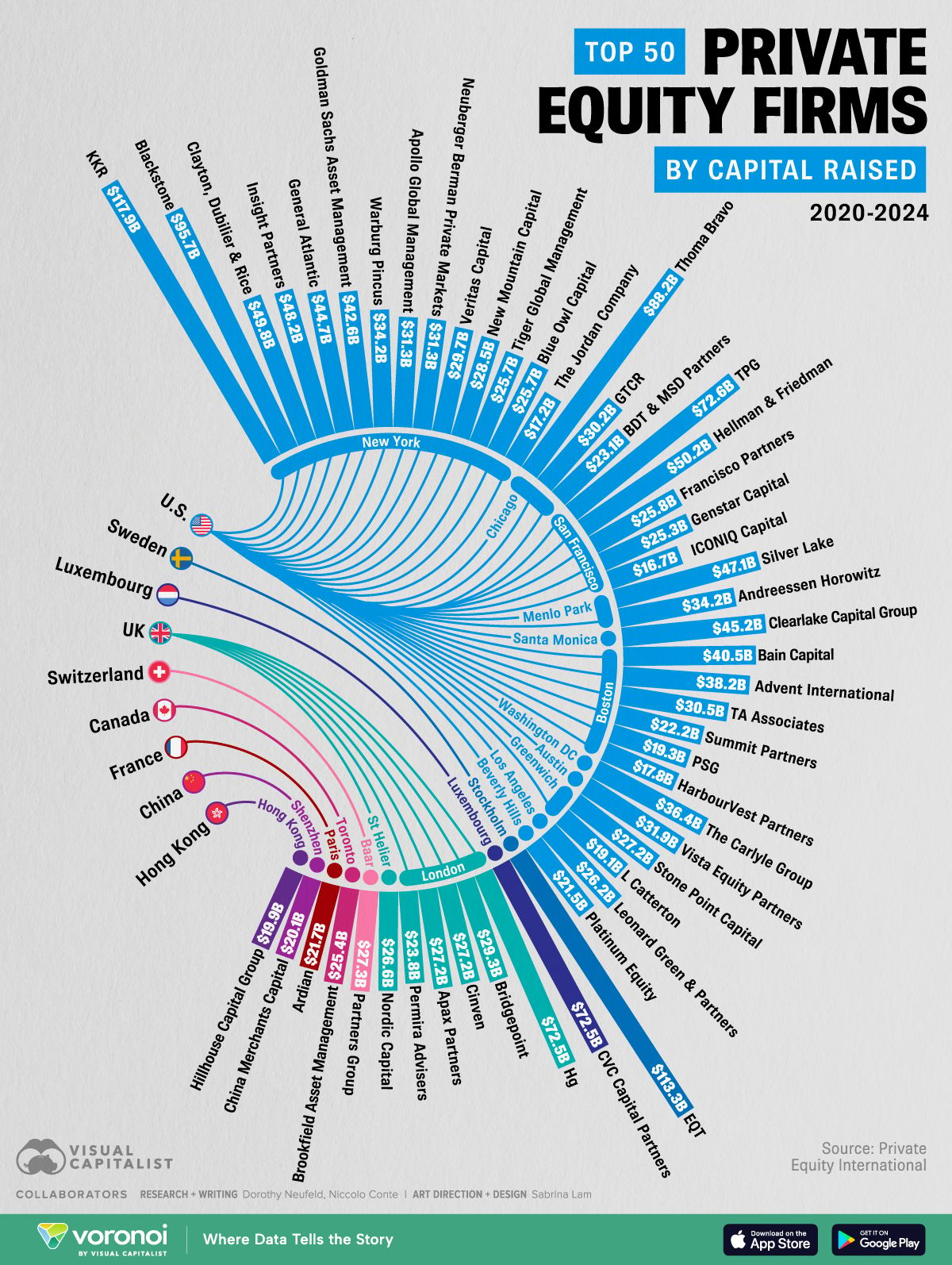

Visualizing the World’s Top 50 Private Equity Firms in 2025

Unreal Real Estate

Macadamia Nut Farm with Ocean Views!

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply