- Zero Flux

- Posts

- AI to erase half of white-collar jobs

AI to erase half of white-collar jobs

Mapped: U.S. Households on Welfare by State and 12 other real estate insights

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.53% | +0.03% | +0.01% | 6.11 / 7.26 |

15 Yr. Fixed | 5.88% | +0.02% | -0.02% | 5.54 / 6.59 |

30 Yr. FHA | 6.09% | +0.03% | -0.01% | 5.65 / 6.62 |

30 Yr. Jumbo | 6.47% | +0.02% | -0.03% | 6.37 / 7.45 |

7/6 SOFR ARM | 5.91% | +0.01% | -0.06% | 5.90 / 7.25 |

30 Yr. VA | 6.10% | +0.02% | -0.02% | 5.66 / 6.64 |

New here? Join the newsletter (it's free).

Macro Trends

AI will erase half of white-collar jobs: WSJ link

Ford CEO Jim Farley said AI could replace “literally half of all white-collar workers” in the U.S., calling it one of the largest labor disruptions in history.

Federal Reserve Chair Jerome Powell told Congress that generative AI has “enormous capabilities” to reshape both the economy and the labor market.

Business leaders at the Aspen Ideas Festival signaled that AI-driven job losses are no longer speculation but a near-term expectation.

Real Estate Trends

Small-Cap Multifamily Sales Climb as These Deals Gain Momentum in 2025 link

Small-cap multifamily hit $11.94B in H1 2025, up 9% YoY; Q2 rose to $6.26B, +10% from Q1 and +9% YoY. Momentum is building despite broader market headwinds.

Traditional apartments led with $10.37B, but senior living was the fastest climber at +16% YoY to $1.19B; student housing rose 6% to $372.4M. That mix signals investors shifting toward needs-based demand.

Big market standouts: Milwaukee soared +269.9%, San Francisco +134.2%, and Chicago +68.3% YoY. Laggards include Dallas–Fort Worth (-44.2%) and Denver (-43.3%), while New York led in volume at $1.12B but fell 12.2% YoY.

Core inflation climbed to 3.1% in August, the highest since February link

Core inflation climbed to 3.1% in August, the highest since February, while producer prices jumped 0.9% in July—triple what economists expected—showing tariff-driven costs are hitting consumers.

Labor data came in weaker than expected, with May and June job numbers revised down sharply, raising pressure on the Fed to cut rates even as inflation lingers.

Market odds of a September rate cut now stand at 93%, but Fed officials warn that easing too soon could risk a 1970s-style stagflation cycle, where inflation and unemployment rise together.

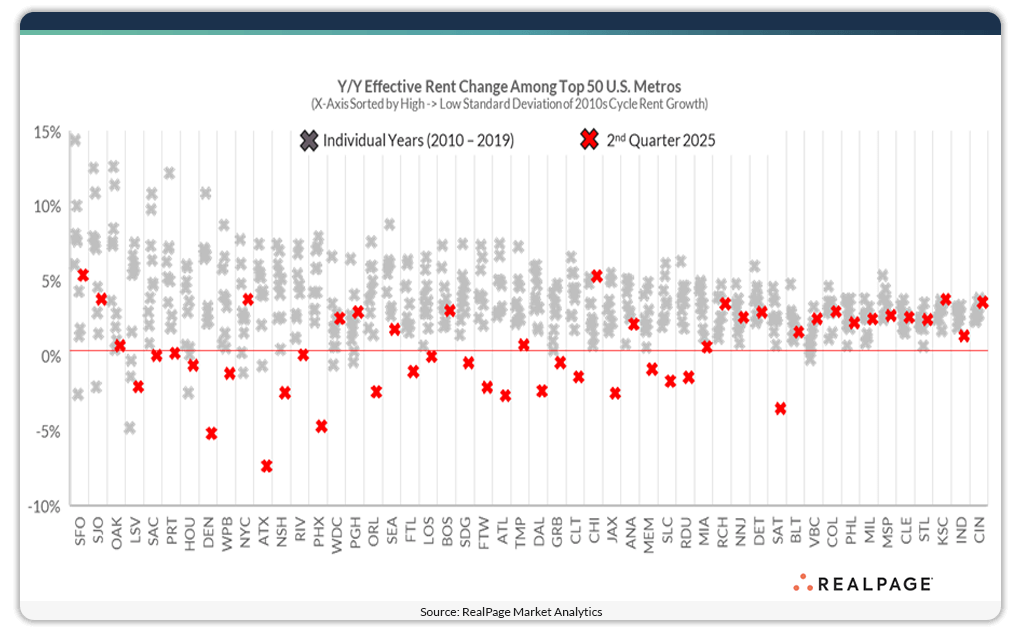

Midwest apartments stay steady while coastal rents swing wildly link

From 2010 to 2019, San Francisco rents swung from -3% to +15% annually, while Midwest markets like Cincinnati, Indianapolis, and Kansas City saw much smaller shifts.

Midwest stability comes from limited new supply and steady renter demand, keeping rent growth predictable.

Cleveland, St. Louis, and other Midwest metros ranked among the least volatile of the nation’s 50 largest apartment markets.

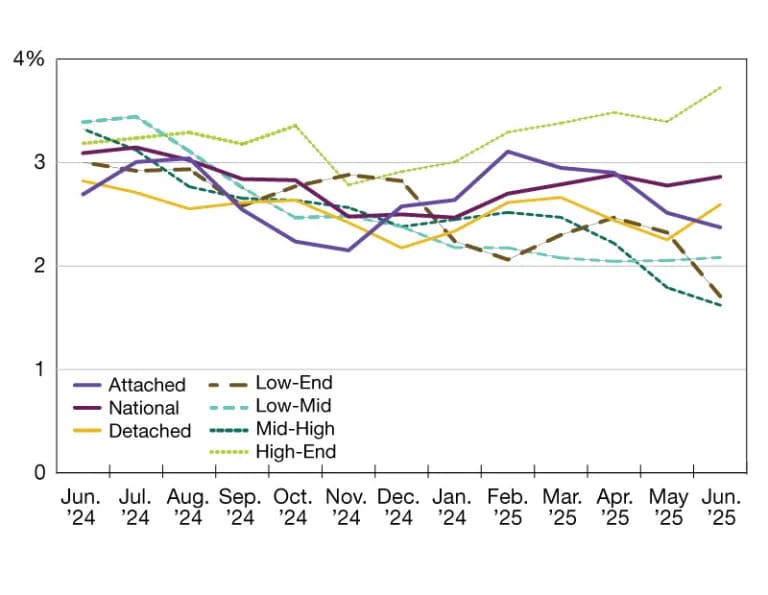

America’s Single-Family Rental Market Splinters in 2025 link

U.S. single-family rents rose 2.9% YoY in June. Chicago led big markets at 5.7%, followed by New York at 5.5%; Philadelphia and Los Angeles hit 3.5%, while Miami slipped -0.5%.

The market is splitting by tier: higher-priced homes climbed 3.7%, but entry-level units rose just 1.7% (slower than 2024). New apartments and build-to-rent townhomes are undercutting the low end, widening the gap.

Product type matters: detached homes gained 2.6%, with attached units softer—Dallas cooled where new supply and multifamily competition grew. Cotality tracks ~75% of stand-alone rentals across 17,500 ZIPs and follows the same unit over time, making these shifts an early signal.

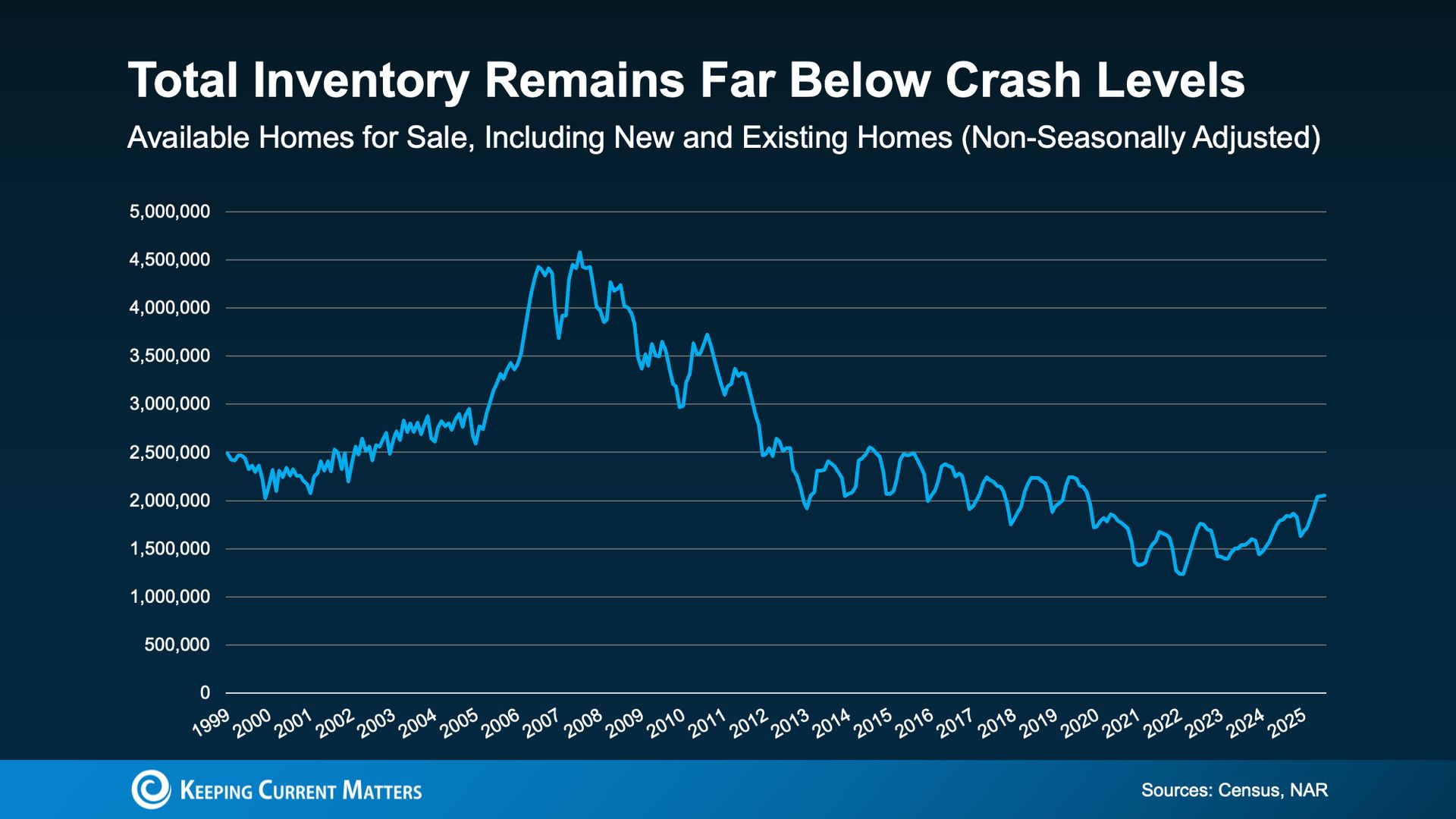

New home inventory hits post-crash high—but here’s what everyone’s missing link

New homes are at their highest level since 2008, but total housing supply is still far below crash-era levels once you add existing homes into the picture. The “2008 comparison” making headlines leaves out half the story.

Builders underbuilt for 15 straight years after the crash, creating a deep shortage. Realtor.com estimates it would take 7.5 years of above-trend building to close the gap.

Inventory varies widely by market, but nationally supply remains tight. The rise in new homes isn’t enough to flip conditions into oversupply.

Something I found Interesting

Utah promised 35,000 starter homes—only 5,100 are actually underway link

Utah’s median home price is about $600,000, far above the national median of $439,450, making starter homes nearly impossible for first-time buyers. Homes linger on the market for a median of 61 days but are still out of reach.

The Utah First Homes Program, a $150M initiative aiming for 35,000 affordable homes in five years, has so far produced only 5,100 homes. Builders have been slow to join despite incentives like infrastructure support and sweat-equity options.

Developers are prioritizing luxury builds instead: over 2,000 ultraluxury homes and condos are under construction, including multimillion-dollar projects like Deer Valley East Village, with many already sold to out-of-state buyers.

AI & Real Estate - Today’s Trends

Tool of the day- Hover

Hover employs AI-powered computer vision to turn ordinary smartphone photos of a property into a precise 3D model, collapsing a multi-hour site inspection into a 15-minute digital workflow. This ensures contractors and insurers get consistent, accurate measurements and documentation with a fraction of the usual effort.

Zillow and Berkshire Hathaway Bet Big on AI to Reshape Real Estate – link

Two industry giants are rolling out AI tools to transform home search, client engagement, and agent productivity — signaling a seismic shift in market dynamics.

This New AI Agent Monitors Property Markets in Real Time – link

Built on n8n and Bright Data, the tool scrapes listings and market signals automatically — giving investors instant intelligence on pricing trends and opportunities.

Zillow’s New AI Showcase Aims to Redefine Agent Competitiveness – link

The platform highlights how AI-driven digital tools are boosting listing performance, leveling the playing field for agents, and reshaping home sales dynamics.

Mastering AI: New Learning Hub Teaches CRE Pros How to Use AI Smarter – link

ChatCRE’s new learning platform gives brokers and investors hands-on training in AI tools — from underwriting workflows to tenant prospecting — to stay competitive in a shifting market.

A word from our sponsor

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

Commercial Real Estate Maturity Wall Insights

(This content is restricted to Pro Members only. Upgrade)

10 U.S. Cities Lead Healthcare Real Estate Transactions

(This content is restricted to Pro Members only. Upgrade)

U.S. Industrial Market Trends

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

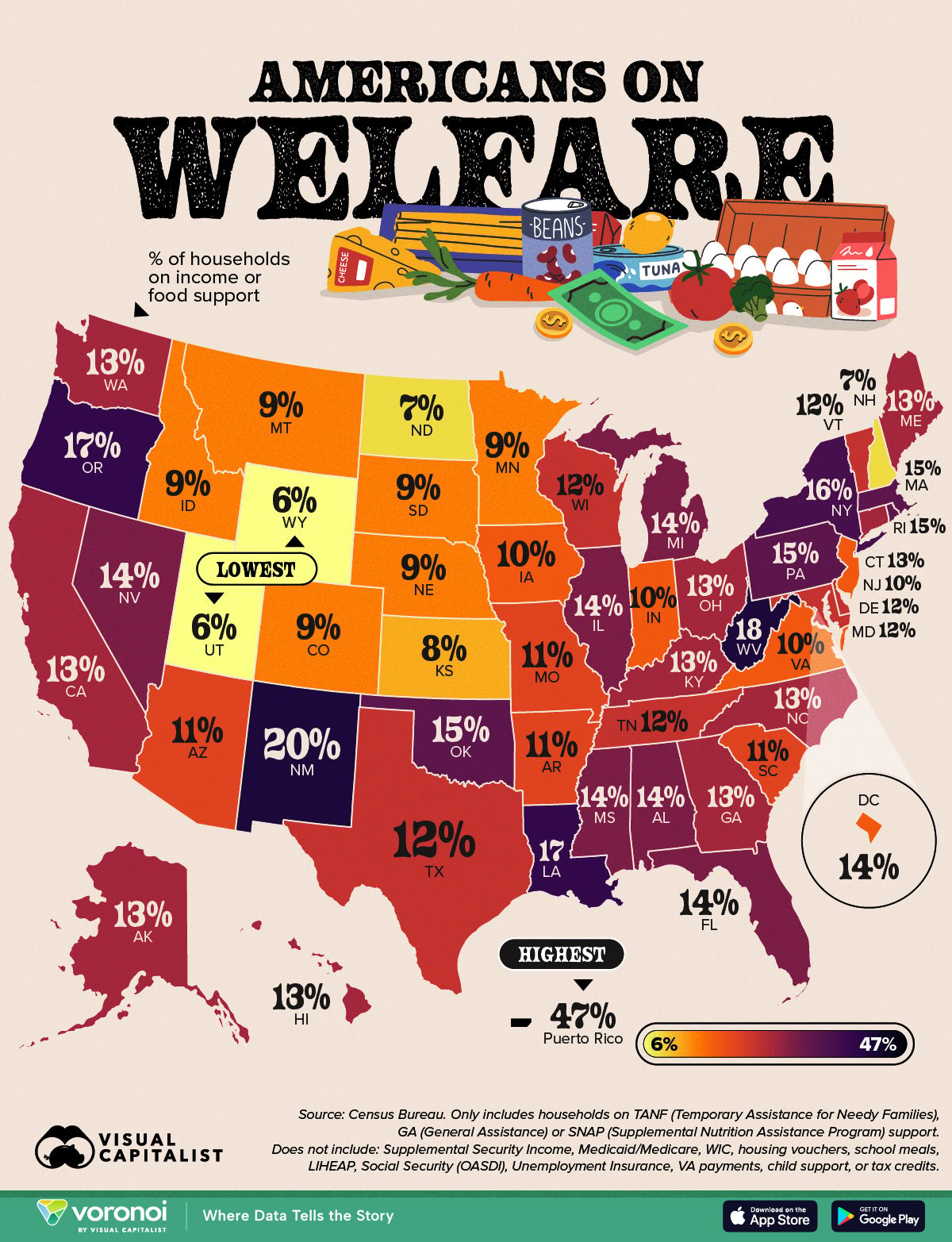

Mapped: U.S. Households on Welfare by State

Unreal Real Estate

For sale for the first time in 200 years

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply