- Zero Flux

- Posts

- AI to Unlock $34B in Real Estate Efficiencies by 2030

AI to Unlock $34B in Real Estate Efficiencies by 2030

Ranked: The World’s Top Startup Cities in 2025 and 12 other real estate insights

Share Zero Flux with a friend using your unique link and unlock 3 months of premium free:

https://www.zeroflux.io/subscribe?ref=PLACEHOLDER

And if you get 25 signups overtime with this link, premium is yours for life 🎉

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.78% | -0.03% | -0.05% | 6.11 / 7.26 |

15 Yr. Fixed | 6.04% | +0.00% | +0.01% | 5.54 / 6.59 |

30 Yr. FHA | 6.35% | -0.04% | -0.02% | 5.65 / 6.62 |

30 Yr. Jumbo | 6.90% | -0.02% | +0.00% | 6.37 / 7.45 |

7/6 SOFR ARM | 6.24% | -0.03% | -0.03% | 5.95 / 7.25 |

30 Yr. VA | 6.36% | -0.04% | -0.03% | 5.66 / 6.64 |

New here? Join the newsletter (it's free).

Macro Trends

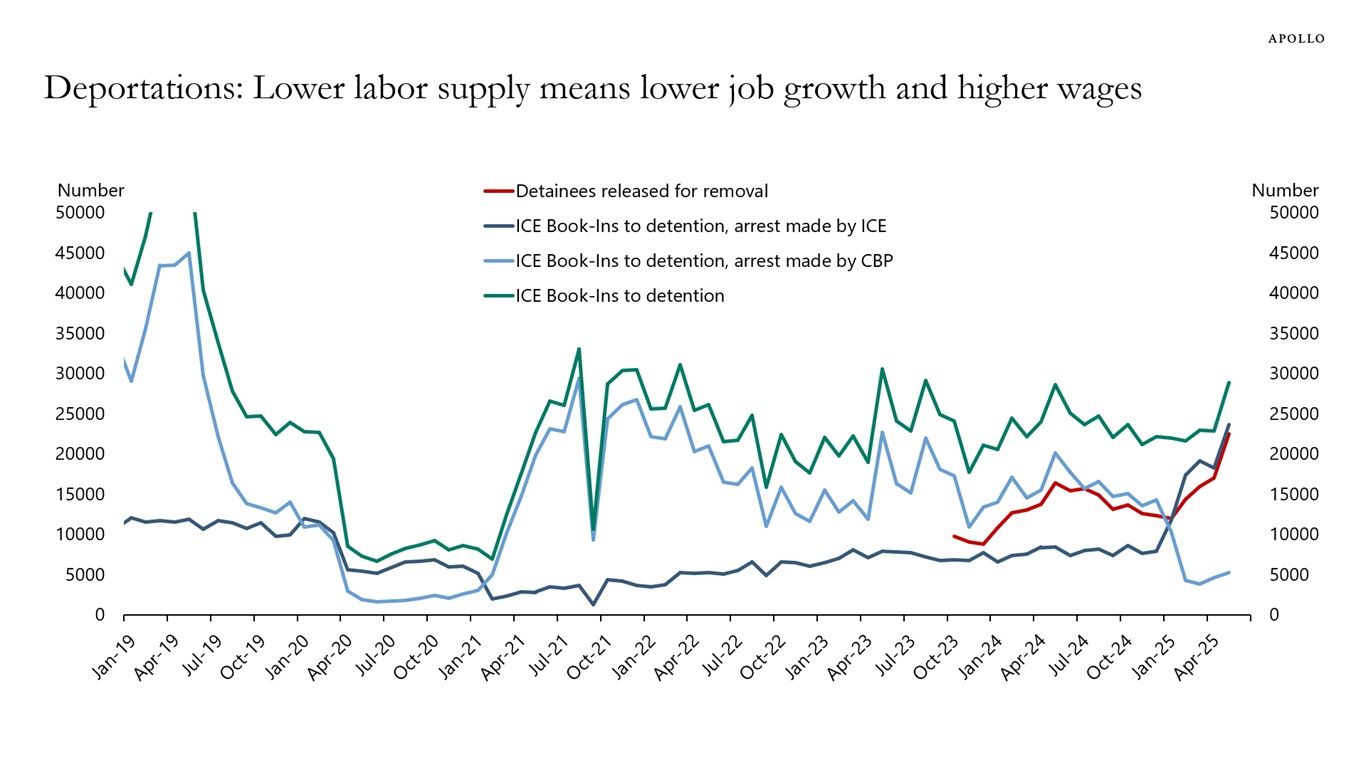

Deportation Spike Could Shrink Labor Force by 1 Million—Wage Pressure Ahead link

Deporting 3,000 unauthorized immigrants daily could slash the U.S. labor force by 1 million in 2025, cutting the participation rate by 0.4%. That drop would also push down job growth and push up wage inflation.

The sectors most impacted would be construction, agriculture, and hospitality—industries already facing tight labor conditions. Higher wage costs here could ripple into broader inflation risks.

This trend is described as “stagflationary,” meaning slower employment growth but higher wage inflation—an unusual combo that could complicate Fed policy and real estate planning.

Real Estate Trends

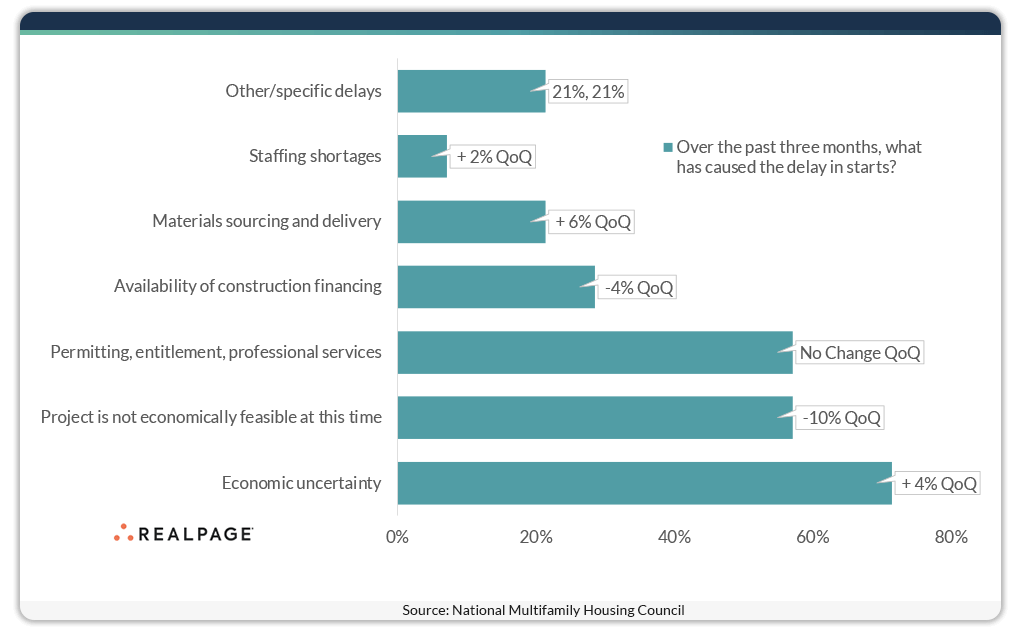

Multifamily construction delays ease slightly—but risks still loom link

In June 2025, 43% of developers reported construction delays, down from 58% in March—marking the lowest feasibility-related delay rate since March 2023. This signals modest improvement, but challenges persist.

71% of respondents still cite “economic uncertainty” as a cause of delays, while 57% blame permitting and pro services—showing that non-financial roadblocks remain just as disruptive.

Only 48% of developers expect labor availability to stay stable over the next three months, suggesting continued caution on workforce and project timelines.

Why More Senior Living Operators Are Turning to Family Office Capital link

Family offices now fund about 10% to 15% of senior living deals, offering flexible capital that institutional investors can’t. Many operators see them as long-term partners who better understand operational challenges.

Several operators said they’re actively moving away from private equity due to short hold periods and rigid return expectations, which clash with the slow recovery of occupancy and margins in senior living.

One executive noted that family office investors allow for patient, mission-aligned growth—especially crucial as senior housing faces rising labor costs and delayed lease-up timelines.

Something I found Interesting

Wealthy Families Are Buying Out-of-State Homes To Snag Tuition Discounts at Top Universities link

In-state tuition can be over 70% cheaper than out-of-state rates, with Florida offering a $22,000+ yearly discount at the University of Florida ($6,380 vs. $28,658). Some families are buying property to qualify and lock in those savings.

Real estate agents in Texas report that education savings—not tax benefits—are now the #1 reason high-net-worth buyers are relocating. Homes near universities are being snapped up quickly, with Houston listings spending just 46 days on the market.

Properties near major colleges often see higher appreciation and resale speed. But states like Texas and Florida require students to live in-state for 12 months before qualifying, so timing the purchase is critical.

Location Specific

Manhattan Office Leasing Surges—NYU Signs Monster Deal link

Manhattan logged 21.1 million square feet of leasing activity in the first half of 2025—the strongest start since 2014. NYU alone took 1.07 million square feet, dwarfing deals by Amazon (330K SF) and Goodwin Procter (244K SF).

Office availability fell 280 basis points year-over-year to 17.2%, with Class B and C properties tightening faster than Class A. This signals growing demand in mid-tier buildings despite broader macro uncertainty.

Average asking rents dropped 2.2% to $74.96 per square foot overall, but Class A rents actually rose 0.8%. Class B and C rents dipped to $60.03, but well-located assets are expected to attract tenants.

AI & Real Estate - Today’s Trends

Tool of the Day – OnsiteIQ

360 construction site documentation & risk analytics platform for real estate developers.

AI to Unlock $34B in Real Estate Efficiencies by 2030 link

AI is expected to slash costs across leasing, maintenance, and operations — with McKinsey projecting $34 billion in savings as adoption accelerates across CRE.

AI Is Now Designing and Building Homes — Can It Solve the Housing Crisis? link

From generative design to robotic construction, AI is streamlining how homes are planned and built — offering a potential fix for skyrocketing costs and supply shortages.

The Smartest Backdoor AI Real Estate Play? Prologis Is Quietly Winning link

As AI data centers explode, Prologis is snapping up industrial land near major metros — positioning itself as the hidden landlord of the AI boom.

This Realtor-Built AI Tool Instantly Polishes Your Listings link

A Florida agent developed an AI-powered tool that rewrites property descriptions to boost clarity, appeal, and click-through rates — no copywriter needed.

One Chart

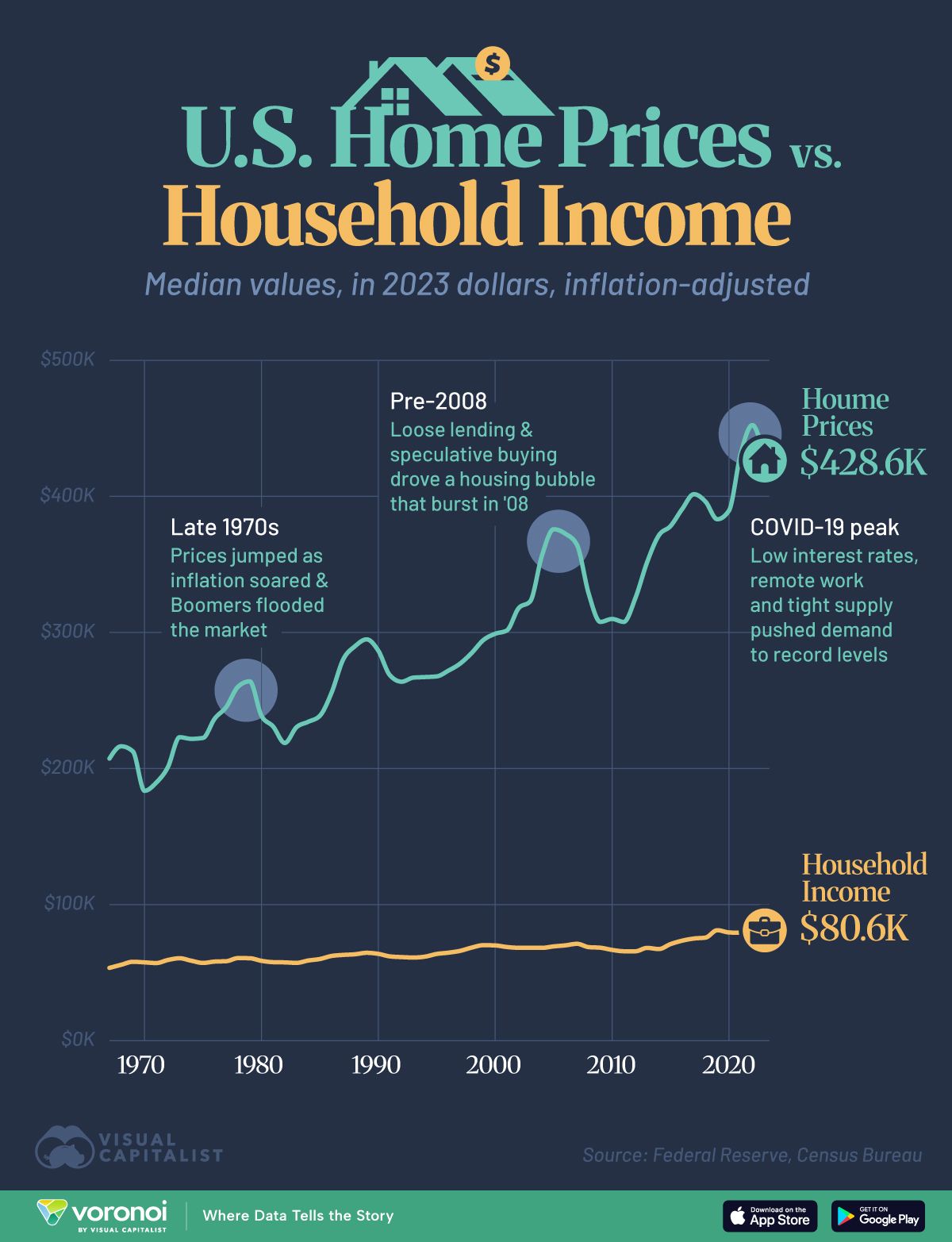

Charted: The Decline of U.S. Housing Affordability (1967–2023) link

A word from our sponsor

Stay Ahead of the Market

Markets move fast. Reading this makes you faster.

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or serious investor, it’s everything you need to know before making your next move. Join 160k+ other investors who get their market news the smart and simple way.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

Multifamily market hits reset. New Trends

(This content is restricted to Pro Members only. Upgrade)

Housing Market Hits A Turning Point

(This content is restricted to Pro Members only. Upgrade)

Trouble brewing in life sciences real estate?

(This content is restricted to Pro Members only. Upgrade)

The 10 Slowest Housing Markets in the U.S.

(This content is restricted to Pro Members only. Upgrade)

2025-2030 Five-Year Housing Market Predictions

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

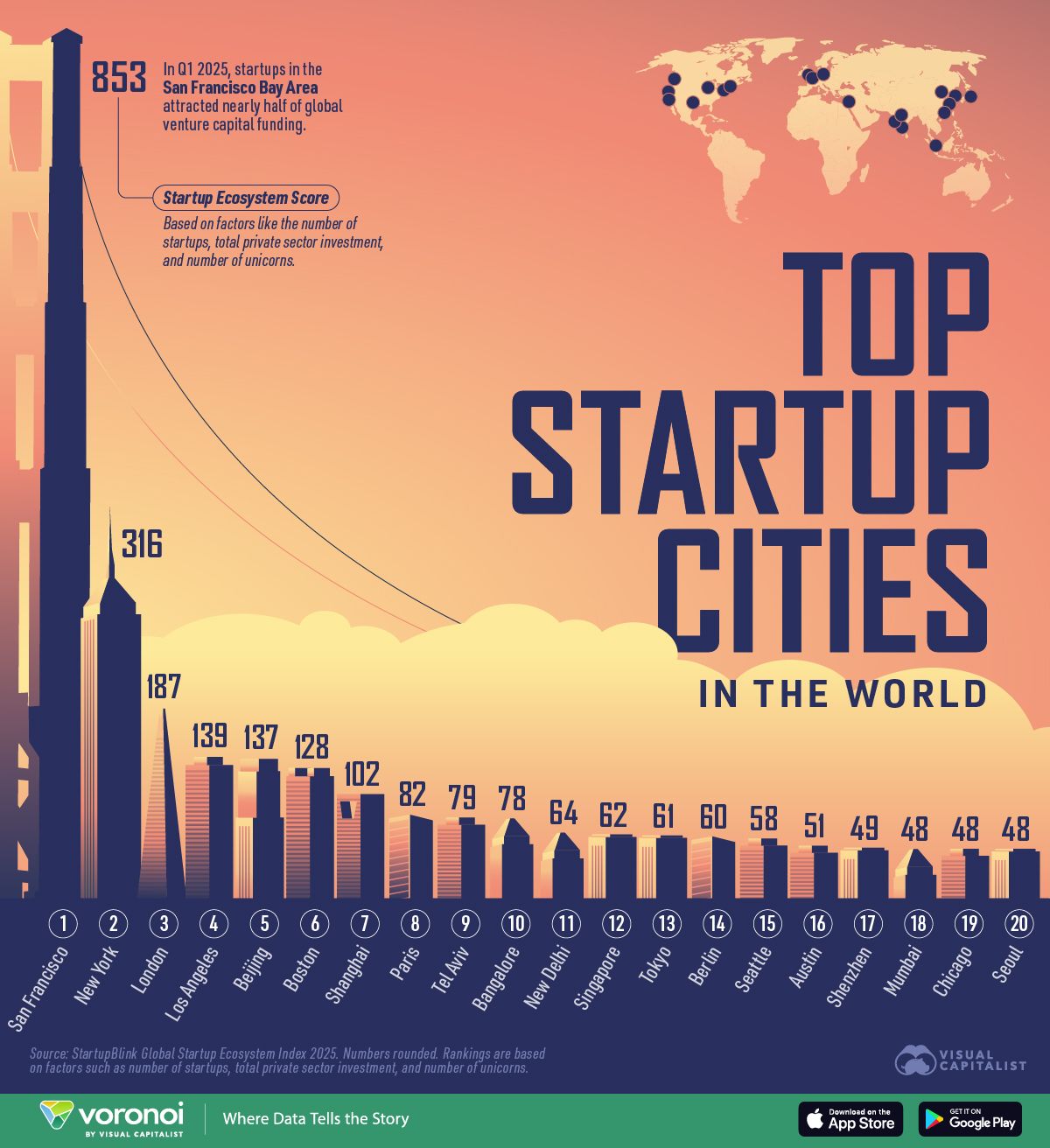

Ranked: The World’s Top Startup Cities in 2025

Unreal Real Estate

A piece of Cold War history for sale!

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply