- Zero Flux

- Posts

- AI Voice Agents Prequalify Real Estate Leads at Scale

AI Voice Agents Prequalify Real Estate Leads at Scale

Ranked: North American cities by increases in home prices, The Bishop Mansion for sale and more!

How can we make this newsletter more valuable to you?

Please reply with any feedback - It would mean a lot!

Hope you enjoy today's insights

A quick word from our sponsor

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.36% | +0.09% | +0.05% | 6.13 / 7.26 |

15 Yr. Fixed | 5.80% | +0.04% | +0.00% | 5.60 / 6.59 |

30 Yr. FHA | 5.92% | +0.03% | +0.02% | 5.82 / 6.59 |

30 Yr. Jumbo | 6.45% | +0.05% | +0.05% | 6.10 / 7.45 |

7/6 SOFR ARM | 6.05% | +0.24% | +0.20% | 5.59 / 7.25 |

30 Yr. VA | 5.95% | +0.05% | +0.03% | 5.85 / 6.60 |

⚡ Snapshot: The 7/6 SOFR ARM surged with a +0.24% jump, far outpacing all other loan types, while fixed rates climbed more modestly across the board.

New here? Join the newsletter (it's free).

Macro Trends

Why duration mismatch is becoming a bigger banking risk link

Banks fund long-term loans with overnight deposits, creating a duration gap that becomes riskier as customers can move money instantly through mobile banking.

Life insurers avoid this issue because their liabilities stretch over many years, letting them hold long-duration assets that match their payout timelines.

My take: This makes the banking system more sensitive to rate shocks, any savings shift to long-term institutions like insurers could ease stress on credit markets.

Real Estate Trends

Home insurance costs up 89% in a decade link

ICE’s 10-year study shows average annual premiums rose from $1,270 in 2014 to $2,405 in 2025, driven by extreme weather losses topping $120B and a 36% jump in home values.

Long-tenured borrowers saw the biggest hit, with insurance costs nearly doubling, while new loan cohorts paid less per $1,000 of coverage due to more active policy shopping.

My take: Rising insurance costs are becoming a core affordability risk, especially in high-hazard counties where premiums now shape mortgage eligibility. Investors should factor insurance trends into underwriting.

GAO probes FHFA chief over alleged political misuse of power link

The GAO opened an investigation into FHFA Director Bill Pulte after Senate Democrats claimed he used agency tools to target political opponents, including Letitia James and Adam Schiff.

A lawsuit also alleges Pulte accessed and leaked private mortgage records, raising questions about how FHFA handles fraud investigations and personal financial data.

My take: Any instability at FHFA matters for housing markets because it can slow policy decisions that affect lenders and GSE oversight. Investors should watch for spillover into regulatory timelines.

Office demand finally turns positive nationwide link

Q3 net absorption swung to +19.8M SF from -14.9M SF, and for the first time since 2021 all four Census regions showed positive demand.

Just 25.3M SF of new space delivered over four quarters, yet vacancy still nudged up to 11.9% as demand concentrated in Class A+ space.

My take: Encouraging breadth, but I would still treat this as an early bounce, not a full office comeback.

Buyer agent fees inch higher post-NAR rule change link

The average U.S. buyer’s agent commission rose to 2.42% in Q3, up from 2.36% a year ago, with sub-$500k homes holding the highest rates at 2.52%.

Commissions remain flat quarter to quarter, as slower sales give buyers enough leverage to push for steady or slightly higher agent compensation.

My take: Higher commissions show sellers are offering more to get buyers in a slow market. If sales stay weak, this trend could stick and make buying and selling slightly more expensive for everyone.

PropTech Funding, Fresh Off the Wire

A construction permitting platform, PermitFlow raised $54M in a Series B led by Accel to accelerate product development across its growing suite of AI agents.

A residential lending platform, Nada closed a $10M Series A led by LiveOak to fuel the rapid expansion of Nada’s HEA product.

A sales productivity tool, JeevaAI secured $9M in funding from JLL Spark.

Location Specific

Nashville’s zoning overhaul signals a new density play for investors link

Nashville approved two major zoning laws that open most single-family areas to townhomes, triplexes, quadplexes, and backyard cottages, directly targeting a 90,000-home supply gap and shifting the city toward “missing middle” density.

Opposition is mounting with infrastructure strain as the core argument, but the council’s 29–11 passage means the new rules will move forward, positioning Nashville as other pro-up zoning metros like Minneapolis and parts of California.

AI & Real Estate

Tool of the day: Rexera

Specialized AI agentic platform to handle real estate closing workflows, from gathering HOA documents and lien searches to sending routine updates.

AI Tools Spread Across 19 Major Real Estate Players link

Built In reports that AI now powers valuations, search, lead gen and site planning across top platforms like Zillow, Redfin, TestFit and Entera. Many tools use deep learning for pricing or natural language for search, while others automate closings and underwriting.

AI Voice Agents Prequalify Real Estate Leads at Scale link

The article explains how teams can use a VAPI-powered AI voice agent plus Twilio to call leads, ask budget and timeline questions, and push hot prospects into the CRM. It claims upto 70% drop in wasted sales calls and qualified leads routed within 2 minutes of inquiry.

New Guide Teaches Agents Fair-Housing Safe AI Prompts link

Medium reports that nearly all agents now use AI, but many risk Fair Housing violations when models generate phrases about people or demographics. The guide gives simple rules and prompt templates to keep AI outputs factual and compliant.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

Smart Buildings Are Quietly Becoming Cash Machines

(This content is restricted to Pro Members only. Upgrade)

The Last 10 Percent: Why Custom AI Is Becoming CRE’s Real Advantage

(This content is restricted to Pro Members only. Upgrade)

Banks Hold $1.8T in CRE Debt, but the Real Risks Hide in the Shadows

(This content is restricted to Pro Members only. Upgrade)

The Quiet Agency Strategy That Triples Leads for Senior Living Operators

(This content is restricted to Pro Members only. Upgrade)

CRE Enters a New Cycle, Powered by AI Growth and Rate Relief

(This content is restricted to Pro Members only. Upgrade)

Exclusive Insights: PropTech Fundings

One Chart

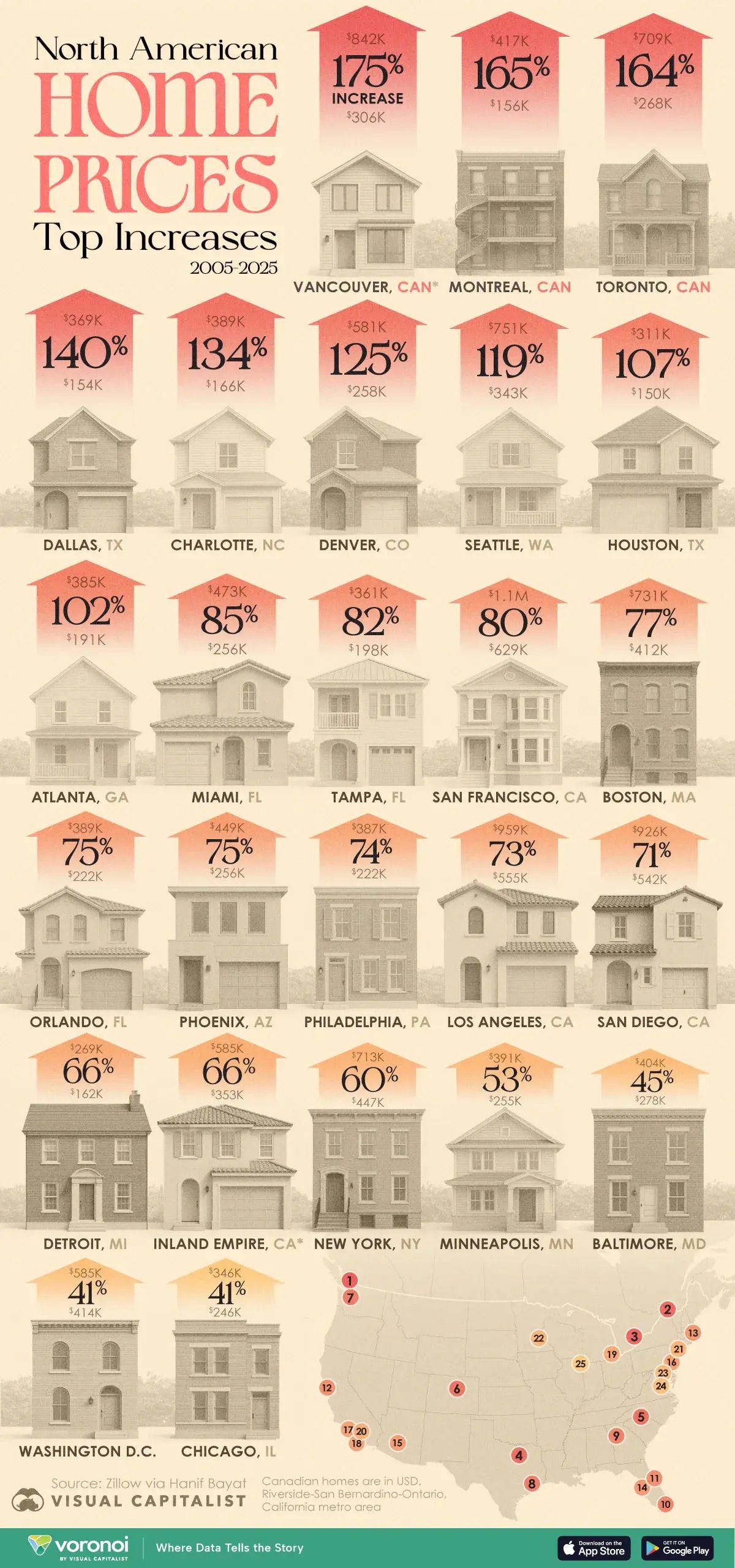

Ranked: North American cities by increases in home prices (2005-2025)

Unreal Real Estate

The Bishop Mansion

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply