- Zero Flux

- Posts

- America’s Happiest States, A Bank For Sale

America’s Happiest States, A Bank For Sale

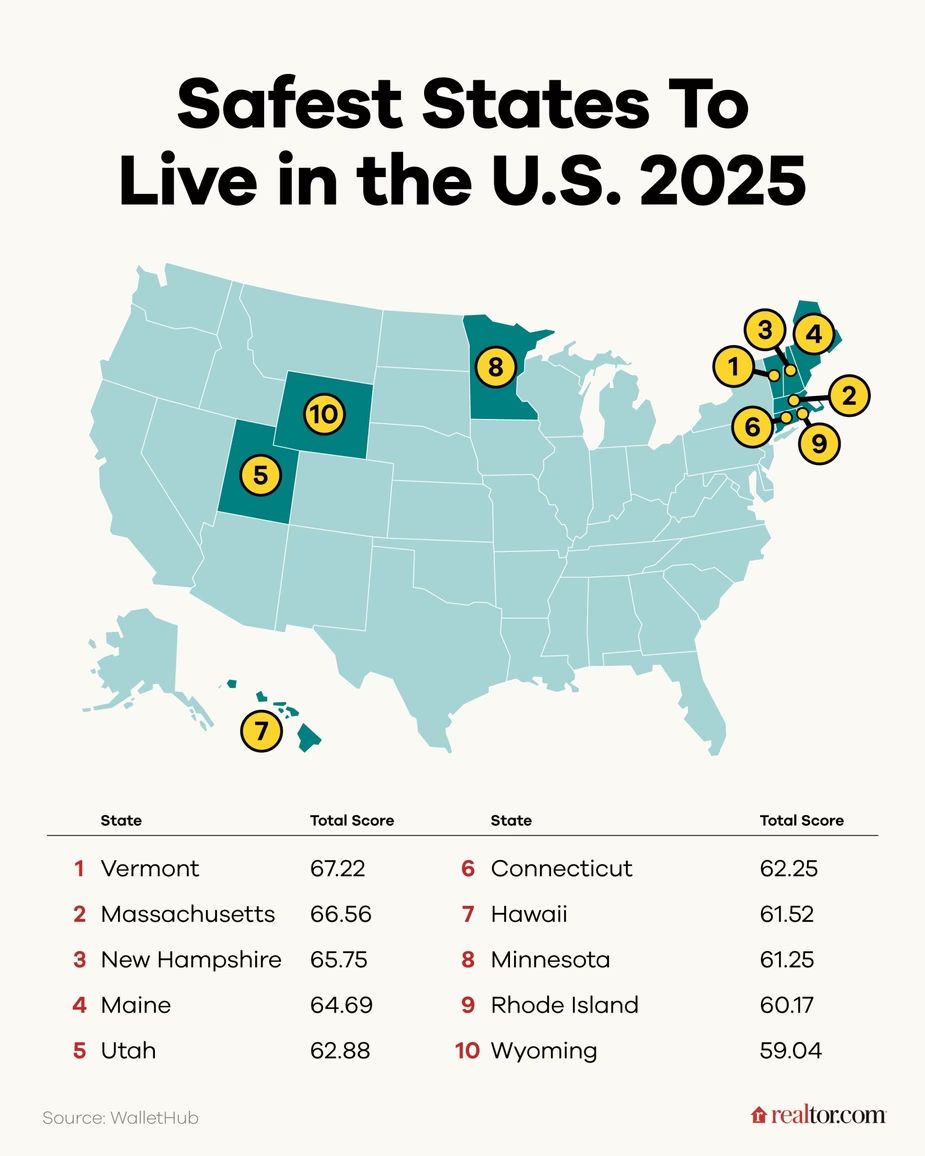

Top 10 Safest States To Live In for Your Health, Finances and more.

Share Zero Flux with a friend using your unique link and unlock 3 months of premium free:

https://www.zeroflux.io/subscribe?ref=PLACEHOLDER

And if you get 25 signups overtime with this link, premium is yours for life 🎉

A quick word from our sponsor

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.38% | +0.00% | +0.01% | 6.13 / 7.26 |

15 Yr. Fixed | 5.90% | +0.00% | +0.01% | 5.60 / 6.59 |

30 Yr. FHA | 6.08% | +0.01% | +0.03% | 5.91 / 6.62 |

30 Yr. Jumbo | 6.29% | +0.01% | +0.01% | 6.14 / 7.45 |

7/6 SOFR ARM | 5.85% | +0.01% | +0.03% | 5.59 / 7.25 |

30 Yr. VA | 6.10% | +0.01% | +0.03% | 5.92 / 6.64 |

New here? Join the newsletter (it's free).

Macro Trends

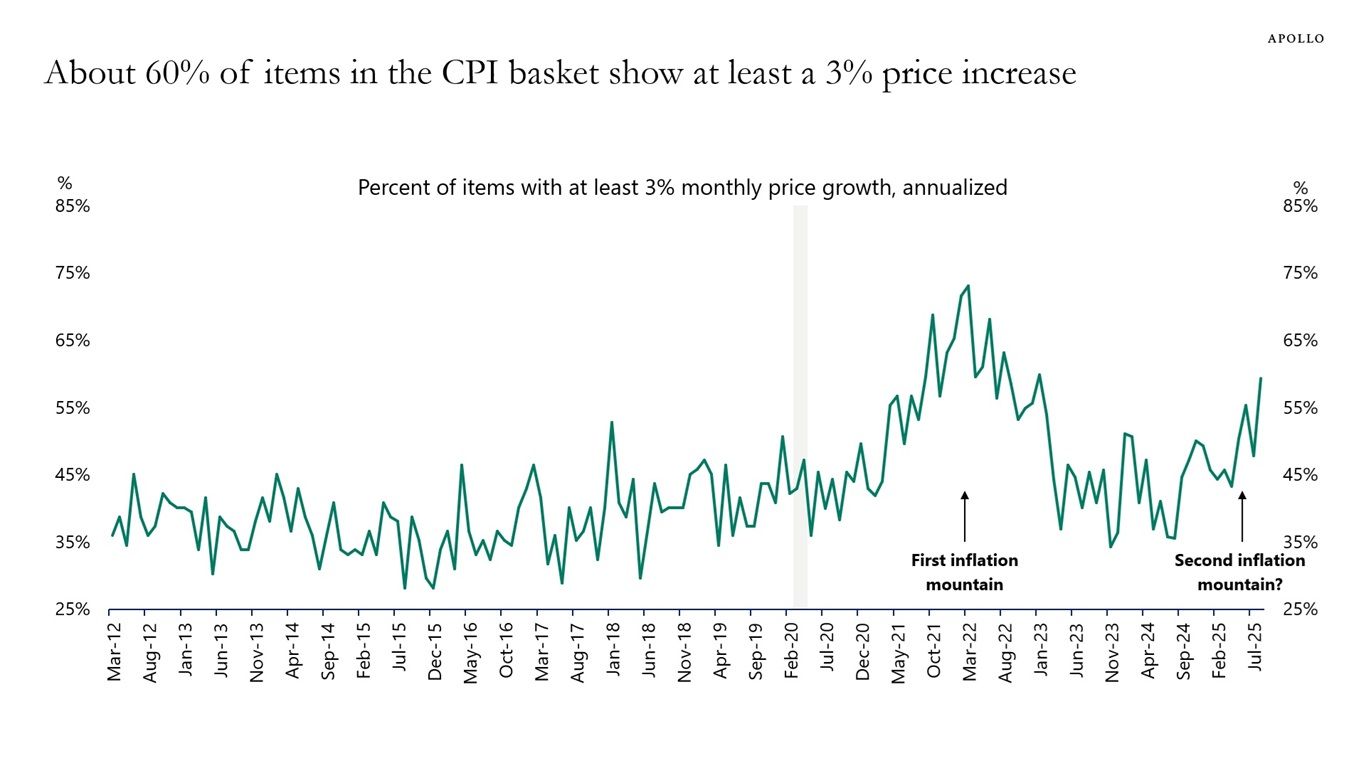

Inflation’s Back? 60% of CPI Items Now Rising Faster Than 3%, Echoes of 2021 Emerge link

Apollo’s chief economist Torsten Sløk warns that inflation may be forming a “second mountain,” with about 60% of items in the CPI basket growing faster than 3% annually.

The broad-based nature of these price hikes suggests inflation pressure isn’t just from energy or shelter, it’s embedded across most consumer categories.

The data mirrors the early signs of 2021’s inflation surge, when price momentum quietly built up before the Fed was forced to tighten sharply.

Real Estate Trends

Hospitals are driving 2025’s healthcare CRE rebound link

New construction fell again in Q2 2025 while absorption rose, pushing national occupancy above 92%. Tight supply is boosting utilization and pricing power for existing facilities.

Buyers shifted: hospitals/health systems and private investors led H1 acquisitions while REITs stayed quiet. Hospital deal volume beat historical averages; MOB cap rates expanded ~10–20 bps QoQ and transaction activity is stabilizing off lows.

Capital remains costly but investors are adapting, and elevated construction costs are curbing new supply and nudging rents up. Watch behavioral health/substance-use facilities and potential H2 portfolio trades if Fed cuts continue.

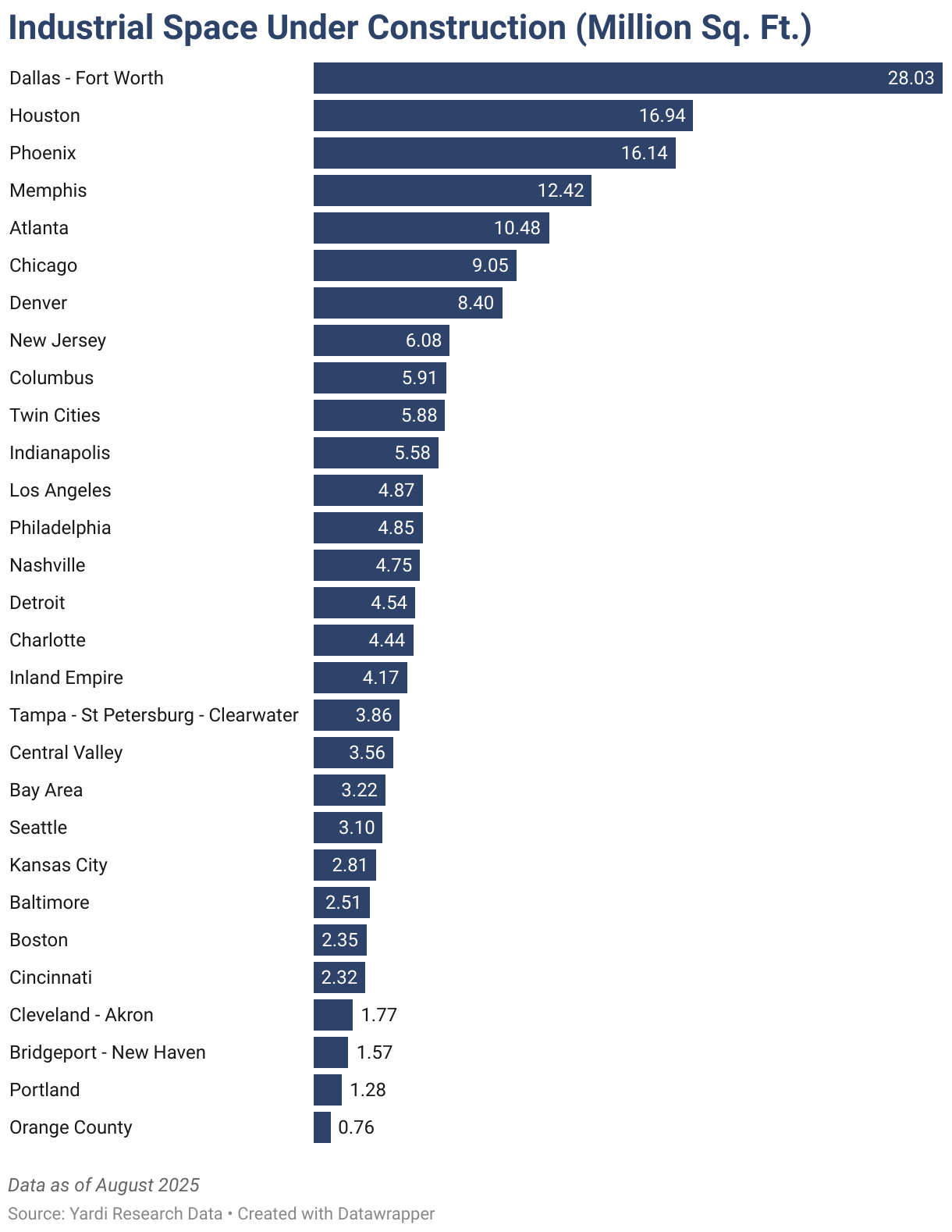

Industrial Outdoor storage rents surge 123% since 2020 link

The industrial outdoor storage (IOS) rents are up 123% since 2020 to $8.66 in August (+6.1% YoY) while vacancy slipped 30 bps to 8.7% on constrained supply; zoning limits are a key bottleneck.

Capital is crowding in: Peakstone bought a 51-asset portfolio for $490M, Barings/Brennan plan to deploy $150M, and Realterm grabbed 13 sites for $277, pushing the sector toward standardized, institutional pricing.

Performance is splitting: inland hubs (Memphis, Atlanta, Phoenix) lead rent gains while SoCal cools, vacancies up to 7.7% (Inland Empire), 8.2% (Orange County), 8.6% (Los Angeles) with LA rents only +4.2%. KC is tight at 4.5% vacancy vs. Columbus at 13.5%; pipeline sits at 340M sf (205M sf delivered YTD), with DFW (28M) and Houston (17M) on top, while the Northeast’s thin 15M sf keeps new-lease premiums elevated.

Starter homes are the only hot lane; prices hit record $260K link

Starter tier set a new August record at $260,508 (+2.2% YoY) with sales +3.8% YoY, while mid/high-tier sales slipped 0.6% and 1.2% at $370,000 (+1.4%) and $575,000 (+2.7%). Demand is concentrating at the low end where buyers can still transact.

Geography is splitting the tape: Indy sells in 16 days (Seattle 17; Warren & Kansas City 20) vs. Florida lag, West Palm 102 days, Fort Lauderdale 109, Miami 87. Pricing diverges too: Anaheim’s “starter” is $760,279 (+3.7% YoY) while Austin is $320,107 (-4.5% YoY) and taking ~70 days.

Supply is rising where it matters: active starter listings +16.4% YoY (vs. +13.4% mid, +12.5% high), but growth is slowing. First-timers are getting outbid by downsizers using equity, reshaping who actually wins bids.

Federal shutdown could derail 1,300 home sales a day link

The National Association of Realtors® estimates that a lapse in the National Flood Insurance Program would halt 1,300 real estate transactions per day, threatening closings in flood-prone areas where flood insurance is required. Nearly 5 million property owners rely on NFIP coverage.

During the 2018–19 federal shutdown, existing-home sales dropped from 5.18 million to 4.97 million before rebounding once funding resumed — a sign of how shutdowns can temporarily choke housing activity.

FHA, VA, and USDA programs will continue at reduced capacity, but rural housing loans and new flood insurance policies would stop entirely, while HUD furloughs and delayed payments could weaken already strained local markets.

Location Specific

Manhattan’s record office-to-housing boom; link

Through August 2025, 4.1M sf across 15 conversions have started, already topping 2024’s 3.3M sf/10 projects and dwarfing 2023’s 1.5M sf; pace is the fastest since 2008’s 4.8M sf/32 buildings. Since 2024, 20 Manhattan office sales tied to conversions have traded.

Vacancy signals the spread: office vacancy peaked at 23.8% (Jun 2024) and eased to 22.3% (Aug 2025), while multifamily sits near 3%, demand that conversions can sell into.

Where the action shifted: since 2020, Midtown captured ~55% of projects (Downtown ~36%, Midtown South <10%); marquee deals include the Flatiron to condos and Pfizer HQ as the city’s largest conversion but CoStar says the “low-hanging fruit” is mostly gone.

AI & Real Estate - Today’s Trends

Tool of the day: Offerin

Offerin is a robust offer management portal tailored for residential real estate agents.

AI in Proptech Moves From Hype to Hard ROI link

Altus Group reports that CRE investors are demanding measurable outcomes from AI tools, shifting focus from buzzwords to clean data, SOC-audited vendors, and point solutions that prove efficiency and financial return.

Radius Launches “Mel AI” to Run Entire Brokerages link

The platform’s new assistant automates lead management, compliance, and deal flow for 200+ real estate teams, earning backing from Trulia and Zillow founders as it positions AI as the backbone of next-gen broker operations.

AI Marketing Delivers 10x ROI for Smart Realtors link

As AI-powered advertising reshapes property sales, agents using predictive targeting and automated content tools report 35–50% higher conversions, faster closings, and major cost savings, closing the tech gap between small firms and big brokerages.

AI Becomes Real Estate Law’s Secret Weapon link

Top real estate attorneys are using AI to draft contracts, review leases, and flag compliance issues in seconds, cutting billable hours while reshaping how legal teams handle property transactions and due diligence.

One Chart

Top 10 Safest States To Live In for Your Health, Finances, and Future

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

The next wave of student housing is already here

(This content is restricted to Pro Members only. Upgrade)

What’s quietly replacing America’s dead malls and why investors are paying attention

(This content is restricted to Pro Members only. Upgrade)

The Rental Math That’s Breaking America’s Middle Class: A Harvard Study

(This content is restricted to Pro Members only. Upgrade)

Industrial real estate braces for a 2026 reset

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

Mapped: America’s Happiest States in 2025

Unreal Real Estate

A bank for sale

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply