- Zero Flux

- Posts

- America’s safest and richest city

America’s safest and richest city

Timeline: When Will One Big Beautiful Bill Programs Take Effect? and 12 other real estate insights

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.51% | -0.01% | -0.10% | 6.11 / 7.26 |

15 Yr. Fixed | 5.88% | -0.02% | -0.09% | 5.54 / 6.59 |

30 Yr. FHA | 6.08% | -0.02% | -0.11% | 5.65 / 6.62 |

30 Yr. Jumbo | 6.48% | -0.02% | -0.20% | 6.37 / 7.45 |

7/6 SOFR ARM | 5.95% | -0.02% | -0.18% | 5.95 / 7.25 |

30 Yr. VA | 6.09% | -0.03% | -0.12% | 5.66 / 6.64 |

New here? Join the newsletter (it's free).

Real Estate Trends

Renters pack city centers while homebuyers pushed to the fringes link

The gap between renting and owning is near historic highs, keeping many potential buyers in rentals instead. This is driving strong lease-ups and higher retention in metro cores, even as other markets soften.

Renewal rates are elevated because moving into ownership has become cost-prohibitive in desirable areas. Tenants who would normally buy are staying put, boosting absorption of new urban supply.

Developers see a split: well-located urban rentals lease fast, while affordable ownership opportunities only exist farther out, carrying different risks and attracting a different resident profile.

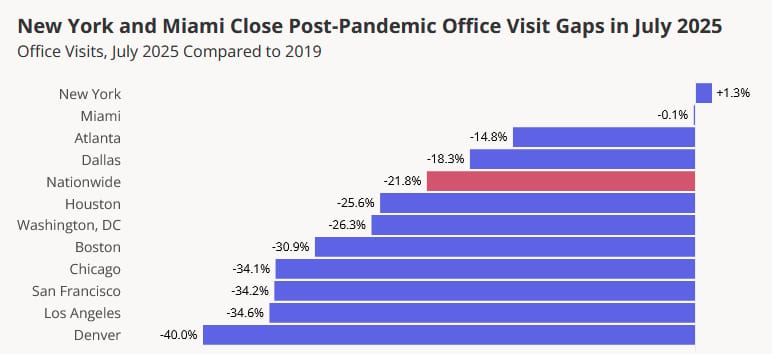

Return-to-Office Update: NYC, Miami Back to Pre-Covid Levels—San Francisco Stages a Surprise Revival link

New York City office visits were 1.3% above July 2019 levels, the first time the market has fully surpassed pre-Covid activity; Miami was just 0.1% below, both fueled by finance sector pressure on workers to return.

Nationwide, office visits in July 2025 were down 21.8% from 2019, the closest gap since the pandemic and up 10.7% from last year. Atlanta (–14.8%) and Dallas (–18.3%) outperformed the national average, while Denver lagged badly at –40%.

San Francisco is showing the fastest recovery momentum, with office visits up 21.6% year-over-year—the strongest among major hubs—helped by rising rents, new business openings, and improved sentiment.

Senior housing quietly outpaces the pack in 2025 link

Senior housing delivered a 4% total return YTD, beating the broader NPI by 85 bps in Q2 (2.08% vs. 1.23%), with income yield (1.36%) outpacing capital appreciation (0.72%).

Independent living outperformed assisted living across all time horizons, posting a 2.58% Q1 return vs. 1.25% for assisted, and averaging 8.03% one-year returns compared to 3.64%.

Occupancy rose to 88.1% in Q2, with independent living at 89.7% and assisted at 86.4%, while inventory growth slipped below 1% YoY—the lowest since 2006.

Existing-home sales slip as fresh listings slow—Midwest holds firm, South lags link

Active listings rose nearly 20% year-over-year in July, but new listings only increased 5%, showing more homes are sitting unsold rather than new supply entering the market. Sales dropped 0.2% from last month and 1.4% compared to last year.

In the top 75 markets, sales track closely with new listings, not overall inventory. Midwest and Northeast metros made up 68% of the “above-average sales” group, while many Southern and Western metros like El Paso and Stockton saw rising supply but weak absorption.

The biggest drag on sales is the mortgage rate lock-in effect—owners holding on to ultra-low rates. Life events like job changes and retirements will be the main force pushing new supply back into the market.

Housing Market Stalls But Rate Cuts Could Shake Things Up link

The median U.S. list price is about $440,000, making a typical home $1,255 more expensive per month than in 2019; higher rates alone have added nearly $300 to monthly costs since 2022.

Delistings surged this summer, with Miami seeing 59 homes pulled for every 100 listed, as sellers resist price cuts—keeping inventory from growing despite weaker demand.

Builders pulled back sharply, with single-family permits down almost 8% year over year, deepening the nation’s 4 million–home shortage even as some regions face oversupply.

Something I found Interesting

America’s safest and richest city isn’t in New York—here’s who took the crown link

Western Springs, Illinois ranked #1, with a mean household income of $294,896, average home value of $837,328, and one of the lowest violent crime rates in the nation (0.076 per 10,000).

New Jersey dominated the list with 7 cities, including Ridgewood (#11) where average incomes hit $288,861 and home values average $1.18 million.

Lexington, MA placed second but with a much steeper cost of living, including average home prices of $1.69 million—double Western Springs.

AI & Real Estate - Today’s Trends

Tool of the day- Nanoprecise

Nanoprecise specializes in implementation of Artificial Intelligence and IoT technology for predictive asset maintenance and condition monitoring. Nanoprecise’s AI + IoT Predictive Maintenance solutions drive mechanical and operational efficiencies that increase production and safety while reducing carbon footprints.

Top Asset Managers Are Using AI to Slash Building Energy Costs – link

From predictive HVAC controls to real-time energy modeling, major landlords are leaning on AI to cut utility spend and hit sustainability targets.

CRE Owners Turn to Drones and AI to Brace for Hurricanes – link

Commercial landlords are deploying drones and AI models to spot vulnerabilities, assess storm damage faster, and harden properties against billion-dollar hurricane losses.

Bellevue Pilots AI to Fast-Track Housing and Development Permits – link

The city is testing AI to cut red tape on permits — aiming to speed housing approvals, boost economic growth, and attract developers.

Prypco & Ovaluate Roll Out AI Tool for Instant Property Valuations – link

The new platform delivers rapid, AI-driven property valuations — giving investors and agents faster insights for pricing and deal decisions.

A word from our sponsor

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

One in Three Older Households Is Cost Burdened- A Harvard Case Study

(This content is restricted to Pro Members only. Upgrade)

Retail Openings Outpacing Closures.

(This content is restricted to Pro Members only. Upgrade)

Immigration is Reshaping Workforce Housing

(This content is restricted to Pro Members only. Upgrade)

Top 10 Metros with the Highest Zombie Foreclosure Rates in Q3 2025

(This content is restricted to Pro Members only. Upgrade)

U.S. Cap Rates Trends

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

Timeline: When Will One Big Beautiful Bill Programs Take Effect?

Unreal Real Estate

The vibe of this house!

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply