- Zero Flux

- Posts

- Best Small Cities To Live in America

Best Small Cities To Live in America

Cold storage demand trends and 12 other real estate insights

Want the full Zero Flux experience?

For a limited time, you can upgrade to Premium at just $6.32/month and get deeper data drops, investor insights, and access to every tool we’ve built for serious operators.

A quick word from our sponsor

Home insurance costs continue to climb, with premiums rising over 9% this year and more than 60% in the past five years. However, coverage hasn’t kept pace, leaving many homeowners paying significantly more for less protection. With affordability becoming a growing concern, it’s more important than ever to compare options—check out Money’s handy home insurance tool to find the best fit for you.

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.34% | -0.02% | -0.04% | 6.13 / 7.26 |

15 Yr. Fixed | 5.84% | -0.03% | -0.06% | 5.60 / 6.59 |

30 Yr. FHA | 6.03% | -0.02% | -0.06% | 5.78 / 6.62 |

30 Yr. Jumbo | 6.25% | -0.01% | -0.04% | 6.14 / 7.45 |

7/6 SOFR ARM | 5.76% | -0.03% | -0.06% | 5.59 / 7.25 |

30 Yr. VA | 6.05% | -0.02% | -0.05% | 5.79 / 6.64 |

New here? Join the newsletter (it's free).

Real Estate Trends

Affordable apartment hubs tighten up link

Image

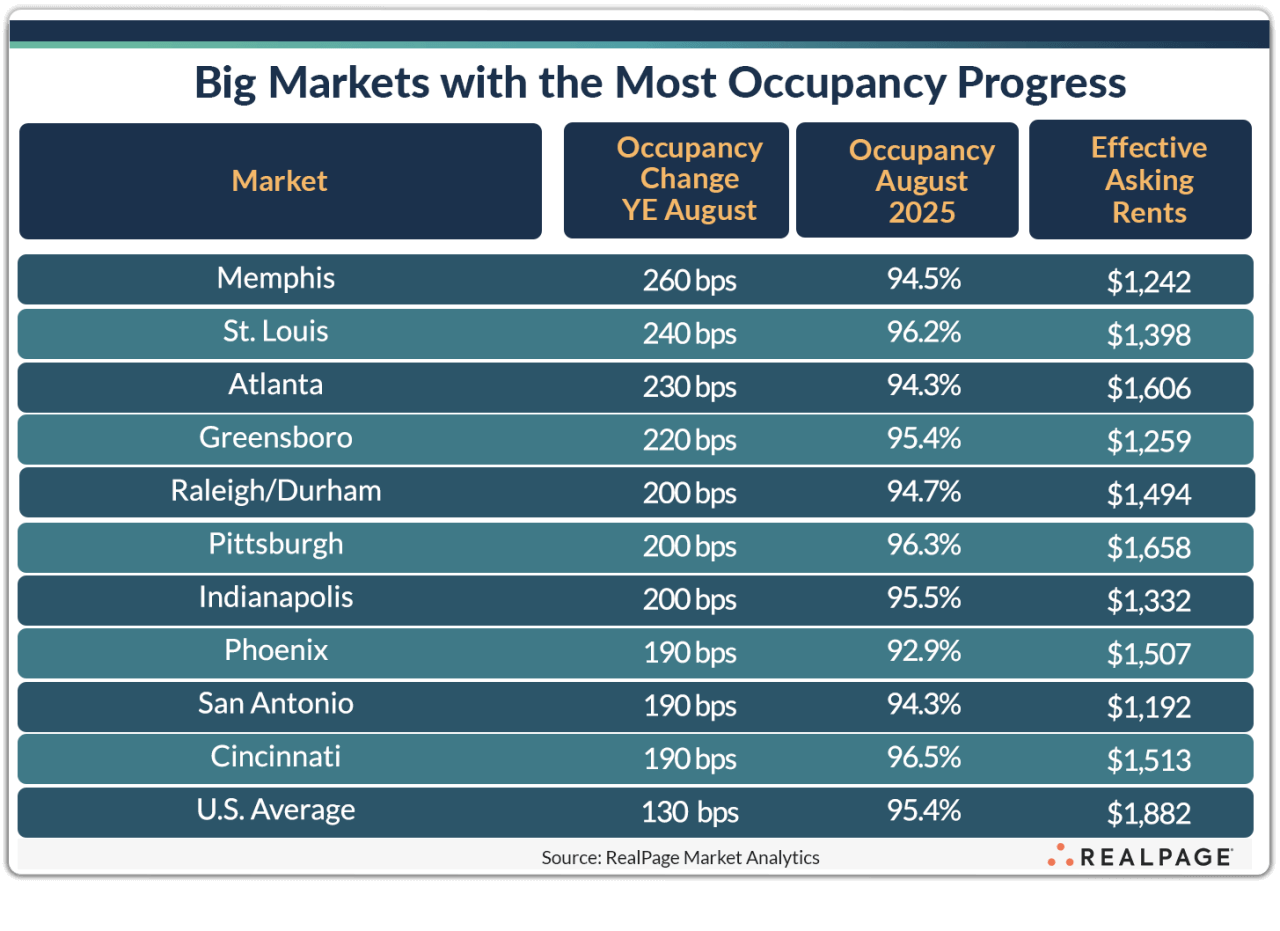

Memphis topped the nation in occupancy gains among the 50 largest apartment markets, climbing 260 bps year-over-year, with average rents of $1,242, far below the national mean.

St. Louis (+240 bps), Atlanta, and Greensboro each saw occupancy improve by more than 200 bps, signaling stronger renter demand in the South and Midwest’s affordable metros.

San Antonio’s rebound stalled despite a 190 bps uptick, occupancy sat at just 92.9%, the weakest among large markets, with the lowest effective rents ($1,192) nationwide.

Cold storage demand reshapes food & beverage real estate link

Cold storage facilities are going vertical, developers are designing buildings up to 60–80 feet high, boosting pallet capacity and rental revenue per cubic foot. This throughput-driven model is making F&B real estate more lucrative than traditional industrial assets.

Infrastructure constraints are tightening: power and water access are now key site-selection criteria as F&B and data centers compete for the same limited resources. Labor access and parking are equally vital for manufacturing-heavy facilities.

Onshoring, local food demand, and Opportunity Zone incentives are driving investment into secondary and rural markets, especially near agricultural hubs and ports. This is sparking a wave of workforce housing and retail development around new F&B clusters.

My take:

This isn’t just about bigger freezers; it’s about a whole new map forming for where jobs and money flow. Cold storage is pulling investment into small towns and farm regions, and that ripple could turn forgotten zip codes into the next industrial hot spots.

Latest on CRE Trends link

Overall CRE sales fell 8% YoY in August, driven by a 94% collapse in portfolio and entity transactions but single-asset trades jumped 6%, showing life in individual dealmaking.

Office volumes surged 17% to $6B, with Manhattan seeing its first $1B+ single-asset sale since early 2022, a sign institutional buyers are tiptoeing back into trophy assets.

Industrial and retail posted the strongest price gains, both up roughly 5% YoY, while hospitality cap rates widened to 8.1%, signaling lingering caution despite improving pricing trends.

Nationwide flip profits are at 17-year lows link

Nearly half of U.S. homes were built before 1980, and “fixer-upper” listings now get 52% more views and sell at a 54% discount versus turnkey homes, signaling a shift as affordability wanes.

Nationwide flip profits are at 17-year lows, with mortgage rates above 6% and tariffs and labor costs eating into margins, making a single construction overrun enough to wipe out returns in high-cost markets like L.A.

Meanwhile, gross rental yields hover around 7.45%, and rents, still 17% above pre-pandemic levels—offer steadier, inflation-resistant cash flow, especially in Midwest metros like Toledo, Detroit, and Dayton, where fixer discounts remain wide.

My take: Flipping is turning into a pro’s game again - thin margins, high costs, and rate pressure make rentals the safer long-term play. Smart money is moving toward cash-flow markets where a bad contractor won’t tank the deal.

Government Shutdown Puts Paychecks at Risk: Are HELOCs the Lifeline or a Trap? link

Roughly 50% of Americans lack a three-month savings cushion, pushing furloughed federal workers to tap into home equity for liquidity as the shutdown drags on.

HELOC rates have fallen from 9.37% in 2024 to 7.88% in late 2025, driving a resurgence in applications, the highest since 2008, as homeowners seek cheap credit amid layoffs and uncertainty.

But the safety net has strings: variable rates and falling home values could leave borrowers “underwater” fast, DC’s housing inventory jumped 56% YoY after recent federal job cuts, signaling potential forced selling.

Location Specific

Mississippi home sales crawl, listings sit 3 weeks longer than U.S. average link

Mississippi’s median days on market (DOM) for single-family homes hit 91 days, compared to the national median of 70, one of the slowest paces in the country alongside Louisiana, Hawaii, and Florida.

The gap is widening: Mississippi homes now take three weeks longer to sell than the U.S. average, signaling sustained sluggish demand rather than a seasonal dip.

Longer selling times could pressure sellers to cut prices or adjust strategies, with elevated DOM hinting at inventory buildup and stronger buyer leverage heading into winter.

AI & Real Estate - Today’s Trends

Tool of the day: Attentive

An AI-powered platform that automates property measurements for landscaping, paving, and construction projects, enhancing efficiency and accuracy for outdoor service businesses.

AI in Real Estate: The Question Shifts From “What’s New” to “What’s Next” link

REINSW’s Tim McKibbin says agents who treat AI as an assistant—not a threat—will win, as future “personal AI agents” automate admin and marketing while freeing humans to deepen trust and client relationships.

AI Turns Lease Agreements Into Living Contracts link

AI and blockchain are reshaping how landlords and tenants manage leases, turning static documents into dynamic, self-updating agreements that reduce disputes, automate compliance, and build long-term trust.

CREA Launches Free AI Webinars for REALTORS® link

The Canadian Real Estate Association is rolling out three expert-led webinars teaching agents how to craft prompts, generate marketing content, and use AI responsibly to boost productivity across their business.

AI Set to Unlock a $975B Proptech Opportunity link

Data-Hat AI argues real estate firms are sitting on “data goldmines,” with full-scale AI adoption projected to boost revenues 15–25%, cut costs 30%, and grow the global AI-in-real-estate market to nearly $1 trillion by 2029.

One Chart

Best Small Cities To Live in America

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

Housing market enters a new phase; signals from Q3 hint at what’s next

(This content is restricted to Pro Members only. Upgrade)

Retail store closures are mounting

(This content is restricted to Pro Members only. Upgrade)

These 10 U.S. Counties Have the Lowest Homeownership Costs

(This content is restricted to Pro Members only. Upgrade)

The new geography of luxury housing

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Unreal Real Estate

A roof terrace with neo-gothic architecture!

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply