- Zero Flux

- Posts

- Experts see prices rising up to 26% by 2029

Experts see prices rising up to 26% by 2029

Top 10 States With the Lowest Property Taxes and more

Want the full Zero Flux experience?

For a limited time, you can upgrade to Premium at just $6.32/month and get deeper data drops, investor insights, and access to every tool we’ve built for serious operators.

A quick word from our sponsor

Reddit’s Top Stocks Beat the S&P by 40%

Buffett-era investing was all about company performance. The new era is about investor behavior.

Sure, you can still make good returns investing in solid businesses over 10-20 years.

But in the meantime, you might miss out on 224.29% gainers like Robinhood (the #6 most-mentioned stock on Reddit over the past 6 months).

Reddit's top 15 stocks gained 60% in six months. The S&P 500? 18.7%.

AltIndex's AI processes 100,000s of Reddit comments and factors them into its stock ratings.

We've teamed up with AltIndex to get our readers free access to their app for a limited time.

The market constantly signals which stocks might pop off next. Will you look in the right places this time?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.22% | -0.01% | -0.10% | 6.13 / 7.26 |

15 Yr. Fixed | 5.80% | -0.01% | -0.04% | 5.60 / 6.59 |

30 Yr. FHA | 5.98% | -0.01% | -0.05% | 5.91 / 6.62 |

30 Yr. Jumbo | 6.18% | -0.02% | -0.07% | 6.14 / 7.45 |

7/6 SOFR ARM | 5.70% | +0.00% | -0.12% | 5.59 / 7.25 |

30 Yr. VA | 6.00% | -0.01% | -0.04% | 5.92 / 6.64 |

New here? Join the newsletter (it's free).

Real Estate Trends

Numbers to Watch: Liquidity Has Returned link

U.S. corporations borrowed at the fifth-highest level on record in September, signaling revived credit confidence and liquidity flowing back into capital markets.

Life insurers now hold nearly one-third of assets in private ventures like data centers and chip factories, up from 22% a decade ago, showing a major institutional tilt toward alternatives.

Fundraising is already at 95% of 2024’s total, suggesting investor appetite is rebounding fast even as single-family rental growth cools in the Sunbelt.

CRE Selling Costs Swing Widely link

Selling costs in U.S. commercial real estate vary from under 1% to over 6% of sale price depending on market, property type, and deal size. In San Francisco, sellers can pay up to 6%, while most states remain below 1%.

In major markets, a 0.5% assumption error can mean millions lost on large transactions, yet many models still use generic 2% assumptions that understate real costs.

Transfer taxes are the biggest wild card: cities like NYC (3.25%), L.A. (5.95%), and Philadelphia (3.28%) have layered taxes that sharply inflate selling expenses, especially for deals above certain thresholds.

My take: Many investors still plug in the same 2% selling cost across every deal, that’s lazy math. If you’re selling in places like Philly or L.A., that mistake can easily wipe out your profit.

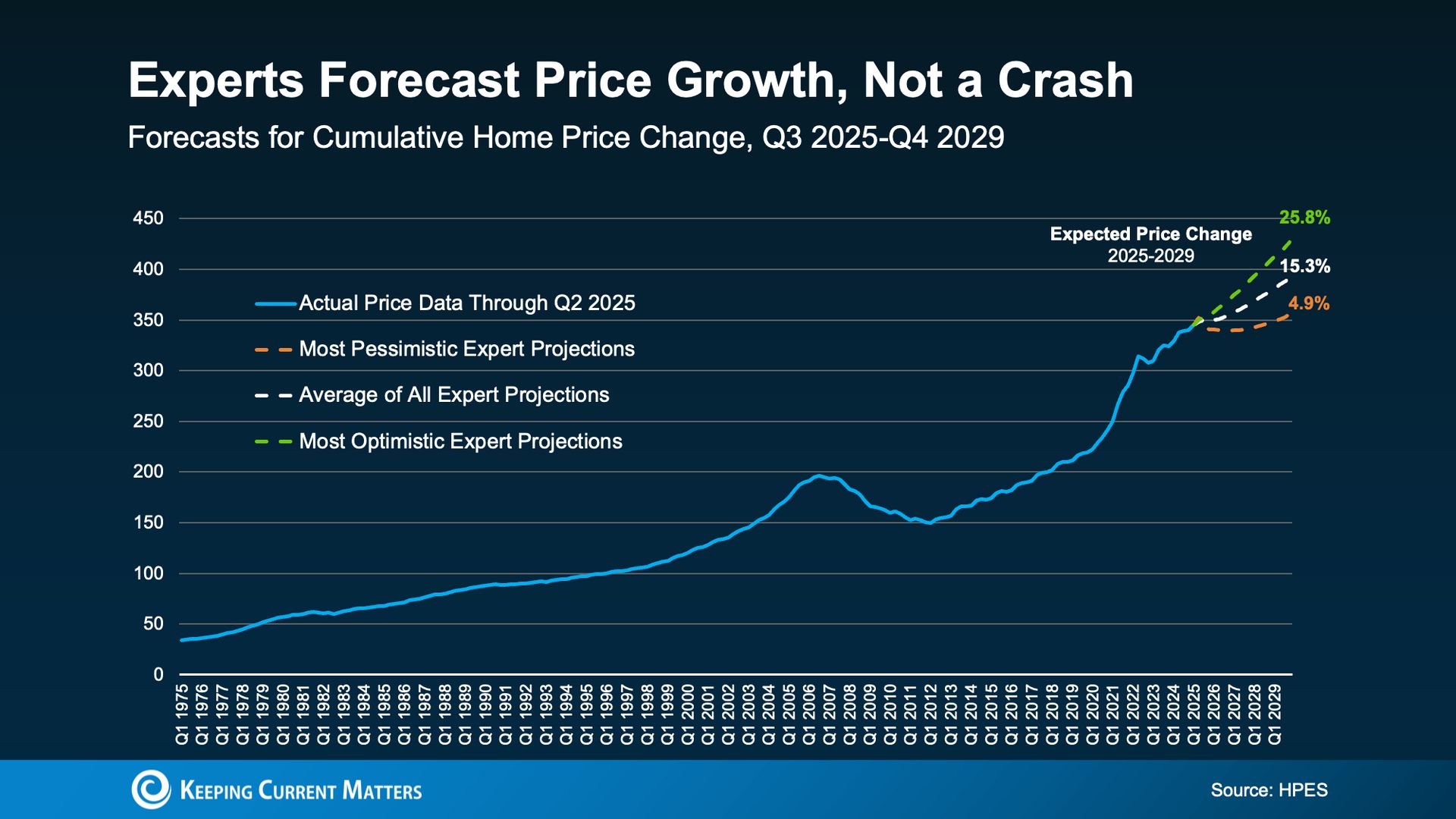

Housing crash fears are overblown, experts see prices rising up to 26% by 2029 link

Over 100 housing experts in Fannie Mae’s Home Price Expectations Survey project national home prices to rise roughly 15% through 2029, with the most optimistic forecasts hitting +26% and even the pessimists seeing +5% growth.

Annual appreciation is expected to stabilize around 2–3.5%, slightly below the 25-year norm of 4–5%, signaling a return to sustainable growth after pandemic-era spikes of 15–20%.

Analysts cite persistent housing shortages and strong demand as the main reason a 2008-style crash isn’t on the horizon, despite affordability pressures.

My take: Everyone’s waiting for a “reset,” but supply just won’t allow it. Unless construction meaningfully outpaces demand, this “slow and steady” market could quietly compound into double-digit gains for patient investors.

$124 Trillion Wealth Transfer Is Rewriting Real Estate link

Over the next 20 years, $124 trillion in wealth will move from Baby Boomers to younger generations, reshaping how real estate capital gets used. Unlike their parents, many millennials are prioritizing community benefit, sustainability, and accessibility over luxury or returns.

A Connecticut couple who sold their startup for $1.5 billion bought a decommissioned power plant island, not to develop condos, but to build “Manresa Wilds,” a public park blending nature restoration and education.

Analysts say this signals a larger shift: younger inheritors see land as stewardship, not speculation, favoring adaptive reuse and local impact projects that could redefine legacy development norms.

My take: If even a fraction of this $124T flows into “impact real estate,” we’ll see a new asset class emerge, less about cap rates, more about civic ROI. For investors, the smart play may be partnering early with these mission-led projects before institutional money catches up.

Location Specific

Houston industrial rents jump 8.3% as vacancy steadies at 7.5% link

Net absorption hit 9.9M sf in the latest period—down 5.7M sf YoY but Savills expects it to stay positive given 2025 leasing. Big wins: PepsiCo (1.05M sf, Southwest), Panelmatic (728,080 sf), and Inventec (540,000 sf).

Asking rents surged to $0.65/sf (+8.3% YoY), with the Northwest at $0.86 and the South at $0.77. Vacancy ticked up just 20 bps to 7.5% as speculative deliveries hit.

Deliveries over the past 12 months totaled 18.9M sf (down 5.3M sf), while space under construction rose by 5.5M sf. Savills says if demand keeps pace with new supply, vacancy should stabilize, helped by population growth and a pro-business climate.

AI & Real Estate - Today’s Trends

Tool of the day: Realie

Realie is an innovative property data platform that delivers real-time, county-sourced information with exceptional speed, scalability, and cost efficiency.

AI Automation Is Quietly Rewriting Property Management link

BBN Times reports that predictive maintenance, digital twins, and IoT-driven analytics are cutting downtime by over 70% and optimizing rents in real time, showing how PropTech-powered AI is turning buildings into self-learning, efficiency-driven assets.

Longbridge Cuts Loan Errors 60% With One Diligence AI link

The reverse mortgage lender adopted One Diligence’s AI platform to automate data validation across loan files, eliminating manual entry, improving accuracy, and enhancing borrower experience in servicing transfers.

AI Beats Agencies at Managing Apartment Google Profiles link

Multifamily Insiders reports that automation now outpaces agency workflows, updating pricing, availability, and photos across hundreds of properties in real time, saving operators weeks of lag and eliminating compliance risks tied to manual updates.

AI Is Rewriting the Rules of Real Estate SEO link

Florida Realtors reports that AI-driven search tools like ChatGPT are forcing agents to rethink keyword strategy, prioritizing conversational queries, local expertise, and content transparency to stay visible in an AI-first search world.

One Chart

Top 10 States With the Lowest Property Taxes

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

AI sparks a new land rush in this area

(This content is restricted to Pro Members only. Upgrade)

These 10 Cities Had the Biggest Jump in Profits in 2025

(This content is restricted to Pro Members only. Upgrade)

Office market hits critical point

(This content is restricted to Pro Members only. Upgrade)

Multifamily market hits reset; signs point to a quieter, more predictable 2027 ahead

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

Blackout Map: Which States Lost the Most Power in 2024?

Unreal Real Estate

Sanctuary or secret lair? This church conversion blurs the line

Link to the listing

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply