- Zero Flux

- Posts

- Fed officials signal support for a December rate cut as odds jump to 85%

Fed officials signal support for a December rate cut as odds jump to 85%

America’s Most and Least Affordable Cities in 2025, A Serene Woodhouse for Sale and more!

How can we make this newsletter more valuable to you?

Please reply with any feedback - It would mean a lot!

Hope you enjoy today's insights

A quick word from our sponsor

Learn how to make every AI investment count.

Successful AI transformation starts with deeply understanding your organization’s most critical use cases. We recommend this practical guide from You.com that walks through a proven framework to identify, prioritize, and document high-value AI opportunities.

In this AI Use Case Discovery Guide, you’ll learn how to:

Map internal workflows and customer journeys to pinpoint where AI can drive measurable ROI

Ask the right questions when it comes to AI use cases

Align cross-functional teams and stakeholders for a unified, scalable approach

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.22% | +0.00% | -0.12% | 6.13 / 7.26 |

15 Yr. Fixed | 5.78% | +0.00% | -0.04% | 5.60 / 6.59 |

30 Yr. FHA | 5.86% | +0.01% | -0.08% | 5.82 / 6.59 |

30 Yr. Jumbo | 6.40% | +0.00% | -0.02% | 6.10 / 7.45 |

7/6 SOFR ARM | 5.70% | -0.01% | -0.22% | 5.59 / 7.25 |

30 Yr. VA | 5.88% | +0.01% | -0.07% | 5.85 / 6.60 |

⚡ Snapshot: The 7/6 SOFR ARM saw the biggest weekly slide (-0.22%), while daily movements were mostly flat, signaling a pause after several sessions of steady declines.

New here? Join the newsletter (it's free).

Macro Trends

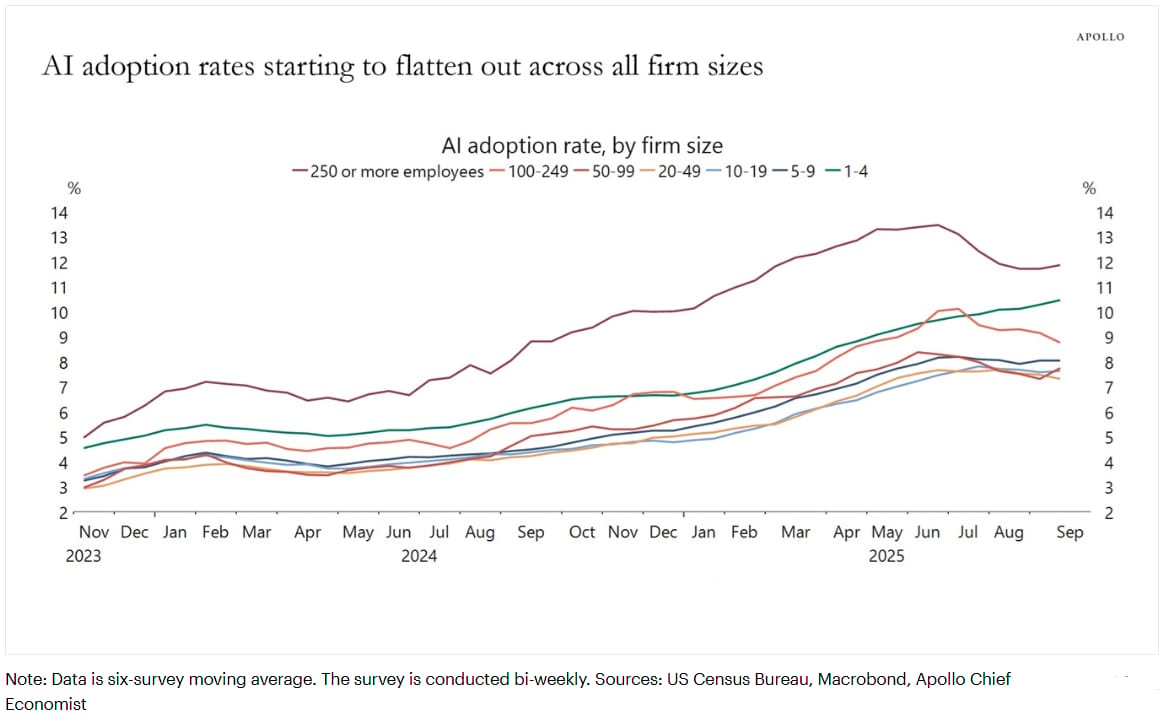

AI adoption plateaus across US firms link

Census and Ramp data show AI adoption growth flattening in 2025, with large firms above 12 percent and smaller firms clustered near 6 to 8 percent.

The slowdown is visible across all company sizes, suggesting the early surge of adoption is giving way to steadier incremental gains rather than rapid expansion.

My take: A plateau in adoption means productivity gains from AI may cool a bit from the early spike, thus softening expectations for a big near-term boost to economic growth.

Real Estate Trends

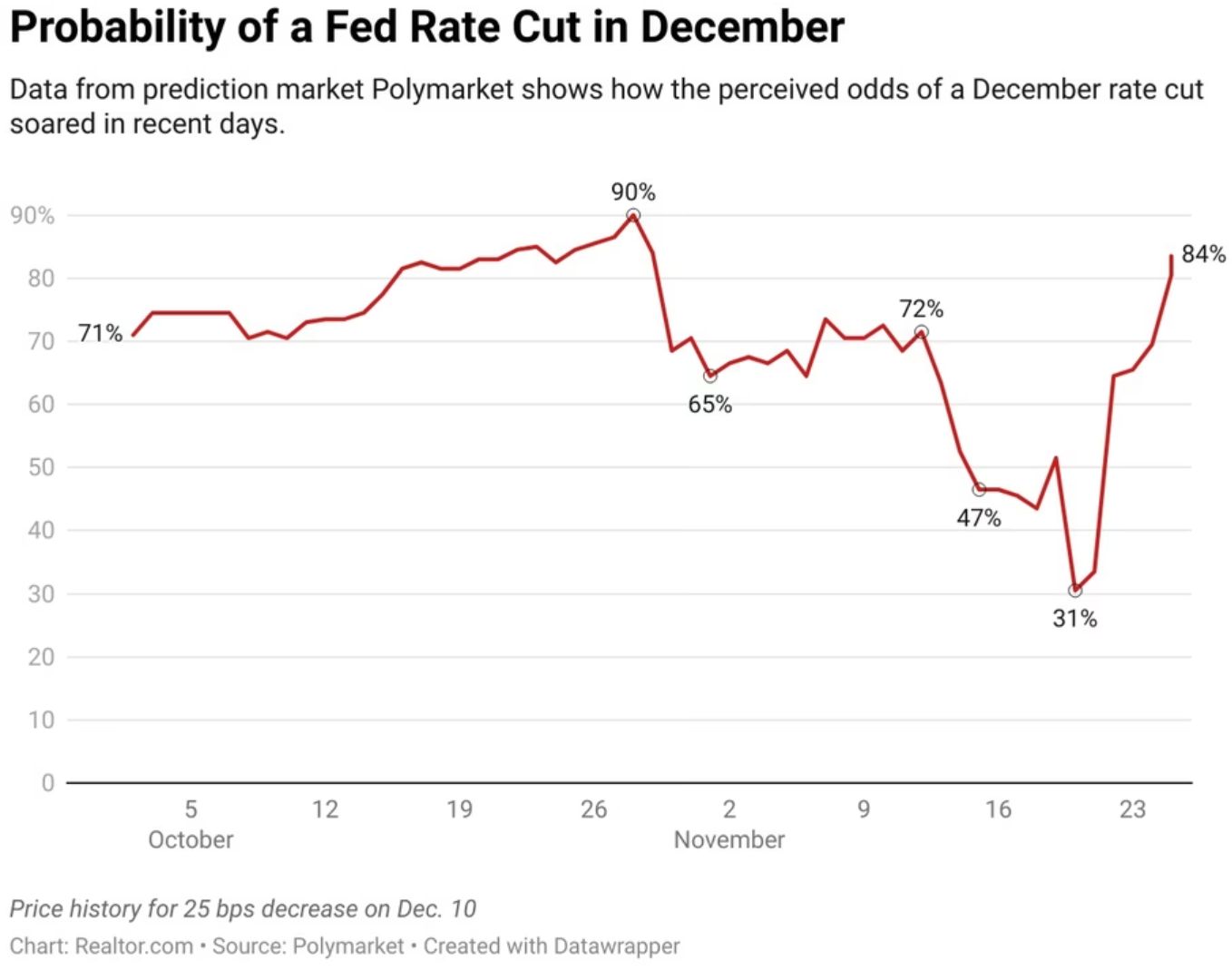

Fed officials signal support for a December rate cut as odds jump to 85% link

Public comments from key Fed leaders pushed market expectations for a December quarter-point cut from 50% to about 85%, pulling the 10-year yield briefly under 4%.

Conflicting data complicates the case, with consumer confidence falling to 88.7 and wholesale inflation holding at 2.7% while September jobs came in stronger than expected.

My take: The Fed looks tilted toward easing, but the data is messy. Mortgage rates may drift lower, though markets are reacting to signals more than fundamentals.

Lenders push tech upgrades to make 7-day refis possible link

Lenders are speeding up refis by using tech-enabled AMCs that offer real-time digital scheduling, borrower self-booking, and tighter oversight of appraiser panels to cut delays and reduce errors.

Smart platforms flag valuation issues early and match appraisers by performance, geography, and availability, lowering risk while improving turn times and reducing rate-lock extensions.

My take: Faster, tech-driven appraisals are becoming a clear competitive edge. Investors should expect lenders with strong AMC partnerships to pull ahead on refi volume.

Hybrid habits keep Friday offices empty link

Only 12.4% of weekday office visits occur on Fridays, while Tuesday to Thursday capture nearly 70% of traffic.

Office traffic is still well below pre Covid levels, but October visits rose 4.7% year over year, led by Miami, New York and San Francisco.

My take: For office owners, this confirms a midweek centric pattern, so leasing, amenities and programming should focus on Tuesday to Thursday peaks.

Bond market signals look mispriced as long-end yields stay too low link

The 10-year SOFR sits only 30 basis points above the 2-year, far below the long-run 65–110 basis point range, signaling an unusually flat curve despite inflation and fiscal pressures.

With CPI near 3% and the 10-year term premium effectively at zero, analysts estimate the long end is undervalued by 40–60 basis points relative to structural fundamentals.

My take: The long end looks out of sync with the inflation and debt math. Investors should watch for a catch-up move that steepens the curve.

Location Specific

Dallas retail’s Q3 plot twist, one metric halves, another triples link

Dallas retail investment sales fell sharply in Q3 to $457.5 million, roughly half of Q2, even as fundamentals held steady with a 4.9% availability rate and only a slight rent dip to $21.65 per sf.

Demand strengthened, with net absorption jumping to +132,000 sf, more than triple Q2, while new deliveries eased to 403,000 sf, showing a market where capital pulled back but occupancy and leasing stayed resilient.

AI & Real Estate

Tool of the day: Locate

AI based analytics platform for evaluating retail store site selection and feasibility

AI Cuts EMD Funding to 48 Hours for CRE Deals link

WRE News reports that Duckfund launched an AI-driven platform that funds earnest money deposits in as little as 48 hours. The system automates underwriting and document checks, helping investors secure deposits ranging from $25,000 to $20 million. With $1.5 billion deals completed, the tool delivers a speed edge in a competitive market.

AI Pilots Surge, Real Results Still Only 5 Percent link

JLL reports that 92 percent of occupiers are now piloting AI in buildings, up from less than 5 percent three years ago. But only 5 percent say they are hitting most of their goals, held back by weak data and poor integration. Investors should note that adoption is high, but impact is still low until firms fix basic systems.

Mitsubishi Plans $15B AI Data Center Push in the US link

W.Media reports that Mitsubishi will build 14 US data center campuses by 2030, a $15 billion bet on AI and cloud demand. The plan adds 2.8 GW of capacity, with early sites landing in Virginia, Georgia, and Illinois. The move shows how rising AI workloads are pulling global real estate giants into US digital infrastructure.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

How Proptech is Reshaping Residential Real Estate.

(This content is restricted to Pro Members only. Upgrade)

AI Bubble Risks and what that implies for Housing.

(This content is restricted to Pro Members only. Upgrade)

December Data Is Quietly Setting Up the 2026 Housing Market

(This content is restricted to Pro Members only. Upgrade)

Muted Multifamily Deals Hide a Bigger Shift in Investor Behavior

(This content is restricted to Pro Members only. Upgrade)

Where Are Builders Finding Real Savings in Workforce Housing?

(This content is restricted to Pro Members only. Upgrade)

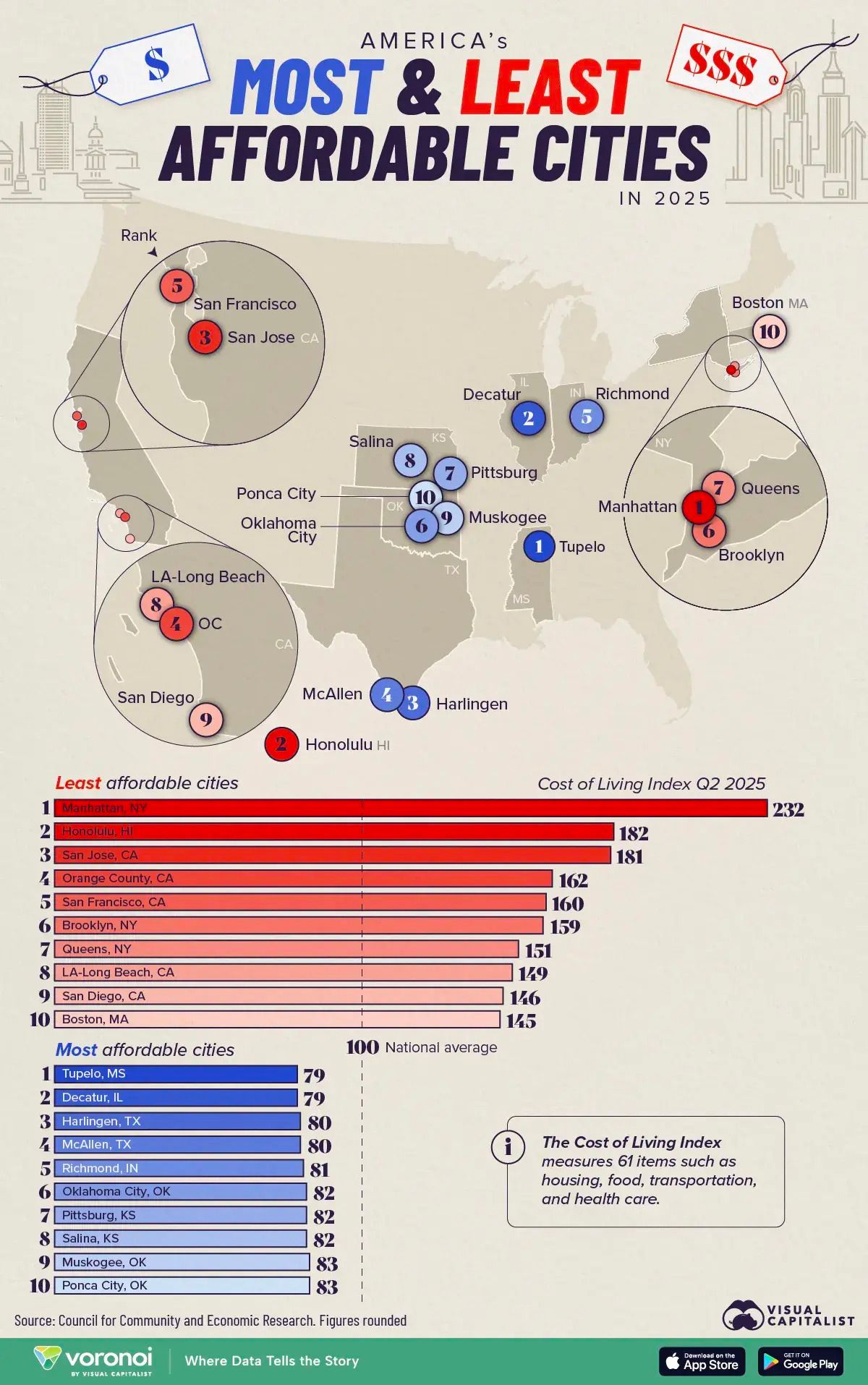

One Chart

Mapped: America’s Most and Least Affordable Cities in 2025

Unreal Real Estate

A Serene Woodhouse

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply