- Zero Flux

- Posts

- Flipping profits sink to 17-year low

Flipping profits sink to 17-year low

The Rising Unemployment Rate of College Graduates and 12 other real estate insights

Want the full Zero Flux experience?

For a limited time, you can upgrade to Premium at just $6.32/month and get deeper data drops, investor insights, and access to every tool we’ve built for serious operators.

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.35% | +0.00% | +0.10% | 6.13 / 7.26 |

15 Yr. Fixed | 5.89% | -0.01% | +0.18% | 5.54 / 6.59 |

30 Yr. FHA | 6.05% | +0.02% | +0.06% | 5.73 / 6.62 |

30 Yr. Jumbo | 6.27% | -0.01% | +0.02% | 6.14 / 7.45 |

7/6 SOFR ARM | 5.79% | +0.01% | +0.15% | 5.59 / 7.25 |

30 Yr. VA | 6.06% | +0.01% | +0.05% | 5.75 / 6.64 |

New here? Join the newsletter (it's free).

Real Estate Trends

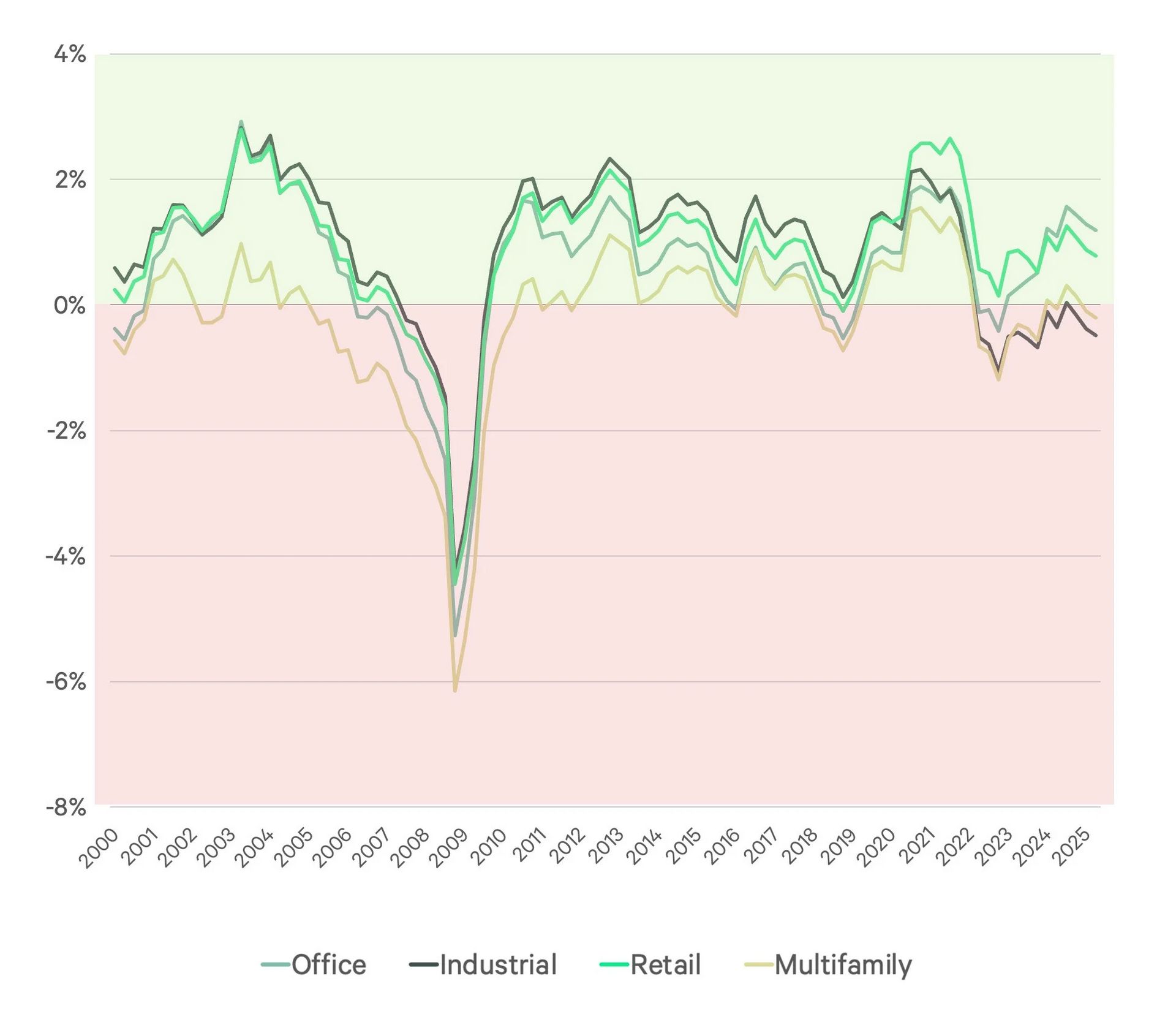

CRE investment set to jump 15% with the rate cuts link

U.S. Cap Rates Less All-In Cost of Capital

The Fed lowered the federal funds rate by 25 bps to 4.00%–4.25% and expects two more cuts this year, bringing it down to 3.50%–3.75%. The 10-year Treasury is projected to stay near 4% through year-end.

CBRE now forecasts commercial real estate investment volume will rise 15% in 2025, up from its earlier 10% call. Liquidity gains will aid refinancing, but distressed office assets remain a drag.

Cap rates have barely moved, 5.95% in Q2 2025 vs. 6% last year, so income-focused strategies are expected to dominate. Leasing growth looks modest, with office recovery driven by flight-to-quality and strong renewals.

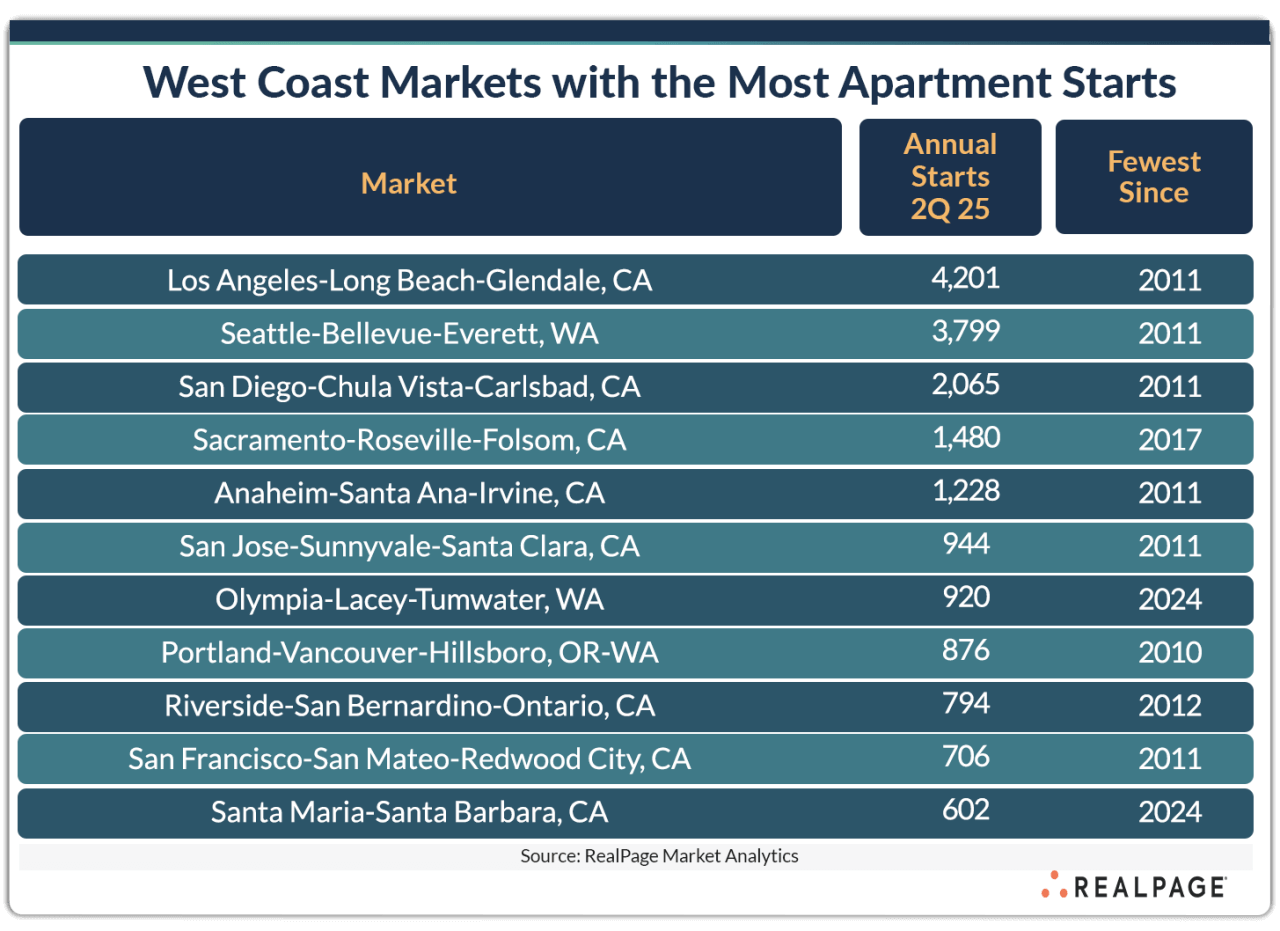

West Coast apartment construction collapses to lowest since 2011, Seattle, LA, San Diego stall link

Only 20,000 market-rate units started on the West Coast in the year ending Q2 2025, the lowest level since 2011.

Los Angeles led with just 4,200 starts, while Seattle slipped under 4,000 and San Diego barely topped 2,000, far below historical norms.

Portland hit its weakest construction year since 2010, signaling a broader regional slowdown that’s unlikely to ease soon.

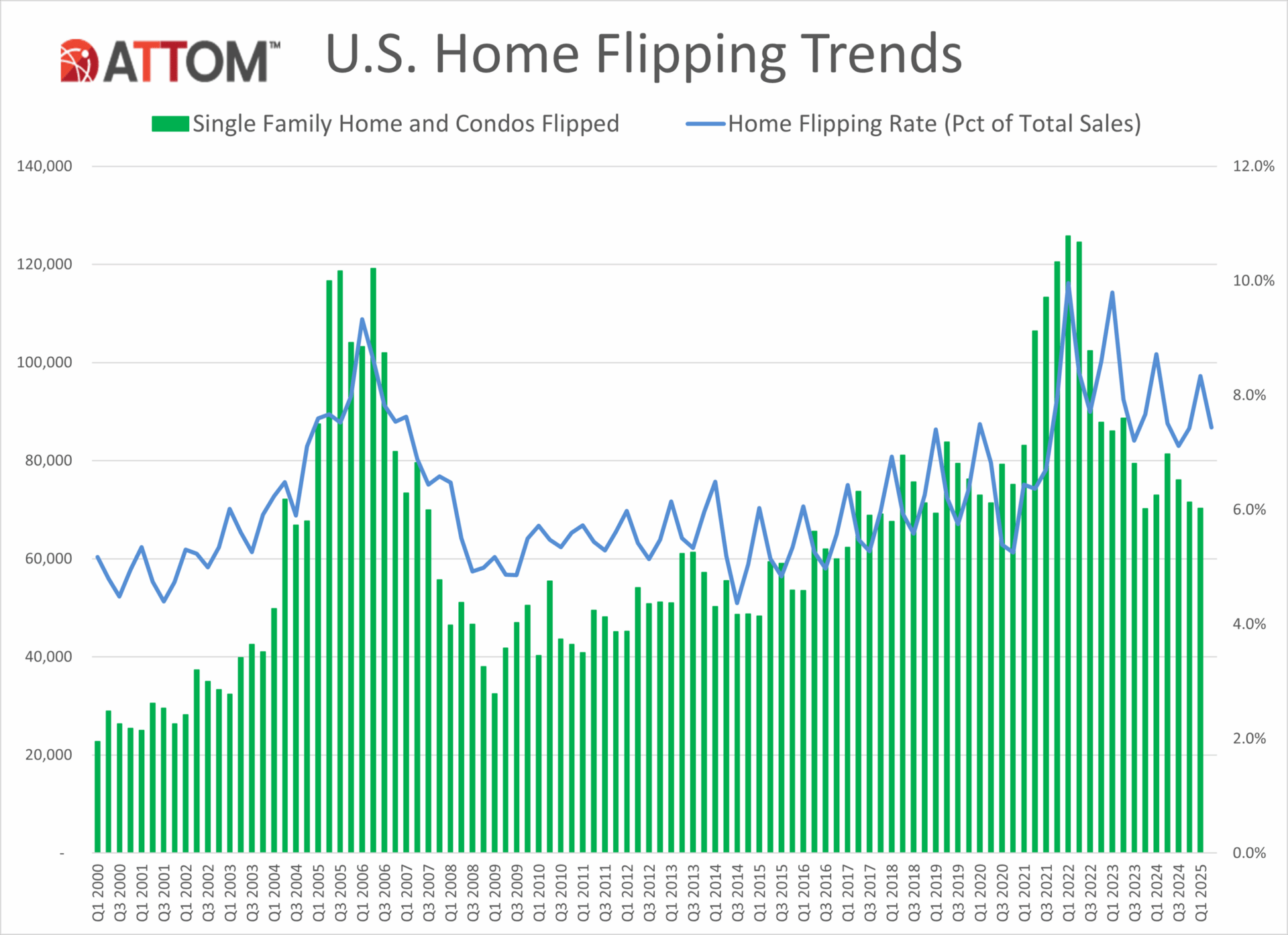

Flipping profits sink to 17-year low margins just 25% link

The median flipped home sold for $325,000 after being bought at $259,700, leaving a gross profit of $65,300, down 13.6% from last year and the weakest 25.1% return since 2008.

Georgia metros dominated flipping activity, with Warner Robins (18.5%), Macon (15.5%), and Atlanta (13.6%) posting the highest flip shares, while large markets like Seattle and Boston stayed under 5%.

Some markets saw profit collapses: Fort Smith, AR dropped from 76.3% ROI to 13.1% in one quarter, while Austin, TX barely cleared 5.5%, but Pittsburgh and Scranton still topped 100% margins.

Mortgage rates dip toward 6%, is the housing market already shifting? link

Mortgage rates briefly touched just under 6% before the Fed’s rate cut announcement, sparking an immediate but short-lived boost in housing demand. They’ve since ticked back up to 6.34%.

The market tends to perform better when rates stay below 6.64% and head toward 6%, but analysts say it takes 12–14 weeks of lower rates before the shift shows clearly in supply and demand data.

Early signals already appeared in mid-June, with HousingWire’s weekly tracker showing movement in applications and inventory tied directly to the rate drop.

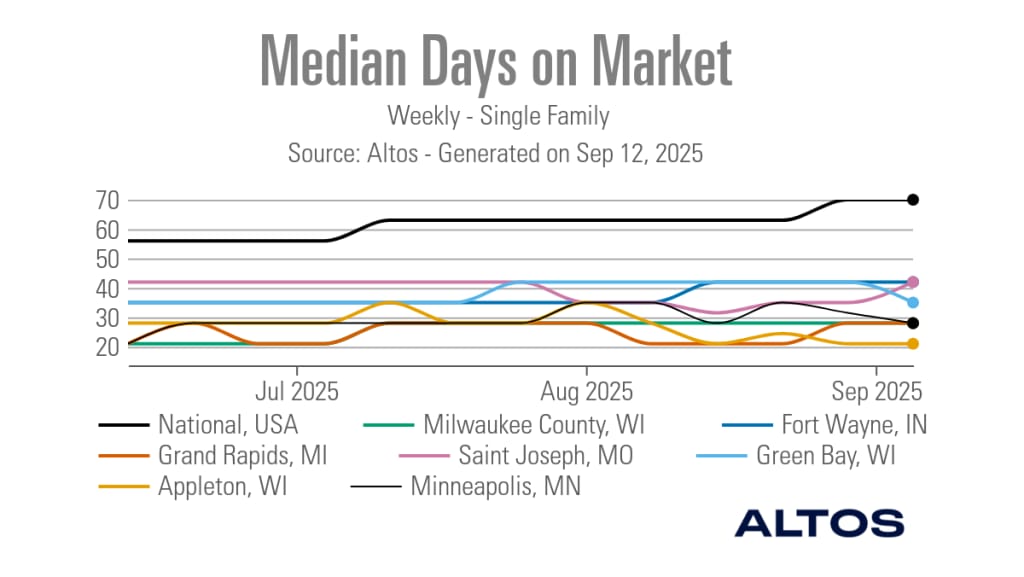

Midwest housing markets defy national days on market trends link

The national median days on market (DOM) is 63, but Midwest homes average just 23.8 days, over 56 days faster. Grand Rapids tops the list with homes selling in 9.6 days, 83% quicker than the national pace.

Statewide, Minnesota homes sell 75% faster than the U.S. average, followed by Wisconsin (72%) and Michigan (64%). Even the slowest Midwest market, Saint Joseph, Missouri, is still 31% faster than the national benchmark.

Fast sales are not driven by cheap homes: Milwaukee’s median price is $525,000 and Minneapolis sits at $549,999, yet both cities still post sub-15-day DOM.

Location Specific

Austin’s Housing Boom Crashes, Inventory Surges, Prices Down 13% link

Austin now has 7.1 months of inventory, well above the national 5.0, making it one of just seven major metros to officially flip to a buyer’s market. Active listings are up 20.1% year over year and 50.2% above pre-pandemic levels.

Median home prices in Austin have dropped 13.2% since August 2022, with the current median listing at $499,000. New builds now make up nearly a quarter of listings and sell at a 7.2% discount compared to existing homes.

Rents are also falling, with the median asking rent at $1,460—5.3% lower year over year and $252 below the national median. Buying a starter home still costs $1,683 more per month than renting.

AI & Real Estate - Today’s Trends

Tool of the day - Marketer

Marketer AI Tool revolutionizes real estate sales with AI-driven price optimization, lead generation, and tailored marketing.

Roosevelt Road Specialty Taps Neural Earth’s AI for Smarter Property Risk Underwriting link

The MGU will embed Neural Earth’s geospatial risk platform into commercial property insurance workflows, aiming for more precise underwriting, better portfolio strategy, and transparent risk intelligence.

NAR Survey: Realtors Spend Big on Tech, Lean on AI for Leads link

Nearly a quarter of Realtors spend over $500 a month on tech, with social media (39%) ranked as the top lead source. AI use is growing, 58% rely on ChatGPT, though 46% say it hasn’t yet moved the needle on business impact.

Commercial Real Estate AI Now Powers Cross-Industry Strategy, ANA Says link

At ANA’s September session, leaders from retail, CPG, tourism, and media showed how AI-driven location and consumer intelligence from CRE is shaping decisions, uncovering growth, and sharpening strategy across industries.

Tech Pulse: E-Signatures, Fraud Protection & AI Networks Reshape Real Estate link

This week’s HousingWire roundup spotlights Florida Realtors’ new nationwide e-sign tool, Closinglock’s fraud-fighting payoff system, Rate’s Spanish-language mortgage app, and Rechat’s AI-powered agent network driving faster referrals.

A word from our sponsor

Buying Cannabis Online Is Now Legal, And Incredibly Convenient

For years, buying cannabis meant taking a trip to a dispensary, dealing with long lines, limited selection, and inconsistent pricing. But thanks to changing laws and innovative online retailers, buying high-quality THC products is now 100% federally legal—and more convenient than ever.

And when it comes to quality and reliability, Mood is leading the way…

Because they’ve completely flipped the script on cannabis shopping. Instead of memorizing hundreds of confusing strain names – like “Gorilla Glue” and "Purple Monkey Breath" – you simply choose how you want to feel: Creative, Social, Focused, Relaxed, Happy, Aroused, and more.

Each gummy is formulated with the perfect blend of Delta-9 THC and botanicals to deliver the perfect mood.

Want a great night’s sleep? Try the Sleepytime gummies. Need laser focus Mind Magic gummies have you covered. Hotter sex? Try the Sexual Euphoria gummies.

It's cannabis shopping that actually makes sense for “normal” people.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

The Next Multifamily Rent Boom is happening in these places

(This content is restricted to Pro Members only. Upgrade)

Roughly 30% of office buildings account for 90% of vacancies and may never recover

(This content is restricted to Pro Members only. Upgrade)

Disasters Reshaping Housing Market: A Harvard Study

(This content is restricted to Pro Members only. Upgrade)

Where Affordable Units Are Losing Ground Fast

(This content is restricted to Pro Members only. Upgrade)

The Housing Law Twist No One Expected

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

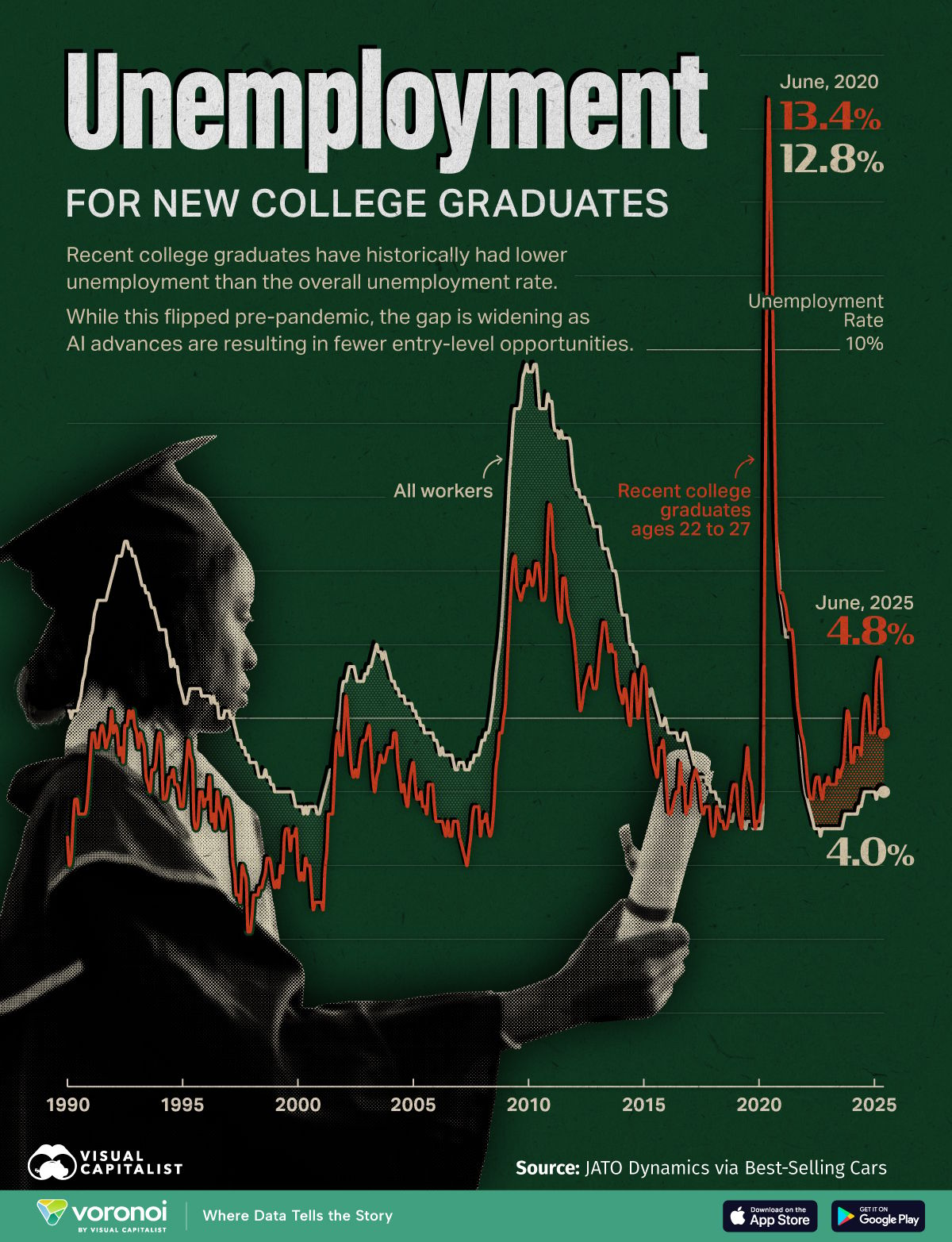

The Rising Unemployment Rate of College Graduates

Unreal Real Estate

Straight out of a Disney movie!

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply