- Zero Flux

- Posts

- Florida’s big four metros flip to buyer’s markets

Florida’s big four metros flip to buyer’s markets

Visualizing the U.S. Population by Age Group and 12 other real estate insights

Want the full Zero Flux experience?

For a limited time, you can upgrade to Premium at just $6.32/month and get deeper data drops, investor insights, and access to every tool we’ve built for serious operators.

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.39% | +0.02% | +0.02% | 6.13 / 7.26 |

15 Yr. Fixed | 5.90% | +0.01% | +0.02% | 5.55 / 6.59 |

30 Yr. FHA | 6.06% | +0.01% | +0.01% | 5.75 / 6.62 |

30 Yr. Jumbo | 6.30% | +0.03% | +0.05% | 6.14 / 7.45 |

7/6 SOFR ARM | 5.82% | +0.00% | +0.05% | 5.59 / 7.25 |

30 Yr. VA | 6.08% | +0.00% | +0.01% | 5.77 / 6.64 |

New here? Join the newsletter (it's free).

Macro Trends

How the macroeconomy affects real estate returns in US metros link

A 1% GDP drop cuts property capital returns by 1.4%–2% across most U.S. metros. This shows how tightly local markets track the national economy.

A 1% rise in consumer inflation lowers property prices by 0.3%–1.8%, with retail taking a bigger hit than industrial. Inflation impacts are felt faster than GDP shocks.

Bond yield changes drive the sharpest price swings, especially for assets with lower discount rates. Consumer recessions take up to 5 years to fully hit values, while inflation bites almost immediately.

My take: For investors, bond volatility is the silent killer, yields reprice assets overnight, while GDP and inflation grind returns down more slowly.

Real Estate Trends

Healthcare Real Estate - 14% of Rural Facilities at Risk link

Healthcare drove 86% of all U.S. job growth in the first eight months of 2025, making it the single biggest employment driver in the economy. This growth is pulling more investor attention into medical real estate.

Over 14% of rural hospitals face possible closure, and half already lack key services like obstetrics or oncology. This will push more patients into urban markets and drive demand for outpatient complexes.

Hospital systems are reversing course by exercising rights of first refusal and buying back key properties. They’re negotiating purchase options into leases to keep control of their real estate.

Net-lease boom: $640M portfolio signals institutions are all in link

New Mountain Capital’s $640M net-lease deal shows big institutions, domestic and foreign, now treat net lease as core CRE, citing better risk-adjusted returns than other property types.

CBRE projects 2025 net-lease transaction volume to rise 5–12%, led by industrial and retail assets, while office deals are only slowly recovering.

Sponsors are pushing longer terms, WALT targets of 6–7 years and even 20-year fixed-escalation leases , enabling mid-to-high-teen return profiles with low perceived risk.

My take: Net lease is quietly morphing from niche to institutional safe haven if capital keeps pouring in, yields will compress fast, and late entrants may be left holding thinner spreads.

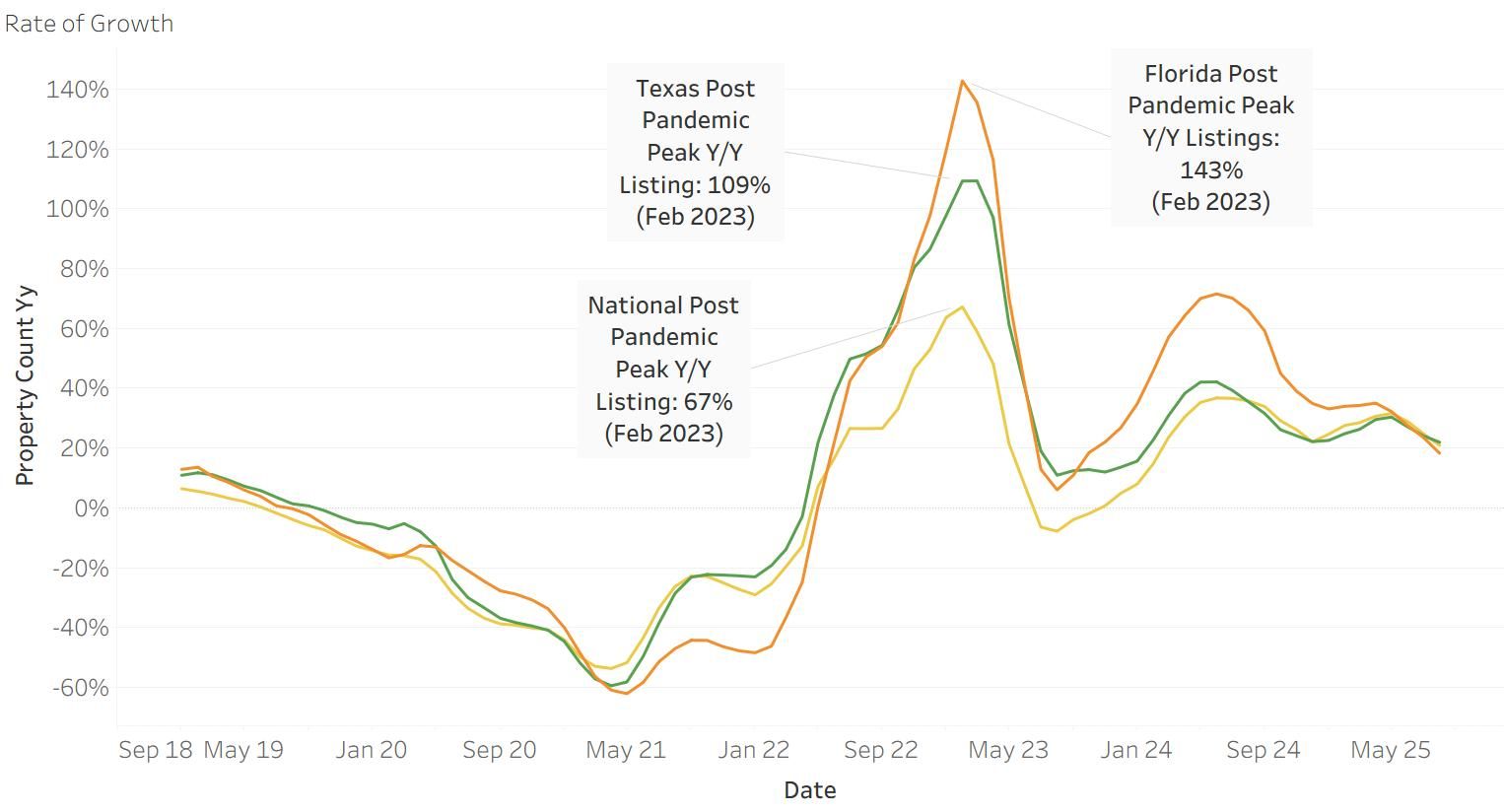

Florida’s big four metros flip to buyer’s markets link

Miami has the nation’s highest housing supply at 9.7 months, with delistings outpacing new listings, 57 homes pulled for every 100 listed in July. Homes are also sitting 16 more days on market than last year.

Florida now holds over 167,000 active listings, 15% of all U.S. inventory, even though it makes up just 6.7% of the population. That’s more than Texas and California, which rank second and third.

Price cuts are spreading: 29.9% of Jacksonville homes and 27.5% of Tampa homes have been reduced. Orlando and Miami show slower price movement but still longer listing times, signaling leverage shifting to buyers.

Trump appointees gut fair housing enforcement, whistleblowers raise alarms link

Internal HUD emails show Trump appointees dismissed decades of housing discrimination cases as “artificial, arbitrary and unnecessary,” marking a major rollback of enforcement.

A career supervisor who resisted reassigning fair housing lawyers was fired within six days, raising red flags about retaliation against staff who push back.

Whistleblowers describe gag orders and intimidation tactics to stall discrimination cases, with one urgent warning already escalated to a U.S. senator.

Location Specific

Philly’s multifamily pipeline collapses after tax-fueled surge link

The city’s 10-year tax abatement expiration in 2021 triggered a building rush that swelled multifamily inventory by 15.8% in just a few years.

Deliveries peaked in 2024 at nearly 7,500 units, but active construction has fallen to 7,775 units, a second straight year of pipeline decline.

Permit activity has reverted to pre-boom levels, making the recent supply surge a one-off event unlikely to return.

In my opinion, as fewer new properties are being built, landlords in Philadelphia might be able to charge higher rents. However, investors expecting more new properties at lower prices might be surprised. This is my version of my take.

AI & Real Estate - Today’s Trends

Tool of the day - Reeco

An AI-driven procure-to-pay platform tailored for the hospitality industry, streamlining procurement, inventory management, and accounts payable into a unified system.

Reverse Mortgage Lenders Put AI in Front of Seniors link

Top lenders like FOA and Longbridge are piloting chatbots and voice agents to serve older borrowers, aiming to boost efficiency and accessibility while carefully balancing tech adoption with seniors’ comfort levels.

AI Adoption in Real Estate Doubles But Most Agents Stick to Free Models link

Intel’s latest survey shows real estate AI adoption has surged to nearly 15% of firms, yet 63% of agents still rely on free-tier tools, limiting impact to basic tasks like property descriptions while paid users unlock productivity gains in lead management and analytics.

NYC’s CRE Crisis Meets an AI Land Grab link

With vacancies rising and values sliding, AI firms are moving into struggling New York properties, transforming empty offices into tech hubs and giving landlords a rare shot at revival.

Keller Williams’ Jason Abrams Busts the Biggest AI Myths link

In a new HousingWire podcast, Abrams argues AI isn’t a threat but a multiplier for agents, revealing how prompt mastery, lead-gen workflows, and ethical guardrails can separate winners from laggards.

A word from our sponsor

The best HR advice comes from people who’ve been in the trenches.

That’s what this newsletter delivers.

I Hate it Here is your insider’s guide to surviving and thriving in HR, from someone who’s been there. It’s not about theory or buzzwords — it’s about practical, real-world advice for navigating everything from tricky managers to messy policies.

Every newsletter is written by Hebba Youssef — a Chief People Officer who’s seen it all and is here to share what actually works (and what doesn’t). We’re talking real talk, real strategies, and real support — all with a side of humor to keep you sane.

Because HR shouldn’t feel like a thankless job. And you shouldn’t feel alone in it.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

U.S. Self Storage Market Trends

(This content is restricted to Pro Members only. Upgrade)

Americans’ Biggest Bet May Backfire in Real Estate

(This content is restricted to Pro Members only. Upgrade)

Latest Hotspots of Office Demand

(This content is restricted to Pro Members only. Upgrade)

Half of U.S. Cities See July Price Drops, Last Time Was 2008

(This content is restricted to Pro Members only. Upgrade)

10-Year Yield Jolted, What It Means for CRE

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

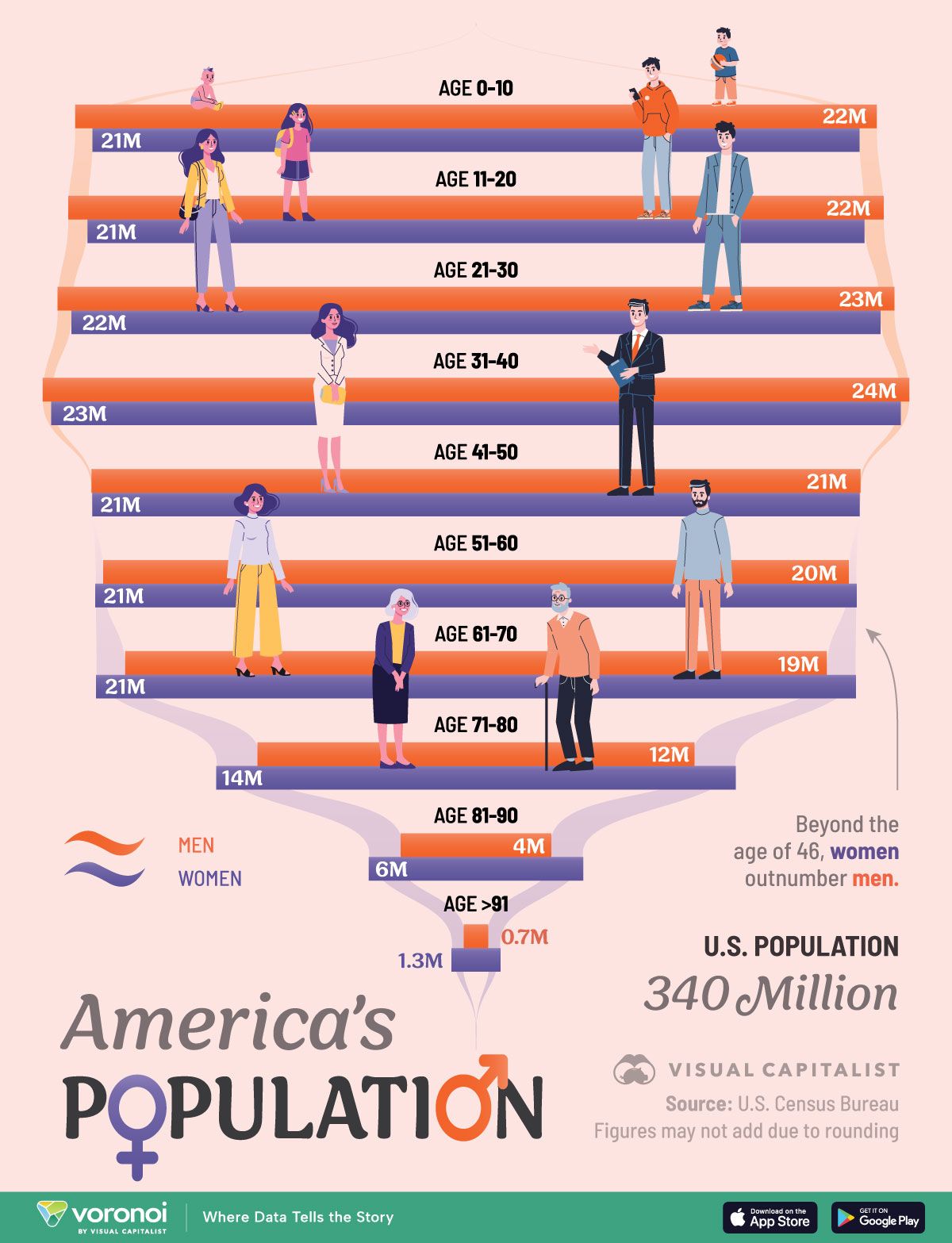

Visualizing the U.S. Population by Age Group

Unreal Real Estate

A cave hangout!

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply