- Zero Flux

- Posts

- GDP jumps 3%, Student housing surges, Hamptons Real Estate Booms

GDP jumps 3%, Student housing surges, Hamptons Real Estate Booms

and 12 other real estate insights

Share Zero Flux with a friend using your unique link and unlock 3 months of premium free:

https://www.zeroflux.io/subscribe?ref=PLACEHOLDER

And if you get 25 signups overtime with this link, premium is yours for life 🎉

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.75% | +0.00% | -0.06% | 6.11 / 7.26 |

15 Yr. Fixed | 6.03% | +0.00% | -0.02% | 5.54 / 6.59 |

30 Yr. FHA | 6.33% | +0.00% | -0.05% | 5.65 / 6.62 |

30 Yr. Jumbo | 6.86% | -0.01% | -0.05% | 6.37 / 7.45 |

7/6 SOFR ARM | 6.25% | -0.01% | -0.02% | 5.95 / 7.25 |

30 Yr. VA | 6.34% | -0.01% | -0.06% | 5.66 / 6.64 |

New here? Join the newsletter (it's free).

Macro Trends

GDP jumps 3%—but trade math hides real slowdown link

The 3.0% GDP growth in Q2 was largely driven by a massive 30% drop in imports, artificially inflating the number through trade accounting quirks. Core domestic demand—excluding trade and government spending—slowed to just 1.2%, the weakest since late 2022.

Consumer spending only grew 1.4%, below the usual ~3% trend, while business investment declined despite available tax incentives. This signals underlying economic softness masked by headline growth.

Tariffs are raising inflation pressure again, with average rates now at 20%, up from under 3% earlier this year. Economists now expect sub-1% growth in both Q3 and Q4 as policy uncertainty clouds business confidence.

Real Estate Trends

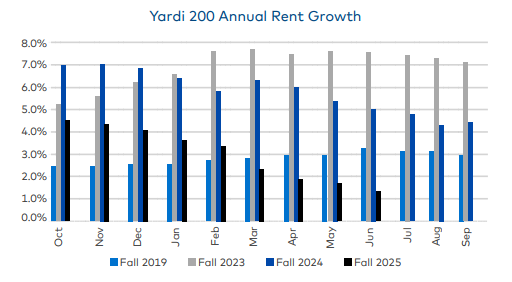

Student housing preleasing surges link

Preleasing at Yardi 200 schools hit 85.3% in June—up 160 bps YoY—but advertised rents slipped to $909 per bed, down from $917 last month. Rent growth is slowing as operators focus on filling inventory before fall.

Sales volume dipped, but asset pricing surged: 50 properties traded hands YTD, with average per-bed pricing jumping to nearly $94,000—up from $73,500 across 2020–2024. Fewer deals, but higher value.

Some schools are way ahead—like University of Cincinnati (up 23.9%)—but 20 markets are lagging 10% or more behind last year’s prelease levels. Notable underperformers include Purdue and North Texas.

Multifamily managers stay bullish—even as renter retention slips link

Property managers aimed for a 63% renter retention rate in 2025, but actual retention came in at 58%. Despite this gap, 73% of managers still believe retention will rise in 2026.

The share of companies targeting 70%+ retention has more than tripled since 2021, signaling a shift toward aggressive retention strategies to protect NOI.

Renters say cost, maintenance, and safety are top reasons for leaving—yet managers wrongly believe life changes and tech features are driving churn.

Vacancy Crisis Deepens: 1 in 10 Office Buildings Now Half Empty link

Vacancy pain is concentrated: While the average vacancy rate sits at 19%, the bottom 10% of office properties are at least 48.7% vacant—up from 32% in 2019. These buildings are struggling far more than the averages suggest.

High-quality offices still winning: Top-tier properties are maintaining full occupancy, showing how tenant demand continues to favor newer, upgraded spaces. The rest of the market is being left behind as leases roll over.

Bigger buildings, bigger problems: Weighted by square footage, the average vacancy rate is 19%, but the unweighted average is just 13.2%. That gap shows that large, commodity buildings are dragging the market down.

Affordable housing just got a profit boost—here’s why investors are piling in link

A new tax and spending bill expanded the Low-Income Housing Tax Credit (LIHTC), increasing the 9% credit allocation to states by 12% and easing financing rules—potentially enabling 1 million new affordable rental homes by 2035.

Jonathan Rose Companies closed a $660 million impact fund focused on acquiring and preserving affordable and mixed-income housing in high-demand urban areas, signaling strong investor interest from family offices and foundations.

Despite bipartisan legislative support, a proposed $27 billion federal rental assistance cut is already making lenders nervous and could stall projects if approved by Congress.

Location Specific

Hamptons Real Estate Booms—Sag Harbor Sales Jump 774%, $1.4B Moves in 3 Months link

Sag Harbor exploded in Q2 2025, with home sales up over 200%, median prices up 79%, and total volume skyrocketing 774%, making it the hottest village in the Hamptons.

Ultra-luxury homes ($20M+) saw a 33% jump in sales, even as the median price hit $11.35M and listing prices neared $8M in areas like Bridgehampton and Sagaponack.

Inventory is finally rising, up 8.2% in the luxury segment, pulling sidelined buyers back in as move-in-ready homes between $2M–$5M dominate demand.

AI & Real Estate - Today’s Trends

Tool of the day - Sameday AI

Virtual AI receptionist for home service businesses that answers calls and books appointment 24/7.

AI Is Coming for Multifamily Utility Billing — And It’s a Game Changer – link

New AI tools are automating utility expense allocation, spotting billing errors, and boosting NOI — giving operators tighter control over property performance.

PropertyLimBrothers Is Quietly Leading the AI Proptech Revolution – link

From AI-enhanced video tours to data-driven pricing strategies, this Singapore-based agency is setting a new global standard for real estate marketing with tech at its core.

Luxury Presence Unveils AI Marketing Team to Power Up Agent Branding – link

The new AI-powered service helps agents generate custom branding, listing content, and social campaigns — streamlining luxury marketing with high-end polish.

New AI Assistant Built Just for Real Estate Agents Hits the Market – link

Designed specifically for agents, this AI assistant handles listing edits, lead responses, and prospecting — saving hours a week and boosting follow-up speed.

A word from our sponsor

100 Genius Side Hustle Ideas

Don't wait. Sign up for The Hustle to unlock our side hustle database. Unlike generic "start a blog" advice, we've curated 100 actual business ideas with real earning potential, startup costs, and time requirements. Join 1.5M professionals getting smarter about business daily and launch your next money-making venture.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

2025 Sales Volumes for All Asset Classes

(This content is restricted to Pro Members only. Upgrade)

These Cities Dominate List of Most Expensive Rental Markets

(This content is restricted to Pro Members only. Upgrade)

10 Markets With Largest Year-Over-Year Price Declines

(This content is restricted to Pro Members only. Upgrade)

How Gen Z Is Transforming Retail Spaces for a New Era

(This content is restricted to Pro Members only. Upgrade)

Multifamily construction surges—these 10 cities are way ahead

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Unreal Real Estate

A 19th century sawmill conversion!

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply