- Zero Flux

- Posts

- Home insurance set to jump another 16 percent

Home insurance set to jump another 16 percent

Ranked: AI Hallucination rates for ChatGPT, Gemini etc, A Beautiful Treehouse for Sale and more!

We are making a push to improve the newsletter before the end of the year.

Please reply with any feedback - It would mean a lot!

Hope you enjoy today's insights

A quick word from our sponsor

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.20% | -0.12% | -0.18% | 6.13 / 7.26 |

15 Yr. Fixed | 5.75% | -0.05% | -0.11% | 5.60 / 6.59 |

30 Yr. FHA | 5.82% | -0.09% | -0.18% | 5.82 / 6.59 |

30 Yr. Jumbo | 6.40% | -0.01% | -0.05% | 6.10 / 7.45 |

7/6 SOFR ARM | 5.70% | -0.18% | -0.34% | 5.59 / 7.25 |

30 Yr. VA | 5.85% | -0.08% | -0.15% | 5.85 / 6.60 |

⚡ Snapshot: The 7/6 SOFR ARM saw the steepest daily drop (-0.18%), and all major loan types moved lower, marking one of the broadest single-day rate declines in weeks.

New here? Join the newsletter (it's free).

Macro Trends

Black Friday spending holds strong even as tariffs push prices higher link

Holiday sales are still expected to reach $1.01 trillion to $1.02 trillion, up 3.7 to 4.2 percent from last year, with online spending already up 7.5 percent from early November. Mall traffic is above 2019 levels, showing shoppers are still showing up despite weaker confidence and higher prices.

Tariffs are pushing costs higher, with 40 percent of general merchandise seeing at least a 5 percent price jump since early 2025 and 83 percent of toys rising that much in September. Retailers are tightening inventory and offering smaller early discounts to preserve pricing power.

Real Estate Trends

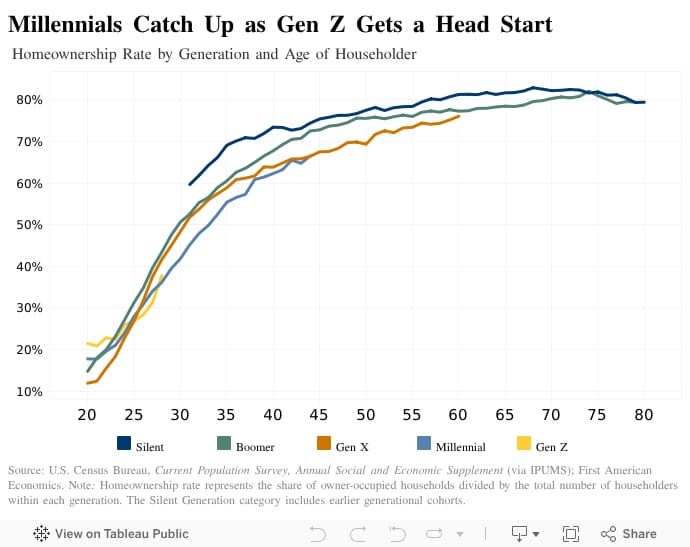

Younger buyers gain momentum as boomers free up future supply link

Millennials are now closing the homeownership gap, matching Gen X by their early forties as rising earnings and family formation finally push demand forward.

Gen Z is entering stronger than expected, with ownership rates 1.7 percentage points above millennials at age 28, helped by wage gains and early-pandemic borrowing conditions.

My take: Demographics are setting up a clearer runway for younger buyers, but the pace will depend on how quickly boomer-owned homes actually return to market.

Home insurance costs set to jump another 16 percent by 2027 link

Average homeowner premiums are projected to rise 8 percent in 2026 and another 8 percent in 2027, driven by construction costs up 44 percent since the pandemic and growing exposure to climate risks that now threaten 12 percent of U.S. homes.

In high-risk states like Florida and Louisiana, soaring premiums are already pushing buyers out of loan approval ranges and forcing owners to sell or relocate, with one in three buyers changing their search area due to insurance challenges.

My take: Insurance is becoming a defining affordability constraint in climate-exposed markets, not just a line item. Investors should watch how these premium spikes reshape demand patterns and lender approvals over the next two years.

Retail absorption flips positive, investors rush back into the sector link

Q3 absorption turned positive at 4.7 million square feet after a -14.4 million slide, with 70% of new leases under 2,500 square feet. Tight supply persists with only 7.6 million square feet delivered and construction down to 50.6 million, keeping rents elevated.

Retail investment hit $40 billion year to date, up 38% from last year, with Q3 alone at $17 billion. High street retail liquidity jumped 82%, led by major deals like the $400 million Rodeo Drive sale.

My take: Investors should expect tighter competition for small format spaces as restaurants and discount retailers dominate demand. For owners, limited new supply and rising liquidity signal strong pricing power but also higher expectations to reposition older assets.

$600M JV targets top spot in private self storage ownership link

Blue Vista, UBS Unified Global Alternatives and Extra Space Storage formed a $600 million partnership to buy and develop value-add, core and core-plus self storage assets across the U.S., leveraging Blue Vista’s 15 years and 65 prior deals in the sector while Extra Space manages operations.

The push comes as Yardi Matrix projects self storage completions to rise 4.3% in 2025 and 4.6% in 2026, even as advertised unit rates just increased for the first time in three years, underscoring a sector seen as resilient but facing a clear supply wave.

My take: Big players are putting serious money into self storage, which shows confidence in the sector. But with more new supply coming, investors need to stay focused on submarkets where construction is heating up.

AI & Real Estate

Tool of the day: Bravi

AI that automates lead follow-ups, client communication, and scheduling for real-estate teams with human-like precision.

AI Speeds Up Permits, Cuts Reviews to 2 Days link

The Builder’s Daily reports that cities are using AI to review zoning and code checks much faster. Hernando County cut review times from 30 days to 2 using SwiftGov, and LA County now gets AI plan reports in one business day.

AI Helps Florida Buyers Close Homes Without Agents link

Business Wire reports that Homa enabled the first US home purchases completed with buyers fully self-representing using an AI platform. One buyer in Florida saved over $24,000 by avoiding the typical 2.78 percent commission. Early demand suggests buyers want more control in the post NAR settlement rules.

New Book Shows Agents Simple Ways to Use AI link

WRE News reports that Real AI co-founder Kevin Hawkins released a new book that teaches agents how to use AI in practical, safe ways. He says most agents still use AI mainly for writing help, even though 80 percent tried tools like ChatGPT in the first year. The book argues real gains will come from simple, real-world workflows, not flashy tools.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

What Real Estate Tokenization means for Property Owners

(This content is restricted to Pro Members only. Upgrade)

A New Cycle Is Forming Under High Rates. Here’s the Signal

(This content is restricted to Pro Members only. Upgrade)

A New Healthcare Segment is Reshaping Medical Office Space

(This content is restricted to Pro Members only. Upgrade)

Refi Boom Masks a Hidden Risk Spike

(This content is restricted to Pro Members only. Upgrade)

Multifamily buyers are still sitting out. The real freeze is deeper in the numbers

(This content is restricted to Pro Members only. Upgrade)

One Chart

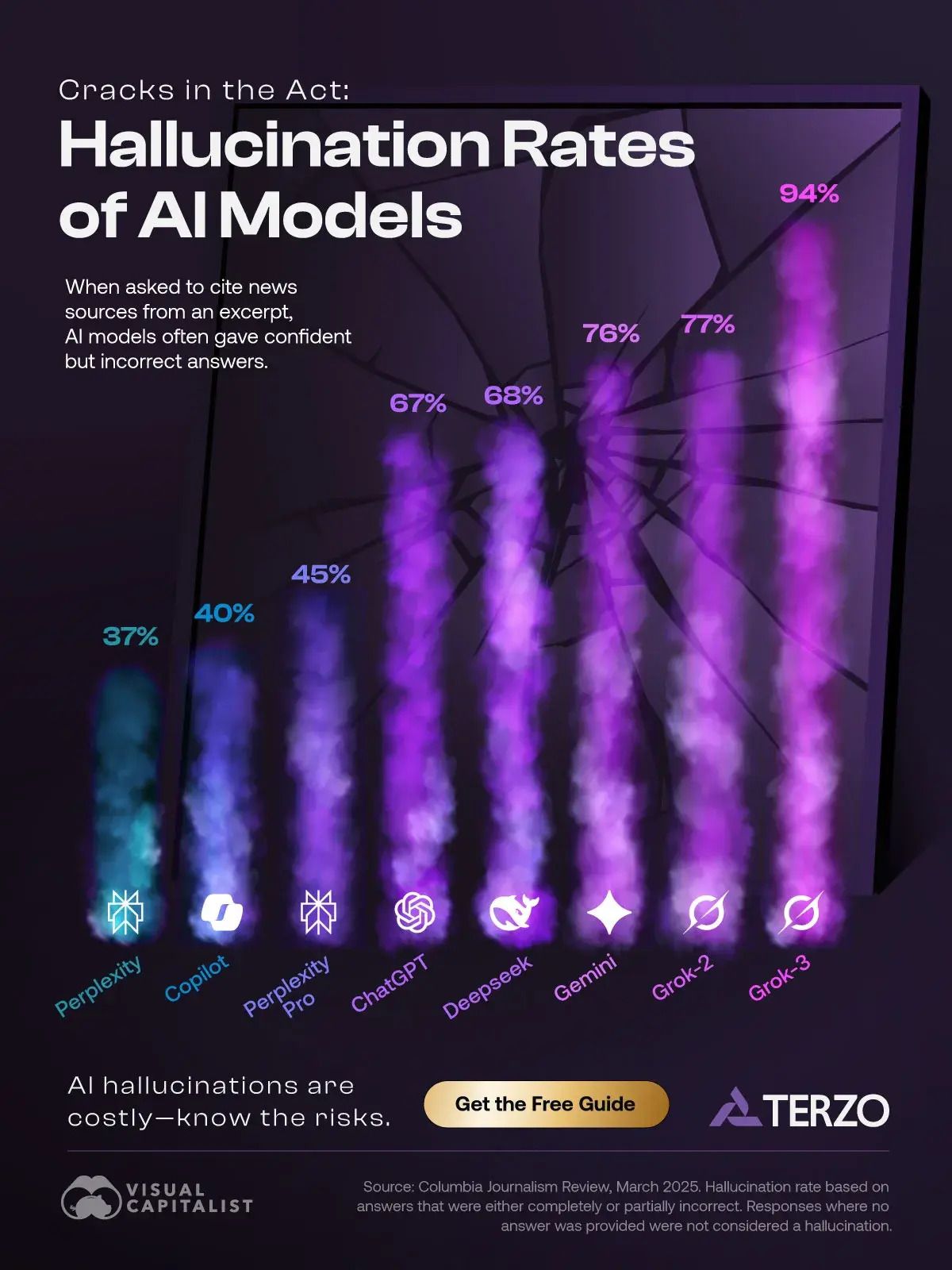

Ranked: AI hallucination rates by Model

Unreal Real Estate

A Modern Treehouse

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply