- Zero Flux

- Posts

- Investors rush back to California retail

Investors rush back to California retail

The most (and least) expensive states for retirees and 12 other real estate insights

Want the full Zero Flux experience?

For a limited time, you can upgrade to Premium at just $6.32/month and get deeper data drops, investor insights, and access to every tool we’ve built for serious operators.

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.36% | -0.01% | -0.03% | 6.13 / 7.26 |

15 Yr. Fixed | 5.87% | -0.01% | -0.03% | 5.60 / 6.59 |

30 Yr. FHA | 6.05% | +0.00% | -0.01% | 5.76 / 6.62 |

30 Yr. Jumbo | 6.26% | -0.01% | -0.04% | 6.14 / 7.45 |

7/6 SOFR ARM | 5.79% | +0.01% | -0.03% | 5.59 / 7.25 |

30 Yr. VA | 6.07% | +0.01% | -0.01% | 5.78 / 6.64 |

New here? Join the newsletter (it's free).

Macro Trends

Job market flip: Tech darlings slump while Phoenix, Philly, Carolinas surge link

Bay Area lost 12,600 jobs YoY in August and Denver shed 3,800; core tech hubs (Atlanta, Dallas, Austin, Seattle, Raleigh/Durham) created 100,000 fewer jobs than last year. Dallas fell from a top-10 growth market to #26, with Seattle #28 and Austin #30.

Growth is tilting to mega-markets: the top 10 added 389,400 jobs (28% YoY) but 71,000 fewer than last month; New York led with +113,400, Philadelphia ~58,000, and Phoenix ~36,000 jumped to #3. The next 10 markets added 156,000 jobs, down 8.3% YoY.

Percentage leaders are smaller, cheaper markets: Myrtle Beach stayed #1, and the Carolinas made up half of the top 10 alongside College Station, Columbia, Fayetteville, Boise, Greenville/Spartanburg, Salem (OR), and Manchester-Nashua/Concord (NH). Pittsburgh and Salt Lake City entered the overall top 10 as Orlando and Detroit fell out.

Real Estate Trends

QSRs lead retail leasing surge, 2,700+ new stores in 2024 link

Quick-service restaurants (QSRs) opened more than 2,700 net new stores in 2024, led by Starbucks, Chick-fil-A, and Raising Cane’s, now making up nearly 20% of all leasing activity. Dining spend is at record highs, driving landlords to compete aggressively for food-and-beverage tenants.

New retail development is muted, forcing landlords to reposition existing assets into mixed-use and experiential centers. Health, wellness, and entertainment are emerging as top growth categories.

Tenants are pushing for shorter leases, performance-based rents, and curated ecosystems with strong foot traffic and digital integration. Landlords adopting “access as currency”, valuing visibility and community over square footage, are gaining an edge.

384 federal leases canceled - $140M “savings” sparks CRE shockwaves link

DOGE has axed 384 federal leases worth ~$140M, but experts warn the cancellations ripple through debt markets as landlords lose once rock-solid anchor tenants. A single D.C. office loss totaled 845,000 sq. ft.

Lease cancellations are destabilizing CMBS pools and commercial financing nationwide; vacant government-backed properties now risk dragging up loan rates across thousands of unrelated deals.

Rural areas face outsized exposure: 63% of leases eligible for termination are outside the top 100 counties, leaving smaller landlords and lenders with fewer fallback options when federal tenants vanish.

Trump’s $100K H-1B visa fee threatens housing demand link

The new $100,000 fee on H-1B visas could hit 730,000 high-skill workers in the U.S., where the median wage is $118,000, a group that disproportionately fuels housing demand in NYC, California, Texas, and Washington.

In markets with tight supply, like NYC (where median rent is already $2,946), economists expect more foreign workers to delay homeownership, boosting high-end rental demand and pushing rents higher.

If the fee extends to renewals or employer changes, companies like Amazon (12,000+ visas approved in early 2025) could face billion-dollar costs, adding uncertainty for lenders who may demand higher down payments or rates from visa-holders.

Hidden rental fees add hundreds a month, 19 states crack down link

A 2022 survey found at least 27 types of rental fees beyond rent itself from pet and pest fees to mandatory insurance, often undisclosed until after signing.

In Philadelphia, a minimum wage worker must log 94 hours/week just to afford the median $1,771 rent, and hidden fees push that burden even higher.

Since 2025, over 30 measures across 19 states have targeted “junk fees,” with Massachusetts banning application fees, Colorado requiring full-price ads, and Maryland capping pet, cable, and parking charges.

Location Specific

Investors rush back to California retail link

Institutional bid volumes for California retail are up 300%+ vs H1 2024, pulling cap rates down on core assets. Capital is targeting supply-constrained, spending-resilient markets (think grocery/necessity).

Debt & equity availability for retail is “at levels not seen in years,” with the retail/industrial yield spread at its tightest since 2017, a sign pricing power is shifting back to retail sellers.

JLL arranged a $27M, 3-year construction loan for a 49,200-sf Rocklin center shadow-anchored by Nugget Markets; within 1 mile, population is up 145% since 2010, with $200K avg HH income and $900K median home value. Leasing/LOIs already cover 60%+ of shop NRA.

AI & Real Estate - Today’s Trends

Tool of the day - Synaps

An AI-powered collaborative architectural planning platform that integrates all necessary processes into a single interface, enhancing efficiency and real-time collaboration for architects.

HousingWire’s Tech Trendsetters Bet Big on AI and Data link

From AI-driven surveys to cloud-native mortgage platforms, 2025’s Tech Trendsetters are retooling housing workflows with smarter pipelines, applied AI, and democratized data to give lenders and agents a competitive edge.

Voiso’s AI Dialer Triples Real Estate Sales Conversations link

By auto-dialing multiple leads and syncing seamlessly with CRMs, Voiso’s AI cuts agent idle time by 40% and drives 3.5x more live calls per day, boosting conversion rates up to 25% without extra headcount.

AI in Multifamily Marketing Hits Its Limits on Branding link

AppFolio data shows AI use in property management jumped to 34%, but experts warn it can’t replace human storytelling, empathy, or brand strategy, residents still crave authenticity that algorithms can’t deliver.

AI Turns Lease Agreements Into Living Contracts link

From smart drafting and predictive rent terms to blockchain-backed transparency, AI and digital platforms are transforming leases from dense paperwork into adaptive, interactive agreements that cut disputes and boost trust.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

Healthcare’s money shift: The trend pulling investor capital in new directions

(This content is restricted to Pro Members only. Upgrade)

These Cities are In UBS' Global Housing Bubble Index Where Prices Outpace Rents

(This content is restricted to Pro Members only. Upgrade)

CRE’s turning point: here’s what 2026 upside hides

(This content is restricted to Pro Members only. Upgrade)

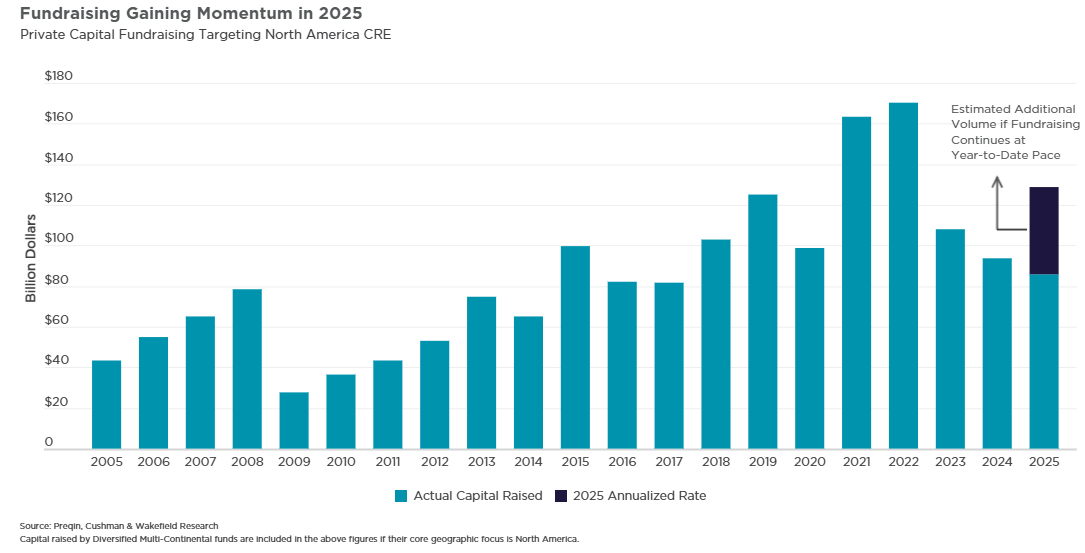

Big money is back in CRE but only for the right bets

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

The most (and least) expensive states for retirees

Unreal Real Estate

An architectural masterpiece!

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply