- Zero Flux

- Posts

- Investors snag record 30% of single-family homes

Investors snag record 30% of single-family homes

The 50 U.S. Colleges That Best Pay Off for Your Career and 12 other real estate insights

Share Zero Flux with a friend using your unique link and unlock 3 months of premium free:

https://www.zeroflux.io/subscribe?ref=PLACEHOLDER

And if you get 25 signups overtime with this link, premium is yours for life 🎉

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.53% | -0.05% | -0.04% | 6.11 / 7.26 |

15 Yr. Fixed | 5.90% | -0.02% | -0.03% | 5.54 / 6.59 |

30 Yr. FHA | 6.11% | -0.03% | -0.06% | 5.65 / 6.62 |

30 Yr. Jumbo | 6.67% | -0.03% | -0.05% | 6.37 / 7.45 |

7/6 SOFR ARM | 6.12% | -0.03% | +0.00% | 6.05 / 7.25 |

30 Yr. VA | 6.12% | -0.03% | -0.06% | 5.66 / 6.64 |

New here? Join the newsletter (it's free).

Real Estate Trends

15 U.S. Apartment Markets Smash Demand Records—South Leads the Surge link

Dallas absorbed over 42,200 units in the past year, more than double its 10-year average demand pace.

Atlanta, Phoenix, and Charlotte saw 22,000–33,000 units absorbed—about three times their decade norms.

Smaller markets like Riverside and Memphis logged demand four to five times their typical pace, even with totals under 10,000 units.

Industrial development slows to 7-year low—Phoenix, Memphis still hot link

Industrial construction starts hit just 86.9 million square feet through May, the slowest pace since 2018, as tariffs on steel and fewer rate cuts push up costs. Projects under construction still total 342.3 million square feet nationwide.

Miami led annual rent growth at 9.8 percent, while Orange County posted the highest rents at $16.69 per square foot. National average in-place rents reached $8.54, up 6.3 percent year-over-year.

Phoenix drew $862 million in industrial sales through May, with average pricing up 14.2 percent from last year. National industrial sales totaled $21.4 billion at $133 per square foot.

Warehousing Vacancies Hit Decade High—but Good Space Is Disappearing Fast link

Vacancy rates climbed to 7.1%, the highest since 2014, yet total capacity contracted for the first time since early 2023, creating a shortage of modern, logistics-ready facilities.

Average asking rents rose to $10.12 per square foot, up 2.6% year-over-year, with Dallas/Fort Worth and Chicago seeing continued absorption despite the supply influx.

Major players like Prologis and Brookfield are doubling down—Prologis committed $900M to mostly pre-leased build-to-suit projects, while Brookfield bought 53 assets for $428M.

Buyer’s agent commissions bounce back link

Average U.S. buyer’s agent commission rose to 2.43% in Q2 2025, matching early 2024 levels before the NAR settlement pushed rates down to 2.36%.

Markets with more sellers than buyers—like Austin—are seeing agents push for 3% commissions, while some buyers in Minneapolis have negotiated down to 2.5%.

Commissions for homes under $500,000 hit 2.52%, the highest since 2023, as sellers and builders cover higher payouts to stay competitive with new home incentives.

Investors snag record 30% of U.S. single-family homes link

Nearly 30% of all single-family home purchases are now made by investors, the highest share ever recorded. Many individual buyers remain priced out by high mortgage rates.

Small, nimble investors are beating large institutional players like Blackstone by acting quickly and targeting smart buys.

Investor buying strength is growing even as total home sales are at decade-plus lows, signaling a shift in market control toward those with cash or quick financing.

Location Specific

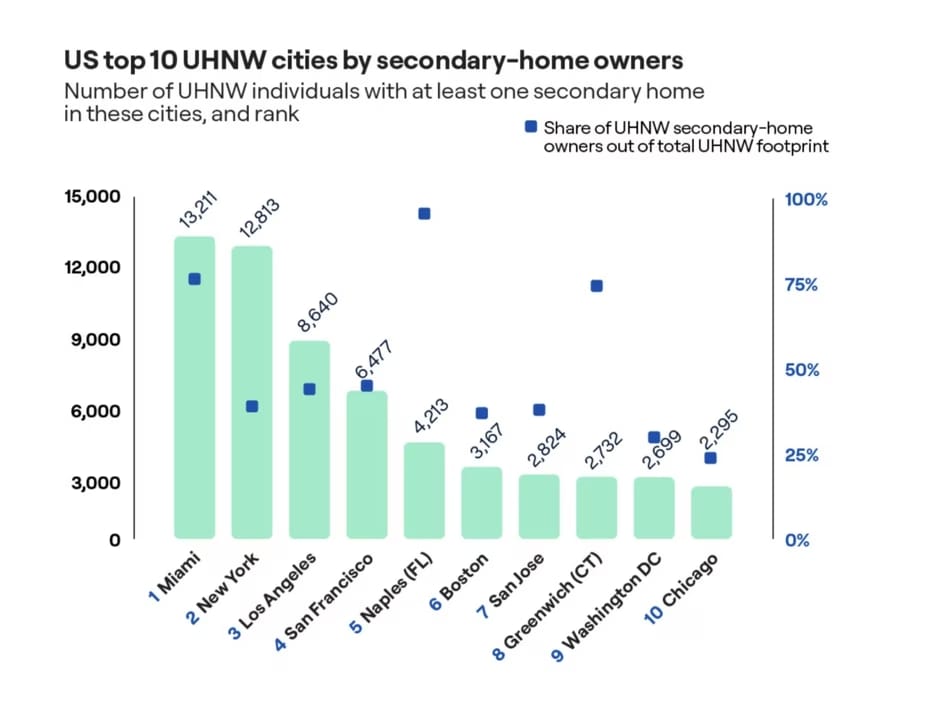

Miami beats NYC as top second-home spot for the ultra-rich — here’s why link

Miami has 13,211 ultra-high-net-worth second-home owners, surpassing New York’s 12,813, despite having fewer overall wealthy residents. Buyers are often acquiring third, fourth, or even fifth homes.

Key draws include no state income tax, year-round warm weather, luxury waterfront estates, and elite amenities like dual kitchens, private marinas, and full-service condos with ocean views. Many pay cash and overpay to secure specific properties.

Top feeder markets are New York, California, and Texas, plus international buyers from Europe, Mexico, Dubai, and Latin America. Preferred neighborhoods include Indian Creek, Star Island, and Bal Harbour for homes; Brickell, Surfside, and Sunny Isles for condos.

AI & Real Estate - Today’s Trends

Tool of the Day - Snaptrude

Cloud-based collaborative 3D building design software.

10 AI Prompts Every Atlanta Real Estate Pro Should Be Using – link

From lead follow-up scripts to neighborhood market breakdowns, these AI prompt ideas are helping Atlanta agents work faster and close more deals.

AI Is Rewriting the Playbook for Apartment SEO in 2025 – link

Property managers are using AI to optimize listings, target high-intent renters, and dominate search rankings — driving more qualified leads at lower cost.

Realtors Are Using AI to Fake Home Photos — And It’s Getting Tricky – link

AI-generated listing photos are blurring the line between marketing and manipulation — raising new questions about disclosure and buyer trust.

AI Tool Promises Near-Perfect Accuracy in Student Housing Communications – link

A new AI platform is helping student housing operators answer tenant queries with almost 100% accuracy — slashing response times and boosting satisfaction.

A word from our sponsor

Stay Ahead of the Market

Markets move fast. Reading this makes you faster.

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or serious investor, it’s everything you need to know before making your next move. Join 160k+ other investors who get their market news the smart and simple way.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

This next big tech shift could reshape prime real estate markets

(This content is restricted to Pro Members only. Upgrade)

2025 U.S. Life Science Market Conditions & Trends

(This content is restricted to Pro Members only. Upgrade)

Why investors are quietly piling into these overlooked housing markets

(This content is restricted to Pro Members only. Upgrade)

More traction building for commercial real estate financing

(This content is restricted to Pro Members only. Upgrade)

Top 10 States Where Inventory is Piling Up the Most

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

The 50 U.S. Colleges That Best Pay Off for Your Career link

LinkedIn’s first Top Colleges list ranks 50 schools using alumni job placement, internships, career advancement, network strength, and skill diversity — with Princeton, Duke, and UPenn taking the top three spots.

Private universities dominate the rankings, with only a small share of public schools like UC Berkeley, University of Virginia, and Purdue making the cut.

Tuition varies widely — from Purdue’s $9,992 in-state rate to private schools exceeding $70,000 — raising questions about ROI despite high career outcome scores.

Unreal Real Estate

An affordable private island!?

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply