- Zero Flux

- Posts

- Manhattan office leasing set for biggest year since 2019

Manhattan office leasing set for biggest year since 2019

Mapped: U.S. States Adding the Most Billionaires (2015–2025) and 12 other real estate insights

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.29% | +0.01% | -0.24% | 6.11 / 7.26 |

15 Yr. Fixed | 5.69% | +0.04% | -0.19% | 5.54 / 6.59 |

30 Yr. FHA | 5.98% | +0.04% | -0.11% | 5.65 / 6.62 |

30 Yr. Jumbo | 6.25% | +0.00% | -0.22% | 6.25 / 7.45 |

7/6 SOFR ARM | 5.68% | +0.06% | -0.23% | 5.59 / 7.25 |

30 Yr. VA | 6.00% | +0.05% | -0.10% | 5.66 / 6.64 |

New here? Join the newsletter (it's free).

Macro Trends

Job Market Cracks Push Fed Toward September Rate Cut link

August payrolls rose just 22,000 vs. expectations of 75,000, with unemployment climbing to 4.3%—the highest in this cycle. Revisions show average job growth of only 29,000 over the past three months.

Job openings fell to 7.18 million in July, the lowest in 10 months, pulling the openings-to-unemployed ratio down to 1:1 from a 2:1 peak in 2022. That shift signals weaker hiring power and less inflation pressure from labor.

Traders are now pricing in a September Fed rate cut, with odds rising for a third cut this year. The 10-year Treasury yield has already dropped nearly 20 basis points since Labor Day.

Real Estate Trends

Apartment rents slip-South & West markets hit hardest link

U.S. apartment occupancy dipped to 95.4% in August, down 10 bps from July, with effective asking rents falling 0.2% year-over-year—the first annual rent cut since March 2021.

The South has not seen annual rent growth since mid-2023, and heavy supply in cities like Austin, Dallas, Phoenix, Denver, and Charlotte is pushing rents lower.

Tech-driven and coastal markets like San Francisco, San Jose, New York, and Chicago bucked the trend, posting annual rent growth between 3% and 7%.

Retail net lease sales hit $3B-but cap rates keep climbing link

Sales volume reached $3.05 billion in Q1 2025, showing stability even as year-over-year activity dipped in a tight capital markets environment. Demand stayed strongest for well-located properties with creditworthy tenants.

Cap rates averaged 6.96% in Q1, up 58 basis points from a year ago and marking nine straight quarters of increases since the 2022 low of 5.60%. The rapid 136-basis-point swing has forced investors to reassess pricing and strategies.

Private buyers led acquisitions at 47% of market share, while institutional investors held 20%. Notably, international capital rebounded sharply, climbing to 15% of Q1 2025 deals from just 1% in all of 2024.

Zillow Home Value and Home Sales Forecast link

Home values are expected to end 2025 down 0.9%, with weakness concentrated in the West and South as listings rise faster than sales. Inventory of existing homes is forecast to reach 4.09 million, up 0.6% from 2024.

Zillow cites weak consumer finances and a slowing labor market as the main drag on demand, leaving a glut of homes on the market. This imbalance is keeping sellers under pressure despite fewer new listings in July.

Rent growth is projected to hit record lows—single-family rents up just 2.5% in 2025 (vs. 4.5% in 2024) and multifamily up 1% (vs. 2.4% in 2024)—the weakest annual increases since Zillow began tracking in 2018.

$13T in Homes at Climate Risk-Miami, New Orleans, Cape Coral Facing Crushing Insurance Costs link

About 26.1% of U.S. homes—worth $12.7 trillion—are exposed to severe climate risks like hurricanes, floods, or wildfires, raising long-term threats to values and insurance access.

Miami leads the nation with a 3.7% insurance cost-to-home value ratio, forcing a median homeowner to pay $22,718 annually on a $614,000 home—six times the national average burden.

New Orleans and Cape Coral aren’t far behind, with homeowners spending 3.6% and 2.2% of property values on insurance, showing how climate risk can hit lower-value homes disproportionately harder.

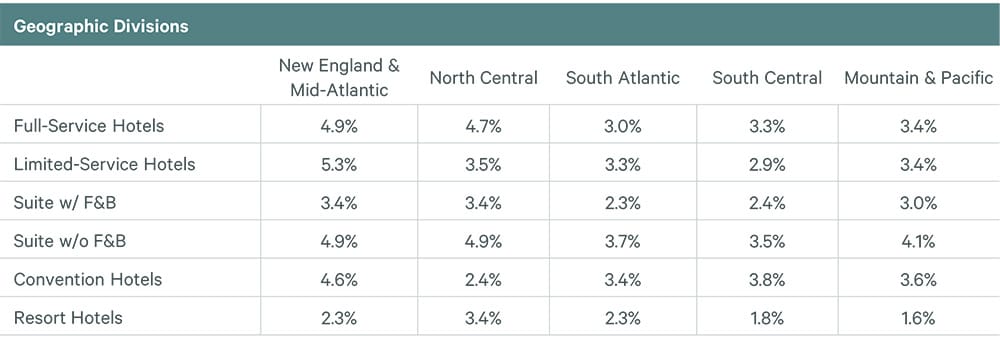

Hotel property taxes can double by location-New England hotels hit hardest link

2024 Property Tax Burden as a Percent of Total Operating Revenue

Full-service hotels in New England & the Mid-Atlantic face the steepest property tax burden at $4,666 per available room, nearly double the South Atlantic average of $2,486. In some cases, these taxes eat up over 4% of total revenue.

Hotel type drives costs too: a full-service hotel in the South Central region pays $2,294 per room in taxes, more than twice the $1,071 for a limited-service hotel in the same region. More amenities almost always mean higher tax exposure.

A South Atlantic hotel owner won a 4.5% tax reduction after appealing based on overlooked expense exclusions like CAM charges—showing how detailed reviews can directly improve NOI and asset value.

Location Specific

Manhattan office leasing set for biggest year since 2019 link

Office leasing in Manhattan jumped 20% in August to 3.7 million square feet, well above the 10-year monthly average of 2.72 million. If this pace holds, 2025 will surpass 40 million square feet leased—the first time since 2019.

Tech and law firms are fueling demand, with Amazon alone signing over 1 million square feet of space since late 2024. High-end new buildings like One Vanderbilt and Hudson Yards now have availability rates as low as 6.7%, compared with 17% in older prewar stock.

Nearly 9 million square feet of offices have been removed for conversions in the past four years. Each million converted triggers about 270,000 square feet of tenant relocations, tightening supply and nudging average rents up to $74.73 per square foot, still 6% below pre-pandemic.

AI & Real Estate - Today’s Trends

Tool of the day - Kaya AI

An AI-powered construction supply chain intelligence platform that interconnects all stakeholders, providing real-time insights and predictive analytics to enhance efficiency, transparency, and sustainability in project delivery.

Restb.ai Rolls Out Compliance AI to Help MLSs Adapt to NAR Settlement – link

The new tool auto-checks MLS listings for rule violations, helping agents stay compliant as commission practices shift under the NAR deal.

How AI Is Changing Property Decisions in Cambridge – link

From smarter valuations to predictive tenant trends, AI is giving Cambridge investors sharper tools to guide acquisitions and property strategies.

BGO Taps AI to Shape Industrial Investment Strategy – link

The global real estate investor is using AI models to forecast industrial demand, optimize portfolios, and get ahead of market shifts.

Blue Sage Unveils AI Sales Agent to Reinvent Mortgage Loan Officer Role – link

The platform’s new AI-powered assistant handles borrower engagement, loan matching, and follow-up — automating key parts of the mortgage sales process.

A word from our sponsor

How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

The Hidden AI Hotspots Turning Into Investor Paydays

(This content is restricted to Pro Members only. Upgrade)

The new truth about townhomes-why the old playbook isn’t working

(This content is restricted to Pro Members only. Upgrade)

CRE’s Hidden Blind Spot That’s Costing Millions

(This content is restricted to Pro Members only. Upgrade)

America’s Quiet Suburb Boom: These 20 Spots Are Outpacing Cities

(This content is restricted to Pro Members only. Upgrade)

The quiet shift in healthcare real estate no one’s talking about

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

Mapped: U.S. States Adding the Most Billionaires (2015–2025)

Unreal Real Estate

The cheapest house in America!

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply