- Zero Flux

- Posts

- Metros with the most housing wealth

Metros with the most housing wealth

Population Projections: The World’s Top Countries by 2100 and 12 other real estate insights

Share Zero Flux with a friend using your unique link and unlock 3 months of premium free:

https://www.zeroflux.io/subscribe?ref=PLACEHOLDER

And if you get 25 signups overtime with this link, premium is yours for life 🎉

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.78% | +0.01% | -0.05% | 6.11 / 7.26 |

15 Yr. Fixed | 6.04% | +0.01% | -0.04% | 5.54 / 6.59 |

30 Yr. FHA | 6.36% | +0.01% | -0.05% | 5.65 / 6.62 |

30 Yr. Jumbo | 6.90% | +0.00% | -0.03% | 6.37 / 7.45 |

7/6 SOFR ARM | 6.25% | +0.00% | -0.07% | 5.95 / 7.25 |

30 Yr. VA | 6.38% | +0.02% | -0.04% | 5.66 / 6.64 |

New here? Join the newsletter (it's free).

Macro Trends

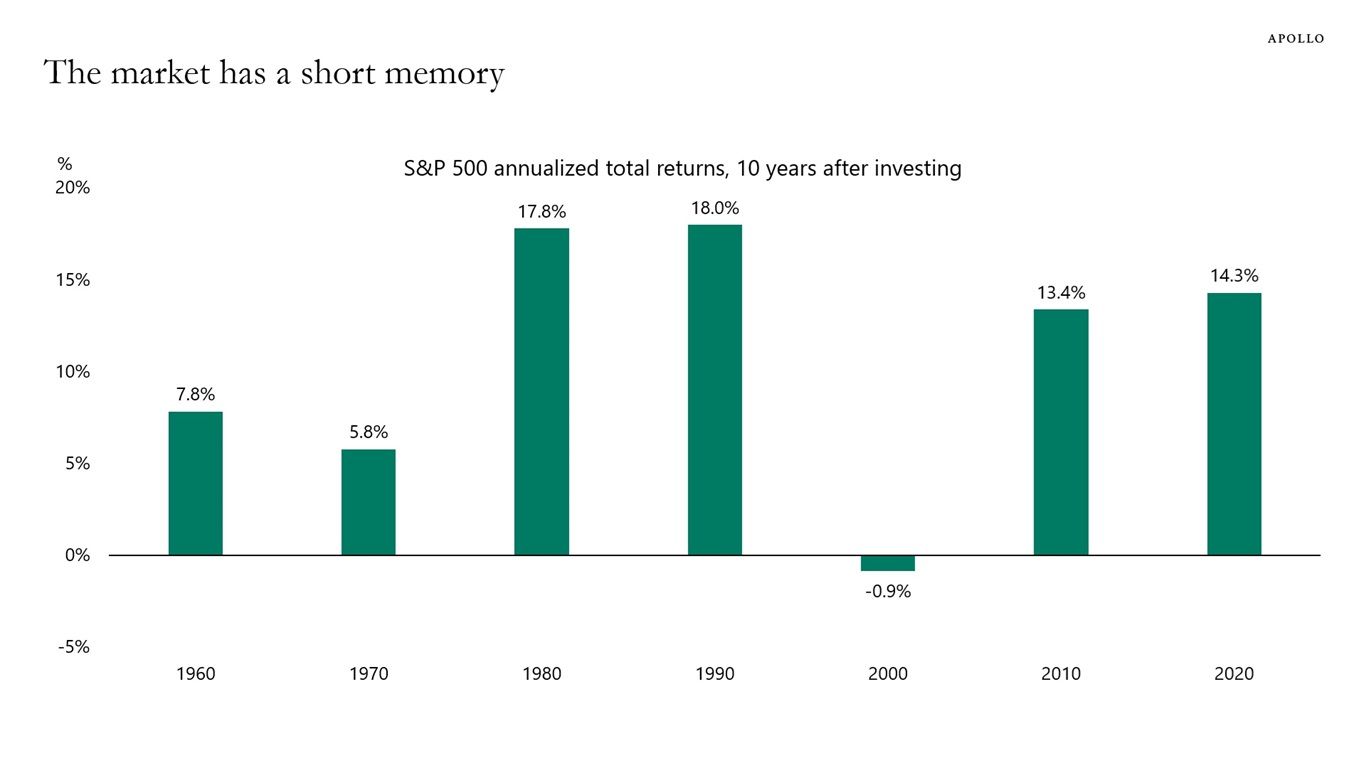

Markets Are Forgetting the Past—Are We Headed Back to the 1970s? link

Many investors assume today’s high yields are abnormal, but bond yields were far higher during previous inflationary decades like the 1970s. If we’re re-entering a similar era, today’s yields may actually be the new normal—not high.

The S&P 500 continues to hit all-time highs, and investors are treating that as a buy signal, ignoring structural risks like ballooning U.S. fiscal deficits and rising inflation pressure.

The market tends to overweight recent trends, largely because many current traders haven’t experienced past economic regimes—creating blind spots in long-term decision-making.

Real Estate Trends

Office Demand Collapses Again link

In April, 17 of the 19 largest U.S. office markets saw a drop in tenant demand, with new office tours down 23% and square footage sought falling 26% compared to March. The pattern closely mirrors the post-SVB banking crisis slump from 2023.

This year marks the first time since at least 2018 that more U.S. office space is being removed than added, according to CBRE. Developers are pulling back due to uncertainty, signaling longer-term supply shrinkage.

A JLL report shows office leasing demand dropped 2% in Q2—breaking a six-quarter growth streak. Tariff concerns, geopolitical tension, and unclear fiscal policy are driving investor and tenant hesitation.

Single-Family Construction Slumps as Unsold Homes Pile Up link

Single-family housing starts fell 10% year-over-year in June 2025, with every U.S. region reporting a decline except the Midwest, where affordability is stronger and seller leverage still exists.

Builders are pulling back amid rising inventory and a slow buying season—May saw the largest drop in new home sales since June 2022, pushing unsold new homes higher and dampening builder confidence.

Despite the building slowdown, the U.S. still faces a 4.7 million home shortfall; the supply crunch is far from over, and this pause in construction could worsen long-term affordability.

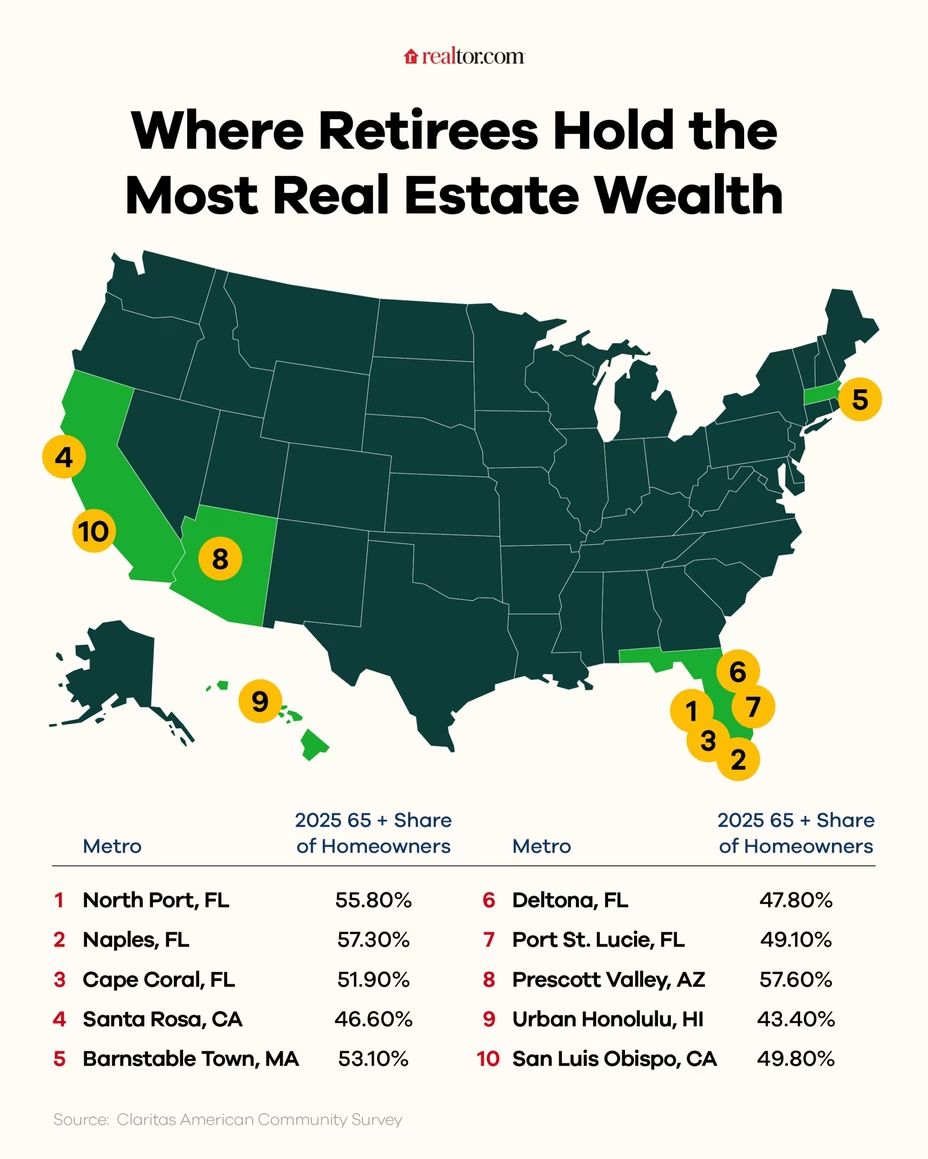

Boomers Are Sitting on Nearly $19 Trillion in Real Estate—Here’s Where They Hold the Most Housing Wealth link

In five Florida metros alone, boomers aged 65+ control over $350 billion in real estate value—North Port-Bradenton leads with $97 billion and a 56% boomer homeownership rate. Naples-Marco Island ranks second, with a median home price of $749,000 and 57% of homes owned by retirees.

The Villages in Florida stands out with 78% of homeowners over 65—the highest in the country—and a median home price of just $369,900, making it a high-concentration, lower-cost retiree stronghold.

Boomers now hold up to $19 trillion of the $34.5 trillion in U.S. home equity, and with 12,000 people turning 65 daily through 2027, this generational grip on housing wealth isn’t loosening anytime soon.

Something I found Interesting

Island Homes Surge in Value—Some Top $4M link

Prices on popular U.S. islands far exceed the national median, with Nantucket topping the list at a staggering $4.8M median and seven other islands hovering around or above $1.4M. Limited land and demand from wealthy buyers drive this price pressure.

The Golden Isles in Georgia offer a more affordable entry point, with a median list price of $474,950—less than half of most others on the list. Investors looking for appreciation potential may find value in overlooked, lower-priced markets.

Inventory is tight across most islands, but especially in the Florida Keys, where constrained land supply keeps prices resilient even during broader housing downturns. The region saw a pandemic-era surge but is now showing signs of a healthy correction.

AI & Real Estate - Today’s Trends

Tool of the Day – Ergeon

Tech-enabled marketplace for outdoor residential construction services (e.g. fencing, landscaping etc.)

Crexi Co-Founder Launches AI Startup to Tackle $3T CRE Debt Wall link

A new AI venture is arming brokers and lenders with real-time debt intelligence to navigate the $3 trillion wave of maturing commercial real estate loans.

AI Is Quietly Reprogramming the Office Real Estate Market link

From layout design to energy use and tenant analytics, AI is helping landlords rethink underused office space and drive higher ROI per square foot.

Tidalwave Snags Top Talent to Disrupt the Mortgage Game with AI link

AI mortgage startup Tidalwave just hired execs from ICE and nCino, signaling a serious push to automate underwriting and shake up how loans get approved.

Morgan Stanley: AI Is Becoming a Core Driver of Real Estate Alpha link

Institutional investors are turning to AI for everything from site selection to rent forecasting — reshaping how real estate value is created and captured.

A word from our sponsor

AI founders: Got a game-changing startup?

Building the future of AI? Here's your shot at $50K to make it happen.

The Next Big AIdea pitch competition is live. If you've got an AI startup that's changing how businesses grow, we want to see it.

Record a 60-second pitch and you could win $50,000 cash, $25K in AWS credits, 600K Clay credits + Pro Plan, and exposure to millions through HubSpot Media's network.

Five finalists get flown to San Francisco to pitch live at INBOUND 2025 in front of 1,000+ industry leaders.

Your AI idea deserves more than just another LinkedIn post.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

Industrial CRE showing cracks lately

(This content is restricted to Pro Members only. Upgrade)

Facility Management disruptions are coming—here’s how top teams are preparing

(This content is restricted to Pro Members only. Upgrade)

Outpatient care is booming—here’s what CRE investors need to know

(This content is restricted to Pro Members only. Upgrade)

The Magic Mortgage Rate Number That Will Push Americans To Buy

(This content is restricted to Pro Members only. Upgrade)

Big Money Moves In as Net Lease Market Finds Its Footing

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

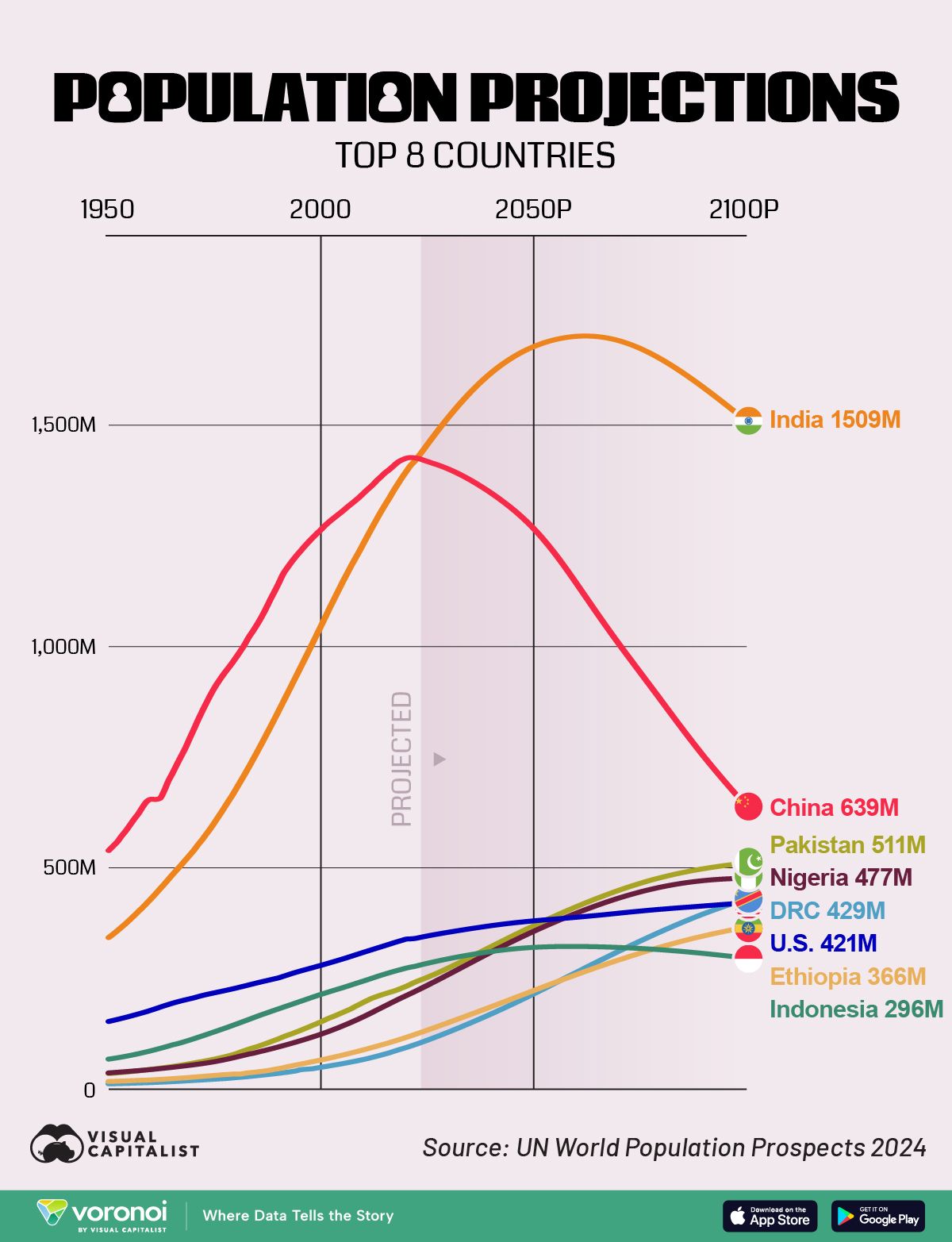

Population Projections: The World’s Top Countries by 2100

Unreal Real Estate

Alligator Drive at Alligator Point on Alligator Bay

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply