- Zero Flux

- Posts

- Multifamily building boom hits 40-year high

Multifamily building boom hits 40-year high

Ranked: The World’s Fastest Growing Wealth Hubs and 12 other real estate insights

Share Zero Flux with a friend using your unique link and unlock 3 months of premium free:

https://www.zeroflux.io/subscribe?ref=PLACEHOLDER

And if you get 25 signups overtime with this link, premium is yours for life 🎉

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.82% | -0.01% | +0.03% | 6.11 / 7.26 |

15 Yr. Fixed | 6.07% | -0.01% | +0.08% | 5.54 / 6.59 |

30 Yr. FHA | 6.40% | -0.01% | +0.10% | 5.65 / 6.62 |

30 Yr. Jumbo | 6.92% | -0.01% | +0.05% | 6.37 / 7.45 |

7/6 SOFR ARM | 6.31% | -0.01% | -0.02% | 5.95 / 7.25 |

30 Yr. VA | 6.42% | +0.00% | +0.11% | 5.66 / 6.64 |

New here? Join the newsletter (it's free).

Macro Trends

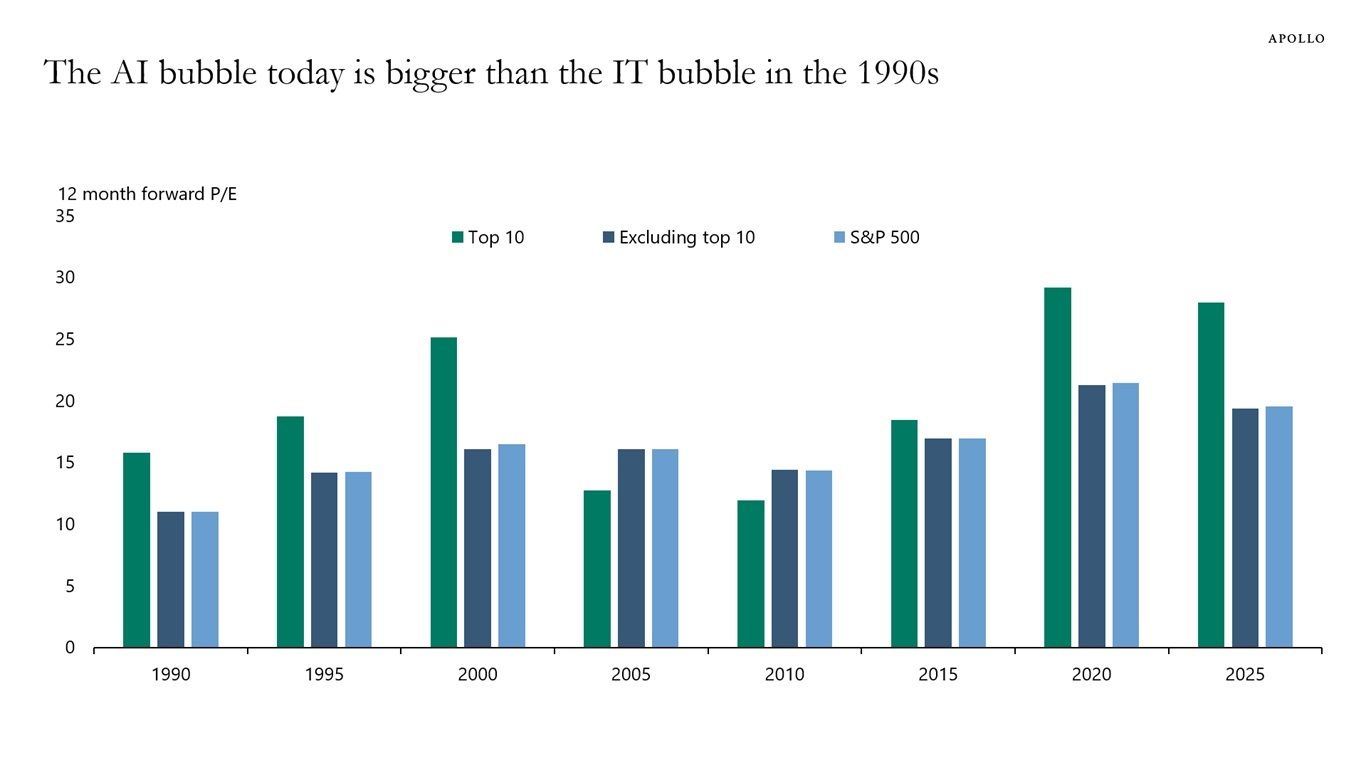

AI Bubble Today Is Bigger Than the IT Bubble in the 1990s link

The top 10 companies in the S&P 500 today are more overvalued than they were during the peak of the 1990s IT bubble, according to July 2025 data from Apollo. That signals potentially higher downside risk if the AI hype deflates.

The AI rally is being driven by a narrower group of companies, concentrating risk at the top of the market. This kind of crowding could trigger sharper corrections in tech-heavy portfolios.

Unlike the 1990s, these valuations come after years of already-strong tech performance—meaning the runway for further gains may be shorter than many expect.

Real Estate Trends

Multifamily building boom hits 40-year high link

The U.S. completed 608,000 multifamily units in 2024, the highest level since the 1980s. Nearly half (330,000) were in high-density buildings with 50+ units, showing a major shift in development focus.

Southern states accounted for 48% of all multifamily completions, rising from 212,000 units in 2023 to 292,000 in 2024. They were the only region where low-density buildings slightly outnumbered high-density ones.

Built-for-rent units made up 95% of multifamily construction, and 55% of those were in high-density buildings—more than double the share from 2004. High-density builds also dominated the for-sale segment, hitting 40% of that market.

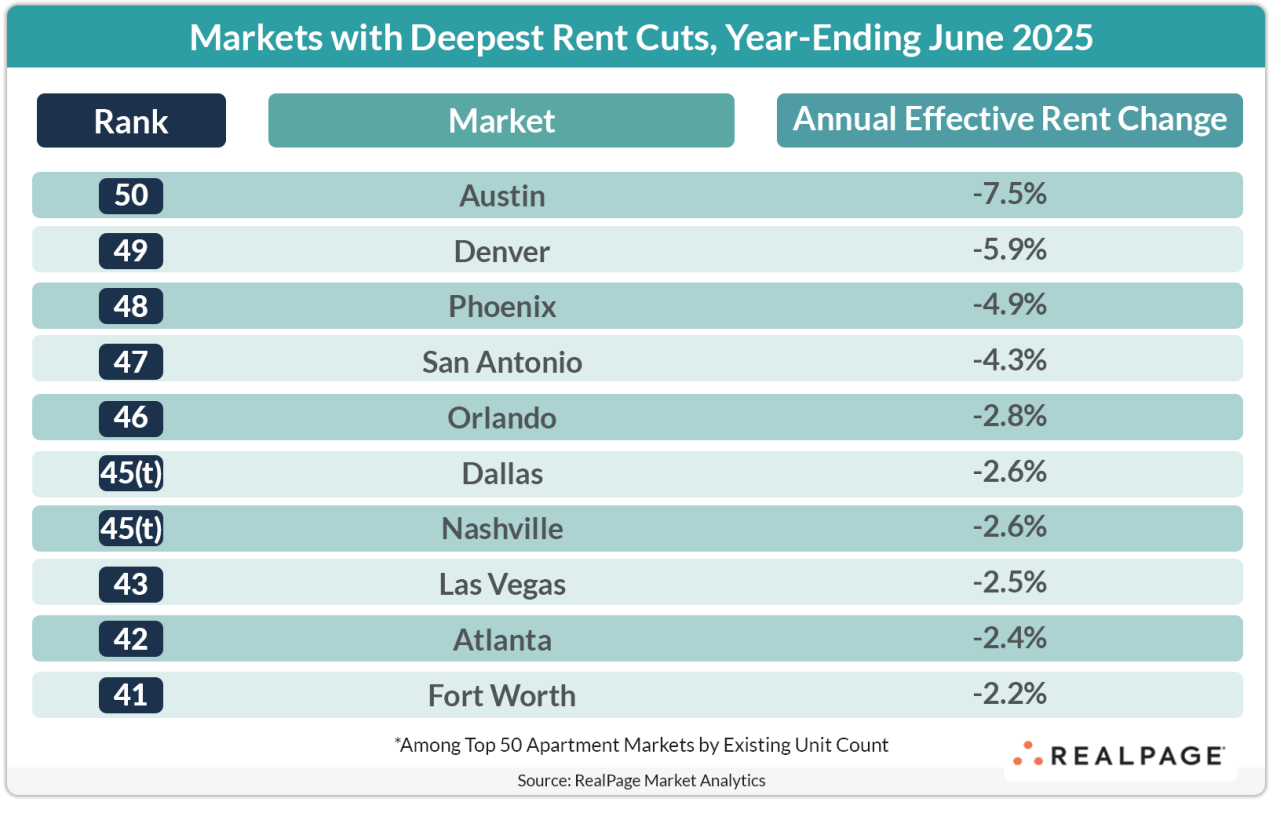

Rent Surge, Stalled Prices: Why the Apartment Market Isn’t Acting Normal link

Over 227,000 apartment units were absorbed in Q2 2025, surpassing 2021–2022 peak levels and showing stronger demand than expected despite economic uncertainty. Occupancy hit 95.6% in June, up 140 basis points YoY.

Rent growth remains weak even with high demand—national rents rose just 0.19% in June. Operators are prioritizing occupancy over price increases, which could lead to more concessions and slower revenue growth.

Construction is finally slowing: 108,000 units were delivered in Q2, below recent highs. Since 2018, 500,000 units have been delayed, straining future supply even further.

What Will the Big Beautiful Bill Mean for Commercial Real Estate and Housing? link

The bill permanently reinstates 100% bonus depreciation and raises Section 179 expensing limits to $2.5M, letting landlords and manufacturers deduct property upgrades and equipment costs upfront—sharply improving cash flow. Cost segregation providers are expected to be overwhelmed as investors rush to take advantage.

The Low-Income Housing Tax Credit (LIHTC) saw its biggest expansion in 25 years, with a 12.5% increase in 9% credit allocations and a reduced bond threshold to 25% for 4% deals—potentially unlocking tens of thousands of new affordable housing units. But the loss of federal block grants and administrative staff could slow actual development.

Wind, solar, and EV tax credits are being phased out, cutting residential solar by end of 2025 and capping utility-scale projects by 2027. This reverses a key driver of industrial CRE growth, with emissions projected to drop only 3% by 2030 vs the original 40% target.

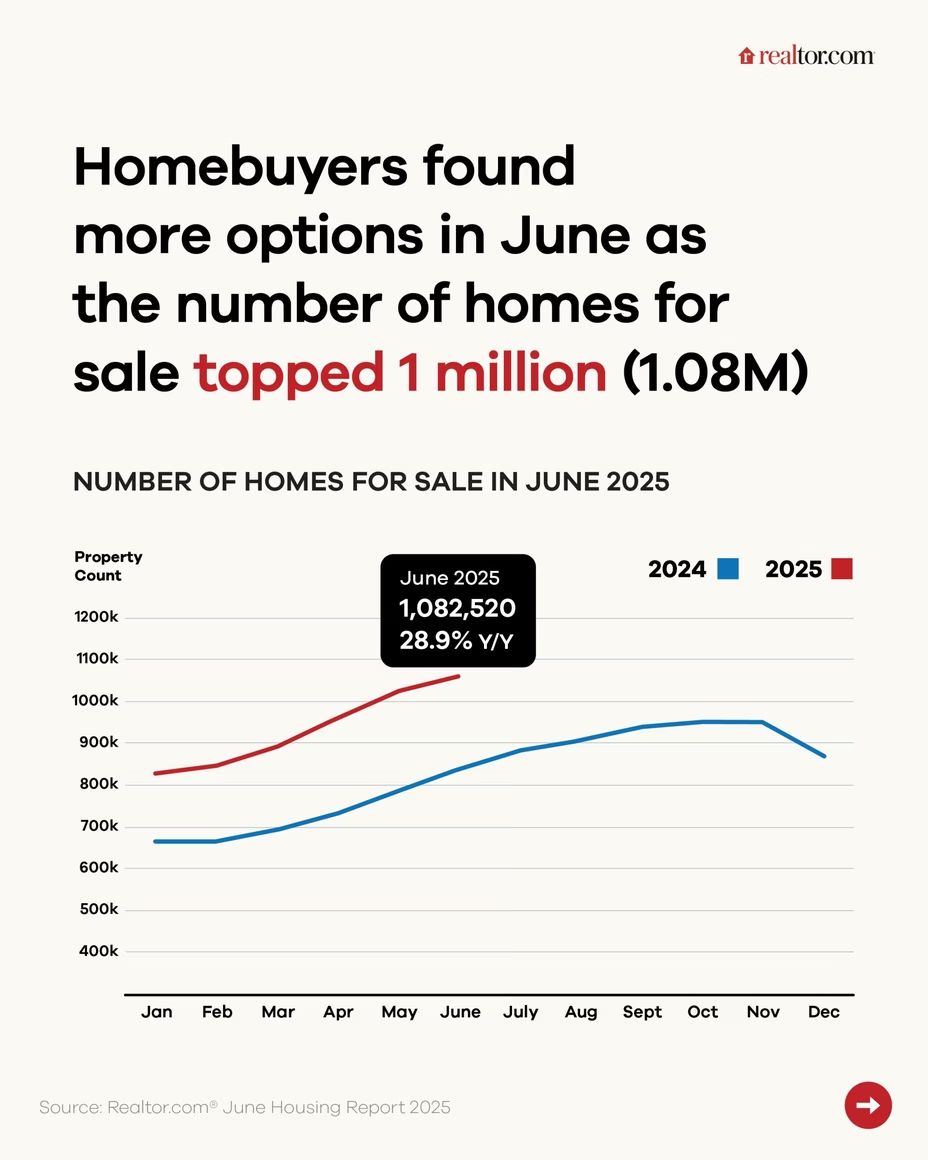

Prices Drop Fast in These 3 Cities—But Buyers Are Pouncing link

Cincinnati saw a 6.3% year-over-year median list price drop—the biggest in the U.S.—but homes are still selling in just one day, driven by demand for smaller, more affordable homes. Active listings are up nearly 29%, yet sellers are cutting prices less than the national average.

Sacramento's active listings surged 47.5% year over year, and 5.9% of homes had price cuts—signaling motivated sellers and a slowdown in new listings. Despite high prices (median $632K), homes still go under contract in about a week.

Miami's listings jumped 35%, and homes are sitting on the market longer—median of 15 days—due to high prices ($510K), rising insurance premiums, and HOA fees. Yet only 19% of listings have price cuts, showing sellers remain stubborn even as buyers hesitate.

Something I found Interesting

Affordable Housing That Actually Works—10 Smart Projects Solving the Crisis link

Argyle Gardens in Portland cut construction costs by 31% using modular design and cohousing, offering formerly homeless residents rent as low as $300/month. It proves that low-cost housing can be both dignified and sustainable.

Sendero Verde in NYC, now the world’s largest Passive House–certified residential building, delivers 709 affordable units plus schools, retail, and services—all while slashing energy use through triple-glazed windows and solar panels.

In Detroit, a 1920s Studebaker service building was transformed into 161 units of workforce housing using $12M in public funding and historic tax credits. Most units are reserved for tenants earning less than 80% of area median income.

AI in Real Estate

Arizona real estate’s secret weapon? AI that spots buyers before they click link

In Scottsdale, brokers use AI to tailor listings with near-instant precision—offering homes based on features like wine fridges and walkability before buyers even ask, speeding up closings significantly.

Mesa developers rely on predictive analytics and drone-mapped geographic data to decide where to build next, even gauging future school traffic and solar potential to stay ahead of zoning decisions.

Arizona brokerages are using AI not just to move faster, but to build trust—auto-generating compliance-ready documents and flagging title issues before they become legal problems.

From Bricks to Brains: How AI is Redefining Real Estate Value Creation link

AECOM's AI tools now slash proposal writing time by up to 80% and reduce early-stage design work by as much as 65%, signaling big productivity gains for firms that adopt automation. These efficiency boosts are already reshaping staffing and project timelines.

Property valuation at Nan Fung Group using a ChatGPT model came within 5–10% of traditional methods, while cutting underwriting research from weeks to hours. AI-driven underwriting could dramatically reduce time-to-decision for acquisitions and deals.

Auki Labs is using AI glasses and drones to handle retail shelf tracking and building inspections, cutting inspection times from weeks to hours in dense cities like Hong Kong. This tech is lowering costs and risk for property managers and investors.

One Real Estate AI tool

Telescope is a real estate data and analytics platform that helps investors identify high-potential markets and properties using advanced AI, predictive modeling, and real-time market insights. It simplifies deal sourcing, underwriting, and investment decision-making.

One Chart

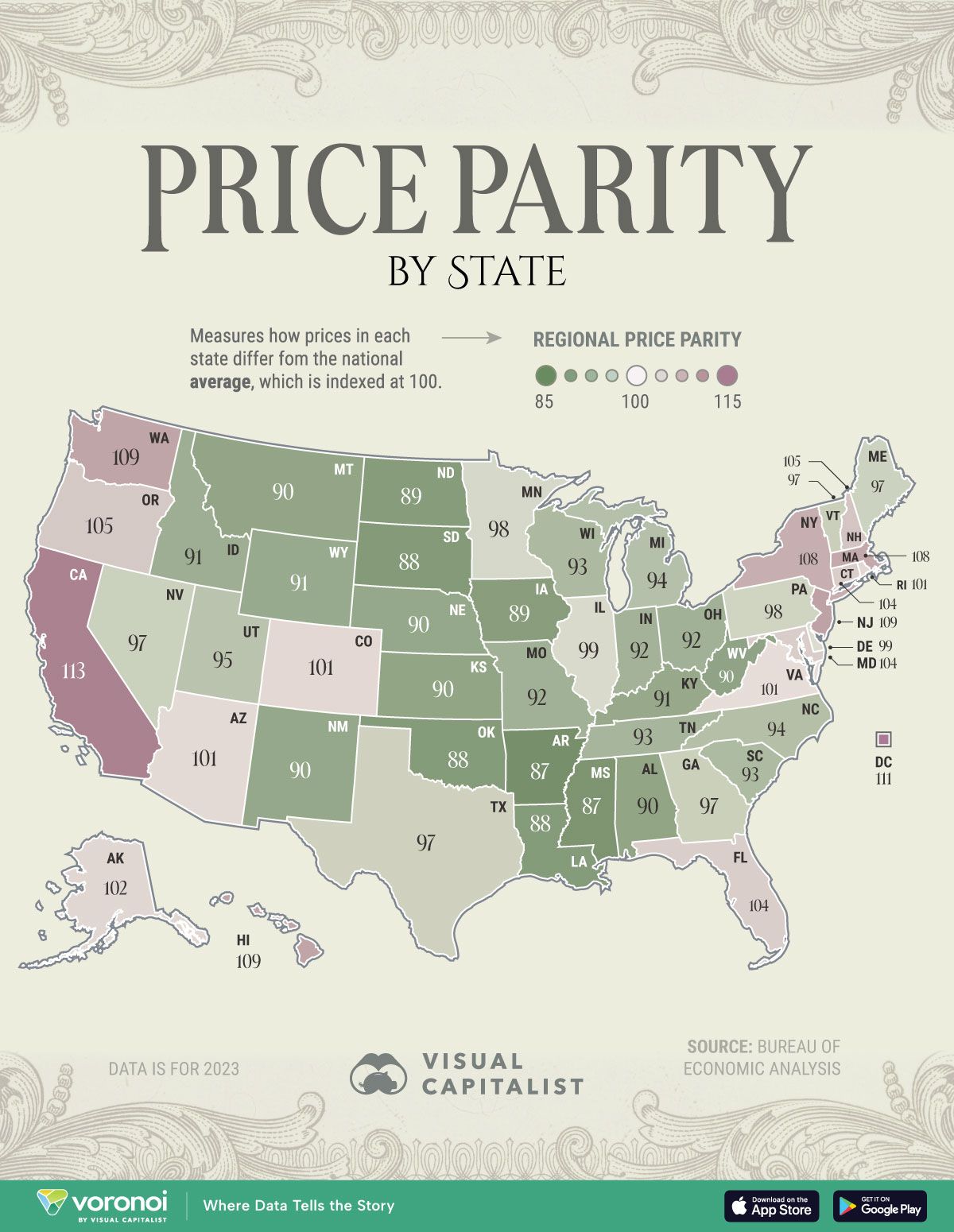

The Most and Least Expensive U.S. States link

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

Retail Real Estate Hits a Wall—What's Behind the Sudden Shift?

(This content is restricted to Pro Members only. Upgrade)

State of the Nation’s Housing Report: Harvard

(This content is restricted to Pro Members only. Upgrade)

2025 U.S. Industrial Investment Outlook Midyear

(This content is restricted to Pro Members only. Upgrade)

CRE market looks calm—but hidden risks are piling up

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

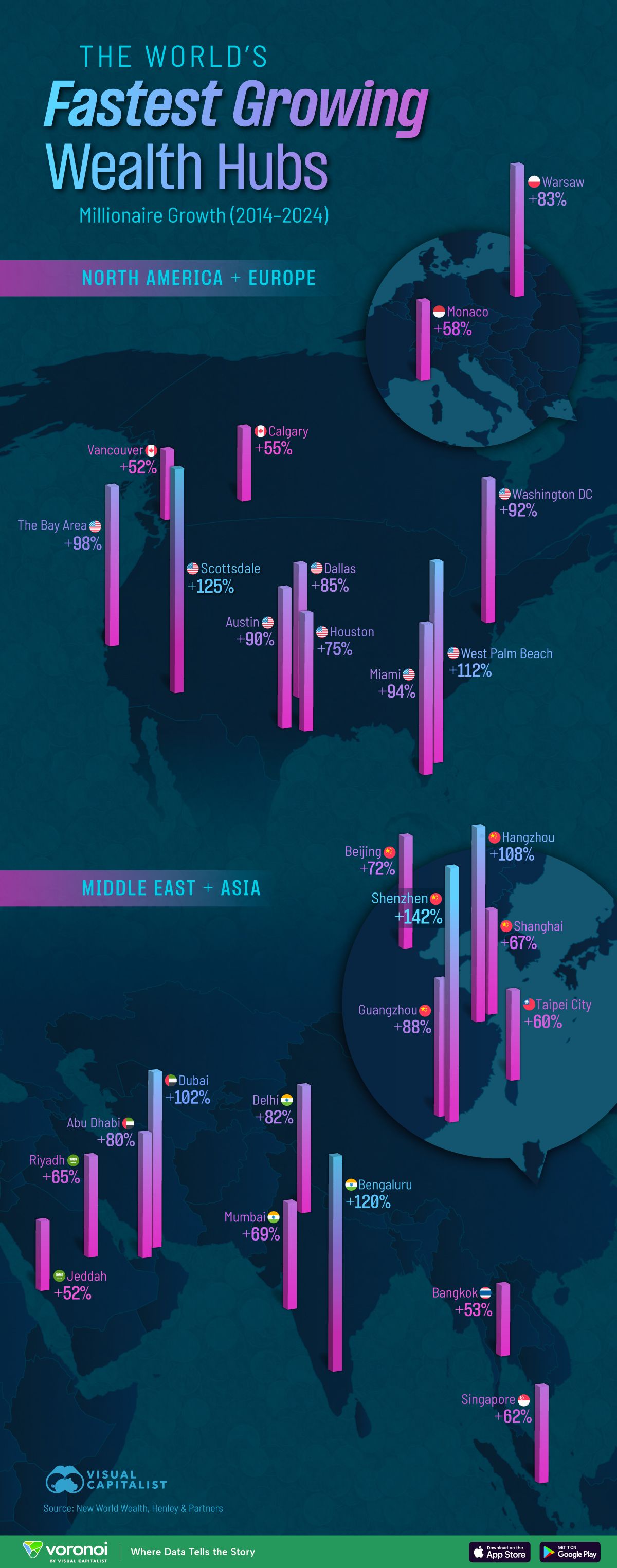

Ranked: The World’s Fastest Growing Wealth Hubs

Unreal Real Estate

Live above the beach… literally.

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply