- Zero Flux

- Posts

- New Homes Beat Resales

New Homes Beat Resales

Ranked: U.S. Job Cuts by Industry in 2025, The Rock House and more!

Share Zero Flux with a friend using your unique link and unlock 3 months of premium free:

https://www.zeroflux.io/subscribe?ref=PLACEHOLDER

And if you get 25 signups overtime with this link, premium is yours for life 🎉

A quick word from our sponsor

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.20% | -0.12% | -0.18% | 6.13 / 7.26 |

15 Yr. Fixed | 5.75% | -0.05% | -0.11% | 5.60 / 6.59 |

30 Yr. FHA | 5.82% | -0.09% | -0.18% | 5.82 / 6.59 |

30 Yr. Jumbo | 6.40% | -0.01% | -0.05% | 6.10 / 7.45 |

7/6 SOFR ARM | 5.70% | -0.18% | -0.34% | 5.59 / 7.25 |

30 Yr. VA | 5.85% | -0.08% | -0.15% | 5.85 / 6.60 |

⚡ Snapshot: The 7/6 SOFR ARM saw the steepest daily drop (-0.18%), and all major loan types moved lower, marking one of the broadest single-day rate declines in weeks.

New here? Join the newsletter (it's free).

Macro Trends

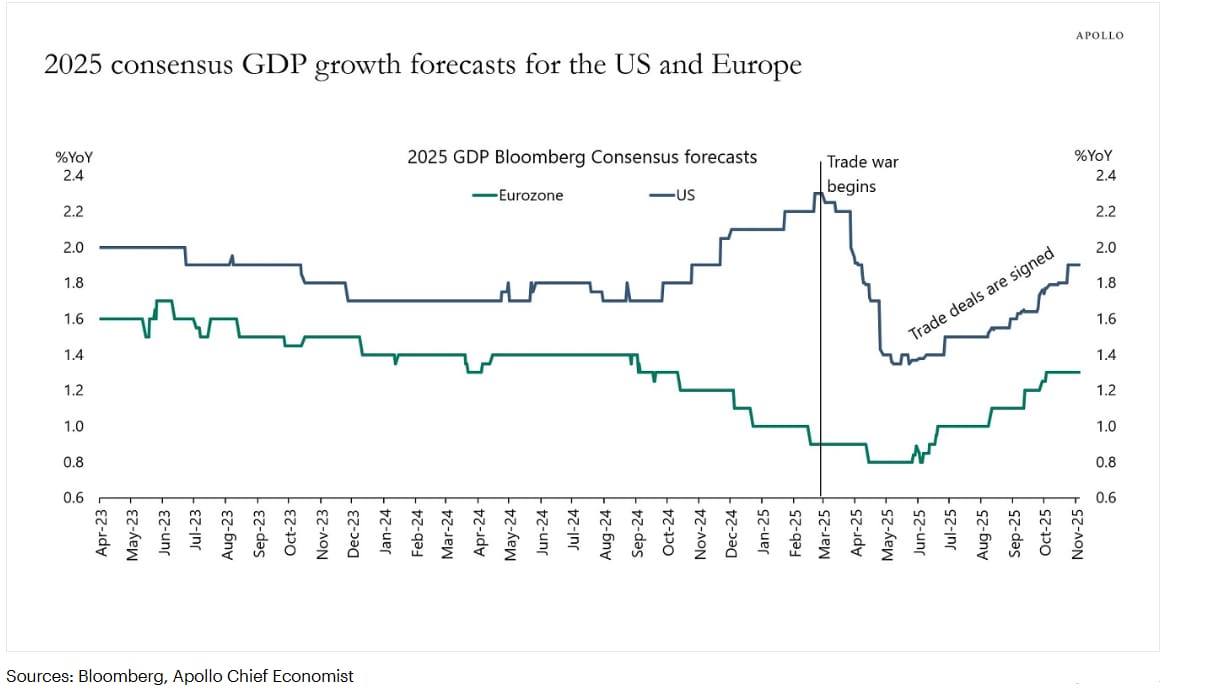

Markets raise 2025 GDP forecasts as trade deals unwind earlier damage link

US and Eurozone GDP forecasts jumped after summer trade deals, reversing sharp downgrades that followed the March trade war start. US 2025 growth expectations fell to almost 1.3 percent in May, then rebounded to about 1.9 percent by November.

Eurozone forecasts also turned higher, rising from a mid-2025 low near 0.8 percent to roughly 1.3 percent after trade tensions eased and confidence stabilized.

My take: If the uptrend in forecasts holds, 2026 could be the year capital markets reopen meaningfully, especially with the CBO projecting a full percentage point GDP boost from accelerated depreciation.

Real Estate Trends

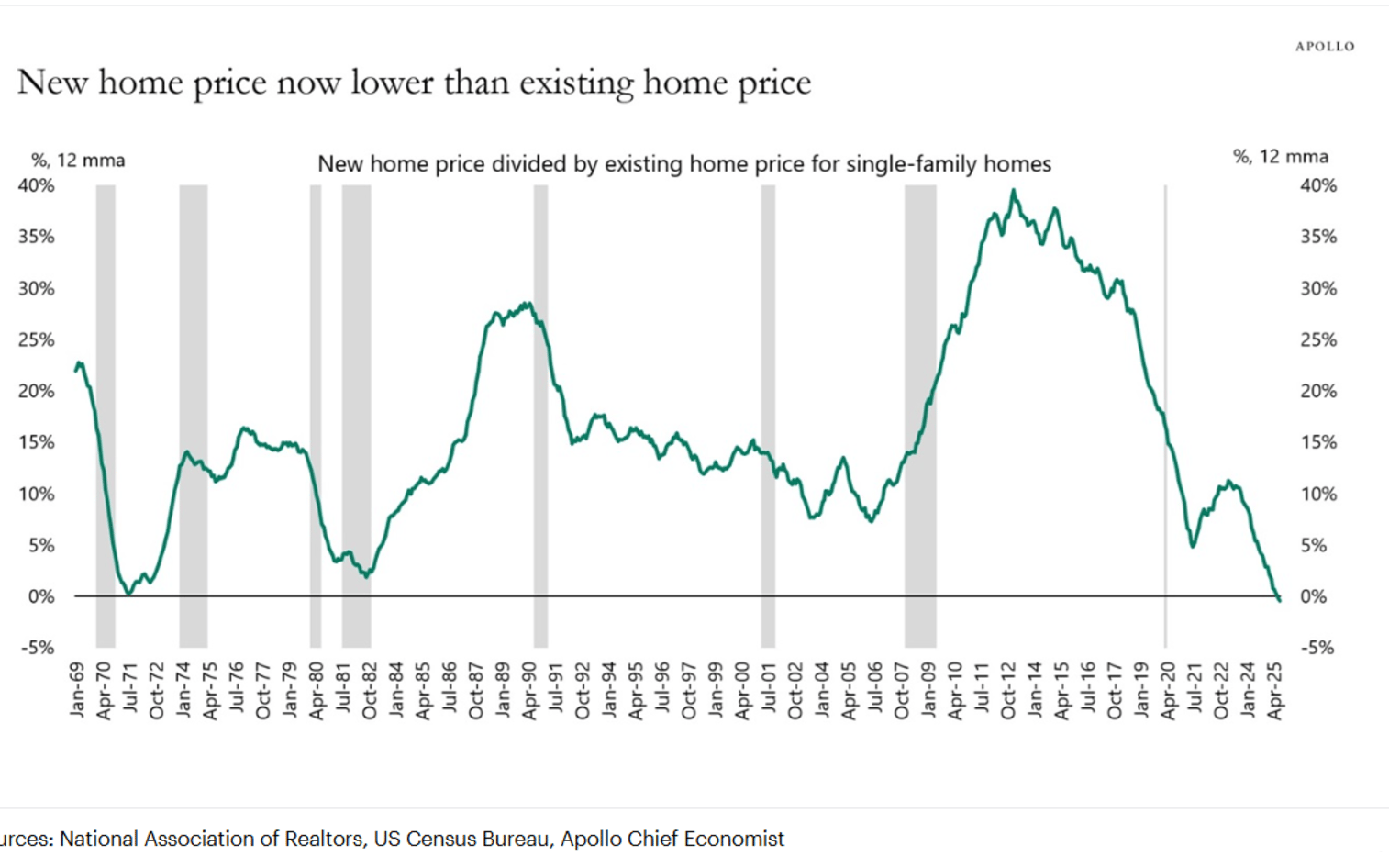

New homes now cheaper than existing homes for the first time in 50 years link

New construction prices have fallen below existing home prices, driven by builders shrinking square footage and offering incentives to offset today’s affordability squeeze. Smaller footprints and rate buydowns are doing the heavy lifting.

Existing home prices are holding firm because inventory is still historically tight. Owners with 3% mortgages are staying put, keeping supply low and propping up resale values.

My take: This is a rare moment where builders have more pricing flexibility than homeowners. For investors and brokers, expect continued deals and incentives on new builds while existing inventory remains sticky and expensive.

Midwest metros dominate growth in purchase mortgage originations link

ATTOM data shows purchase originations fell 6.6 percent YoY nationally, yet several metros posted sharp gains, led by South Bend at 51.7 percent and Indianapolis at 51.4 percent. Even large markets like Phoenix grew, adding nearly 2,000 more purchase loans YoY.

Indiana stands out with four metros in the top ten, signaling strong buyer demand despite higher rates. Honolulu and Buffalo also posted big jumps, suggesting pockets of resilience even as national purchase volume softens.

My take: These markets are outliers in an otherwise cooling purchase landscape. Investors should watch whether this demand reflects real economic strength or a temporary catch-up from last year’s slowdown.

Commercial, multifamily lending jumps 36 percent as investors rush back in link

MBA data shows originations up 36 percent YoY and 18 percent QoQ, driven by sharp rebounds in office, retail, and hotel lending. Office loans surged 181 percent YoY, retail doubled, and hotels climbed 66 percent as values stabilized and maturities forced refinancing.

GSEs, depositories, and CMBS all ramped activity, with GSE loan volume up 37 percent QoQ and banks up 36 percent. Life companies were the outlier, cutting lending by 22 percent QoQ and 4 percent YoY.

My take: Momentum like this usually signals that lenders believe the worst of the CRE price reset is behind us. For investors, stronger capital availability could compress cap rates in rebounding sectors faster than expected.

Medical office demand climbs as rents hit record highs link

MOB investment jumped 27 percent QoQ to $2.7 billion, with average prices at $298 per sq ft, a 51 percent premium over traditional office. Cap rates averaged 7.0 percent, down 6 bps QoQ but slightly above last year.

Record-high rents of $25.20 per sq ft and two straight quarters of positive absorption signal steady demand, with Dallas, Phoenix, and Philadelphia leading 2.4 million sq ft of space under construction.

My take: MOBs continue to act steady, with strong pricing power and stable demand even as traditional office struggles. Investors should watch construction pipelines in Dallas and Phoenix, where new supply could shape cap rates next year.

Location Specific

Texas multifamily pipeline finally cools, easing pressure on lease-ups link

New Texas apartment deliveries are set to drop to about 11,700 units per quarter in early 2026, roughly half the 23,000-plus quarterly pace seen in 2024 and 2025. Lease-up occupancy is running 100 to 120 bps below stabilized levels in major metros like Austin, San Antonio, Houston and Dallas due to the recent supply surge.

Smaller markets with limited new construction, including Lubbock, College Station and Midland, show lease-up occupancy essentially equal to stabilized assets, highlighting how uneven the supply pressure has been across the state.

AI & Real Estate

Tool of the day: Potion

AI that creates personalized agent-style video messages at scale to boost real-estate lead engagement and conversions.

Anarock Launches AI Platform to Boost Residential Sales link

Staff Writer reports that Anarock has launched Anarock.AI, a suite of generative and predictive AI tools that help developers engage leads and recover failed opportunities. The platform uses eight years of data to score top prospects and has already driven 700 sales across 80 projects.

AI Balloons Give Insurers Ultra-Detailed Home Imagery link

Realtor.com reports that Near Space Labs now captures 7-cm roof and yard imagery using AI balloons, giving insurers far more accurate risk data. The tech could help carriers keep writing policies in high-risk states, but privacy groups warn that there are no clear rules on notice or consent.

Tidalwave Raises $22M to Speed Up Mortgage Approvals with AI link

Fortune reports that Tidalwave raised $22 million to automate mortgage reviews using AI linked directly to Fannie Mae and Freddie Mac. The platform gives real-time, multilingual feedback to borrowers and aims to process over 200,000 loans a year. The company says faster reviews can cut costs for lenders and give buyers clearer, quicker decisions.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

These metros are winning the new battle for out-of-market tenants

(This content is restricted to Pro Members only. Upgrade)

Buyer’s market on paper, affordability crisis in reality?

(This content is restricted to Pro Members only. Upgrade)

Housing leaders flag two big pivots for 2026

(This content is restricted to Pro Members only. Upgrade)

Where California’s Quietest CRE Outperformers Are Emerging

(This content is restricted to Pro Members only. Upgrade)

Power risks ahead, what commercial owners are doing to protect NOI

(This content is restricted to Pro Members only. Upgrade)

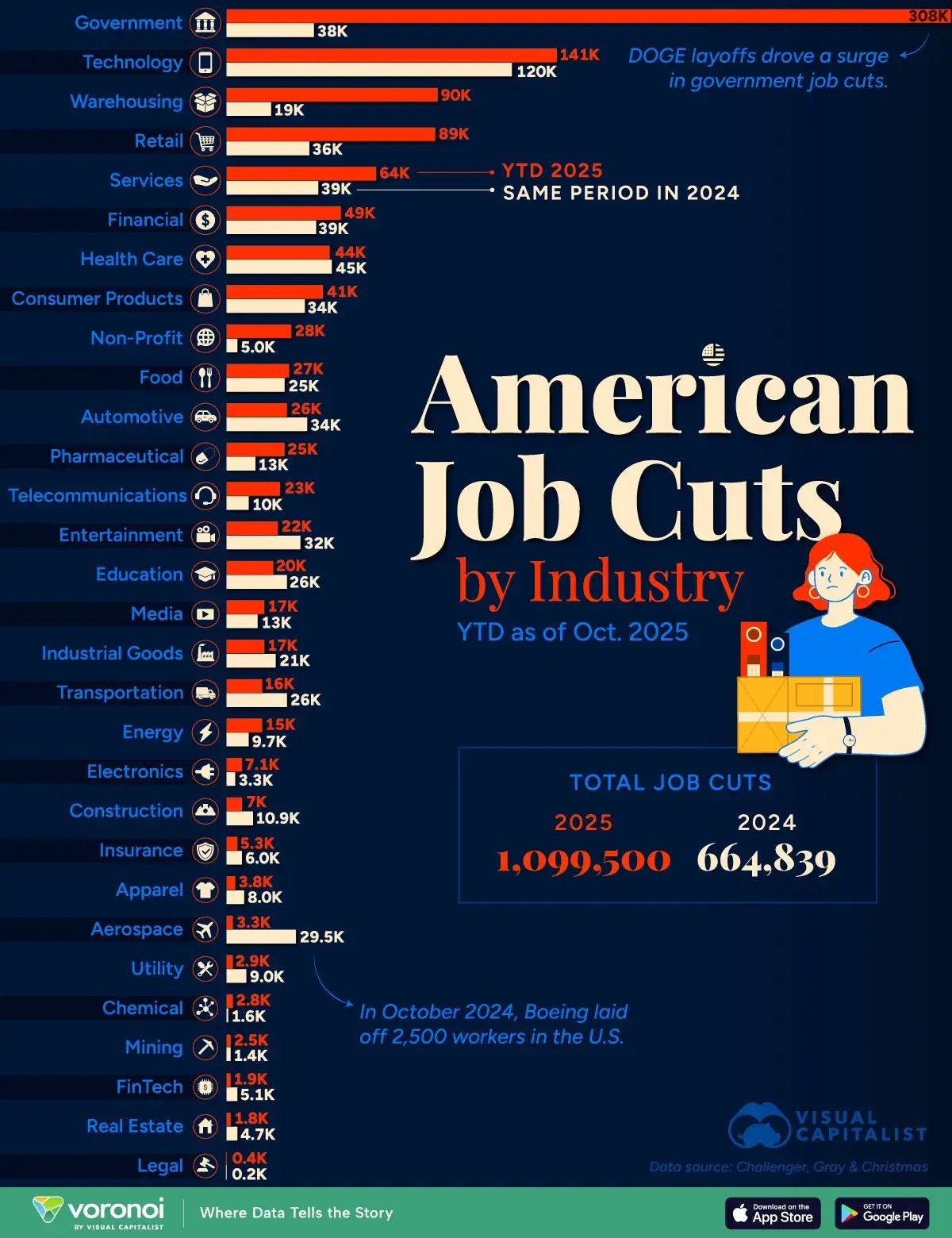

One Chart

Ranked: U.S. Job Cuts by Industry in 2025

Unreal Real Estate

The Rock House

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply