- Zero Flux

- Posts

- One in Five U.S. Mortgages Now Carry Rates Above 6%; A Ticking Time Bomb for Housing

One in Five U.S. Mortgages Now Carry Rates Above 6%; A Ticking Time Bomb for Housing

Mapped: The Value of a College Degree, by U.S. State, 240 acres in rural Vermont and more

Want the full Zero Flux experience?

For a limited time, you can upgrade to Premium at just $6.32/month and get deeper data drops, investor insights, and access to every tool we’ve built for serious operators.

A quick word from our sponsor

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.19% | +0.01% | -0.04% | 6.13 / 7.26 |

15 Yr. Fixed | 5.76% | +0.02% | -0.05% | 5.60 / 6.59 |

30 Yr. FHA | 5.95% | +0.04% | -0.04% | 5.90 / 6.62 |

30 Yr. Jumbo | 6.14% | +0.04% | -0.06% | 6.10 / 7.45 |

7/6 SOFR ARM | 5.85% | +0.03% | +0.15% | 5.59 / 7.25 |

30 Yr. VA | 5.97% | +0.04% | -0.04% | 5.91 / 6.64 |

New here? Join the newsletter (it's free).

Macro Trends

One in Five U.S. Mortgages Now Carry Rates Above 6%; A Ticking Time Bomb for Housing link

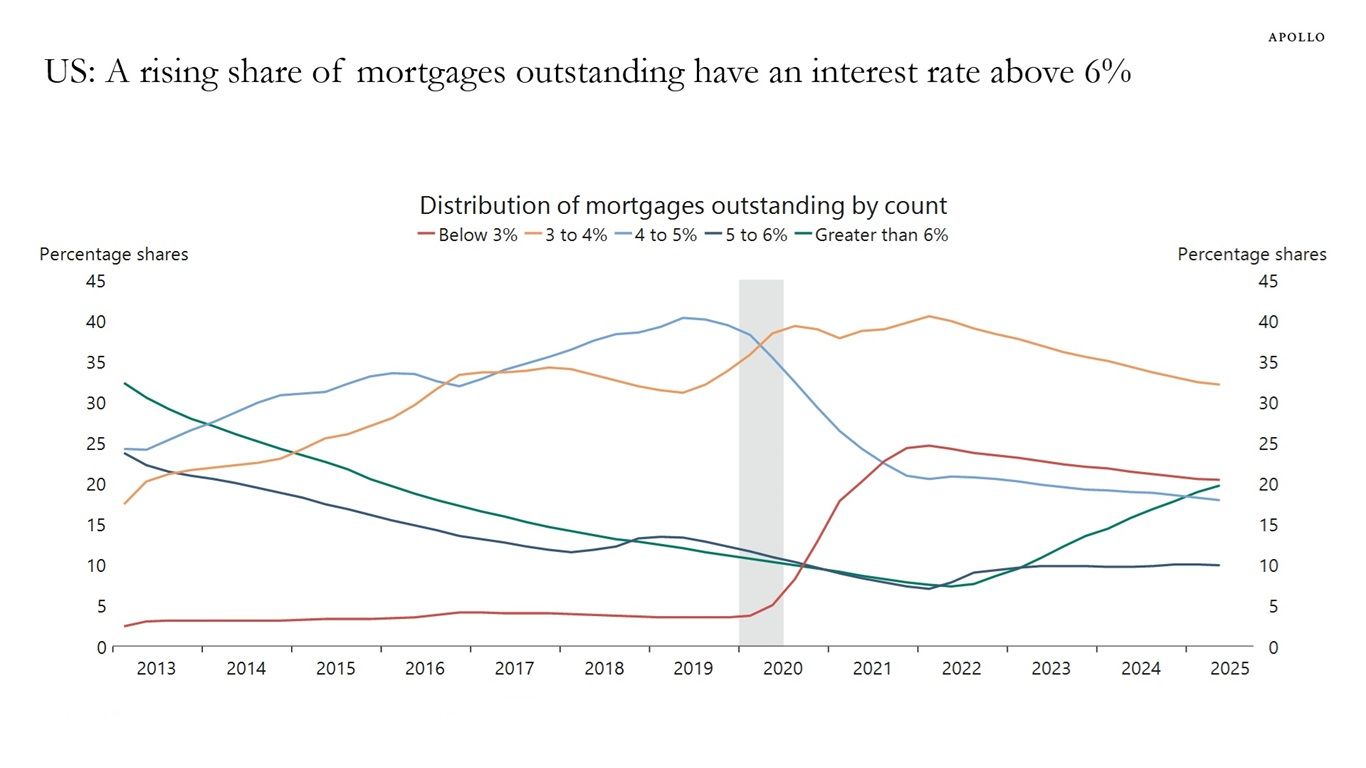

According to Apollo Chief Economist Torsten Sløk, 20% of all outstanding U.S. mortgages now have interest rates above 6%, marking a steep climb in high-cost debt since the Fed began hiking rates.

The data from the FHFA and Macrobond shows a rising share of homeowners locked into expensive loans, limiting mobility and keeping inventory artificially low.

This shift creates a two-tier housing market, older, low-rate mortgages vs. new, high-rate loans, which could distort pricing, refinancing, and demand patterns well into 2026.

My take: A lot of people are just stuck, those with low rates can’t afford to move, and new buyers can’t afford to get in. Until rates come down, the market’s going to stay pretty quiet.

Real Estate Trends

Rental Concessions Rise to New Level link

37.3% of Zillow listings included a giveaway in September (record high), up from 36.7% in August and far above 2019’s 14.4%. Concessions are likely to keep climbing into winter; once normalized, managers may have to cut face rents, pressuring NOI.

The split is regional: rent drops are concentrated in the South/Sunbelt/Mountain West (Austin, Denver, San Antonio, Phoenix, Orlando), while tighter, higher-barrier markets (Chicago, San Francisco, New York, Providence, Cleveland) are holding firmer. 37 metros saw concessions rise (led by Pittsburgh, Seattle, Richmond, Raleigh, Hartford) while 12 fell (including Birmingham, Los Angeles, Minneapolis, Cleveland, San Francisco).

Affordability is the best in four years as new supply floods the market: asking multifamily rent is $1,809 (−0.2% MoM) and annual growth slowed to 1.7% (second-lowest since 2021). Single-family rentals are up just 3.2% YoY , the smallest gain since 2016 , hinting at broader cooling.

My take: When this many landlords are giving away free rent, it usually means demand is softening faster than they’d like to admit. If this keeps up through winter, actual rents will start falling , especially in those oversupplied Sunbelt cities.

Industrial vacancies level off as leasing surges and construction slows link

Industrial leasing jumped 9.8% year-over-year to 682M sq. ft., driven by occupiers upgrading to newer facilities and outsourcing to 3PLs.

Despite 13 straight quarters of completions outpacing absorption, the vacancy rate stabilized at 6.6%, ending a two-year trend of steady increases.

Build-to-suit projects fueled 53.3M sq. ft. of net absorption in Q3, helping offset space returns from consolidating occupiers.

My take: Leasing strength from logistics players is keeping the industrial market from tipping. But if construction keeps rising faster than absorption, 2026 could finally test how deep demand really runs.

Homebuyers are saying no to chains and snapping up houses in cities with unique downtowns link

In Ridgewood and Chatham, NJ, buyers are paying more per square foot to live near authentic, walkable downtowns , even trading larger lots for proximity to cafes and shops. Homes in Chatham Borough sell for more than nearby Township homes thanks to access to local culture and transit.

The “post-pandemic reset” has fueled demand for small-town Main Streets filled with independent coffee shops, bakeries, and boutiques, as residents seek connection and community over convenience.

Real estate brokers note that too many chains or big-box stores near a town center now hurt buyer perception, as shoppers prefer local variety that reflects neighborhood character and engagement.

My take: The next premium isn’t just location, it’s local. Investors who bet on towns preserving authentic downtowns may see faster appreciation than in sprawling suburbs with copy-paste retail.

Home Equity Rates Decline in Third Quarter link

Equity-rich homes dropped to 46.1% of U.S. mortgaged properties in Q3 2025, down from 48.3% a year earlier despite record-high median home prices of $370,000.

Underwater homes climbed to 2.8% nationwide, rising year-over-year in 46 states, with the sharpest jumps in D.C. (+1.8 pts), Maryland (+1.1), and Louisiana (+1.1).

Florida, Arizona, and Colorado saw the biggest declines in equity-rich share (down 6–7 pts), while Vermont and the Midwest counties dominated the top of the equity leaderboard, with some reaching 90%+ equity-rich rates.

My take: The equity dip shows cracks forming beneath record prices, not a crash, but a cooling. Watch out for high-growth Sun Belt markets like Florida and Arizona; they’re shifting from “equity-rich” to “risk zone” faster than the headlines suggest.

Location Specific

San Diego life science leasing rebounds link

Q3 gross leasing hit 703,042 SF, powered by Novartis’ 466,598 SF build-to-suit at Campus Point; net absorption turned positive for the first time in ~12 months. Still, availability in the core cluster climbed to a record 31.2%.

Demand is clustering in built-out, turnkey spec suites with 24–36 month terms,seven such deals closed this quarter. Touring for <15,000 SF jumped in late September as tenants prioritize speed and flexibility over cost.

Vacancy nearly doubled YoY to 29.2% while under-construction fell to 1.0M SF from 4.3M SF (-77.7%); rents are steady but tenants are downsizing, sharing labs, or shifting to cheaper submarkets. Venture funding ticked up to $563M and post-IPO proceeds hit a record $5.2B, yet NIH tightening keeps capital scarce.

AI & Real Estate - Today’s Trends

Tool of the day: Hedral

Automate multi-disciplinary building design and optimize cost and constructability.

WAV Group Warns MLSs: “AI Will Bypass You Without MCP Servers” link

Victor Lund argues that unless MLSs build Model Context Protocol (MCP) servers soon, AI tools like ChatGPT and Gemini will access listing data directly,eroding broker cooperation, ownership, and the foundation of the MLS system itself.

Agents Enter the GEO Era,AI’s New Frontier for Real Estate link

Real Estate News says SEO is out and “Generative Engine Optimization” is in,agents who adapt content for AI search will stay visible, while those who don’t risk disappearing from the next generation of discovery platforms.

AI Platforms Like Visit Are Transforming Property Teams link

Propmodo reports that AI-native systems are cutting building management time 8×,analyzing tenant sentiment, predicting maintenance issues, and streamlining workflows,showing how next-gen platforms are turning property operations into proactive, data-driven ecosystems.

AI Fuels Arizona’s Desert Data Center Boom link

Realtor.com reports Arizona is becoming the epicenter of AI-driven construction as tech giants and investors buy up desert land for massive data centers,boosting jobs and infrastructure while sparking debates over power, water, and sustainability.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

U.S. Office Market Dynamics, Q3 2025

(This content is restricted to Pro Members only. Upgrade)

Housing’s Boom-Bust Cycle Is Flattening, Here’s Why Smart Money Is Shifting Strategy

(This content is restricted to Pro Members only. Upgrade)

U.S. Retail Trends | Q3 2025

(This content is restricted to Pro Members only. Upgrade)

Big money edges back into multifamily

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

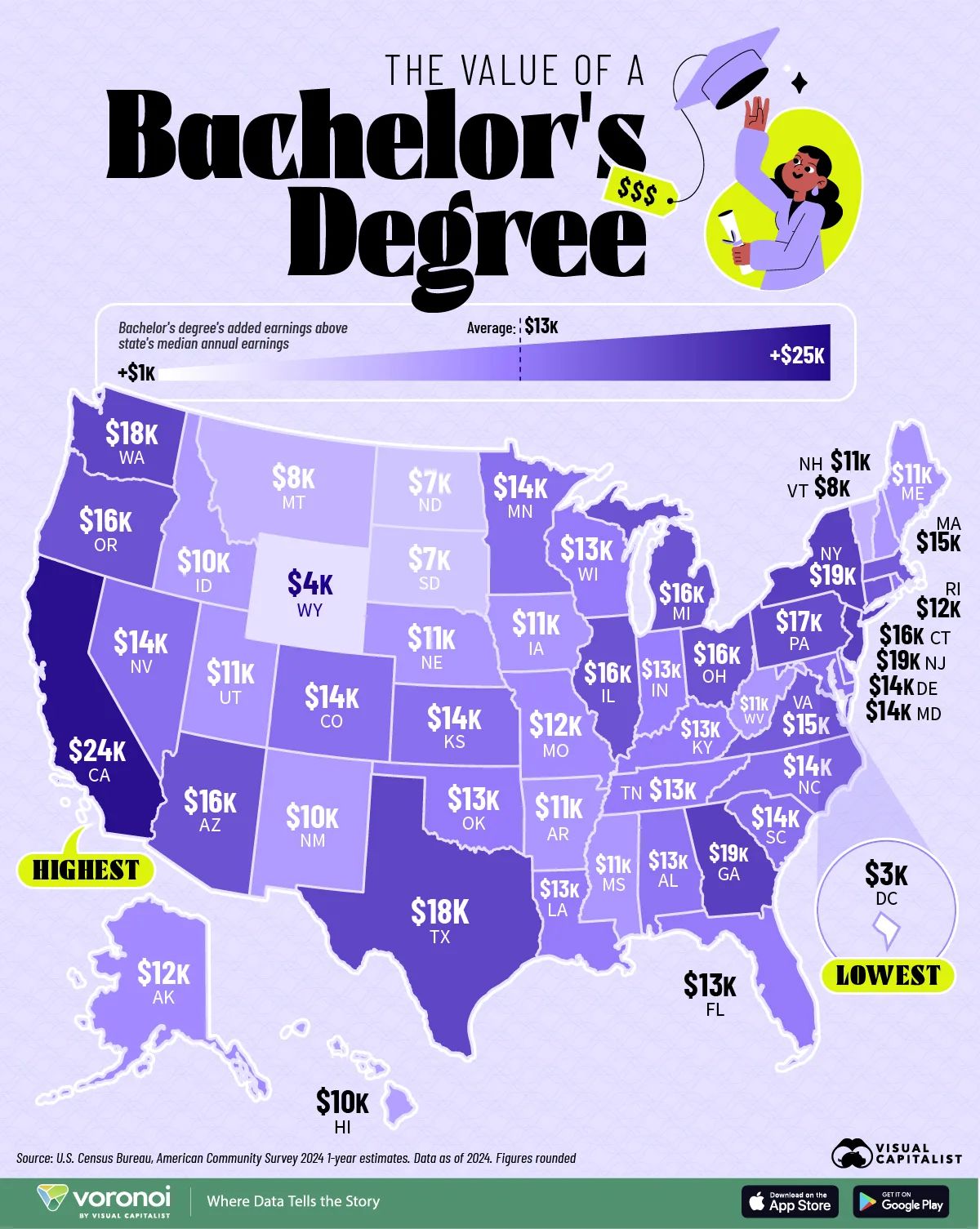

Mapped: The Value of a College Degree, by U.S. State

Unreal Real Estate

240 acres in rural Vermont

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply