- Zero Flux

- Posts

- Retirement housing crisis

Retirement housing crisis

Ranked: States Where Americans Have the Most Cash in the Bank and 12 other real estate insights

Share Zero Flux with a friend using your unique link and unlock 3 months of premium free:

https://www.zeroflux.io/subscribe?ref=PLACEHOLDER

And if you get 25 signups overtime with this link, premium is yours for life 🎉

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.85% | +0.02% | +0.04% | 6.11 / 7.26 |

15 Yr. Fixed | 6.07% | +0.04% | +0.05% | 5.54 / 6.59 |

30 Yr. FHA | 6.40% | +0.03% | +0.06% | 5.65 / 6.62 |

30 Yr. Jumbo | 6.92% | +0.02% | +0.02% | 6.37 / 7.45 |

7/6 SOFR ARM | 6.25% | -0.02% | -0.20% | 5.95 / 7.25 |

30 Yr. VA | 6.41% | +0.02% | +0.06% | 5.66 / 6.64 |

New here? Join the newsletter (it's free).

Real Estate Trends

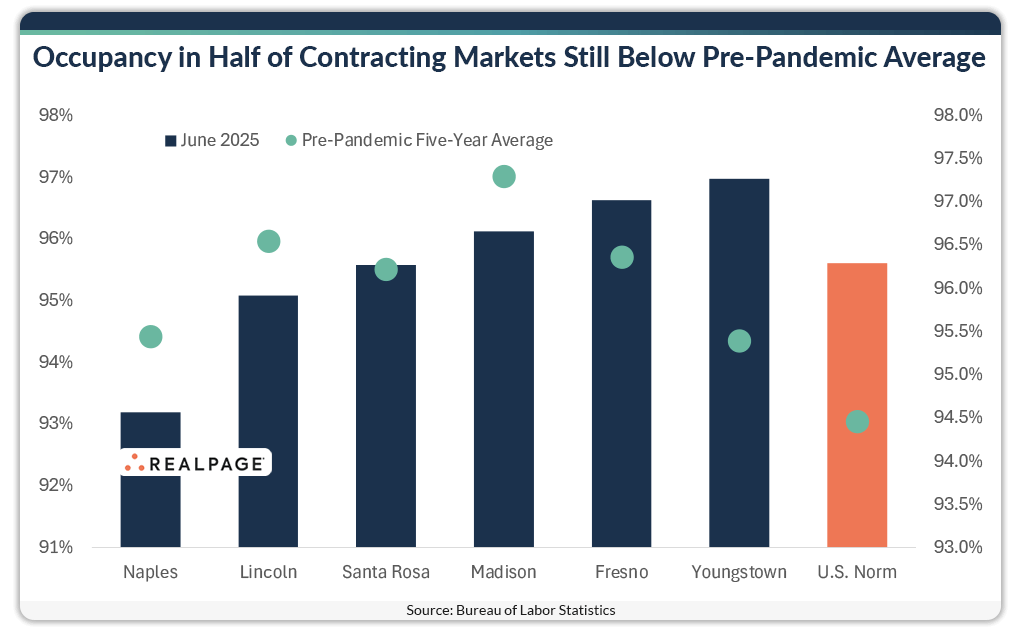

Apartment Occupancy Rebounds—Only 6 Markets Still Losing Ground link

National apartment occupancy climbed 140 basis points over the past year, reaching 95.6% in June—marking a broad rebound across nearly all major U.S. markets. Only 6 out of the top 150 markets saw year-over-year declines.

Lincoln posted the sharpest drop, falling 100 bps to 95.1%—150 bps below its pre-COVID average—due to oversupply, with demand for 876 units trailing 1,139 new deliveries.

Madison’s occupancy dipped 60 bps to 96.1%, but with new construction down 18% and demand improving, the market is stabilizing and nearing balance again.

Global Industrial Real Estate Faces Power Crunch and Reshoring Surge link

U.S. tariffs have more than doubled from 10% to 22%, forcing companies to rethink global supply chains and prioritize regional resilience over cost alone. This shift favors reshoring in defense, electronics, and pharma sectors.

Private capital is now outpacing institutional investment in U.S. industrial real estate, with investors targeting markets like the Inland Empire and Gulf Coast for lower costs and emerging logistics advantages.

Power and labor shortages are becoming major barriers to industrial growth, especially in the U.S., where outdated distribution infrastructure is slowing data center and cold storage expansion.

Retirement housing crisis: Market slowdown leaves seniors stranded link

Harborside, a luxury senior living facility in Long Island, charged a $945,000 entrance fee with promises of partial refunds, but after three bankruptcies, it was sold and cut services—forcing vulnerable residents out.

Continuing-care retirement communities rely heavily on upfront fees to cover debt and operations, making them especially fragile during housing market slowdowns when seniors can’t sell their homes quickly.

The broader trend shows financial strain across senior housing as delayed home sales shrink incoming cash flow, raising risks for both operators and retirees expecting stable care.

Homebuyers Now Need a $17K Raise Just to Afford a Typical Home link

The U.S. housing shortage worsened in 2023, with a gap of 4.7 million homes despite 1.4 million new units added. The number of vacant homes available for sale or rent hit 3.4 million, largely due to affordability issues.

In cities like San Jose and San Francisco, buyers need income increases of $251K and $165K respectively to afford a typical home. Even in mid-tier cities like Milwaukee and Denver, required raises top $36K and $43K.

A record 8.1 million families are doubling up, mostly millennials and Gen Z, as homeownership drifts further out of reach. Zillow recommends easing zoning laws to increase density and relieve affordability pressure.

Prices Surge in Midwest and Northeast—Rockford and Springfield Lead the Pack link

Springfield, MA held the top spot for the second month in a row, with homes selling in just 23 days—over 3 weeks faster than the U.S. average—thanks to high demand and low supply. It's now led the rankings five times, driven by its Boston-adjacent location and tight inventory.

Rockford, IL saw the fastest annual price growth of any hot market in June at 13.4%, despite a median list price of just $249,000. Its proximity to Chicago and relative affordability are attracting buyers priced out of larger metros.

Nearly three-quarters of June’s hottest markets were priced below the national median, yet saw 2.9x more views per listing. This signals strong investor and buyer interest in lower-cost, high-demand regions—especially in New England and the Midwest.

Location Specific

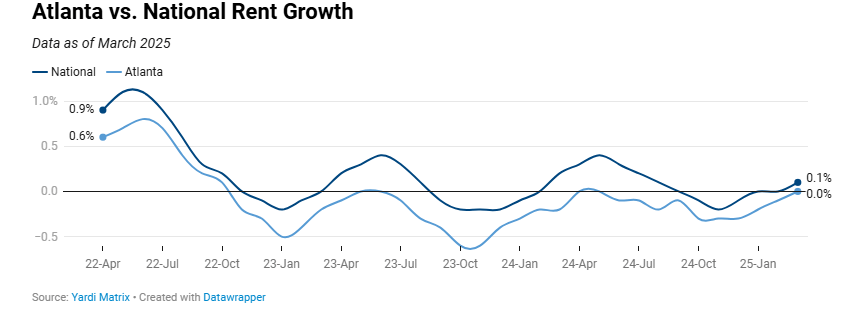

Atlanta rents stall, investment drops 18%—is the market cooling off? link

Atlanta’s average asking rent stayed flat at $1,637 in March, while national rents rose 1% year-over-year. Local rents fell 1.6% compared to a year ago, underperforming the U.S. average.

Multifamily investment dropped to $323 million in Q1, with price per unit falling 18.2% year-to-date to $154,342. This slowdown comes despite strong absorption and stable occupancy at 92.5%.

Job growth in Atlanta is slowing, with only 23,100 new jobs added over 12 months and losses in half the employment sectors. Trade and transportation shed 8,100 jobs, while education and health added 20,500.

One Real Estate AI tool

Build Voice AI that performs. Design and deploy real-time conversational AI with global telephony, dedicated AI infrastructure, and full customizability all in one platform.

A word from our sponsor

Finally, a powerful CRM—made simple.

Attio is the AI-native CRM built to scale your company from seed stage to category leader. Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Join fast growing teams like Flatfile, Replicate, Modal, and more.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

Real estate investors are betting on the moon—yes, seriously

(This content is restricted to Pro Members only. Upgrade)

U.S. Office MarketBeat Report

(This content is restricted to Pro Members only. Upgrade)

Top Destinations in the US for Foreign Buyers

(This content is restricted to Pro Members only. Upgrade)

Retail vacancies spike—but good space is almost impossible to find

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

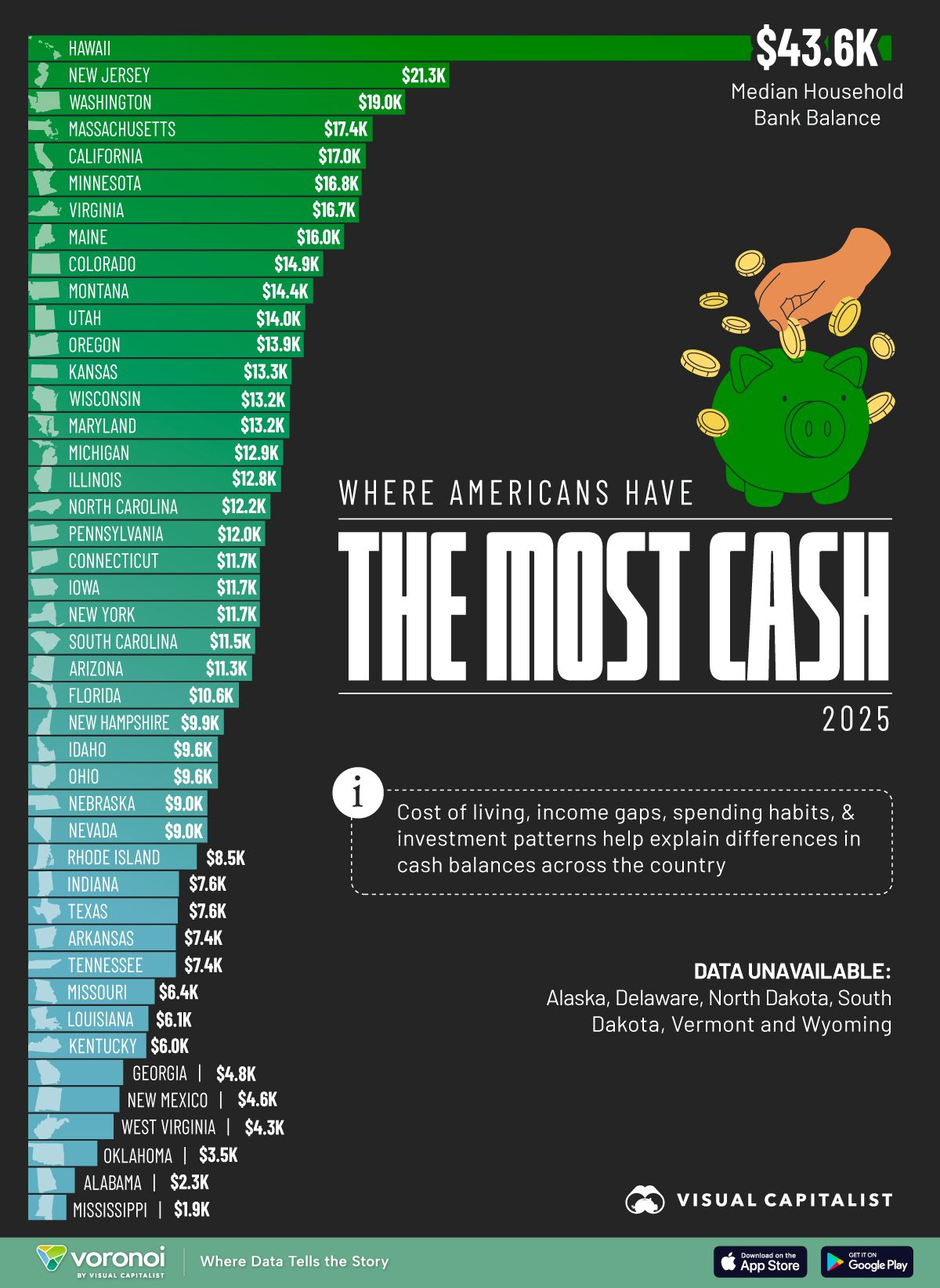

Ranked: States Where Americans Have the Most Cash in the Bank

Unreal Real Estate

A Japanese-Chalet style home!

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply