- Zero Flux

- Posts

- Return to office trends

Return to office trends

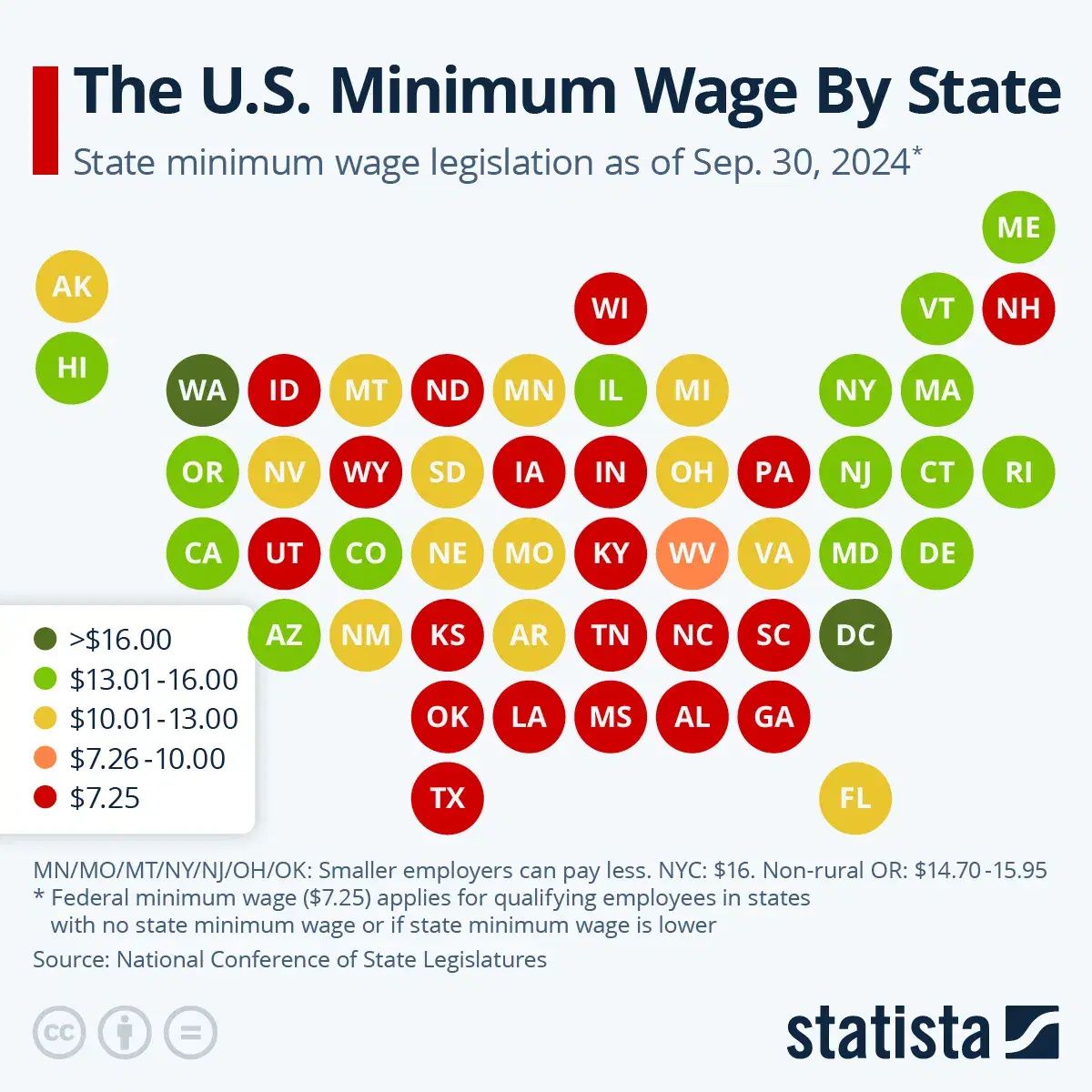

Mapping the Minimum Wage of Each U.S. State and 12 other real estate insights

Want the full Zero Flux experience?

For a limited time, you can upgrade to Premium at just $6.32/month and get deeper data drops, investor insights, and access to every tool we’ve built for serious operators.

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.27% | +0.00% | -0.20% | 6.11 / 7.26 |

15 Yr. Fixed | 5.70% | +0.01% | -0.15% | 5.54 / 6.59 |

30 Yr. FHA | 5.99% | +0.01% | -0.06% | 5.65 / 6.62 |

30 Yr. Jumbo | 6.25% | +0.00% | -0.17% | 6.25 / 7.45 |

7/6 SOFR ARM | 5.65% | -0.03% | -0.17% | 5.59 / 7.25 |

30 Yr. VA | 6.01% | +0.01% | -0.06% | 5.66 / 6.64 |

New here? Join the newsletter (it's free).

Real Estate Trends

Cash buyers dominate net lease deals link

Cash buyers dominate net lease deals, like a $75.9M all-cash purchase of a 10-property retail portfolio at just under a 7% cap rate, favoring grocery, auto service, and coffee tenants. Tight lending keeps leveraged buyers at a disadvantage.

QSRs with drive-thrus and medical tenants (dental, dialysis, veterinary, behavioral health) are drawing the most demand thanks to sticky tenancy and stable sales. By contrast, weak-credit pharmacies, boutique fitness, and dollar stores face headwinds from tariffs and format risk.

1031 exchange activity has slowed sharply, creating a backlog across property types, while sale-leasebacks are less attractive due to high development costs and rents. Bonus depreciation and potential rate cuts are expected to fuel future activity and compress cap rates.

Small, mid-sized warehouses beat big-box spaces in occupancy link

Vacancy for 10,000–100,000 sq. ft. industrial properties was just 4.4% in March, compared to 21% in recently built large-scale facilities. Older stock built before 2020 is also holding under 5% vacancy.

Nearly 75% of current industrial construction is for projects over 200,000 sq. ft., while smaller projects make up only 10% of the pipeline. This skew is leaving big-box space oversupplied and smaller space scarce.

Developers delivered only 67M sq. ft. of industrial space in Q1 2025, the lowest quarterly total in seven years. With financing tightening and vacancies rising in newer stock, lenders are expected to be more selective.

Return to office trends link

JLL found employees at five big New York financial firms are leaving work 13–30 minutes earlier than in 2019, costing millions in lost productivity. Suburban hubs like Summit, NJ now see peak outbound commutes at 4pm instead of 6pm.

In Chicago, Dallas, and San Francisco, workers are heading home 18–26 minutes earlier than before the pandemic, underscoring how rigid return-to-office (“RTO”) rules clash with family schedules and longer suburban commutes.

Buildings near transit hubs such as Grand Central and Penn Station show stronger leasing and higher RTO rates, making transit access a key competitive factor for companies trying to pull suburban workers back.

August 2025 Hottest Housing Market link

Springfield, MA pulled in 3.2x the national average views per property in August, with homes selling nearly 30 days faster than the U.S. median. The median list price there was $355,000, attracting buyers from Boston, NYC, and Hartford.

16 of the 20 hottest markets were priced below the national median, with 7 metros offering homes under $300,000. Affordability in the Midwest is fueling intense competition, with listings getting twice the national average traffic.

Large U.S. metros cooled, dropping 10 spots on average year-over-year, with prices falling 1.2%. Kansas City stood out, climbing 50 ranks to 111th hottest market as demand shifted away from pricier cities.

HOA Fees Crack $500 for Millions of Homeowners, New York, DC, and Hawaii Top the List link

About 21.6 million U.S. homeowners, 1 in 4, paid HOA or condo fees in 2024, with 3 million households paying more than $500 a month. The national median fee is just $135, showing how steep the top end has become.

New York homeowners face the highest costs, with a median of $739 per month and 64% paying over $500. DC ($505) and Hawaii ($470) follow, where roughly half of owners also pay above $500.

New construction is driving the spread of HOAs, 80% of new homes in 2024 had HOA fees compared with 38% of existing homes. Even resale buyers are pulled in as HOA memberships transfer with the property.

Mortgage demand surges to 3-year high as rates tumble link

The average 30-year fixed mortgage rate fell to 6.49% from 6.64%, the lowest since October 2024, driving the strongest borrower demand since 2022.

Refinance applications jumped 12% in a week and are now 34% higher than a year ago, with refis making up nearly half (48.8%) of all mortgage activity.

Purchase mortgage applications rose 7% in a week and are up 23% year-over-year, with ARMs gaining share as their rates sit well below fixed options.

AI & Real Estate - Today’s Trends

Tool of the day - Nekst

Nekst is a comprehensive transaction management platform designed to streamline real estate operations. It offers features such as customizable workflows, automated communication via email and SMS, centralized information storage, and personalized client portals.

Beyond the Hype: AI Gets Real in Construction & CRE link

From contract review bots to digital twins and predictive maintenance, firms are moving past buzzwords to hands-on AI adoption, unlocking efficiency while grappling with data security and workforce shifts.

Seattle’s $80B AI Bet Is Reshaping Tech and Real Estate link

Microsoft, OpenAI, and xAI are pouring billions into the Pacific Northwest, fueling talent wars, housing demand, and AI-driven permitting that’s cutting project timelines in half, making Seattle ground zero for AI-real estate convergence.

Agentic AI Promises Faster Leasing & Always-On Prospecting link

BetterBot says AI agents can fill units two weeks faster, capture 62% of after-hours leads, and handle every inquiry, reshaping how multifamily teams scale without extra staff.

AI Sales Agent Promises Faster, Smarter Mortgage Workflows link

HousingWire reports a new AI digital lending assistant can handle borrower scenarios and loan lookups in real time, streamlining the mortgage process and easing pressure on loan officers.

A word from our sponsor

Professional Bitcoin Mining Made Simple

With Bitcoin breaking through $120k recently, smart entrepreneurs aren't just buying at record highs - they're generating Bitcoin through professional mining operations at production cost.

Abundant Mines makes Bitcoin mining completely turnkey. You own the Bitcoin-generating equipment in our green energy facilities while our professionals handle everything else. No technical expertise required. No equipment management. No operational headaches.

Receive daily BTC payouts straight to your wallet, benefit from massive tax advantages through 100% bonus depreciation, and acquire Bitcoin significantly below market rates. It's like owning the money printer instead of buying the money.

Perfect for busy professionals who want serious Bitcoin exposure without complexity. Our clients include successful entrepreneurs who've scaled from test investments to multi-million dollar mining operations.

Claim your free month of professional Bitcoin hosting and see how the smart money generates Bitcoin.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

CMBS Delinquencies: The Waiting Game Investors Can’t Ignore

(This content is restricted to Pro Members only. Upgrade)

How AI Is Quietly Flipping CRE

(This content is restricted to Pro Members only. Upgrade)

Multifamily REITs in 2025

(This content is restricted to Pro Members only. Upgrade)

Most Expensive Towns in America

(This content is restricted to Pro Members only. Upgrade)

The Future of Real Estate: 7 Trends That Could Reshape the Industry

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

Mapping the Minimum Wage of Each U.S. State

Unreal Real Estate

A Home That Might Sink Into the Ocean

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply