- Zero Flux

- Posts

- Rise of mid-term rentals

Rise of mid-term rentals

World's most expensive Condo Markets, A Dreaming Dome for sale and more!

Help us shape the next version of ZeroFlux.Vote on how often you want to get the newsletter. Share additional feedback, and you can get 6 months of Premium free! |

A quick word from our sponsor

Tackle your credit card debt by paying 0% intro APR until 2027

Did you know some credit cards can actually help you get out of debt faster? Yes, it sounds crazy. But it’s true.

The secret: Find a card with a “0% intro APR" period for balance transfers or purchases. This could help you fund a large purchase or transfer your debt balance and pay it down as much as possible during the intro period. No interest means you could pay off the debt faster.

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.36% | +0.00% | +0.02% | 6.13 / 7.26 |

15 Yr. Fixed | 5.85% | +0.00% | +0.02% | 5.60 / 6.59 |

30 Yr. FHA | 5.98% | -0.01% | -0.05% | 5.89 / 6.59 |

30 Yr. Jumbo | 6.43% | -0.01% | +0.01% | 6.10 / 7.45 |

7/6 SOFR ARM | 6.05% | +0.02% | -0.02% | 5.59 / 7.25 |

30 Yr. VA | 5.99% | -0.01% | -0.06% | 5.90 / 6.60 |

⚡ Snapshot: The 7/6 SOFR ARM posted the only meaningful uptick today (+0.02%), while most major loan types dipped slightly or stayed flat, continuing the slow cooling trend across mortgage rates.

New here? Join the newsletter (it's free).

Macro Trends

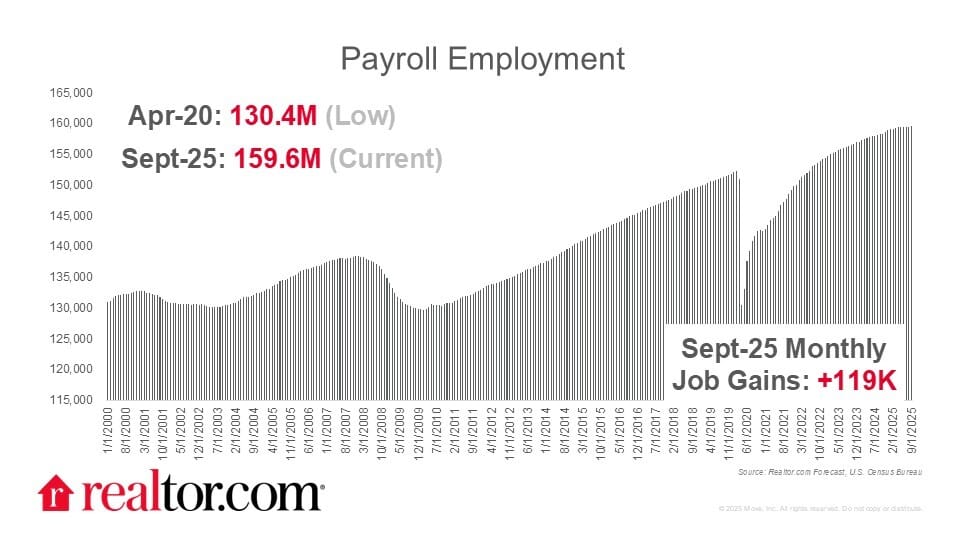

Jobs beat forecasts, unemployment ticks up, Fed split on December cut link

The September report showed 119,000 new jobs, more than double expectations, but the unemployment rate rose to 4.4%, signaling a labor market that is softening even as hiring continues.

Wage growth slowed to 0.2% month over month, keeping annual gains near 4%, a level that leaves the Fed divided on whether inflation risks remain too high for a December rate cut.

My take: The data points in two directions at once, which makes the Fed’s job harder. For housing, the mix of cooler wages and higher unemployment nudges the odds slightly toward lower rates, but buyer confidence will depend on whether job losses continue.

Real Estate Trends

FSBO share drops to just 5%, the lowest ever recorded link

FSBO sales now make up only 5% of all home transactions, down from 21% in 1985, and the median FSBO price of $360,000 is 18% lower than agent-listed homes at $425,000.

NAR data shows 91% of sellers used an agent this year, citing help with pricing, marketing, negotiation, and paperwork, while 40% of FSBO sellers admit they did not actively market their home at all.

My take: The gap in sale prices makes the trend clear. Most sellers are deciding that the time and money risks of going solo outweigh the savings on commission.

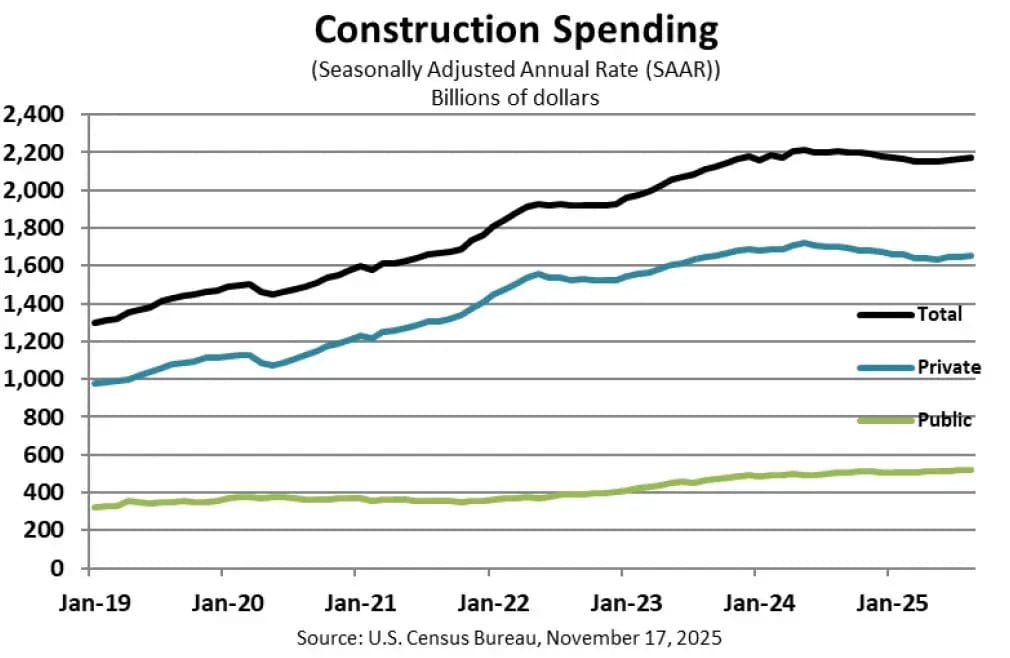

Construction spending slips 1.6% from last year as nonresidential cools link

Total construction spending in August came in at $2.17 trillion, down 1.6% from August 2024, with year-to-date spending also 1.8% lower than last year. Private residential spending rose modestly to $914.8 billion, while private nonresidential dipped to $737.3 billion.

Public construction held flat at $517.3 billion, with only small movements in categories like education and highways, signaling that federal and state projects are doing little to offset private-sector softness.

My take: The slowdown is concentrated outside housing. Residential is holding up better than nonresidential, but overall spending remains weaker than a year ago, which could weigh on construction employment and material demand heading into 2026.

Multifamily operators turn to mid-term rentals as vacancies rise link

With vacancies climbing, 88% of multifamily operators say they are likely to adopt mid-term rentals, and nearly half already offer 1 to 9 month furnished stays. Operators experimenting with flexible models also report testing co-living (61%) and revenue-sharing or pop-up leasing (54%).

The shift comes as CoStar expects rent growth to fall from 0.6% to –0.1% in late 2025 and vacancies to reach 8.2%, with new deliveries dropping 28% in 2025 and 55% in 2026, a setup that increases pressure to fill units in weaker submarkets.

My take: The softness in rents is pushing operators to diversify. Mid-term rentals are becoming less of a niche strategy and more of a practical tool to manage vacancy until supply and demand rebalance.

Net lease market splits as cap rates diverge by credit and lease length link

Cap rates have widened into clear tiers: mid-5% for high-credit tenants, high-6% for mid-credit, and 7% for lower-credit, with properties holding under 5 years of term trading around 7.7% versus 6.1% for long-term leases.

Transaction activity is strong, with private investors making 64% of purchases and volume up 18% from 2024, boosted by the permanence of 100% bonus depreciation and renewed interest in car washes, c-stores, and auto service assets.

My take: Pricing is becoming more sensitive to both credit and lease duration. Private buyers are filling the gap left by institutions, but they’re being more selective about risk as they step in.

AI & Real Estate

Tool of the day: Desk

AI-powered transaction coordinator for real-estate agents that drafts contracts, tracks deadlines and automates paperwork with precision.

PropTech Market Set to Hit $119.9 Billion by 2032 link

EIN Presswire reports that PropTech is on track to reach $119.9 billion by 2032 as AI, IoT, and digital platforms reshape property operations. The report highlights strong demand for smart buildings, automated valuation models, and predictive tools that cut costs and improve transparency. North America leads adoption, but Asia-Pacific is growing fastest due to smart-city investments and digital infrastructure pushes.

HomeSage.ai Debuts New AI APIs for Property Intelligence Series link

MarTech Series reports that HomeSage.ai has launched upgraded AI models and APIs covering 145 million US properties, giving developers instant valuation, condition scoring, and investment analysis. The APIs use neural networks and computer vision to assess property condition, estimate renovation costs, and score ROI for rentals and flips.

D.R. Horton Turns to AI Zoning Search to Speed Up Land Decisions link

CNBC’s Diana Olick reports that D.R. Horton is adopting Prophetic’s AI zoning platform to accelerate land acquisition in a tight U.S. housing market. The tool pulls zoning rules from thousands of city and county manuals across 25 states, giving builders near-instant answers on what can be built on any parcel. Prophetic says the AI cuts zoning analysis from hours to 30 seconds, giving builders a speed edge in securing buildable land.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

The New Credit Score That Could Quietly Reshape 2026 Mortgage Approvals

(This content is restricted to Pro Members only. Upgrade)

A notable consolidation just hit the student housing market

(This content is restricted to Pro Members only. Upgrade)

The hidden risk in America’s “move-in-ready” housing boom

(This content is restricted to Pro Members only. Upgrade)

What’s steering the housing recovery?

(This content is restricted to Pro Members only. Upgrade)

The multifamily signal buried inside 2026’s volatility

(This content is restricted to Pro Members only. Upgrade)

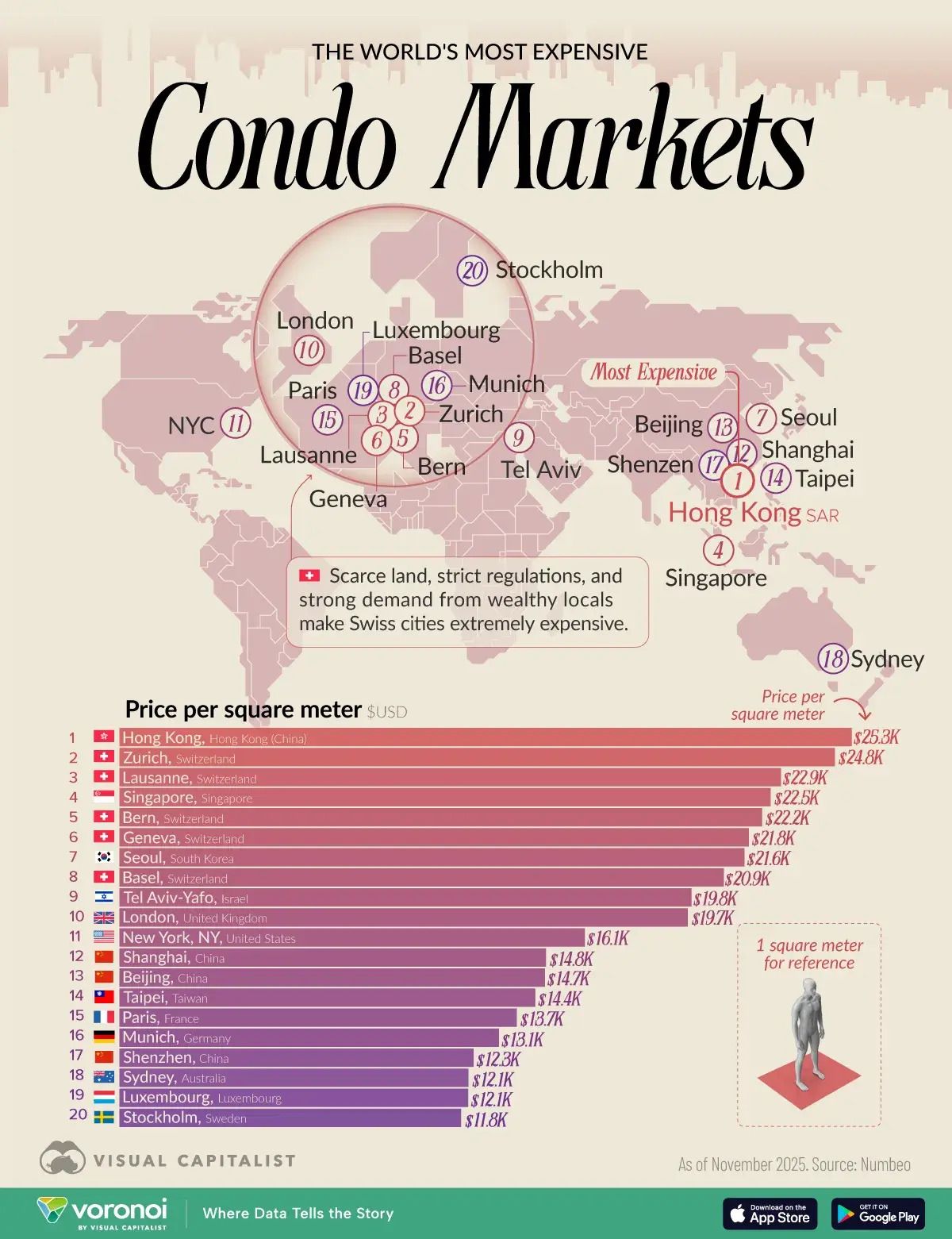

One Chart

Ranked: World’s Most Expensive Condo Markets in 2025

Unreal Real Estate

The Dreaming Dome

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply