- Zero Flux

- Posts

- Senior housing boom, A house with a water park

Senior housing boom, A house with a water park

Visualizing America’s Wealth Distribution by Generation and more

Want the full Zero Flux experience?

For a limited time, you can upgrade to Premium at just $6.32/month and get deeper data drops, investor insights, and access to every tool we’ve built for serious operators.

A quick word from our sponsor

Start investing right from your phone

Jumping into the stock market might seem intimidating with all its ups and downs, but it’s actually easier than you think. Today’s online brokerages make it simple to buy and trade stocks, ETFs, and options right from your phone or laptop. Many even connect you with experts who can guide you along the way, so you don’t have to figure it all out alone. Get started by opening an account from Money’s list of the Best Online Stock Brokers and start investing with confidence today.

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.38% | +0.02% | +0.02% | 6.13 / 7.26 |

15 Yr. Fixed | 5.88% | +0.01% | +0.01% | 5.60 / 6.59 |

30 Yr. FHA | 6.05% | +0.00% | +0.00% | 5.91 / 6.62 |

30 Yr. Jumbo | 6.29% | +0.01% | +0.03% | 6.14 / 7.45 |

7/6 SOFR ARM | 5.85% | +0.02% | +0.06% | 5.59 / 7.25 |

30 Yr. VA | 6.07% | -0.01% | +0.00% | 5.92 / 6.64 |

New here? Join the newsletter (it's free).

Real Estate Trends

Senior housing is about to match multifamily occupancy link

To sustain ~90% occupancy at current penetration, construction must run nearly 2× the historical peak for 20 years, yet today it’s at ~25% of that pace. NIC MAP estimates >$1T of new inventory needed by the early 2040s, leaving an ~$800B shortfall on the current trajectory.

Demand is accelerating: 2023 net absorption hit all-time highs, 2× any pre-COVID four-quarter span, and Q1 2024 absorption rose 40% YoY. Since 2022, the 80+ population is growing faster than inventory, pushing occupancy higher.

Operators are regaining margin: with inflation easing, rents are now rising faster than expenses, reversing pandemic-era compression. NIC MAP notes the sector has fully recovered penetration even before the demographic tailwinds fully kick in.

Shopping-center vacancy climbs to 5.8% link

Vacancy hit 5.8% in Q2, up 20 bps QoQ and 50 bps YoY, pushing asking rents down to levels small, nontraditional tenants can actually clear. Expect pressure on rent growth over the next few quarters as store closures and costs bite.

Rents are still rising but only ~2% vs ~4% post-pandemic, signaling a deceleration investors can’t ignore. Medical offices and spas are among the categories actively taking shopping-center space.

Leasing terms are loosening: shorter leases, partial fit-outs, and rent-free periods are on the table. NYC stays pricey, but markets with failed big-box and no data-center backfill present abundant small-business opportunities, tempered by high small-biz failure risk.

My take: This is a credit-mix trade: more occupancy from locals, less from nationals. I’d underwrite slower rent growth and higher rollover costs and hunt secondary centers where big-box exits give you pricing power on entry.

Cash buyers dominate both ends of the market, especially in these 6 metros link

Roughly 1 in 3 U.S. home sales in early 2025 were all-cash deals, barely dipping from last year’s peak, showing how tight credit and high rates keep favoring buyers with liquidity.

Two-thirds of homes under $100K and over 40% of $1M+ homes sold for cash, forming a “U-shaped” market where investors dominate the low end and wealthy buyers control the top.

Miami leads with 43% all-cash sales, followed by San Antonio (39.6%), Kansas City (39.2%), Birmingham (38.8%), Houston (38.8%), and St. Louis (38.1%), a mix of luxury, investor, and affordable markets.

Housing inventory growth stalls; listings up just 17% vs 33% peak link

Active housing inventory growth has slowed sharply in 2025, from 33% year-over-year earlier this summer to just 17.66% last week, signaling an early seasonal peak.

Many sellers pulled listings after mortgage rates ticked higher, reversing what had been one of the strongest supply rebounds since the pandemic.

The slowdown suggests fewer new listings are hitting the market even as buyer demand stays soft, keeping prices stickier than expected heading into Q4.

Location Specific

Manhattan Office Now Set for Strongest Annual Leasing Since 2014 link

Manhattan logged 10.6M sq. ft. of office leasing in Q3, up 20.4% from the prior quarter and 1.1M sq. ft. higher year-over-year, according to Savills, putting 2025 on pace for the strongest leasing volume in over a decade.

Availability fell sharply to 16.2%, down 350 basis points from last year, with Midtown tightening further to just 13.8%, signaling a market swing back toward landlords in core submarkets.

Class A rents ticked up 1% to $86.35/sf even as overall asking rents slipped 0.6%, showing that the “flight to quality” remains strong but Savills expects well-located Class B assets to see rising demand as top-tier space gets scarce.

AI & Real Estate - Today’s Trends

Tool of the day: Styldod

Styldod is a design-tech company that automates real estate marketing, enabling agents to showcase properties effectively online. Their services include virtual staging, photo editing, 3D renders, and AI-driven marketing tools.

Zillow’s ChatGPT Integration Sparks MLS Showdown link

The new Zillow–ChatGPT partnership lets users pull listings through AI prompts but MLS experts warn it may breach IDX data rules, forcing the industry to rethink how innovation fits within real estate’s strict data policies.

First American’s Xander Snyder on the AI Playbook for CRE link

In a new Commercial Real Estate Show episode, Snyder explains how AI is reshaping due diligence, underwriting, and market research, boosting efficiency while exposing risks around data quality and workforce shifts.

Construction Firms Boost AI Budgets 35%, Office Tasks Lead the Way link

Bisnow reports construction companies are rapidly expanding AI use for accounting, estimating, and marketing, with early adopters cutting report time from hours to minutes while exploring next-gen site safety and bidding tools.

Real Estate’s AI Readiness Gap Widens, Survey Finds link

Commercial Observer’s 2025 AI Survey shows 82% of CRE investors plan to increase AI spending next year but only 29% have clear deployment strategies, exposing a growing divide between enthusiasm and execution.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

Tariffs Are Quietly Rewriting the Math on U.S. CRE Projects

(This content is restricted to Pro Members only. Upgrade)

What is the future of factory-built housing?

(This content is restricted to Pro Members only. Upgrade)

Institutions are changing how affordable housing gets financed

(This content is restricted to Pro Members only. Upgrade)

Wall Street’s quiet comeback, CMBS market heats up again

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

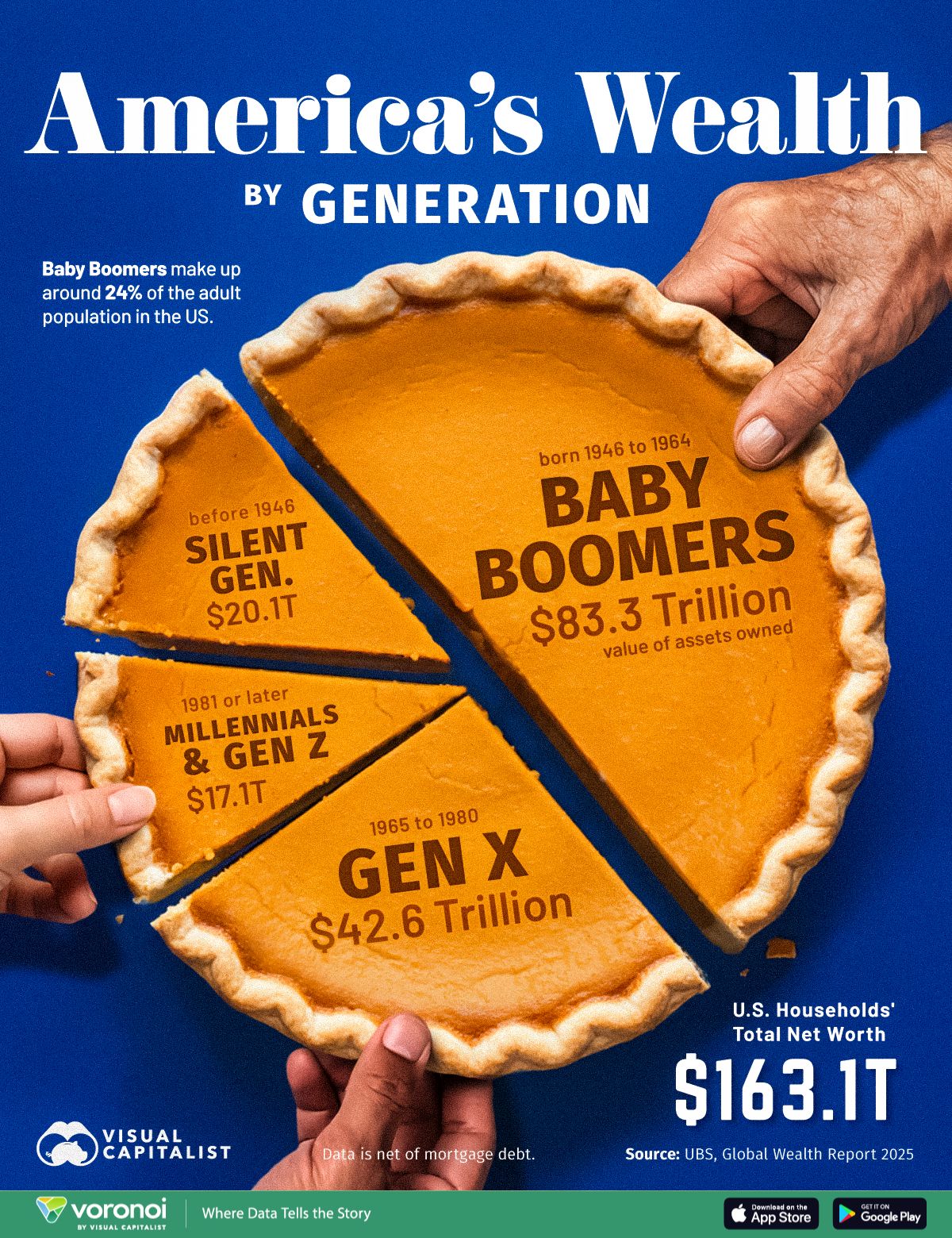

Visualizing America’s Wealth Distribution by Generation

Unreal Real Estate

A house with a water park

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply