- Zero Flux

- Posts

- SFR rent growth at 15-year low, one room wonder house

SFR rent growth at 15-year low, one room wonder house

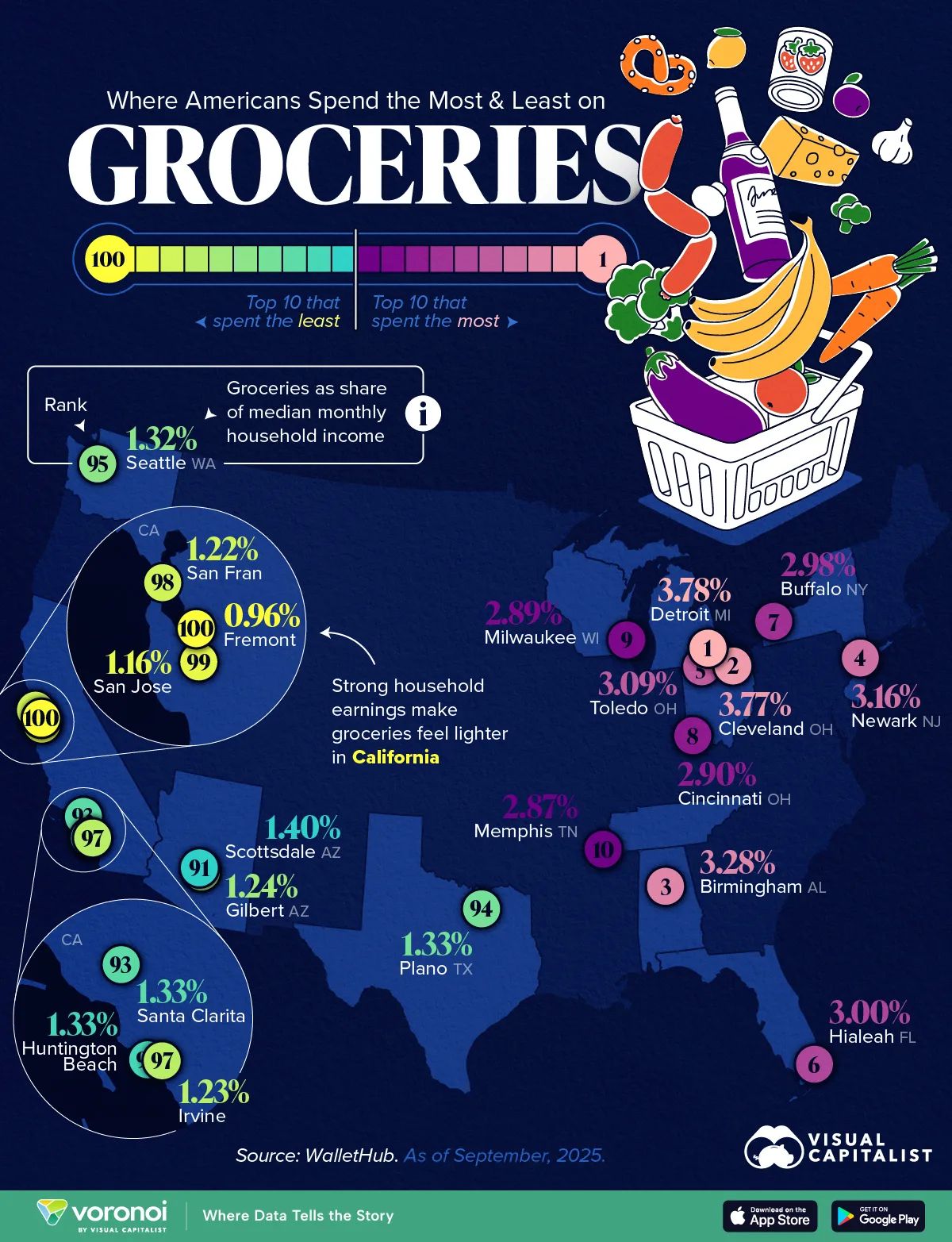

Cities Where People Spend the Most and Least on Groceries, The Average Credit Score in Every State and more

Want the full Zero Flux experience?

For a limited time, you can upgrade to Premium at just $6.32/month and get deeper data drops, investor insights, and access to every tool we’ve built for serious operators.

A quick word from our sponsor

Reddit’s Top Stocks Beat the S&P by 40%

Buffett-era investing was all about company performance. The new era is about investor behavior.

Sure, you can still make good returns investing in solid businesses over 10-20 years.

But in the meantime, you might miss out on 224.29% gainers like Robinhood (the #6 most-mentioned stock on Reddit over the past 6 months).

Reddit's top 15 stocks gained 60% in six months. The S&P 500? 18.7%.

AltIndex's AI processes 100,000s of Reddit comments and factors them into its stock ratings.

We've teamed up with AltIndex to get our readers free access to their app for a limited time.

The market constantly signals which stocks might pop off next. Will you look in the right places this time?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.18% | +0.01% | -0.05% | 6.13 / 7.26 |

15 Yr. Fixed | 5.74% | +0.01% | -0.06% | 5.60 / 6.59 |

30 Yr. FHA | 5.91% | +0.01% | -0.07% | 5.90 / 6.62 |

30 Yr. Jumbo | 6.10% | +0.00% | -0.10% | 6.10 / 7.45 |

7/6 SOFR ARM | 5.82% | +0.11% | +0.11% | 5.59 / 7.25 |

30 Yr. VA | 5.93% | +0.02% | -0.06% | 5.91 / 6.64 |

New here? Join the newsletter (it's free).

Macro Trends

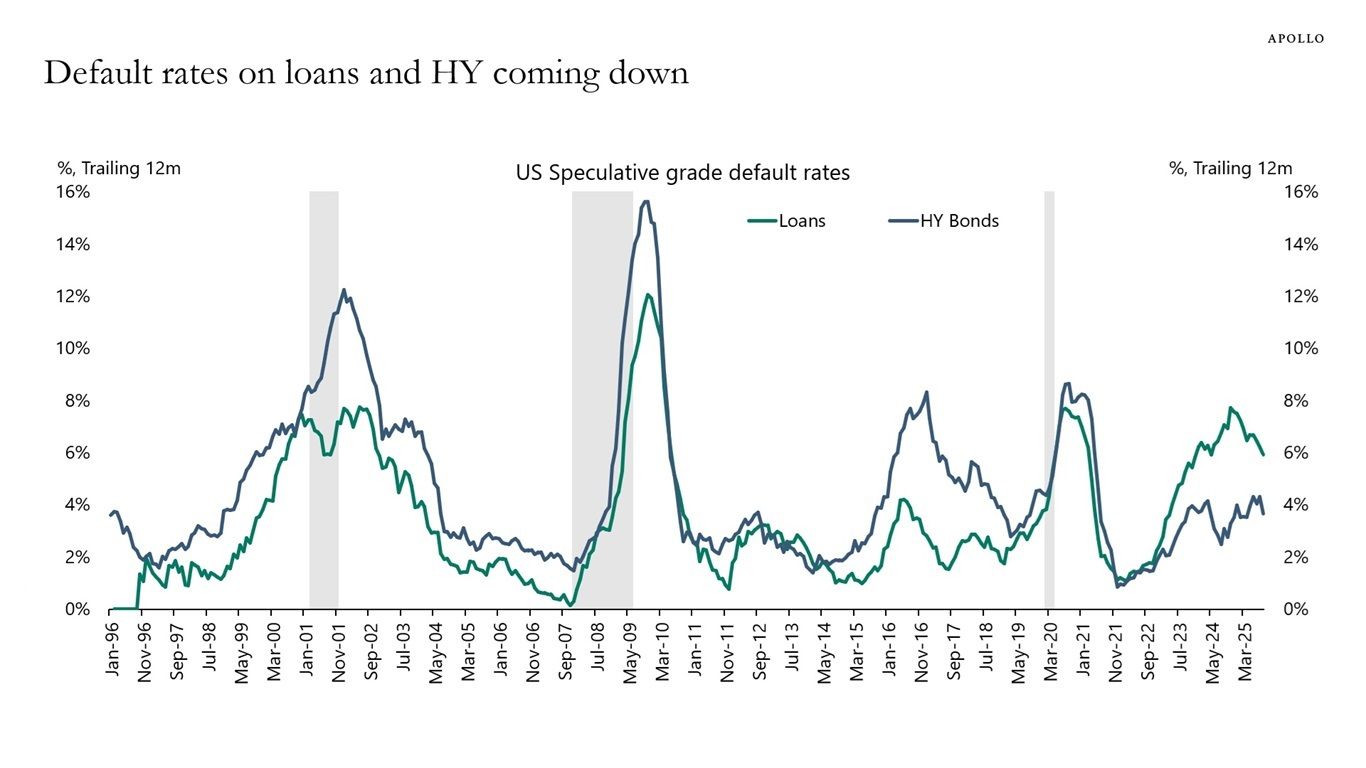

AI boom and ‘industrial renaissance’ erase trade war pain, Apollo says link

Default rates for high-yield debt and consumer loans have already peaked, signaling a turning point in credit stress. Moody’s and Fed data show both corporate and household delinquencies easing after months of steady climbs.

The AI buildout, especially in data centers and energy infrastructure, is now offsetting much of the drag from ongoing trade tensions. Rising stock prices are also fueling consumer spending, cushioning broader growth.

Apollo sees an “industrial renaissance” taking hold across aerospace, defense, biotech, and manufacturing, suggesting the next leg of expansion could come from sectors long considered mature.

Real Estate Trends

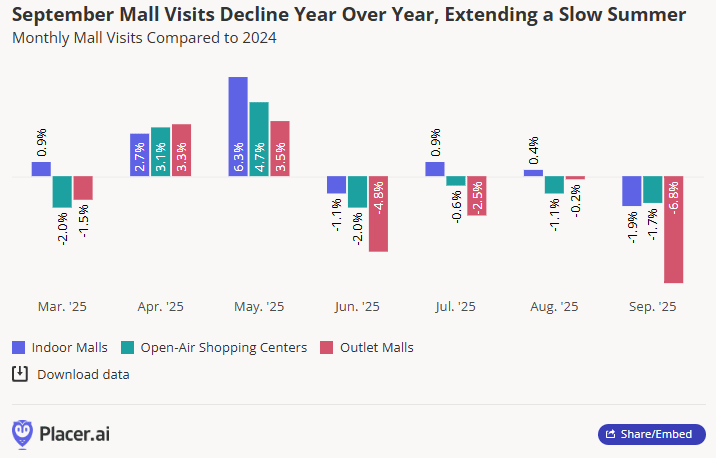

Mall foot traffic stalls into fall; Q3 mostly flat ahead of holidays link

September broke the summer streak: indoor mall visits fell 1.9% YoY, outlets dropped 6.85%, and open-air centers slipped 1.7%. One fewer Sunday vs. 2024 likely dragged results, outlets get ~18.2% of visits on Sundays vs. ~16% indoor and ~15.4% open-air.

Q3 was steadier than the headlines: indoor mall visits were down just 0.1% YoY, with open-air at -1.1% and outlets at -2.8%. Given inflation, tariffs, and higher living costs, those are mild declines.

Outlets are the laggard all year: trade areas skew lower- to middle-income (43.8% under $75k vs. 40.8% indoor, 37.8% open-air) and value shoppers are shifting to off-price chains (T.J. Maxx, Ross, Burlington, Marshalls, HomeGoods) that kept traffic steady. Limited dining/entertainment at outlets further caps repeat visits and dwell time.

My take: Outlet malls are losing the crowd. Unless they add food spots or experiences that make people want to stay longer, they’ll keep bleeding visits to places like T.J. Maxx and Ross. Indoor and open-air centers still have a shot this holiday season, but if foot traffic doesn’t bounce back, landlords could be in for some tough rent talks next year.

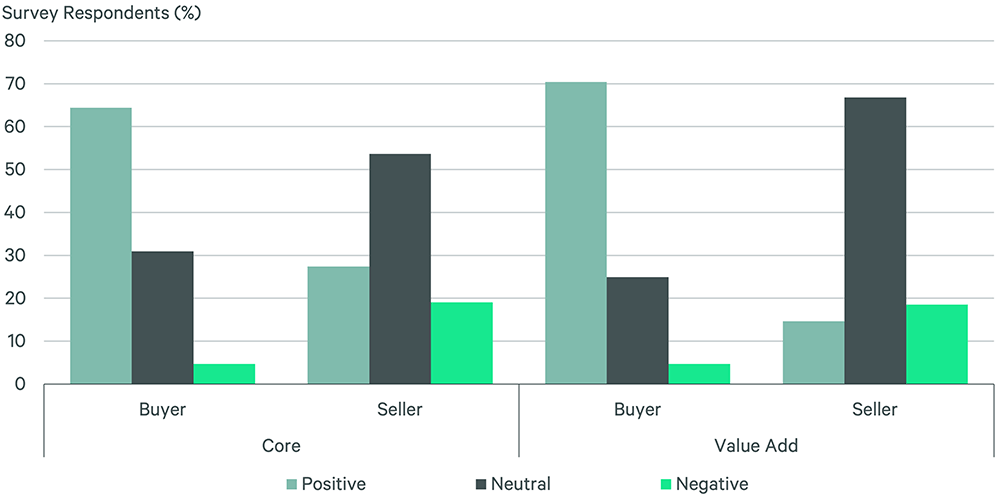

Multifamily buyer confidence climbs as rate cuts spark renewed deal appetite, Sun Belt markets lead gains link

Buyer & Seller Sentiment for Core & Value-Add Assets

Core multifamily going-in cap rates dipped 2 bps to 4.73%, while value-add IRRs fell for the seventh straight quarter to 9.49%, signaling tighter yield expectations amid cheaper financing.

Buyer sentiment jumped to 64% positive for core assets and 70% for value-add, the highest levels since 2023, led by Atlanta, Miami, and Nashville as the Fed’s September rate cut improved financing conditions.

Despite stronger demand, most sellers are still on hold, keeping the bid-ask spread narrow but persistent; CBRE expects more listings in Q4 as liquidity improves and cap rates compress further.

My take: Rate cuts are starting to thaw the multifamily freeze but not evenly. Expect Sun Belt metros to see bidding wars return first, while high-cost coastal markets lag until spreads normalize.

Americans Staying Put Longer Than Ever, Average Home Tenure Hits 8.4 Years link

The average U.S. homeowner who sold in Q3 2025 had owned their home for 8.39 years, the longest tenure in at least 25 years, up from 8.13 years last quarter. High mortgage rates and limited inventory are locking people in place.

Massachusetts tops the list with a record 12.9-year average tenure, while Maine ranks last at 4.8 years. The spread suggests that mobility has become sharply regional, influenced by local affordability and job market stability.

All-cash sales now account for 38.9% of transactions nationwide, up from 37.6% a year ago. In states like Hawaii (66.7%) and Vermont (100%), cash buyers dominate, a sign that equity-rich downsizers and investors are outmuscling financed buyers.

My take: Homeowners are “rate-locked,” but cash buyers aren’t and they’re quietly reshaping who controls housing supply. When mobility stalls and cash rules, expect fewer listings and more investor pricing power through 2026.

Single-family rent growth sinks to 15-year low link

U.S. single-family rents rose just 1.4% year-over-year in August, the weakest gain since 2010, according to Cotality. That’s down from 2.3% in July and well below last year’s 3% average.

Dallas rents fell 0.6%, the sharpest decline in the nation, as new apartment supply floods the market. Meanwhile, Chicago (+4.7%) and Los Angeles (+2.8%) led the few metros still seeing growth.

Multifamily vacancies hit a record 7.1% in September, with national median rent down to $1,394 , $48 below its 2022 peak but still 22% higher than early 2021.

My take: Rent growth has flipped from overheated to oversupplied. For investors, this isn’t a crash , it’s a reset. Builders and landlords in high-construction markets like Dallas will feel the squeeze first, while constrained metros like Chicago and L.A. may quietly win.

Something I found Interesting

65% of Americans say they’d buy a haunted house, if the price is right link

A Rocket Mortgage survey found 65% of Americans would consider buying a haunted home, with 39% saying yes outright and 26% open to the idea. One in three claim they’ve already lived in one.

Nearly 40% of buyers want at least a 40–59% discount to take on a “haunted” property, while only 15% would accept less than 20% off, showing how far affordability pressures are pushing the market.

Stigmatized homes are losing their stigma: 41% of respondents said they’d “befriend the ghost” or dig into the home’s backstory, and over half would still buy if a death occurred on-site, a sharp break from pre-pandemic buyer sentiment.

Location Specific

Southeast takes over CRE in 2025; 66% of Q2 projects, ~30% of U.S. capital link

Southeast captured 42.7% of projects in Q1 and 66.2% in Q2, with ~30% of total capital each quarter; Southwest ranked second for projects (16.8% → 14%), while the Northeast ranked second for capital (22% → 25.2%).

Multifamily led: 31% of projects (Q1) and 29.5% (Q2), pulling 67.6% of Q1 dollars and 30.2% in Q2; mixed-use, industrial, office, retail, and hospitality were each tiny slivers. Outside the survey, “residential” and “other” (land, car washes) each made ~30% of H1 activity, signaling capital rotation.

Fundraising shifted: Southeast’s capital share fell 11.5% while the Southwest rose 10.6%; the Northeast still eked out a +3.7% gain despite tougher conditions reported in West/Northeast.

My take: If the Southeast controls two-thirds of Q2 projects but lost capital share, entry cap rates there may finally loosen; I’d watch for softer pricing on good dirt. The Southwest’s +10.6% capital bump looks like the next bid, I’d shop multifamily and land there while others chase yesterday’s Sun Belt winners.

AI & Real Estate - Today’s Trends

Tool of the day: Lofty

Lofty is the all-in-one platform for real estate professionals. Automate marketing campaigns, boost your brand awareness, capture and convert more leads, all in ONE intuitive platform.

AI Is Officially Taking Over the Housing Market link

A new Realtor.com–Newsweek report shows 82% of Americans now use AI for housing insights,mainly ChatGPT and Gemini,reshaping how buyers find homes, narrow searches, and make decisions, even as agents remain the most trusted human advisors.

Mercator.ai Helps GCs Win Projects Before They Hit Bid Boards link

The Texas-based platform tracks 65,000+ active projects using AI to surface early signals like rezoning and land transfers,giving contractors a 40% efficiency boost and letting them win work weeks before public bids go live.

Tavant Unveils “TOUCHLESS” AI Mortgage Suite link

The fintech’s new system uses agentic AI and its assistant MAYA to handle underwriting, document checks, and borrower guidance, boosting underwriter productivity 12×, cutting origination costs 60%, and moving the mortgage industry toward fully automated lending.

Better.com Launches AI-Powered Wholesale Lending Platform link

Using its Tinman AI system, Better introduced a wholesale HELOC and CES lending program that lets brokers price and process loans up to $500K in minutes,bringing automation, faster closings, and zero origination fees to the wholesale market.

One Chart

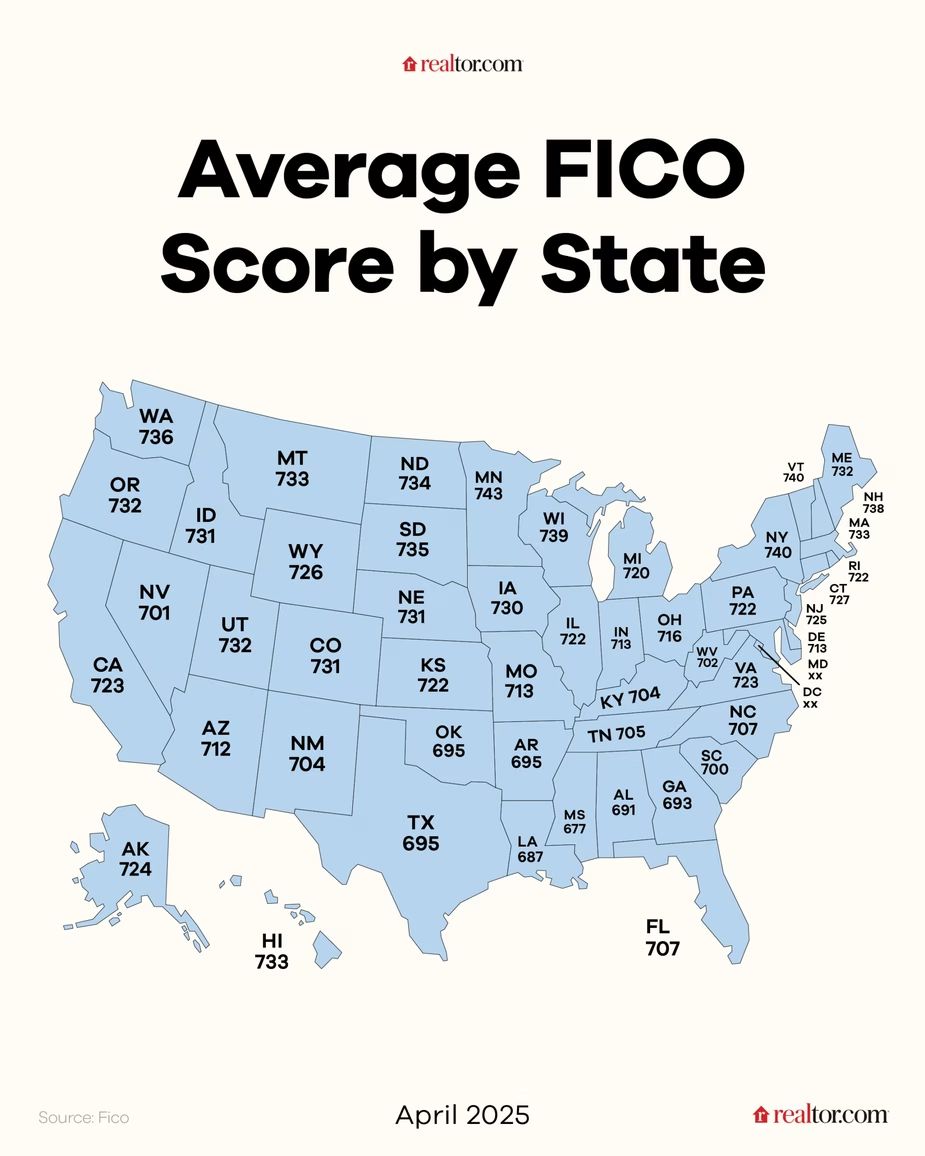

The Average Credit Score in Every State, as FICO Scores for Homebuyers Rise to 735

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

Nine Major Markets Record Sustained Annual Rent Growth for Five Years

(This content is restricted to Pro Members only. Upgrade)

The AI boom just broke the power grid

(This content is restricted to Pro Members only. Upgrade)

Top Markets for Planned Power Capacity

(This content is restricted to Pro Members only. Upgrade)

How Generational Shifts Are Reshaping the Rental Market

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

U.S. Cities Where People Spend the Most and Least on Groceries

Unreal Real Estate

One room wonder

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply