- Zero Flux

- Posts

- SFR Rent growth hits 15-yr Low

SFR Rent growth hits 15-yr Low

Charted: How Investors allocate their Investments by country, A Doomsday Bunker and More!

How can we make this newsletter more valuable to you?

Please reply with any feedback - It would mean a lot!

Hope you enjoy today's insights

A quick word from our sponsor

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.24% | +0.01% | +0.02% | 6.13 / 7.26 |

15 Yr. Fixed | 5.76% | +0.01% | -0.02% | 5.60 / 6.59 |

30 Yr. FHA | 5.86% | +0.01% | +0.01% | 5.82 / 6.59 |

30 Yr. Jumbo | 6.39% | +0.01% | -0.01% | 6.10 / 7.45 |

7/6 SOFR ARM | 5.82% | +0.05% | +0.11% | 5.59 / 7.25 |

30 Yr. VA | 5.87% | +0.01% | +0.00% | 5.85 / 6.60 |

⚡ Snapshot: The 7/6 SOFR ARM led today’s moves with a +0.05% bump, while fixed-rate products barely budged, suggesting early signs of rate stabilization after several volatile weeks.

New here? Join the newsletter (it's free).

Macro Trends

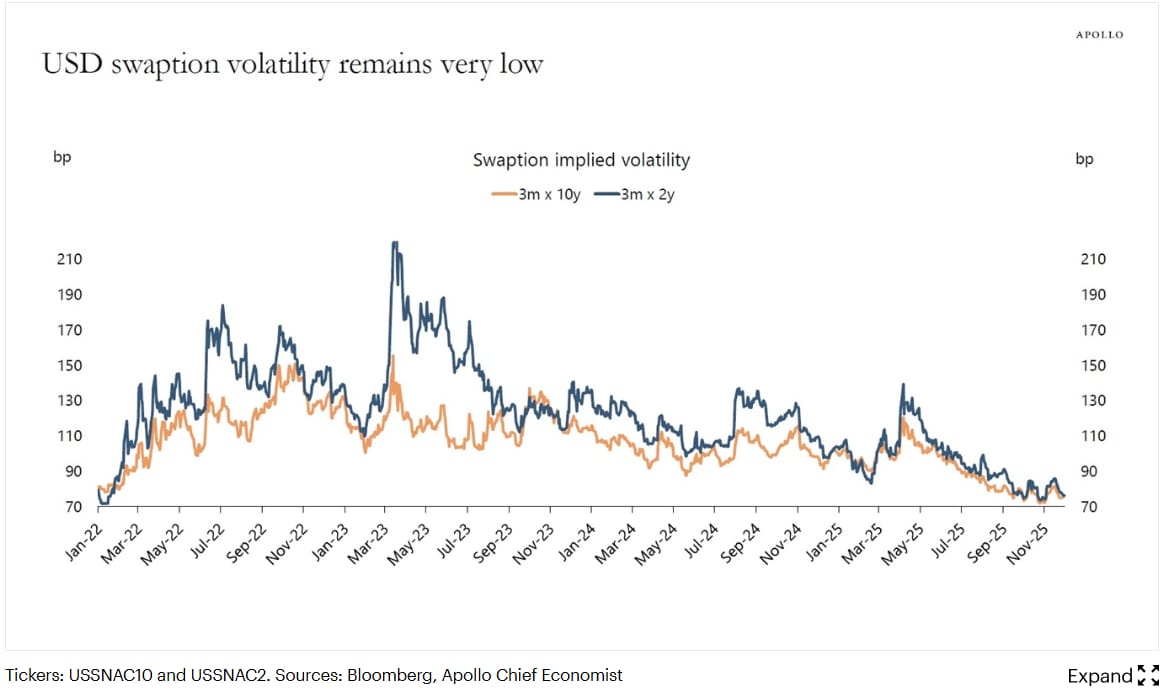

Markets signal calm despite Fed uncertainty link

Swaption implied volatility for both 3m x 2y and 3m x 10y has fallen toward multi-year lows near 80 to 90 bp, even with debate over the upcoming Fed decision.

The market is pricing in minimal near-term rate swings, suggesting traders expect yields to stay broadly stable over the next three months.

My take: Low rate volatility shows investors see the Fed’s path as more predictable than the headlines suggest, which lowers recession odds and supports steadier financing conditions.

Real Estate Trends

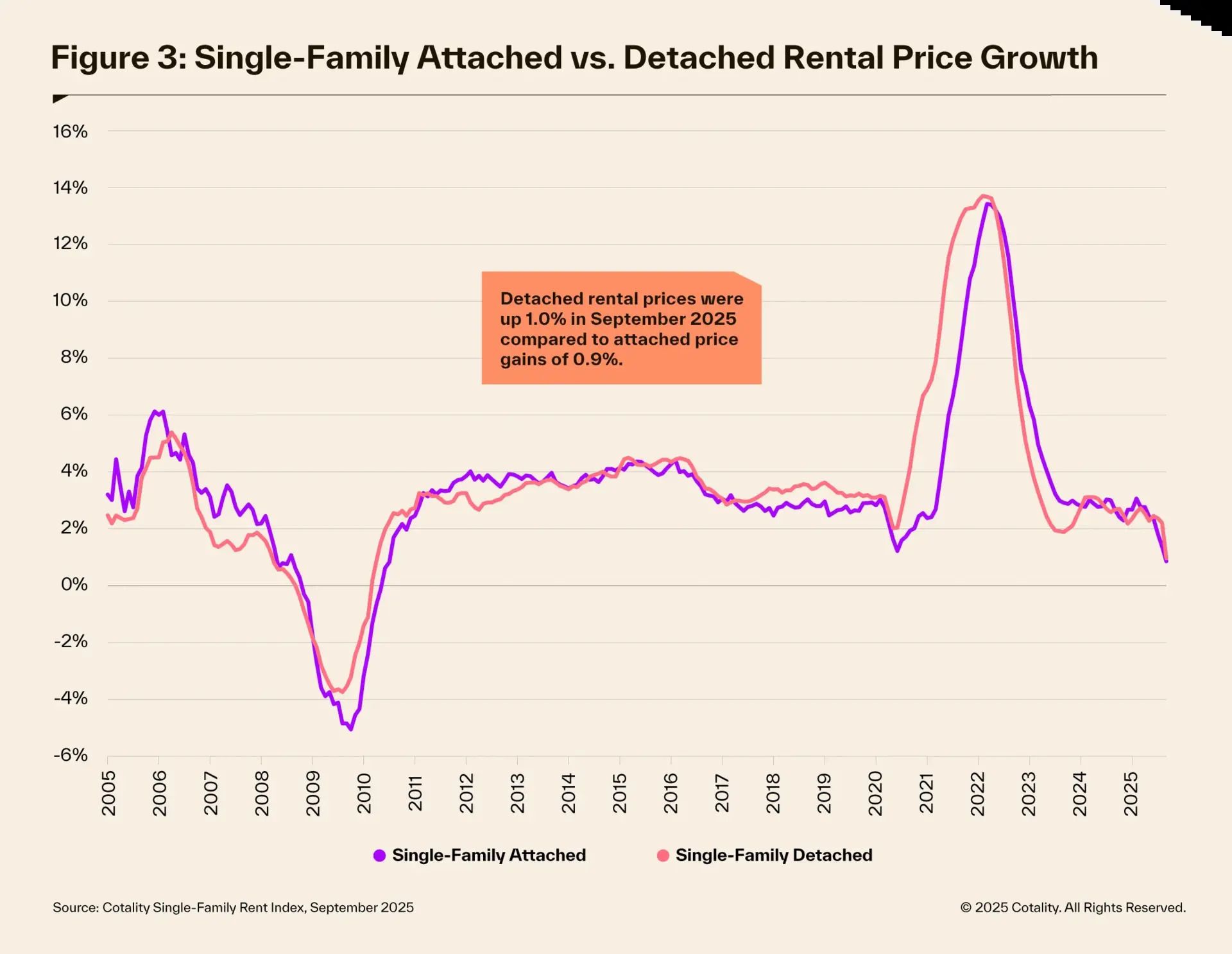

Single-family rent growth hits 15-year low link

U.S. single-family rents rose just 1% year over year in September, the weakest growth since 2010, with 26% of major metros posting rent declines.

Despite the slowdown, rents are still up 29% in five years, adding about $7,300 a year to the average renter’s costs, with Miami and Dallas seeing some of the steepest cumulative increases.

My take: Softening rent growth helps affordability, but high cumulative hikes mean renter budgets stay tight.

Big Money Is Quietly Building a New CRE Asset Class link

B+E data shows early-education real estate for sale is up 14%, with strong tenants like KinderCare signing long triple-net leases that deliver bond-like income and double-digit operator margins.

A 6 million-child supply gap and 51% of U.S. markets classified as child-care deserts are pulling developers into high-demand locations, backed by new institutional capital like Fortec’s $100 million fund.

My take: Investors should watch this niche, because the fundamentals look like early-stage senior housing or MOBs before they institutionalized. Tight supply and long leases make it a rare yield play in a high-rate market.

Historic MOB Supply Drop Will Reshape Healthcare Real Estate in 2026 link

CBRE reports MOB completions will fall another 26% in 2026, hitting decade-low levels, which is expected to push rents to record highs as occupiers shift into second-generation retail and office space.

Aging demographics and tighter healthcare margins are accelerating demand for lower-cost outpatient sites, while AI adoption rises and new federal policy cuts more than $1 trillion in spending, reshaping provider real estate strategy.

My take: Investors should watch MOB rent growth and conversion plays, because constrained supply and shifting care models could drive outsized returns in select markets.

Small-bay industrial keeps outperforming big-box link

As per Yardi Matrix, sub-100k SF facilities saw a 16% jump in 2025 groundbreakings and 10.6% sale price growth, versus 3.5% for larger assets.

Industrial vacancy reached 9.6% nationally, yet small-bay rents stay firm, with Miami in-place rents up 8.9% year over year despite new supply.

My take: Investors should target infill small-bay deals, where demand and pricing still run ahead of the broader industrial market.

Proptech Funding, Fresh Off the Wire

Buildroid, a simulation-First Robotics Platform raised a $2M pre-seed led by Tim Draper.

Tidalwave secured $22M Series A led by Permanent to leverage AI for scaling its mortgage management platform.

MadeCard closed an $8M seed round led by Jump to expand its mortgage payment rewards offering with AI-enabled home journal and concierge chatbot functionalities.

Location Specific

Ohio’s housing market is tightening faster than the rest of the country link

Ohio’s supply sits at 2.1 months, 24% tighter than the national average, even as active inventory jumped 22% year-over-year and homes sell 28 days faster than the U.S. median.

Price cuts hit 45% of listings, well above normal levels, with Columbus leading at 51.6%, signaling demand soft spots despite rising statewide prices.

AI & Real Estate

Tool of the day: InspectMind

AI tool for generating construction inspection reports and field observations in minutes

AI Tools Boost Appraisals, Agent Systems and Location Data link

HousingWire reports that Tech100 winners pushed AI deeper into valuations, agent platforms and location intelligence. ValueLink added new AI review tools, Lofty scaled its AI system to 70,000 agents, and Local Logic now reaches 22 million monthly users.

AI Agents Move Closer to Real Banking Tasks link

Business Wire reports that Payman AI and Middlesex Federal are building an AI agent that can move money, pay bills and handle tasks from simple voice or text prompts. The system ties natural language to secure transactions with full audit trails, keeping humans in the loop.

AI Sales Platform Gains Traction with CRE Teams link

WebWire reports that Jeeva AI raised $9 million to scale its agentic sales platform, now used by 35,000 reps across real estate and other sectors. JLL says the tool cuts busywork and boosts deal productivity by up to 10x.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

The Student Housing Metric Hinting at 2026 Winners

(This content is restricted to Pro Members only. Upgrade)

How to Spot Good Bones Before You Pay for an Inspection

(This content is restricted to Pro Members only. Upgrade)

AI cuts underwriting time and triples portfolio capacity at a $100B bank

(This content is restricted to Pro Members only. Upgrade)

Housing’s Slowdown Finds an Unexpected Winner

(This content is restricted to Pro Members only. Upgrade)

CMBS Delinquencies Ease, but Lodging and Industrial Show New Stress

(This content is restricted to Pro Members only. Upgrade)

Exclusive Insights: PropTech Fundings

(This content is restricted to Pro Members only. Upgrade)

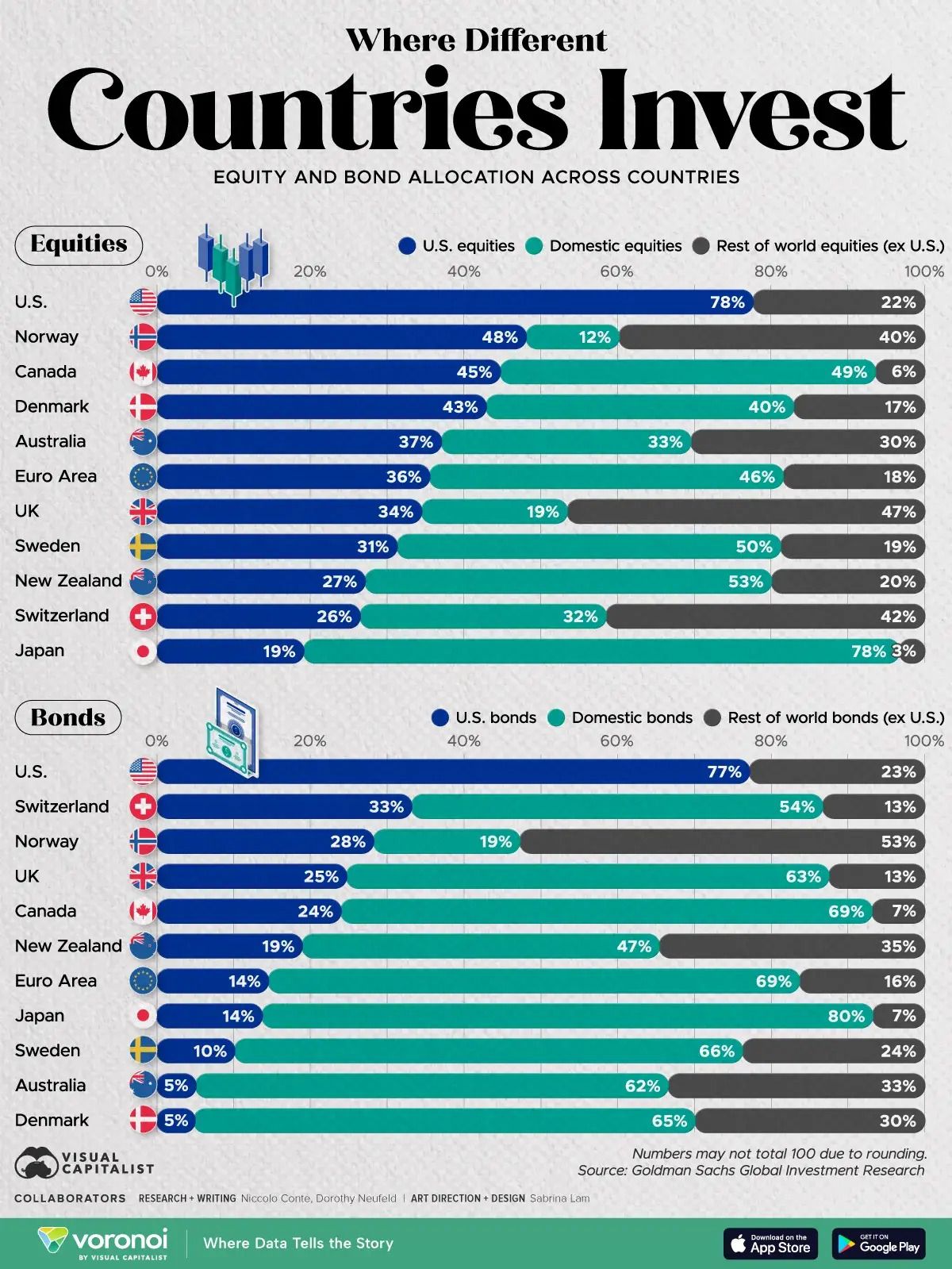

One Chart

Charted: How Investors allocate their Investments by country

Unreal Real Estate

A Doomsday Bunker

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply