- Zero Flux

- Posts

- Suburban malls are being converted to these

Suburban malls are being converted to these

Mapped: The Most Common Job in Each U.S. State in 2024 and 12 other real estate insights

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.81% | +0.00% | +0.03% | 6.11 / 7.26 |

15 Yr. Fixed | 6.06% | +0.01% | +0.02% | 5.54 / 6.59 |

30 Yr. FHA | 6.39% | +0.00% | +0.04% | 5.65 / 6.62 |

30 Yr. Jumbo | 6.90% | +0.00% | +0.00% | 6.37 / 7.45 |

7/6 SOFR ARM | 6.26% | +0.00% | +0.02% | 5.95 / 7.25 |

30 Yr. VA | 6.40% | +0.00% | +0.04% | 5.66 / 6.64 |

New here? Join the newsletter (it's free).

Macro Trends

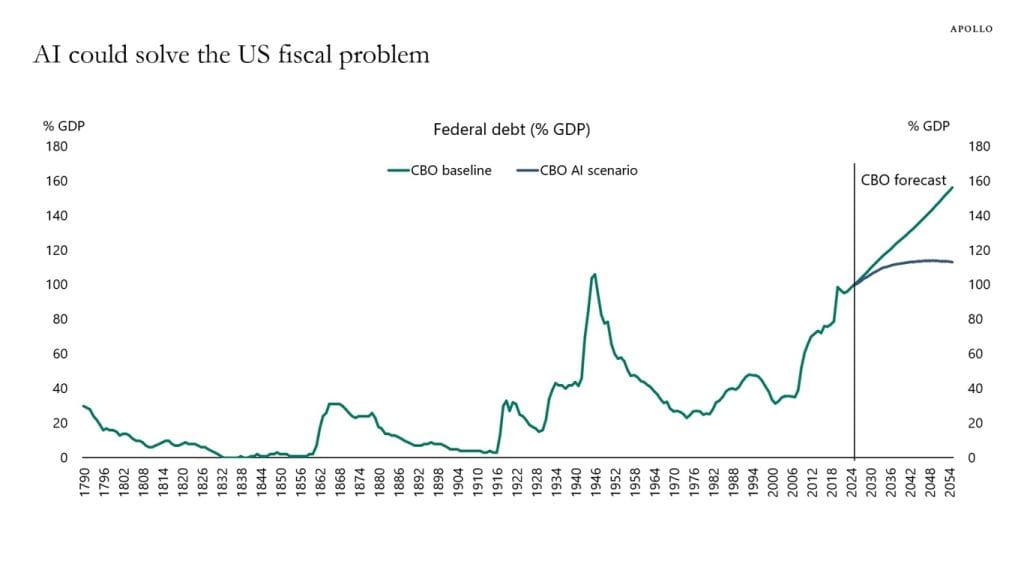

AI Could Solve the US Fiscal Problem link

The Congressional Budget Office says AI could permanently boost GDP growth and cut inflation, which in turn could fix the long-term U.S. debt outlook. That’s a big claim with trillion-dollar implications.

If AI drives sustained productivity increases, it could shrink the U.S. budget deficit without needing higher taxes or spending cuts. This would be a rare win-win scenario for both policymakers and investors.

The chart referenced shows drastic improvement in fiscal projections under an AI-driven growth scenario—basically flipping the outlook from deep red to stable. But this hinges on AI delivering real economic gains over time.

Real Estate Trends

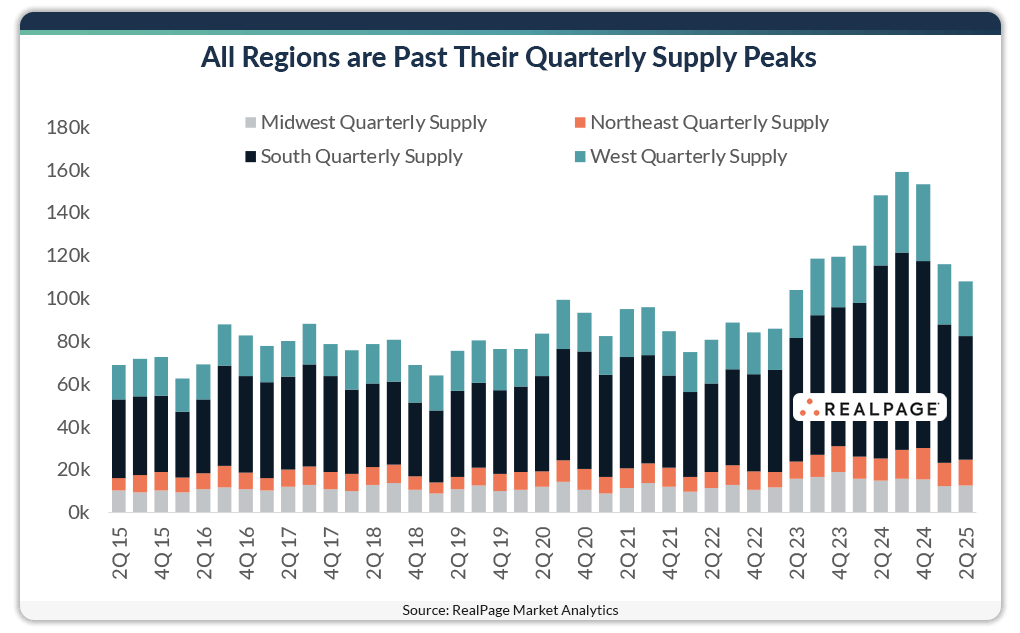

Apartment supply cools fast—South hit hardest link

Only 108,200 units were completed nationwide from April to June 2025, a sharp drop from the Q3 2024 peak of 159,000 units. This ends a 9-quarter streak of record-breaking apartment deliveries.

The South delivered 57,800 units in Q2—the most of any region—but that’s nearly 7,000 fewer than Q1, showing the steepest pullback in the country.

Dallas, New York, Phoenix, and Austin each added over 5,000 units last quarter, but all four saw delivery volumes decline from recent highs, signaling a slowdown even in high-growth markets.

Speculative Industrial Projects Stall—Build-to-Suit Takes Over link

The share of build-to-suit (BTS) industrial space jumped from 28.6% to 34.5% year-over-year, while speculative deliveries dropped from 87.4% to 71%, signaling a major shift in development strategy.

Midwest markets like Indianapolis and Columbus, where BTS now makes up as much as 79% of construction, saw minimal vacancy increases—just 30 bps—compared to up to 210 bps in other regions.

Vacancy rates are projected to rise into the mid-to-high 7% range nationally, but tenant-favorable conditions may be short-lived as speculative pipelines shrink and BTS dominates.

Suburban malls are being torn down—for apartments, senior housing, and 'town greens' link

Over 4.3 million square feet of retail space is being removed across the Tri-State area, with 1.3 million square feet of new housing planned in mall redevelopments. At least 12 malls have changed hands since 2015, signaling a major repositioning of retail real estate.

Garden State Plaza is adding 1,400 apartments, a 7-story hotel, medical offices, a transit center, and a public “town green.” This shift is turning malls into mixed-use hubs built around walkability and multigenerational living.

Lifestyle centers like Green Acres Mall are investing $150M to demolish old department stores and build 400,000 sq. ft. of outdoor-facing retail, food, and entertainment spaces. These designs aim to keep shoppers longer and attract higher-end tenants.

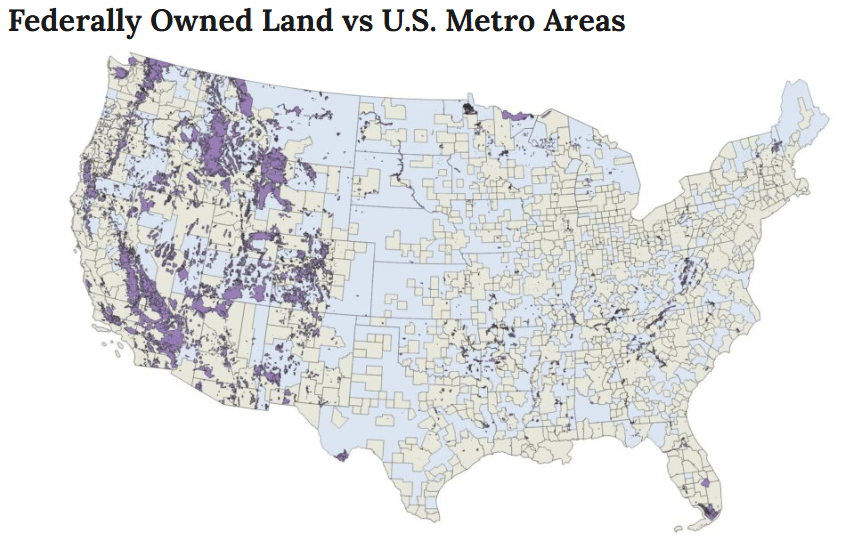

Federal land won't fix the housing crisis—here’s why link

The U.S. faces a housing shortfall of nearly 4 million homes, but most federal land is located in Alaska and Western states—far from the high-demand metros in the Northeast, which alone is short 830,000 homes. This mismatch limits the impact of federal land sales on solving the housing crunch.

Even if federal land were released, only about 10% of U.S. metro/micropolitan areas include Bureau of Land Management (BLM) land. For example, Las Vegas added 90 acres in a March auction, but local inventory is already 30% above pre-pandemic levels, suggesting other metros need the help more.

To close the 3.8 million home gap at typical county density (1 home per 2.5 acres), about 10 million acres of land would be required. The BLM manages over 240 million acres, but much of it is too remote, lacks infrastructure, or is in regions with low housing demand.

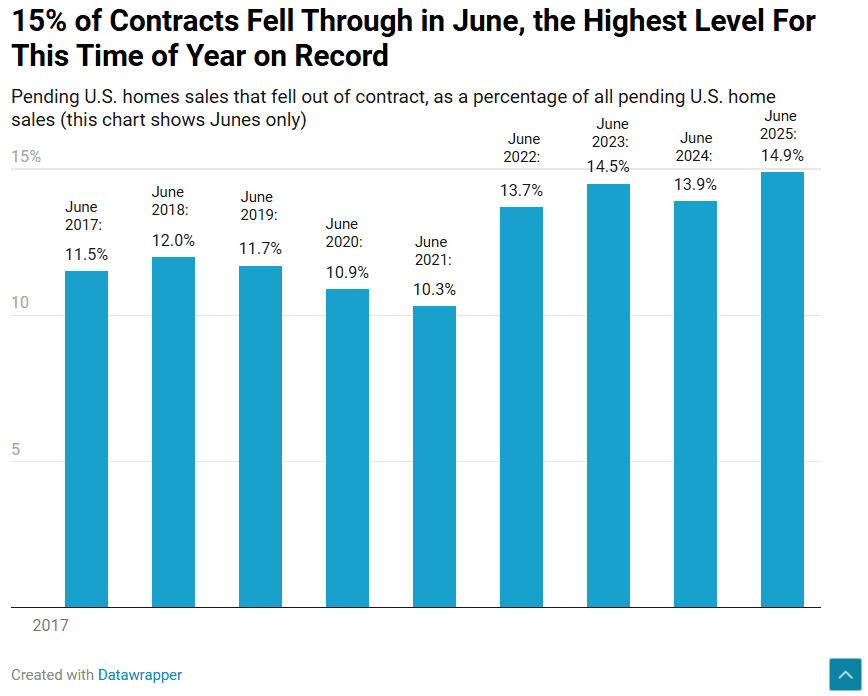

1 in 7 Homebuyers Are Walking Away From Deals—Sun Belt Cities See the Most Cancellations link

Nationwide, 14.9% of pending home sales were canceled in June, the highest June rate since at least 2017. That’s over 57,000 deals falling through, driven by buyer hesitation and better options popping up.

Sun Belt cities are getting hit hardest, with Jacksonville (21.4%), Las Vegas (19.7%), and Atlanta (19.6%) topping the cancellation list. High new construction volume and rising insurance costs in places like Florida and Texas are pushing buyers to back out.

It’s a full-blown buyer’s market, with more sellers than buyers and softening negotiation standards. In some cases, sellers are slashing prices by six figures just to keep deals alive.

Something I found Interesting

U.S. Manufacturing Boom Stalls—Billions Spent, Few Jobs Gained link

Manufacturing job numbers have dropped by 150,000 since 2023, falling from 12.9M to 12.75M workers, despite massive federal investment and construction growth. The sector has seen little recovery since the pandemic.

Spending on manufacturing construction tripled from $6.26B in April 2021 to $20.80B in October 2024, but factory output and hiring haven’t followed. Much of the spending focused on semiconductors and clean energy, with limited return so far.

PMI data shows continued contraction, with the Institute for Supply Management’s Manufacturing PMI remaining below 50 for most of the past three years. CRE investors face rising vacancy risks as new facilities sit underused and industrial demand softens.

AI & Real Estate - Today’s Trends

Tool of the day - PredictAP

PredictAP is an AI-powered invoice processing platform that automates accounts payable workflows for real estate and property management companies. It extracts and codes data from invoices, reducing manual entry and improving accuracy and efficiency in financial operations.

First-Time Sellers Are Turning to AI for Virtual Staging That Sells link

AI tools now let sellers stage empty rooms with photorealistic furniture in minutes — boosting listing appeal without the cost of traditional staging.

AI Is Taking Over Real Estate Content — And It’s Working link

From listing descriptions to social media and video tours, agents are using AI to create high-converting content at scale — saving time while driving engagement.

Investors Are Flocking to AI-Powered Property Inspections in 2025 link

Smart inspection tools now use AI to spot damage, code violations, and deferred maintenance — helping investors de-risk deals before they close.

AI Set to Reshape Private Real Estate Over the Next Decade – link

From predictive analytics to automated asset management, private real estate firms are betting big on AI to boost returns and streamline decision-making in the 2030s.

A word from our sponsor

Stop Drowning in Market News. Focus On Making Money.

Every day: 847 financial headlines, 2,300 Reddit stock mentions, 156 Twitter trading threads, 12 IPO updates, 94 crypto developments.

Your problem isn't lack of information; you have too much.

While you're scanning headlines wondering what matters, profitable trades slip by. The signal gets buried in noise.

What if someone did the heavy lifting for you?

Stocks & Income reads everything:

Twitter traders

Reddit buzz

IPO announcements

Crypto insider takes

Crowdfunding opportunities

Market news

Then we send you only what can actually move your portfolio.

No fluff. No useless news. Just actionable stock insights in 5 minutes.

We track every source so you don't have to. You get the 3-5 opportunities worth your time, delivered daily.

Stop wasting time on useless “investing news” and start thinking critically about real opportunities in the stock market.

Stocks & Income is for informational purposes only and is not intended to be used as investment advice. Do your own research.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

Newest Office Trends - pretty interesting!

(This content is restricted to Pro Members only. Upgrade)

10 Industrial Real Estate Markets That Are Breaking All the Rules

(This content is restricted to Pro Members only. Upgrade)

Top 10 Housing Markets with Largest Annual Increases in Profit Margins in Q2 2025

(This content is restricted to Pro Members only. Upgrade)

Trouble Brewing for Malls

(This content is restricted to Pro Members only. Upgrade)

Rent discount trends. What’s happening?!

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

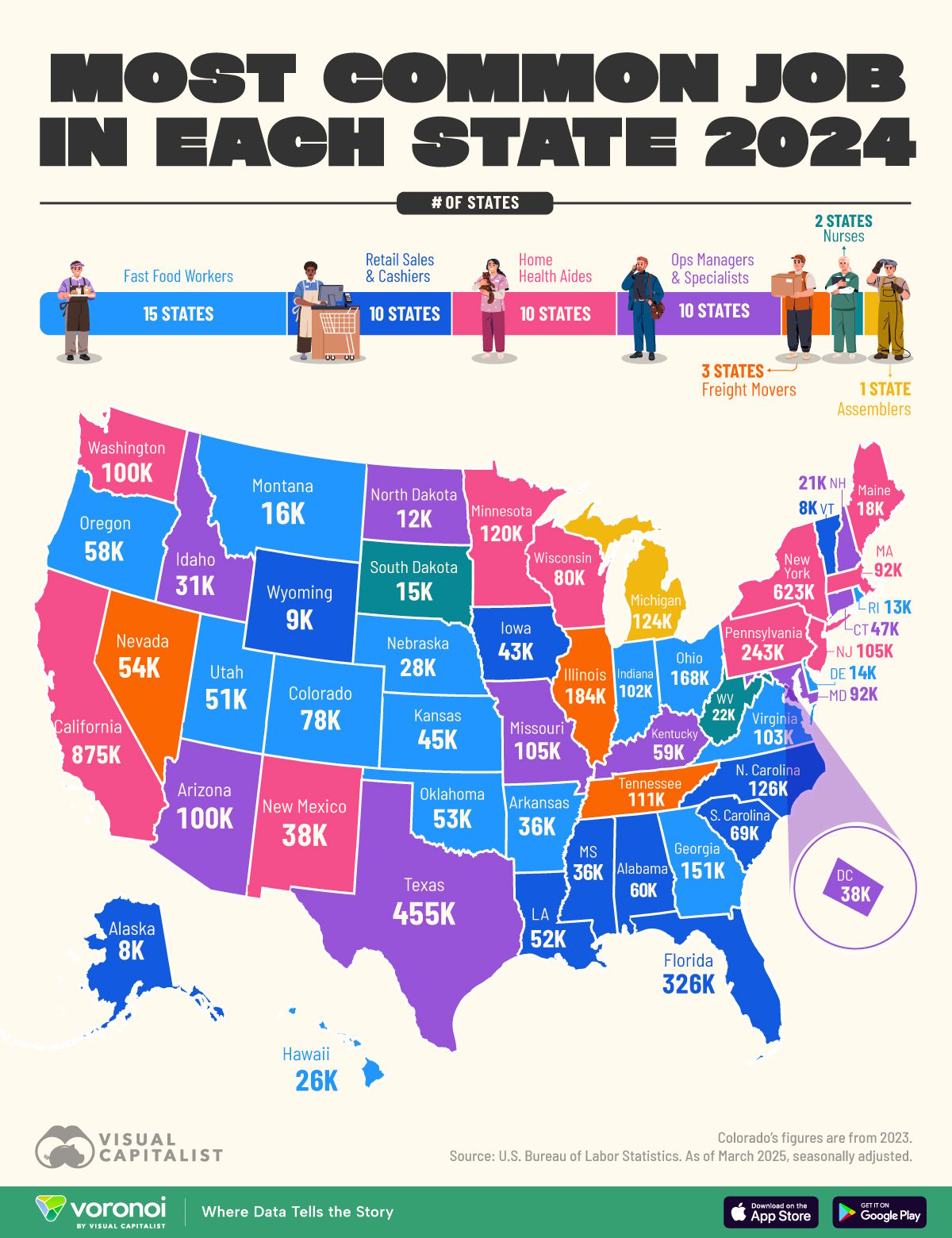

Mapped: The Most Common Job in Each U.S. State in 2024

Unreal Real Estate

70’s upper middle class chic!

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply