- Zero Flux

- Posts

- This asset is beating the CRE slump

This asset is beating the CRE slump

AI Tool of the day and 12 other real estate insights

Share Zero Flux with a friend using your unique link and unlock 3 months of premium free:

https://www.zeroflux.io/subscribe?ref=PLACEHOLDER

And if you get 25 signups overtime with this link, premium is yours for life 🎉

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.45% | -0.04% | -0.05% | 6.11 / 7.26 |

15 Yr. Fixed | 5.81% | -0.04% | -0.05% | 5.54 / 6.59 |

30 Yr. FHA | 6.03% | -0.02% | -0.03% | 5.65 / 6.62 |

30 Yr. Jumbo | 6.40% | -0.02% | -0.05% | 6.37 / 7.45 |

7/6 SOFR ARM | 5.80% | -0.02% | -0.10% | 5.80 / 7.25 |

30 Yr. VA | 6.05% | -0.02% | -0.03% | 5.66 / 6.64 |

New here? Join the newsletter (it's free).

Macro Trends

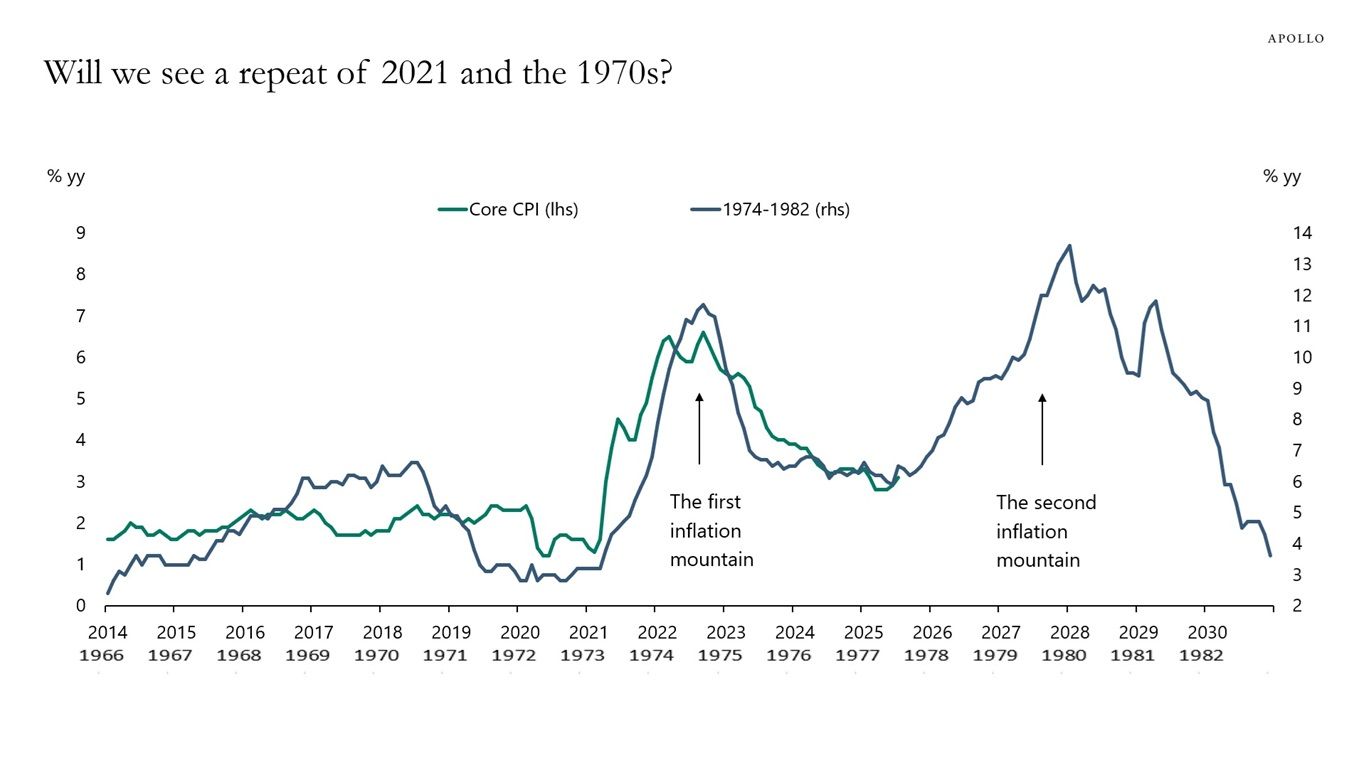

Will We See a Repeat of 2021 and the 1970s? link

Apollo’s chief economist says tariffs, a weaker dollar, and Fed infighting could push inflation and expectations higher, echoing 2021 or even the 1970s.

He warns of another “inflation mountain” forming in the coming months, with charts showing the parallels.

The Fed’s split focus between slowing jobs and rising prices increases the risk of policy missteps, which could prolong inflation pressures.

Real Estate Trends

Manufactured housing beats CRE slump - investors chase steady cash flow link

The U.S. now has 7.4 million manufactured housing units, and production hit 103,000 in 2024—double what it was a decade ago—yet vacancy remains just 5.2%. Demand is holding even as supply expands.

Manufactured housing cap rates have nearly converged with multifamily: in 2015 the spread was 145 basis points, but by 2024 rates were nearly identical at 5.48% vs. 5.52%. Investors are valuing the sector more like core multifamily.

Credit performance is strong: delinquency rates are only 1.39% compared to 10.99% for office and 6.19% for multifamily. Institutional ownership is still just 20%, leaving room for more capital to enter.

Multifamily supply surge: Yardi lifts 2025–27 completions forecast link

Yardi now expects about 550,000 multifamily units to deliver in 2025, 430,000 in 2026, and 360,500 in 2027—raising forecasts by 2.1%, 1.8%, and 2.9%. The Q2 2025 pipeline still holds more than 1 million units despite a 6.5% quarterly drop.

Market-rate apartment deliveries are set to collapse 60% by 2026 compared to 2024, nearly twice the decline forecast for affordable housing. This signals a widening supply gap between luxury and affordable segments.

Federal incentives under the One Big Beautiful Bill Act—expanding LIHTC funding and lowering bond thresholds—could push more capital into affordable housing and reshape delivery trends beyond 2027.

CMBS delinquencies climb again - office and multifamily pain deepens link

The overall CMBS delinquency rate rose to 7.29% in August, up for the sixth straight month, with $44.1 billion now delinquent out of $604.6 billion outstanding.

Multifamily delinquencies jumped 71 basis points to 6.86%, the highest in nine years, while office hit another record at 11.66% after a 62-point surge.

Retail was the only bright spot, with its delinquency rate falling 48 basis points to 6.42%, the lowest level in a year.

Investor housing market share dips but stays high link

Investors bought 32% of single-family homes in January 2025, but their share slipped to 29% by June. Even with the dip, activity is still well above past averages.

Medium-sized investors—those larger than mom-and-pop landlords but smaller than Wall Street firms—are driving much of the buying volume. Their influence has grown steadily in recent years.

The decline in Q2 signals cooling momentum, but the sustained high share suggests investors remain a major force shaping housing supply and affordability.

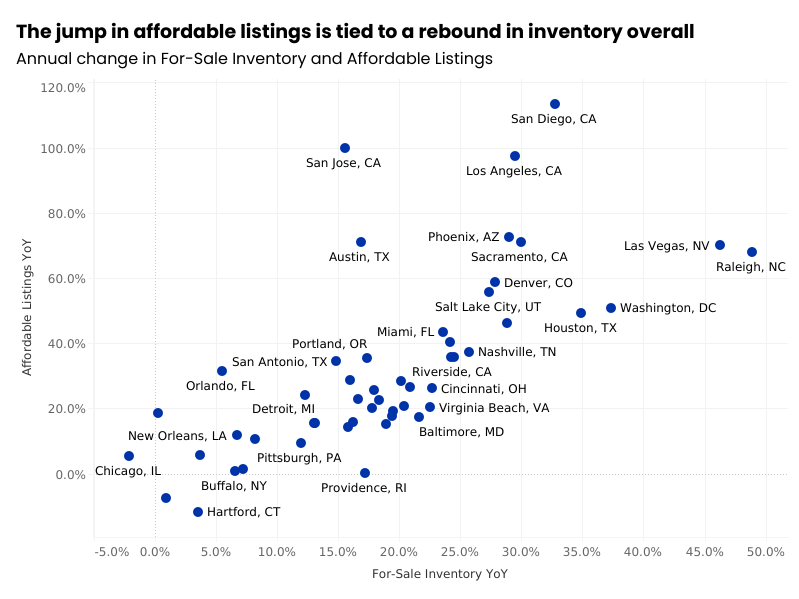

Affordable listings hit 3-year high, but true housing relief still out of reach link

About 439,000 homes were affordable to median-income households in July 2025, the most since August 2022 and 20% higher than last year, thanks to an 18% jump in total inventory. But only 31.7% of listings were affordable, far below the 53.7% share in July 2020.

Affordability is split by region: more than half of listings were affordable in Buffalo, St. Louis, Pittsburgh, Detroit, and Cleveland, while Los Angeles offered just 3% and San Diego only 6.4%. Sun Belt markets like Austin and Phoenix saw the sharpest gains in affordability share.

Zillow says it would take mortgage rates dropping to 4.43% or home values falling 18% to make the typical U.S. home affordable—both scenarios tied to economic downturn. The underlying problem is a 4.7 million-home deficit that can only be solved by building more housing.

AI & Real Estate - Today’s Trends

Tool of the day - Higharc

Connected cloud platform for automated homebuilding design and planning.

Building the Ultimate AI Tech Stack for Multifamily Operators – link

Altus Group outlines how owners can layer AI tools for leasing, maintenance, and revenue management — creating a streamlined, future-proof multifamily operation.

JLL’s CTO Explains How AI Will Redefine Commercial Real Estate – link

JLL CTO Yao Morin shares how AI is driving smarter site selection, portfolio optimization, and tenant experiences — setting the stage for a data-first CRE industry.

AI Is Reinventing the Multifamily Maintenance Call Center – link

AI-driven call centers are triaging tenant requests, predicting repair needs, and dispatching vendors faster — slashing costs while improving resident satisfaction.

Realie Uses AI to Create Ultra-Realistic Virtual Property Tours – link

The new platform blends AI and VR to generate lifelike, customizable property walkthroughs — giving buyers immersive experiences without stepping inside.

A word from our sponsor

The Gold standard for AI news

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

List of Riskiest U.S. Housing Market Counties in Q2 2025

(This content is restricted to Pro Members only. Upgrade)

Most Popular Cities for Mega Investors- new hot spots may surprise you

(This content is restricted to Pro Members only. Upgrade)

How one CRE giant is finding undervalued assets in unlikely areas

(This content is restricted to Pro Members only. Upgrade)

Healthcare real estate is shifting fast- what’s fueling the new wave of development?

(This content is restricted to Pro Members only. Upgrade)

Real Estate Forecast Next 10 Years: Future of Housing Market

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

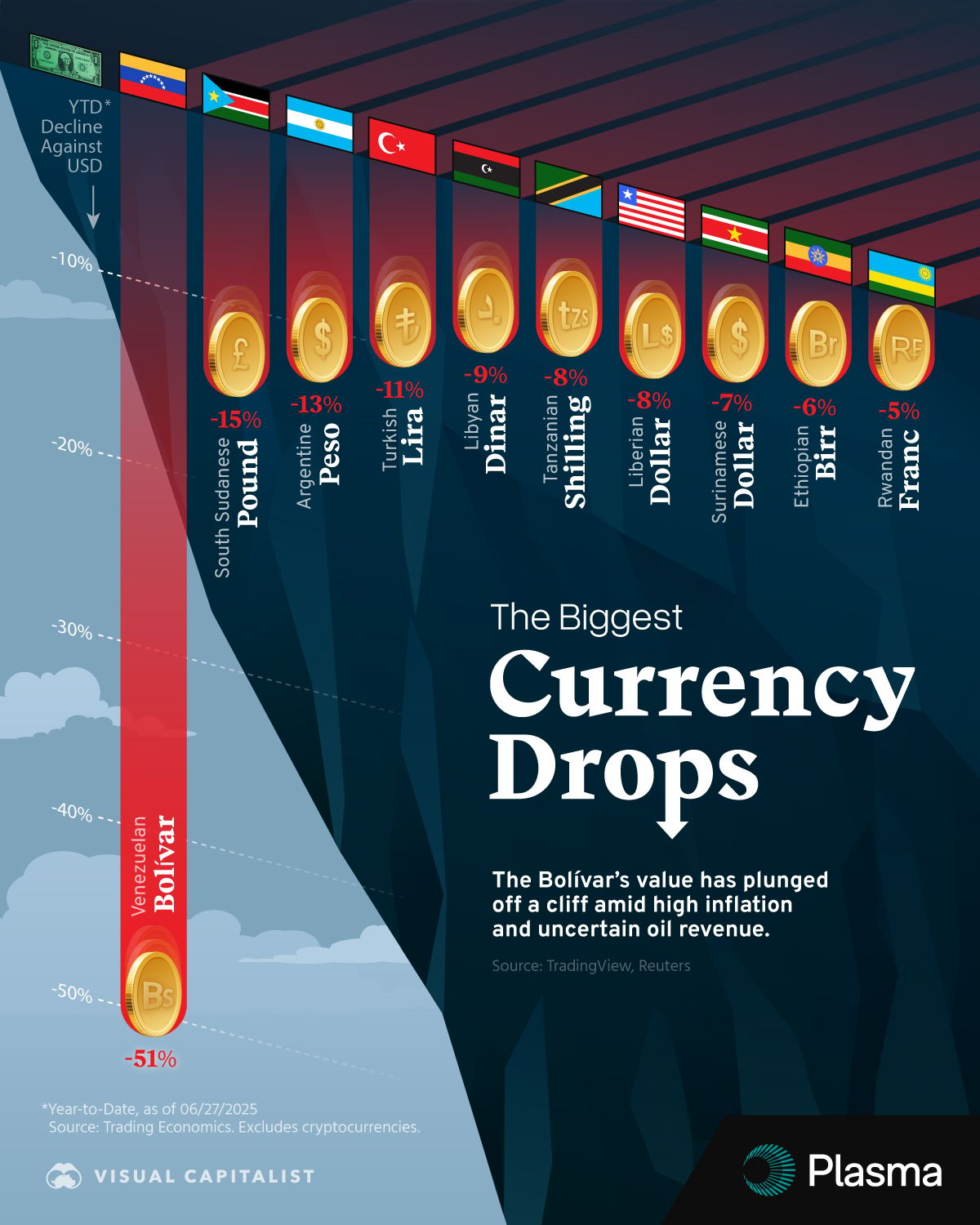

Ranked: The Biggest Currency Drops So Far in 2025

Unreal Real Estate

Creepy alright!

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply