- Zero Flux

- Posts

- Trump may axe capital gains tax on home sales

Trump may axe capital gains tax on home sales

Ranked: U.S. States Most Dependent on the Federal Government and 12 other real estate insights

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.81% | +0.03% | -0.01% | 6.11 / 7.26 |

15 Yr. Fixed | 6.05% | +0.01% | -0.02% | 5.54 / 6.59 |

30 Yr. FHA | 6.38% | +0.02% | -0.02% | 5.65 / 6.62 |

30 Yr. Jumbo | 6.91% | +0.01% | -0.01% | 6.37 / 7.45 |

7/6 SOFR ARM | 6.27% | +0.02% | -0.04% | 5.95 / 7.25 |

30 Yr. VA | 6.40% | +0.02% | -0.02% | 5.66 / 6.64 |

New here? Join the newsletter (it's free).

Macro Trends

Dollar Poised for Rebound After Surprising Slump in Early 2025 link

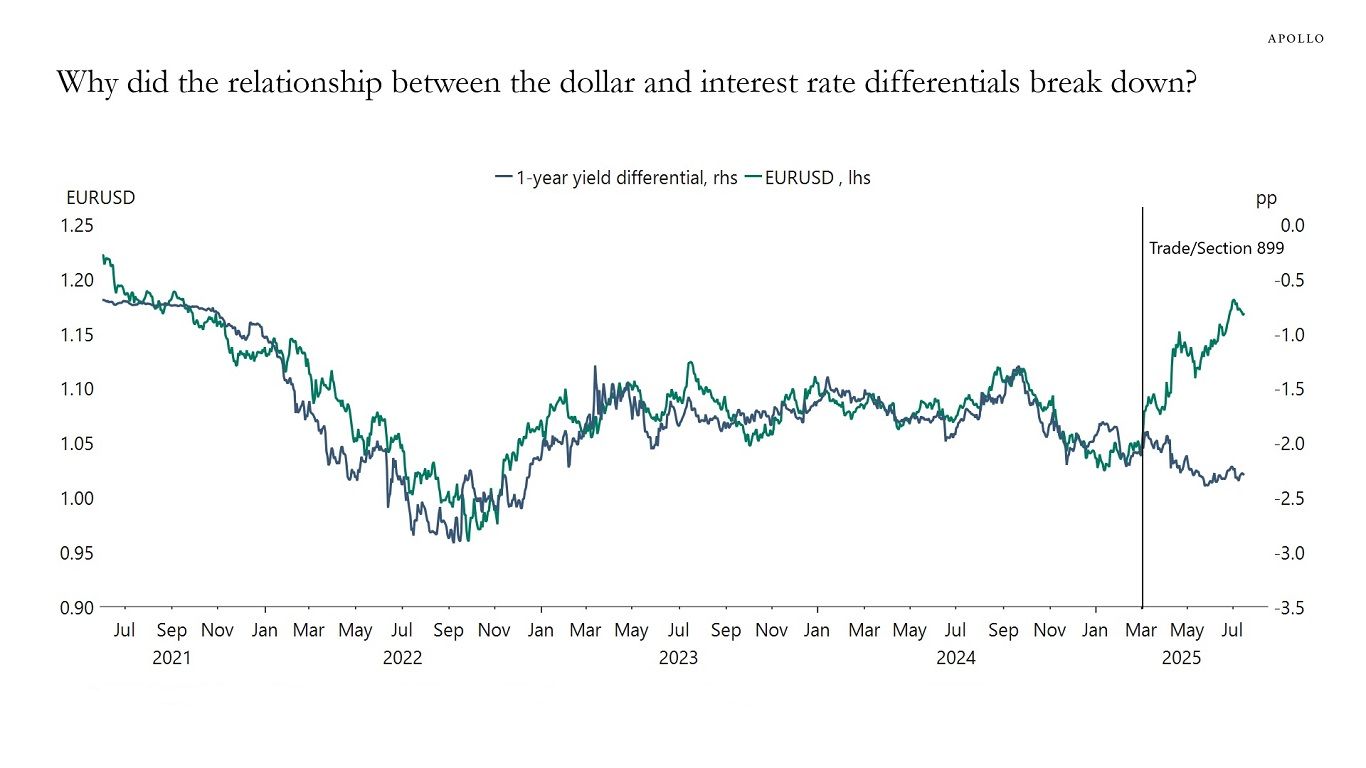

The U.S. dollar fell more in the first half of 2025 than interest rate differentials would suggest, largely due to foreign investor concerns over Section 899 and the Mar-a-Lago Accord. This broke the usual correlation between yield spreads and currency movement.

A reversal is now expected as Section 899 is resolved and the trade war is likely to end within weeks. Investors have already started piling back into U.S. assets, signaling renewed confidence.

Treasury International Capital data from May shows a clear uptick in foreign demand for U.S. securities after "Liberation Day," pointing to a broader recovery in dollar sentiment.

Real Estate Trends

CMBS Issuance Surges—Is 2025 the New 2007? link

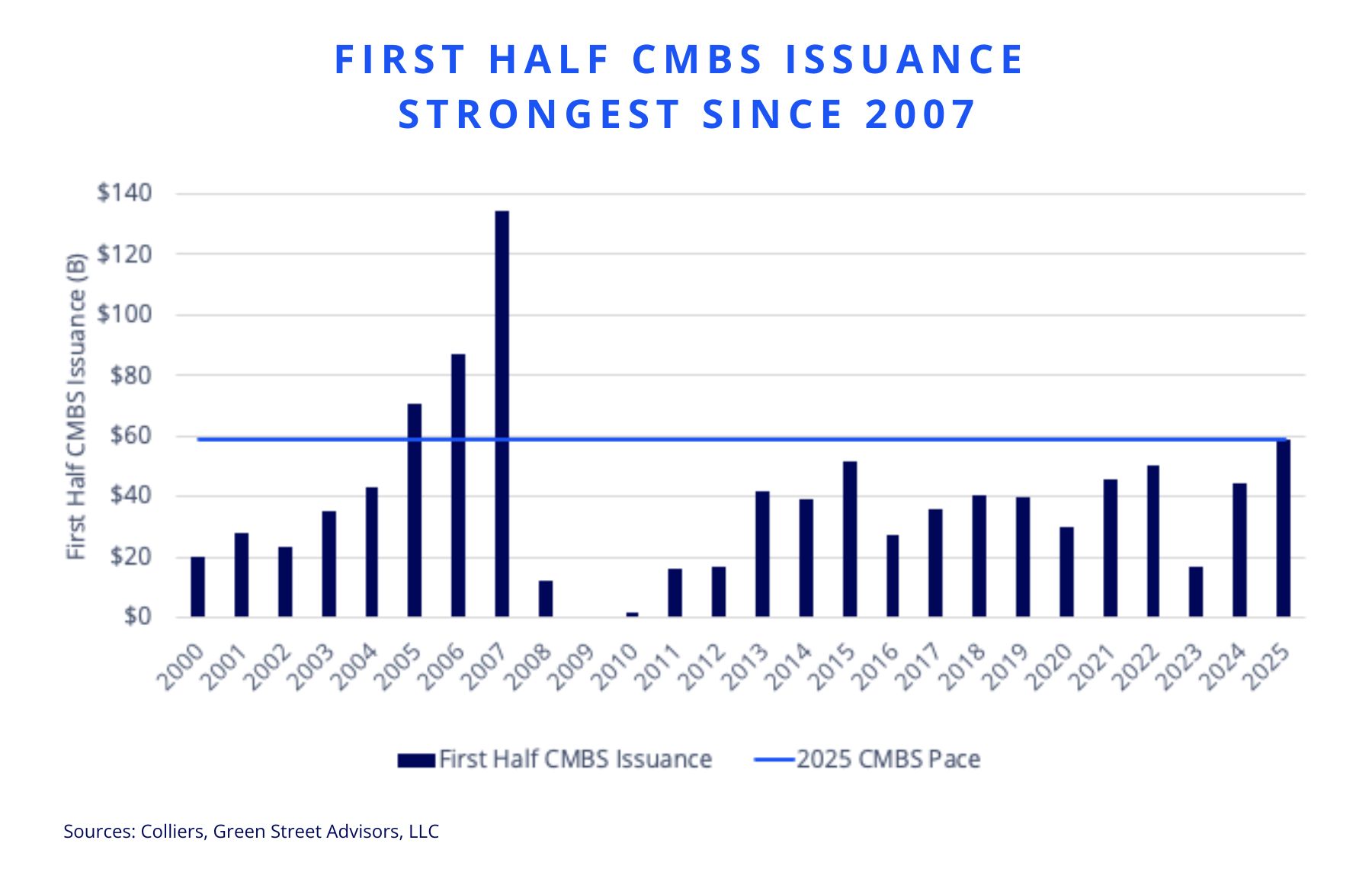

CMBS issuance hit $58.8 billion in the first half of 2025—a 33% jump from last year and already 28% above 2021 levels. The market is on pace to beat 2024's $100B and become the strongest year since 2007.

Single-asset, single-borrower (SASB) deals dominate, making up 74% of activity so far. Thirteen deals exceeded $1 billion, accounting for 37% of all issuance.

Blackstone alone has refinanced over $10 billion through CMBS this year, and multifamily borrowers now represent 11% of the total volume. Office deals are also picking up pace despite broader market challenges.

Apartment Demand Far Outpaces Starts in Sun Belt Markets link

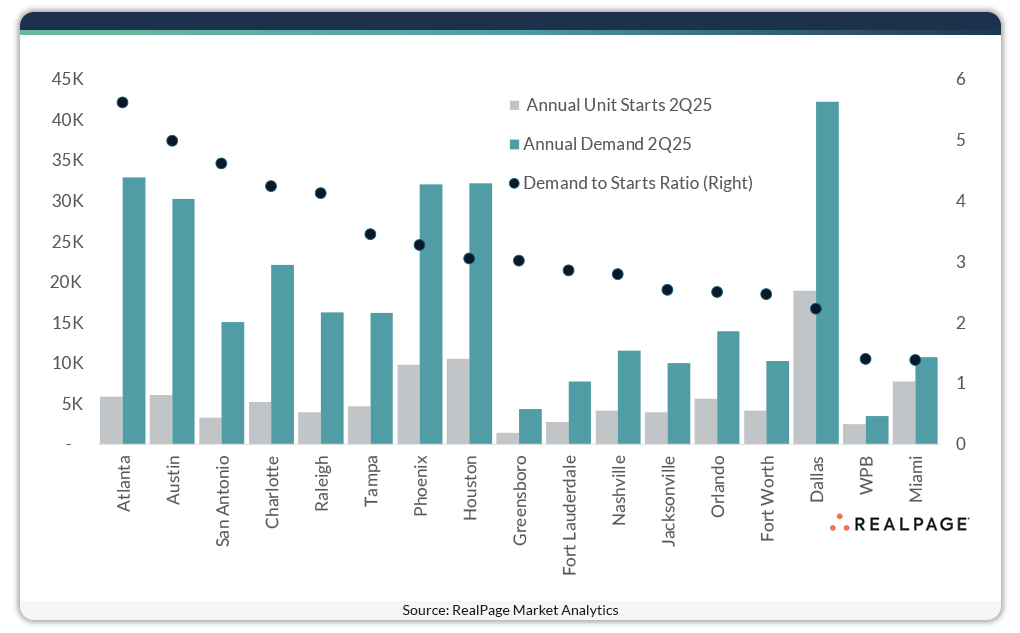

Nationwide, nearly 800,000 apartment units were absorbed over the past year, while only 215,000 new units broke ground—a demand-to-starts ratio of nearly 4:1. That’s up from a 3.4:1 ratio just a quarter earlier.

Atlanta leads the imbalance, with 5.6 times more apartments absorbed than started. Austin (5.0), San Antonio (4.6), Charlotte (4.4), and Raleigh (4.1) show similar gaps, signaling undersupply risks in key growth markets.

Miami and West Palm Beach were outliers, with demand-to-starts ratios of just 1.4, suggesting new construction there is more closely matching demand—at least for now.

Condos Crash Again—Biggest Price Drop Since 2023 link

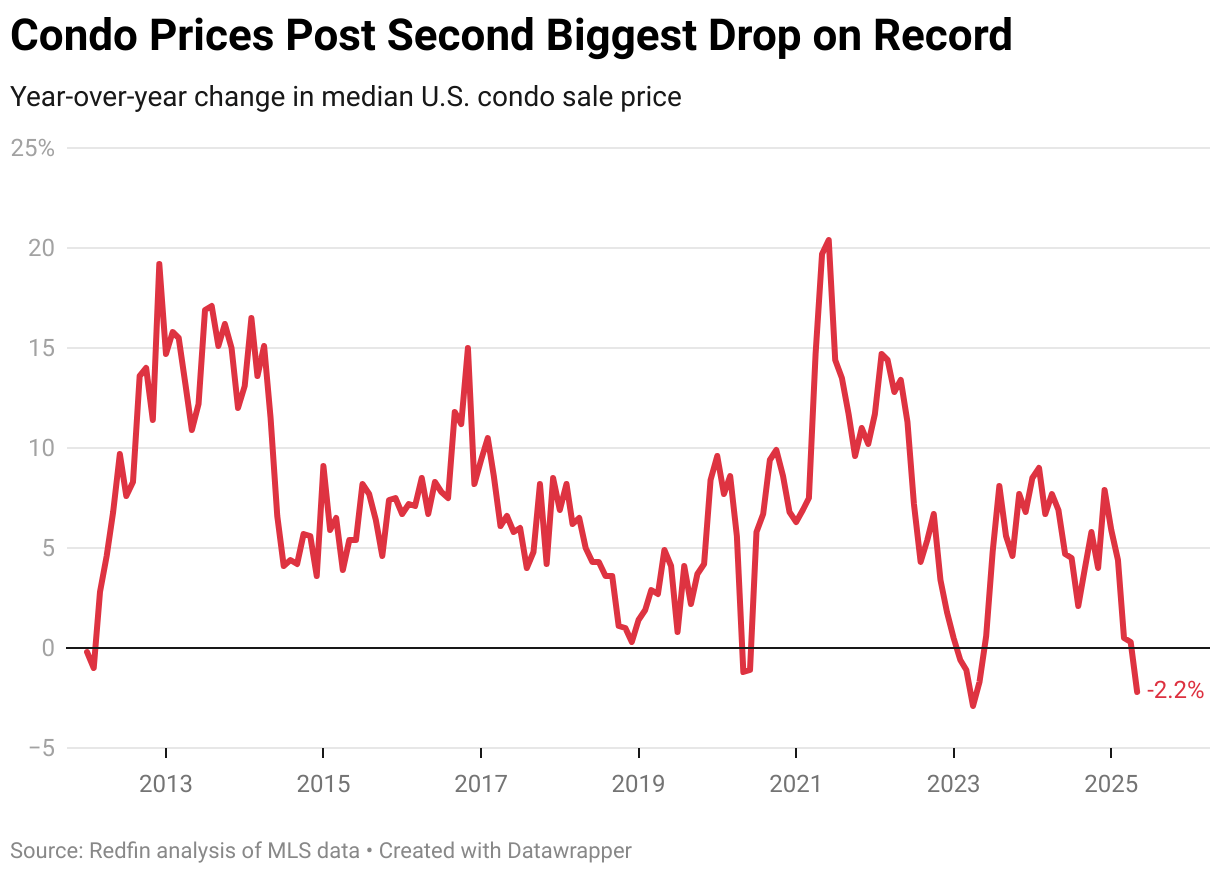

Condo prices posted their second-biggest year-over-year drop on record in May, driven by an 80% gap between sellers and buyers. This mismatch is dragging down demand and pushing prices lower fast.

Sales fell 11.9% in May, the steepest drop since June 2024, as higher HOA fees, rising insurance costs, and surprise special assessments spooked owners into selling.

Many condo associations still ban FHA loans, cutting off access for first-time buyers and further freezing demand, especially in urban areas like Boston.

Trump may axe capital gains tax on home sales—millions could cash out tax-free link

Nearly 29 million homeowners (34%) could exceed the $250,000 capital gains threshold for single filers if they sell, due to soaring home prices—up 190% since 1997.

The $250K/$500K exemptions for home sale profits haven’t been adjusted for inflation in nearly 30 years, making more longtime owners—especially in high-cost states—subject to tax.

Trump’s plan would fully eliminate capital gains taxes on primary home sales, but experts say Congress is more likely to raise the exemption than approve a full repeal.

Location Specific

Las Vegas Listings Surge as Retirees Bail and Investors Cash Out link

Las Vegas saw a 77.6% year-over-year jump in new home listings—by far the biggest increase of any U.S. city. Nationally, inventory rose just 6.2% in comparison.

Retirees and investors are driving the exodus, with older homeowners seeking family support or cooler climates and landlords offloading properties to reallocate funds.

Despite growing inventory and softening demand, Las Vegas still has only a 3.6-month supply, keeping it technically in a seller’s market—for now.

AI & Real Estate - Today’s Trends

Tool of the Day - Flume

Flume is an AI-powered sourcing platform that connects buyers to a global network of vetted suppliers for building materials. Platform connecting buyers with vetted building material suppliers

AI Is Quietly Reshaping Office Leasing Behind the Scenes link

From smarter tenant targeting to faster deal cycles, AI is streamlining office leasing operations in ways that go far beyond flashy tech headlines.

How Brokers Are Actually Using ChatGPT o3 in the Field – link

From prospecting and tenant scoring to market analysis, CRE brokers are putting AI tools like ChatGPT o3 and Genspark to work — and getting real results, fast.

Smart Capital Center Debuts AI Tool to Turbocharge CRE Deal Flow – link

Their new AI system extracts key lease and property data in seconds — speeding up underwriting, loan processing, and asset management for commercial investors.

AI Is Quietly Transforming How Capital Projects Get Built – link

Developers are using AI to streamline budgeting, scheduling, and risk management — accelerating timelines and reducing costly overruns on major CRE projects.

A word from our sponsor

Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs who backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits in their operating history.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

Mid-Year Office Check-In - shifts underway

(This content is restricted to Pro Members only. Upgrade)

Remodeling Slowdown Ahead - A Harvard Study

(This content is restricted to Pro Members only. Upgrade)

Multifamily shifts quietly in Q2—investors signal changing mood

(This content is restricted to Pro Members only. Upgrade)

Self Storage Market Finds Its Footing—What Happens Next?

(This content is restricted to Pro Members only. Upgrade)

Big-City Homebuyers Are Leaving-See Which Markets Are Catching All the Attention

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

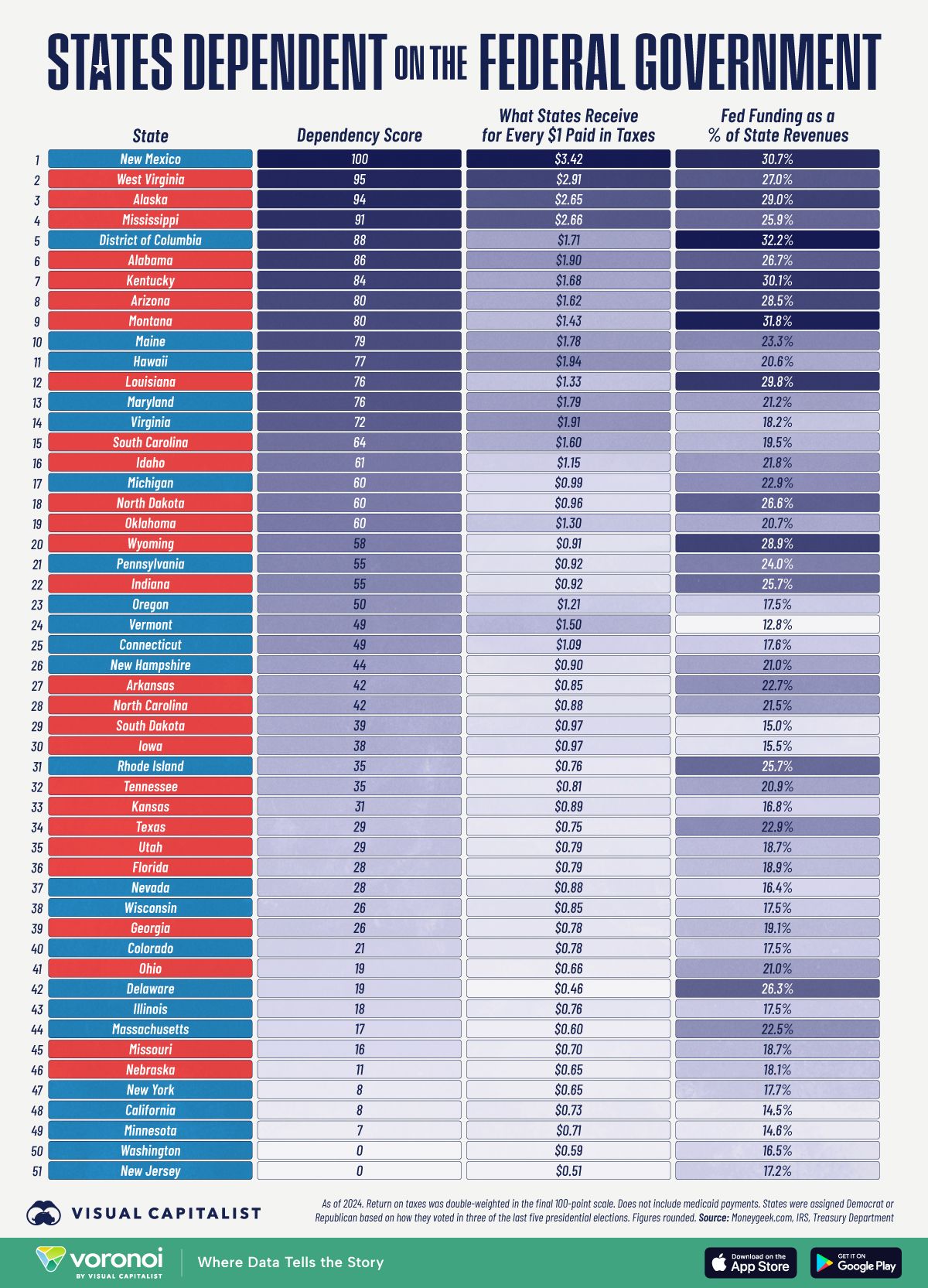

Ranked: U.S. States Most Dependent on the Federal Government

Unreal Real Estate

Live off-grid in style—massive underground bunker

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply