- Zero Flux

- Posts

- Where Americans Moved in 2025:

Where Americans Moved in 2025:

Ranked: The World’s 50 Most Powerful Militaries, Cliffside fixer-upper with inside/outside swimming pool and more

Latest Rates

Loan Type | Current Rate | Day Change | 1 Week | 1 Month | 1 Year | 52-Week Range |

30 Yr. Fixed | 6.17% | -0.03% | +0.01% | -0.01% | -0.88% | 6.01% - 7.13% |

15 Yr. Fixed | 5.75% | -0.01% | +0.00% | +0.02% | -0.75% | 5.55% - 6.50% |

30 Yr. FHA | 5.80% | -0.04% | -0.01% | -0.01% | -0.63% | 5.69% - 6.53% |

30 Yr. Jumbo | 6.35% | -0.01% | +0.01% | -0.01% | -1.10% | 6.10% - 7.45% |

7/6 SOFR ARM | 5.59% | -0.05% | -0.03% | -0.11% | -1.26% | 5.59% - 7.25% |

30 Yr. VA | 5.81% | -0.04% | -0.02% | -0.01% | -0.63% | 5.70% - 6.54% |

New here? Join the newsletter (it's free).

Real Estate Trends

Where Americans Moved in 2025: Link

Image

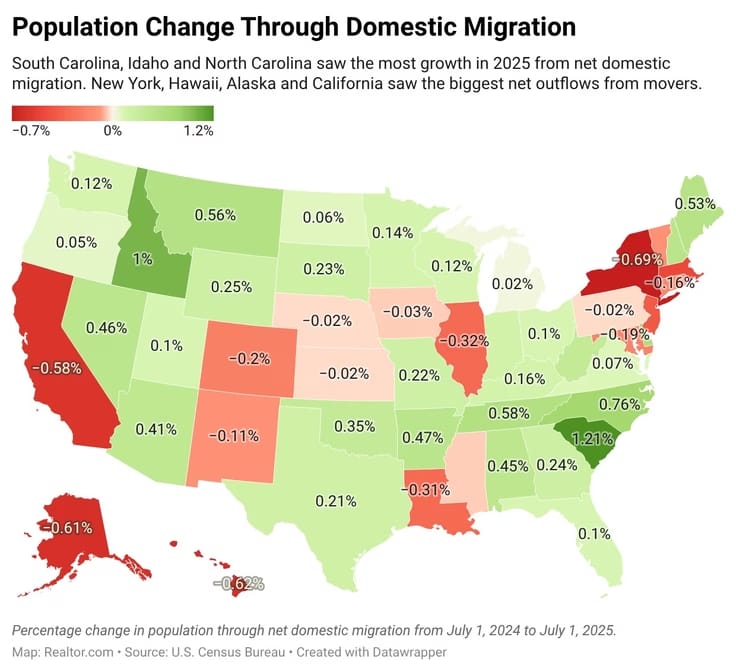

South Carolina, Idaho, and North Carolina led the nation in net domestic migration growth relative to their population sizes in 2025.

States with the highest outflows, including New York and California, suffered from low housing affordability and weak homebuilding activity.

Migration to Florida and Texas slowed significantly from pandemic peaks, with Florida seeing its lowest annual gain since 2010 due in part to soaring insurance costs.

My take: People are no longer just chasing sunshine; they are fleeing states where the math of daily life doesn't add up anymore. When the cost of insuring a home or paying rent outweighs the local salary, the "lifestyle" of a place like Florida or California loses its pull.

Apartment rents just dropped to the lowest level in 4 years Link

The national median rent fell to $1,353 in January, a 1.4% decline from last year and the lowest January level since 2022.

National vacancy rates hit a record high of 7.3% as a peak wave of new apartment supply met cooling demand from a tighter job market.

Rent prices are now 6.2% lower than their previous peak in the summer of 2022, with the sharpest declines occurring in the South and Mountain West.

My take: Landlords are losing their grip on pricing because they finally built enough units to outpace the number of people looking to move. For renters, the power dynamic has flipped, making this the first time in years where walking away from a renewal offer actually carries weight.

I post the most popular insights from the day on Reddit. Follow along ↓

Reddit

Foreclosure auction volume reaches highest level since Q2 2020 Link

Foreclosure auction volume surged 48% year over year in the fourth quarter of 2025, with growth occurring across all loan types in 43 states.

Despite the spike in inventory, actual sales rates declined because higher pricing discouraged buyers from closing the deal.

My take: We are finally seeing the post-pandemic safety net completely unravel as foreclosure activity returns to a more natural, pre-2020 rhythm. The real story isn't just the volume increase, but the standoff at the auction block where banks are asking for prices that investors aren't yet willing to pay.

Healthcare Real Estate Capital Flows: Trends and Insights for 2026 Link

Aging demographics and a shift toward outpatient services are driving national healthcare spending toward $2 trillion, ensuring steady demand for medical office buildings and ambulatory hubs.

Public REITs have become active sellers to manage balance sheets, while private equity and health systems are stepping in as buyers to gain more control over clinical delivery and costs.

Outpatient revenue has grown 45% since 2020, leading to a surge in specialized facilities for cardiology and spinal procedures that offer investors stable occupancy and 92.5% average occupancy rates.

My take: Investors have realized that "healthcare" isn't just about big hospitals anymore; it's about following the patient to the local clinic. While traditional offices struggle, the medical office is the new "safe haven" because you can't perform spinal surgery over a Zoom call.

AI & Real Estate - Today’s Trends

Tool of the day: Telnyx

Telnyx is a global communications platform that enables businesses to build and scale real-time voice, messaging, and AI-powered applications. It offers carrier-grade telephony, programmable APIs, and a private global IP network to ensure secure and low-latency connectivity. With tools for Voice AI, IoT, and networking, Telnyx empowers developers to create intelligent, scalable solutions without relying on multiple vendors.

Propy Raises $100 Million to Reimagine Real Estate Transactions with AI link

This massive capital injection signals a major shift toward using AI to automate the entire U.S. closing process, potentially eliminating traditional title and escrow bottlenecks.

Fundrise Launches AI Tool to Democratize CRE Analysis link

By opening up institutional-grade data to individual investors, this tool levels the playing field in the U.S. commercial market, allowing retail users to identify undervalued assets with the same precision as major private equity firms.

GoCanopy Raises €2.1M Seed Funding for AI Platform for Institutional Real Estate link

While European-based, this funding validates a growing global trend of AI-driven portfolio management that U.S. institutional players are rapidly adopting to streamline asset due diligence and reporting.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

2026 North American Investor Intentions Survey Results

(This content is restricted to Pro Members only. Upgrade)

Top Multifamily Markets Share a Common Playbook

(This content is restricted to Pro Members only. Upgrade)

Industrial Absorption Trends

(This content is restricted to Pro Members only. Upgrade)

Where Opportunity Lies in 2026 in CRE

(This content is restricted to Pro Members only. Upgrade)

Life Sciences Trends

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

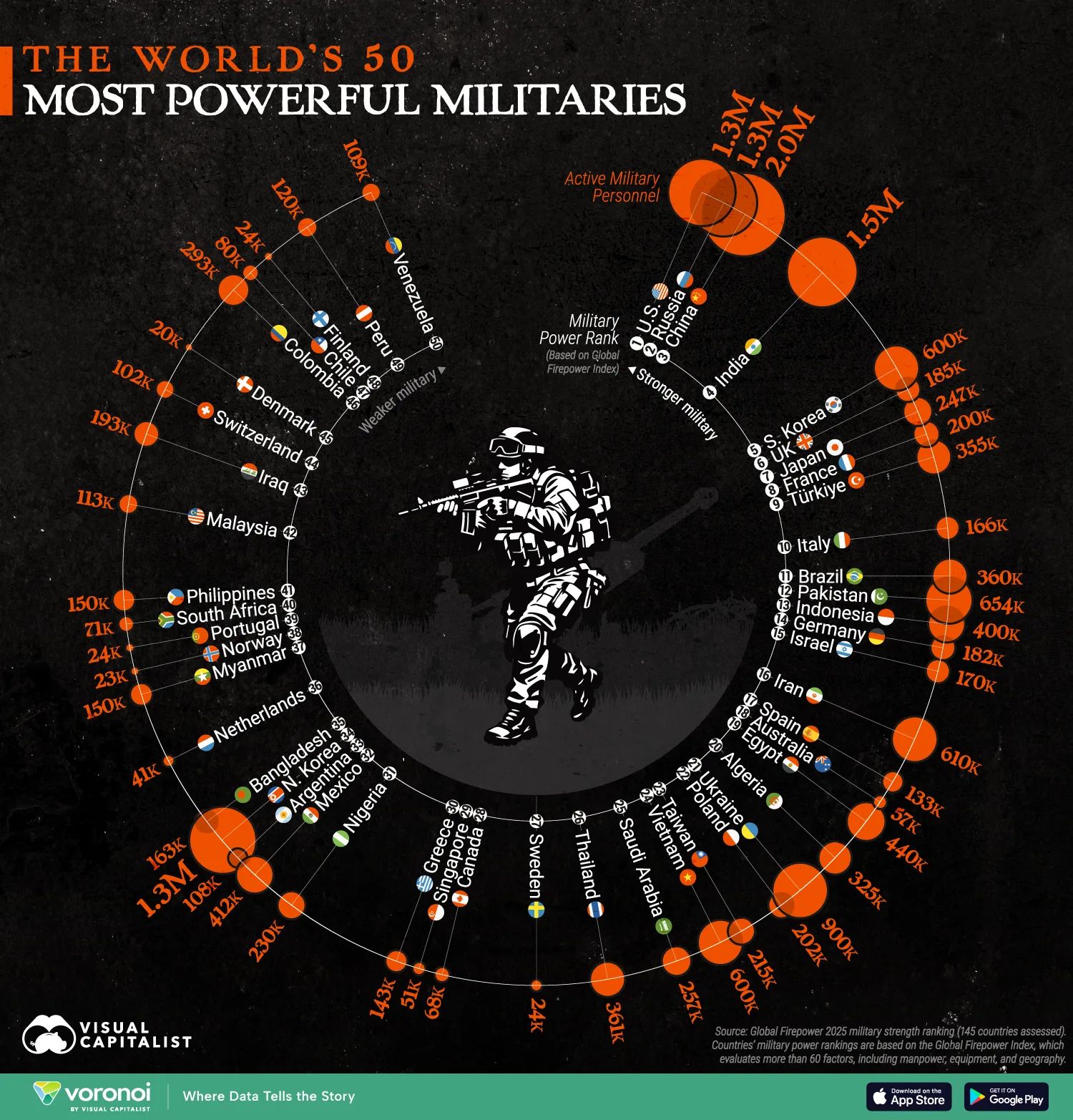

Ranked: The World’s 50 Most Powerful Militaries

Unreal Real Estate

Cliffside fixer-upper with inside/outside swimming pool

Image

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply