- Zero Flux

- Posts

- Where Housing Inventory is Rising in U.S. Cities

Where Housing Inventory is Rising in U.S. Cities

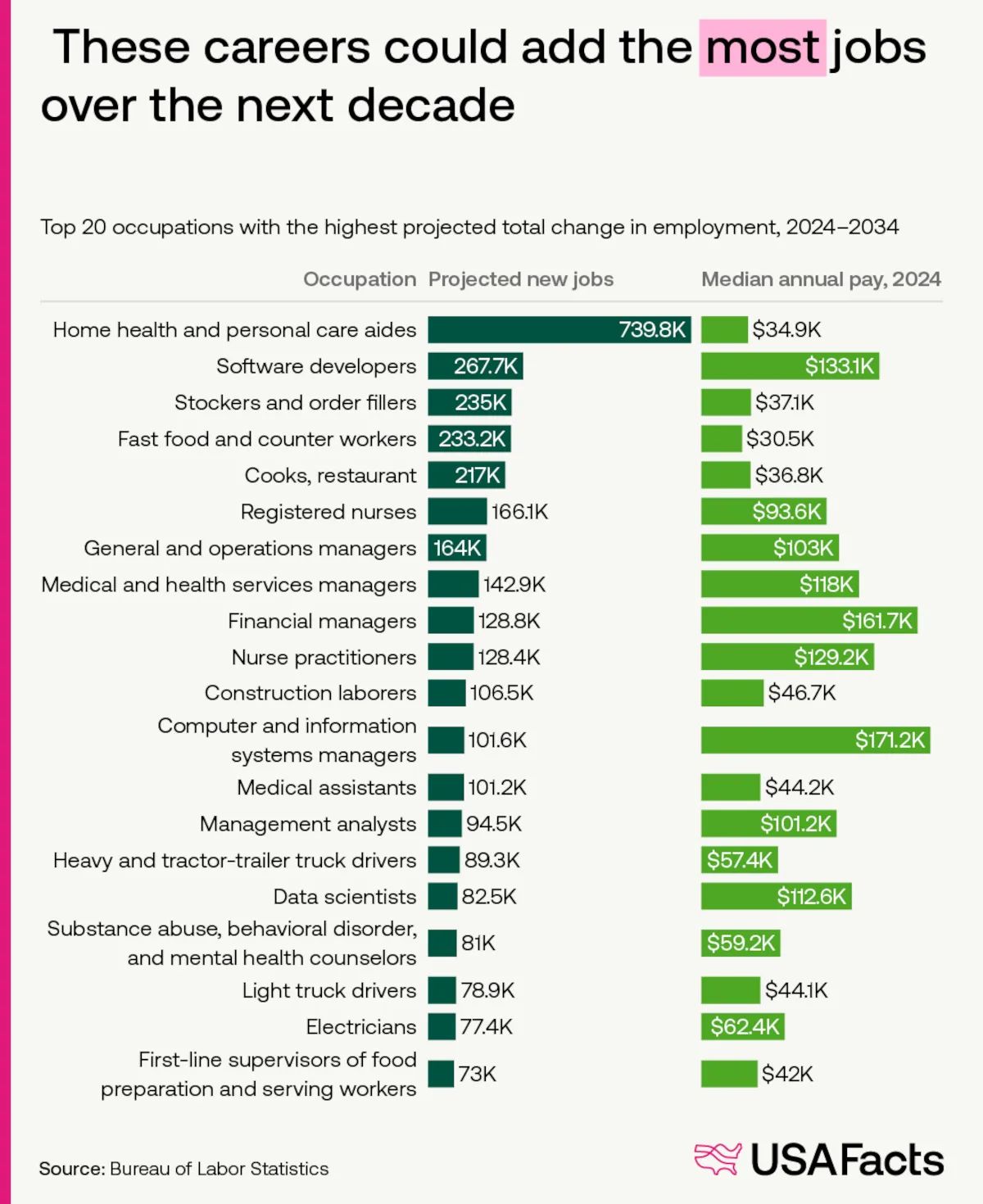

Ranked: The Fastest-Growing Jobs in the Next Decade, a stunning cali home and more.

One Off Market Deal

6 single-family homes in Birmingham are available.

6 single-family homes. About $6.3k per month in current rents. Five are occupied. One is vacant but was rented recently.

Not a flip or a heavy rehab situation. It’s a rent-first portfolio in working-class neighborhoods, likely a better fit for long-term holders and Section 8 operators than appreciation-driven buyers.

There’s no asking price. Just looking to connect with serious buyers and see where interest lies.

More pictures and details ↓

New here? Join the newsletter (it's free).

Real Estate Trends

Billions of Square Feet, Untapped: Inside Flexible Warehouse Leases Link

Insights

There is currently a 7.5% vacancy rate across 19.5 billion square feet of U.S. industrial stock, leaving nearly 1.5 billion square feet idle.

Digital platforms are replacing slow, manual leasing processes to help landlords monetize space during the 12 to 36 months it typically takes to secure long-term tenants.

Short-term demand is driven by seasonal surges, product launches, and "tariff jumping" where companies rush to store goods before new trade taxes take effect.

My take: Rigid long-term leases are a tax on agility. In a world of trade wars and instant delivery, the winning landlords will stop selling real estate and start selling "space-as-a-service."

6 retail trends to watch in 2026 Link

Insights

AI investment is hitting a performance wall where retailers must move from chatbot experimentation to proving actual ROI on physical goods and supply chain workflows.

A K-shaped economy is widening the gap between value-driven mass merchants and specialty retailers who are struggling with high interest rates and e-commerce competition.

Physical retail is shifting from "managed decline" to "mixed-use reinvention," with B-rated malls being reclassified as community-centric anchors for non-retail services.

My take: Proximity is the new prime real estate because speed beats efficiency in a 30-minute delivery world. If you own the local "last mile" store, you own the customer; if you rely on a distant warehouse, you’re already obsolete.

A quick word from our sponsor

Last Time the Market Was This Expensive, Investors Waited 14 Years to Break Even

In 1999, the S&P 500 peaked. Then it took 14 years to gradually recover by 2013.

Today? Goldman Sachs sounds crazy forecasting 3% returns for 2024 to 2034.

But we’re currently seeing the highest price for the S&P 500 compared to earnings since the dot-com boom.

So, maybe that’s why they’re not alone; Vanguard projects about 5%.

In fact, now just about everything seems priced near all time highs. Equities, gold, crypto, etc.

But billionaires have long diversified a slice of their portfolios with one asset class that is poised to rebound.

It’s post war and contemporary art.

Sounds crazy, but over 70,000 investors have followed suit since 2019—with Masterworks.

You can invest in shares of artworks featuring Banksy, Basquiat, Picasso, and more.

24 exits later, results speak for themselves: net annualized returns like 14.6%, 17.6%, and 17.8%.*

My subscribers can skip the waitlist.

*Investing involves risk. Past performance is not indicative of future returns. Important Reg A disclosures: masterworks.com/cd.

Mid-Tier Multifamily Quietly Takes the Lead Link

Insights

Luxury assets face a 0.2% rent decline as they comprise 70% of current construction, while three-star properties saw 0.5% growth due to nearly zero new competition.

The Midwest and Northeast are outperforming the Sun Belt by maintaining a strict balance between new deliveries and actual demand, avoiding the "supply overhang" hurting high-growth metros.

San Francisco has become a national outlier with strong rent growth driven by AI sector hiring, whereas Washington, D.C. is softening due to significant federal workforce reductions.

My take: Luxury is currently a commodity, but "average" is a monopoly. When everyone builds for the 1%, the real money is made serving the other 99% who have nowhere else to go.

Something I found Interesting

Top BTR Pipelines Are Consolidating Under a Small Group of Operators Link

Insights

Eight major developers currently control the lion's share of the 64,250 build-to-rent homes under construction across the United States.

The top players with over 1,000 units each include Empire Group, Taylor Morrison, Cavan Companies, NexMetro Communities, Core Spaces, Redwood Living, American Homes 4 Rent, and Quinn Residences.

My take: Wall Street is finishing its land grab and moving into the "monopoly" phase. These eight companies aren't just building houses; they are building a future where they control the rental price floor for entire ZIP codes.

One Chart

Mapped: Where Housing Inventory is Rising in U.S. Cities

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

This Southwest City Has the Most Manufactured Housing in the U.S. as Buyers Snap Up Affordable Homes

(This content is restricted to Pro Members only. Upgrade)

The Best Markets for First-Time Homebuyers in 2026 Revealed

(This content is restricted to Pro Members only. Upgrade)

Top 10 Counties with the Largest Annual Increase in Median Home Price in Q4 2025

(This content is restricted to Pro Members only. Upgrade)

Why the fix-and-flip sector is poised for a breakout in 2026

(This content is restricted to Pro Members only. Upgrade)

Off Topic

Ranked: The Fastest-Growing Jobs in the Next Decade

Unreal Real Estate

No words needed

Image

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply