- Zero Flux

- Posts

- Will 7-Day Homes Make the American Dream Affordable Again?

Will 7-Day Homes Make the American Dream Affordable Again?

Mapped: Which U.S. Cities Saw Record-Breaking Temperatures in 2024? and 12 other real estate insights

Want the full Zero Flux experience?

For a limited time, you can upgrade to Premium at just $6.32/month and get deeper data drops, investor insights, and access to every tool we’ve built for serious operators.

Latest Rates

Loan Type | Rate | Daily Change | Wkly Change | 52-Wk Low/High |

|---|---|---|---|---|

30 Yr. Fixed | 6.37% | -0.01% | +0.00% | 6.13 / 7.26 |

15 Yr. Fixed | 5.89% | -0.01% | -0.01% | 5.55 / 6.59 |

30 Yr. FHA | 6.05% | -0.02% | -0.01% | 5.75 / 6.62 |

30 Yr. Jumbo | 6.28% | +0.00% | +0.02% | 6.14 / 7.45 |

7/6 SOFR ARM | 5.82% | -0.02% | +0.02% | 5.59 / 7.25 |

30 Yr. VA | 6.07% | -0.02% | +0.00% | 5.77 / 6.64 |

New here? Join the newsletter (it's free).

Real Estate Trends

Healthcare construction costs surge 40% since 2020, landlords and tenants feel the squeeze link

Non-residential construction costs are up as much as 40% since Feb 2020, with healthcare projects hit hardest, 35–50% of their budgets go to MEP systems, double that of typical commercial builds.

Rising costs push landlords to reduce tenant improvement allowances, shift expenses back to tenants, and set higher rental rates tied directly to escalating development budgets.

Providers face delays in facility expansion, limited patient capacity, and rising care costs as high rates, supply chain issues, and labor shortages ripple through the system.

My take: Healthcare used to be one of the “safe bets” in CRE, but spiraling build costs mean even hospitals and clinics now face the same margin pressure as office and retail. Deep pockets will keep building, everyone else will get squeezed out.

Mall vacancies climb, small businesses step into prime spots link

U.S. shopping center vacancy rose to 5.8% in Q2 2025, driven by chain-store failures, creating prime-location openings for independents.

Landlords are offering flexible leases, partial fit-outs, and even rent-free periods as they try to backfill empty spaces with service-oriented tenants.

While rents are still rising, growth has slowed from 4% to ~2% annually, giving small businesses a window to expand into formerly “off-limits” locations.

U.S. office recovery splits, investors reposition for a two-track market link

Nationwide vacancy is 18.7%, down 80 bps YoY, while “flight to quality” keeps amenitized assets full. NYC leads leasing at a five-year high; tech hubs still lag as AI spend favors data centers over headcount.

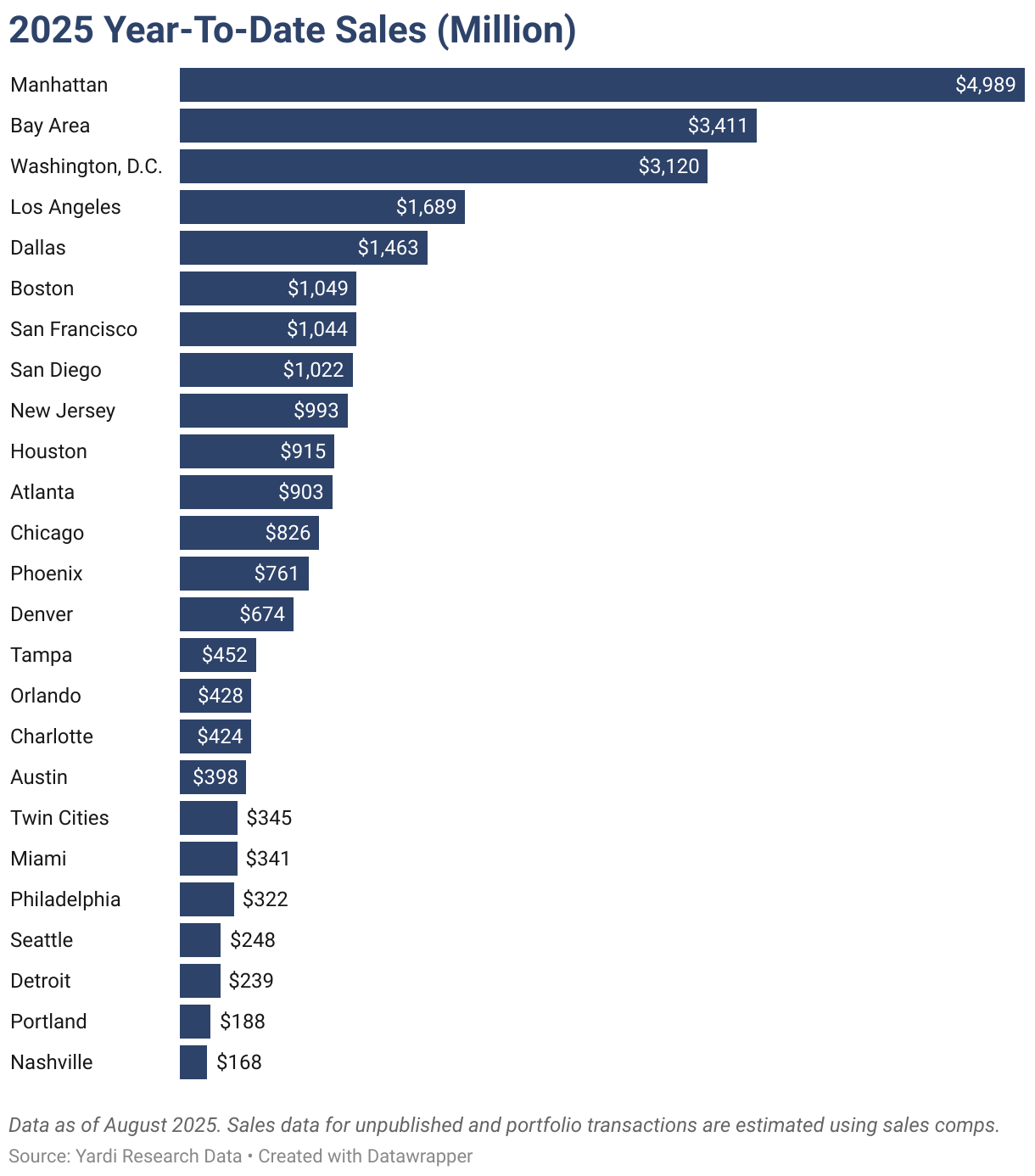

Pricing and liquidity remain reset: ~$33B in office sales YTD at ~$190/sf versus ~$280 in 2019. Dallas bucks the trend with prices jumping from $107/sf (2024) to $240 this year.

Supply pressure is muted with ~40M sf under construction (<1% of stock); starts were 10.7M sf and deliveries 17.3M sf. Rents show the spread: SF asks ~$64+/sf vs. national ~$32.63, while Midwest markets like Detroit (~$22) and Minneapolis (~$27) stay value plays.

My take: It’s basically a barbell market right now; shiny NYC towers are filling up, while West Coast offices keep bleeding tenants. The real play is either scooping up distressed space in tech hubs or paying up for trophy assets where demand is proven.

These metros are already flashing “best week to buy” signals link

Hartford buyers this week have 16% more listings, one-third less competition, and homes priced 7% below summer peaks, with properties sitting on the market three weeks longer.

Virginia Beach inventory is up 14% with new listings 5% higher, while median prices are down 3.3% from summer and buyer competition is 30% lower than peak season.

Memphis homes are nearly $100K below the national median, with buyers seeing 15% more inventory, 30% less competition, and prices ~5% below peak levels.

Can 7-day, factory-built homes make the American Dream affordable again? link

Modular builder Fading West can produce finished homes in just seven days, claiming costs up to 20% lower than stick-built construction.

FEMA tapped modular for the first time post-2023 Maui wildfires, commissioning 82 units at $165K–$227K each — a shift from traditional trailers.

Despite making up only 1–3% of U.S. single-family starts, modular is drawing new state backing (e.g., New York) and investor interest as labor and affordability pressures mount.

My take: Modular’s been “the future” for decades, but FEMA using it in Hawaii shows it’s finally breaking through. If states lean in, this could shift from a fringe experiment to one of the only practical ways to fix the housing shortage.

Something I found Interesting

Why governments keep betting on new cities and what history shows about their payoff link

Case studies from Brasilia to Shenzhen show new cities consistently outperform their national averages on productivity, income, and growth.

Abuja’s productivity is nearly 10x Nigeria’s national average, while Naypyidaw’s is over 3x Myanmar’s illustrating how new capitals can turbocharge local economies.

Beyond politics, new cities thrive by leapfrogging aging infrastructure and embedding industrial strategies, from logistics in Milton Keynes to electronics in Shenzhen.

AI & Real Estate - Today’s Trends

Tool of the day - reAlpha

AI-powered smart buyer's agent helping with home search and offers.

TitleTrackr’s AI Slashes Weeks Off Title Searches link

The startup’s new Abstract Tool auto-extracts deeds, liens, and mortgages into a clean ownership timeline, letting title firms cut costs, reduce errors, and deliver reports in minutes instead of days.

Coldwell Banker Crowns First-Ever “AI Innovator of the Year” link

The brokerage giant created a new award to spotlight agents using AI for lead gen, marketing, and deal flow, signaling how mainstream brokerages are racing to reward tech-savvy professionals.

REALTORS® Go All-In on AI, NAR Survey Shows link

A new NAR survey finds nearly half of agents now use AI for marketing, client communication, and listing optimization, marking a sharp jump in adoption as digital tools become standard in daily workflows.

People-Powered AI Gives CRE Its Human Edge link

Observer argues the winners in commercial real estate won’t just be those with the best algorithms but the firms that pair AI-driven data crunching with human creativity, client strategy, and judgment.

A word from our sponsor

Learn Real Estate Investing from Wharton's Best Minds

In just 8 weeks, learn institutional-grade real estate analysis and modeling from Wharton faculty and seasoned investors.

You’ll gain:

Insider insights on how top firms like Blackstone and KKR evaluate deals

Exclusive invites to recruiting and networking events

Direct access to Wharton faculty and a certificate that signals credibility

Join a thriving community of 5,000+ graduates for ongoing career development, networking, and deal flow.

Use code SAVE300 at checkout to save $300 on tuition + $200 with early enrollment by January 12.

Program starts February 9.

Pro Member Only Content Below

Most of the insights below stem from extra research and include content from paid sources and special reports.

College towns split wide open-one market tops $2M while others linger near the bottom

(This content is restricted to Pro Members only. Upgrade)

10 U.S. cities where buyers hold the leverage over sellers

(This content is restricted to Pro Members only. Upgrade)

A decade of office numbers reveals a surprising trend

(This content is restricted to Pro Members only. Upgrade)

Condos vs. townhouses: the 10-year study

(This content is restricted to Pro Members only. Upgrade)

Proptech Startups That Just Got Funded

(This content is restricted to Pro Members only. Upgrade)

Off Topic

Mapped: Which U.S. Cities Saw Record-Breaking Temperatures in 2024?

Unreal Real Estate

A house with private lagoon!?

That's all folks. If these emails aren't for you anymore, you can unsubscribe here.

Cheers,

Vidit

P.S - Read past newsletters here

What did you think of today's newsletter? |

Referral Milestones

Discount | Referrals Needed |

|---|---|

3 MONTHS FREE on the Pro Plan | 1 |

30% off FOREVER on the Pro Plan | 5 |

50% off FOREVER on the Pro Plan | 10 |

75% off FOREVER on the Pro Plan | 15 |

100% off FOREVER on the Pro Plan | 25 |

If you are finding value, please consider helping the newsletter by becoming a paying subscriber

A subscription gets you:

✓ More issues per week

✓ Special reports on new housing studies

✓ Exclusive insights that are usually tucked behind paywalls (which I cover the costs for)

✓ Curated Top 10 lists

✓ The latest updates on prop-tech funding rounds

Want to sponsor the newsletter? Details here

Reply